You probably didn’t get into credit card debt overnight.

For most of us, it’s a gradual process of buying a little too much, then missing a payment or two, then realizing the card’s introductory rate expired, and the full 26.99 percent of interest just kicked in.

I know all this because I’ve been there, too. Before you know it, you owe $5,000 on a card that had only a $3,000 limit, and it feels like taking a breath is costing you interest.

It can be tempting to forget the whole mess — to stop even trying to pay the balances, to just accept you’ll have rotten credit for the better part of a decade.

Table of Contents

- The Truth About Credit Card Debt

- Why Would My Credit Card Negotiate With Me?

- First Things First: Adjusting Your Outlook

- Knowing What a Credit Card Issuer Can Offer

- Look At Your Overall Picture Before Making a Decision

- Let the Credit Card Negotiations Begin

- In Too Deep? A Third Party Can Negotiate

- Why Bother Negotiating to Start With?

- Bottom Line – How to Negotiate With Credit Card Issuers

The Truth About Credit Card Debt

We’ve reached the point where you might expect to hear something reassuring, right? This is where I should say, “Yes, you can get out of debt. Things aren’t as bad as they seem. You just need to keep trying.”

Well, there is some truth in that, but I’d rather just be straight with you:

If you’re in deep with one or more credit cards and you’re starting to feel like it’s hopeless, you can still get out of the hole.

But it’s going to take more than patience. It’s going to take a lot of persistence, some self-discipline, and some serious strategizing.

Why Would My Credit Card Negotiate With Me?

Like I said, I’ve been there. I know how it feels. Every time you pay on your credit card balance, you don’t see any results on the bottom line.

At this point, the credit card company is simply taking your money and not even reducing your balance in any meaningful way. Why would it want to help you put an end to that set-up?

Well, yes, it is a credit card company’s goal to make money by lending you money at interest and then enforcing its rules about late fees, over-balance fees, and punitive interest rates.

But that doesn’t mean the company benefits from your out-of-control account, especially if you give up on paying it off.

Let’s take a look at it from the credit card’s point of view:

- If you give up, the company spends a lot of time and money trying to collect your balance, then finally sells off your debt for pennies on the dollar.

- If you give up, the company loses the ability to lend you money since you no longer qualify for loans, meaning they’ve lost a customer.

- Not only has your credit card lost your business, but the entire legitimate credit industry has lost you as a customer because your credit score prevents you from borrowing, except in rare situations.

But working with your creditors is not an exact science. You can’t just call the customer service line and set your terms.

You’ve got to know what to ask and how to ask it. You need to know who has the authority to help you. You need to know how much you can afford to pay if you reach a settlement.

If you’re ready to make this happen, to get out of from under that dark cloud you’re carrying around in your purse or wallet, read on to learn about some strategies.

First Things First: Adjusting Your Outlook

Before we get into the details, it’s time to get prepared for battle. You won’t need armor or weaponry. You could need some polish for your negotiating skills, though.

Here are some obvious things that can go a long way:

Be Nice and Polite

Yes, as a customer, you do have some sway, but that doesn’t mean you should go in guns blazing and make demands for lower interest rates and forgiveness of late fees.

Instead, engage with a spirit of cooperation. This can be helpful elsewhere in life, too. Being willing to look for solutions that mutually benefit both parties will open doors.

Accept Responsibility

Like it or not, if you’re in some credit card trouble, your choices helped create the situation. Even if you feel tricked or cheated, you still make the decision to use the card.

If you had no choice but to over-use the card because you were struggling to buy groceries and your roommate disappeared without paying the power bill, you still benefited from the transactions that led to the current chaos.

If this is true, it’s not helpful to open negotiations by pointing fingers at the credit card company for its behavior.

Doing that will likely get you written off as unreasonable and simply unwilling to pay what you owe.

Accepting responsibility for the situation can work its own kind of magic.

Instead of saying, “You people are stealing from me and ruining my credit,” say, “I let things get out of control and would like to talk about possible solutions.”

Be Willing to Go the Long Haul

Chances are you won’t solve your problems in one phone call or even two or three phone calls. But you can save time by knowing this up front and being willing to call back and continue the discussion.

Once you’ve reached a credit manager or someone else with the authority to make changes to your account, get that person’s name and direct contact information.

That way, you can get back in touch with them directly after you’ve had a chance to think about the solutions you’ve discussed.

If you don’t get immediate results, try again the next day and the next week. Too many people open negotiations and then never follow up because they didn’t like the manager’s first offer.

Knowing What a Credit Card Issuer Can Offer

After you’ve started discussing your situation with a credit manager, you’ll start to hear some terms thrown around.

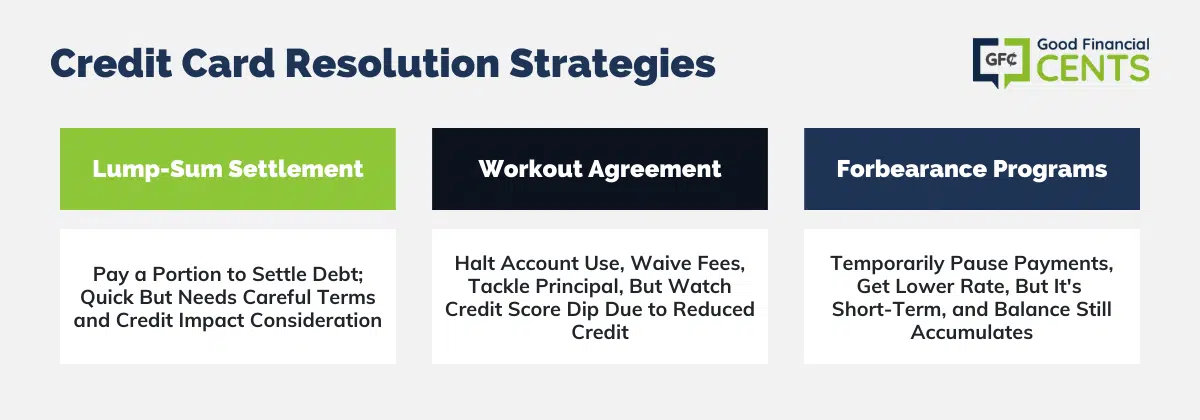

Lump-Sum Settlement

One of the fastest and easiest ways out of debt is to settle on a lump sum. If your credit card trouble is part of a larger financial problem, I realize you may not have this option.

After all, if you had lump sums of cash lying around, you probably wouldn’t have an out-of-control credit card or two.

But it’s still a good option for a lot of people, especially if they’ve just inherited some money or sold some real estate and would like to use the proceeds to get out of debt.

Let’s say, for example, you owed $10,000 on one card, though only $7,500 of that was money you’d actually spent. The other $2,500 resulted from fees and interest rates.

In this case, you may be able to agree on paying off just the $7,500.

Be absolutely sure the money you’re paying will close the account and result in a zero balance. Get it in writing before sending the money, just in case there was a misunderstanding or in case the credit manager entered the wrong code on your file.

Here’s something else important: Find out how the credit card company plans to report the settlement to the credit bureaus. If they call it a charge-off, this could hurt your credit score.

Workout Agreement

A workout agreement resembles a lump-sum payment without the lump sum.

You basically will stop using the account and can eliminate some or all of the late fees that result when you surpass the card’s credit limit.

You can also erase some or all of the finance charges incurred because of punitive interest rates, which kicked in when you maxed out the card.

Basically, you can turn the clock back to before things get out of control.

You’ll still owe the principal balance and will need to pay it off within an agreed-upon amount of time. But things won’t be getting worse every minute.

Keep in mind this kind of deal can hurt your credit score in the short run because your “available credit” will take a hit. Your amount of available credit is one of the factors credit bureaus consider when compiling your score.

The way the credit card company reports this deal can also impact your score. Try to avoid a charge-off which will look bad to other creditors.

Forbearance Programs

Some credit card companies may offer to put your account in forbearance. (If you owe student loan money, you may already know all about forbearances.)

This can be a very convenient tool if you have a temporary financial problem such as unemployment or short-term disability.

However, forbearance is not a long-term solution to your credit card problems. Yes, you’d be getting a break from payments and late fees, and you may even be able to get a lower interest rate during the forbearance period.

But after the period ends, you’ll still owe the entire balance of your card. Your balance may even go up some since it would still generate interest while you aren’t paying.

Use this deal only as a temporary solution to get you through a rough patch, not as a long-term solution.

Note: If you successfully negotiate your debt favorably, you could owe more on your taxes. The IRS considers forgiven debt a form of income. Your tax software should be able to handle this.

Look At Your Overall Picture Before Making a Decision

Only you know what you can afford as you negotiate with a creditor. Before agreeing to a plan of any kind, make sure the payments you’re agreeing to fit your budget.

All the negotiating in the world won’t help if you still can’t afford to pay the agreed-upon amount. And things could be worse since you’ll have to go back to the drawing board with less strength from which to negotiate.

So, if you don’t already have a budget, make one. Or at least do some quick math to find out how much you’re spending on gas, food, the mortgage, and other essentials so you’ll know how much you can spend paying down your credit card debt.

Make a Realistic Plan You Can Follow

Fixing your debt issue will require some sacrifice, but don’t sacrifice too much.

If you’re thinking about getting your financial life on track by eating out less and going to the movies only twice a month instead of four times a month, that’s great.

If you’re looking to cut your Amazon spending in half, that’s good, too.

However, don’t go overboard by making sacrifices you can’t continue. That will set you up for failure. Chances are you’re going to have to eat out at some point during the month, so saying, “I won’t eat out so I can pay off my credit card,” may not be the best plan.

In other words, don’t paint yourself into a corner in an attempt to get out of debt. Be reasonable and make decisions that you can sustain.

Knowing how much you can realistically afford to spend on debt reduction will help in your negotiations.

Let the Credit Card Negotiations Begin

You know how much you can afford to pay, and you know what a credit card company might offer. Now it’s time to get started negotiating.

You didn’t get into debt overnight, and it’s going to take more than a few minutes on the phone to negotiate a solution.

Save Your Ammo

You can start by calling the number on the back of your credit card or the contact number you find online. The first person who answers will likely be unable to help, though.

Don’t use your negotiating prowess on that person. Instead, kindly ask for someone who can actually make decisions about your account.

For most companies, this person is a credit manager or account manager. Get this person’s name and contact information right away in case you’re cut off and so you can cut to the chase next time you call.

Because there will be a next time, you shouldn’t agree to the first offer the manager throws out.

Take notes and ask for some time to think about the offer. After you hang up the phone, run some numbers. Does the offer help you get out of debt sooner? How does it fit into the larger plan of your monthly finances?

Can You Get a Better Offer?

If the offer you got doesn’t measure up, or if you think better terms would help you get back on track much faster, call back and make a counteroffer.

Ask the manager why he or she can’t lower your interest rate back to its original percentage or erase all of those late charges.

Again, be willing to work with the manager, and don’t fall into the trap of accusing the credit card company of cheating you or intentionally luring you into the world of high-interest debt.

Stay patient and cooperative, but also stay persistent. Keep calling back until you have the answers to your questions.

Remember:

Get It In Writing

Assuming you do reach an agreement that helps you — and I think you can — be sure to get the terms in writing before you agree to the deal and certainly, before you send in a check or an online payment.

Things happen: Codes get entered incorrectly. The manager you worked with may get a phone call right after yours and mix things up in his or her head before making notes.

Getting your new terms in writing helps you know what you’re agreeing to, and it gives you some recourse if the agreement doesn’t play out the way you’d expected.

Live Up to Your Promises

If you agree to pay off a certain balance in a specified amount of time, be sure you follow through on your end of the bargain.

Failure to pay a negotiated settlement can wreak even more havoc on your precarious credit situation.

In Too Deep? A Third Party Can Negotiate

People who have more than a few credit cards teetering on the edge of disaster may find it too daunting to negotiate each one individually.

Third-party debt management programs exist to help. Here’s how they work:

They pay off all of your accounts, then issue you a new loan for the combined balances they paid off. Chances are this new loan will have a lower interest rate, which means you can pay less monthly on the same principal debt.

When you go this route, keep a few things in mind:

- A Lower Score: Your credit score will still take a hit because of all the closed accounts. But at least you’ll be preventing a credit score disaster by letting the individual credit card accounts go bad.

- You Have a Right to Know: The credit manager negotiates on your behalf, but you still have a right to know how they’ve managed to negotiate your accounts. Again, try to avoid charge-offs if possible.

- You’re Still Paying All of the Debt: In most cases, you’ll still be paying the full balances of the accounts. They’re being consolidated and not negotiated down.

- Control Spending Going Forward: You should have a little more room in the monthly budget compared to before your debt consolidation. Use that room to get ahead in your finances and not to accrue more trouble.

Why Bother Negotiating to Start With?

As individuals, credit can get us ahead in life. Just imagine how hard it would be to buy a house if you had to save $200,000 of your own money while simultaneously paying rent.

Credit is a two-edged sword. It gives our economic system liquidity for day-to-day activities, but it also gives us the ability to overextend ourselves.

When you’re drowning in too much credit, you risk losing the buying power credit gives you. By getting your credit cards under control, you’ll save yourself a lot of money down the line.

Even if you already have a car and a house and feel like you could let your credit score go, think about what you don’t know and how credit could help:

- What if you needed to borrow $12,000 for a new HVAC system next winter?

- What if you had a great idea for a new business but needed to borrow some capital to get it going?

- What if your son or daughter needed you to cosign on a loan for a car or a student loan in a few years?

These are among the dozens of good reasons to keep your credit score as high as possible — to keep yourself a viable participant in the credit market.

If out-of-control credit cards have you on the verge of losing this ability and you see very little hope for paying off your cards, start the process of getting out from under that debt by asking for help.

You aren’t asking for forgiveness or an unreasonable favor — just a better way to keep moving forward.

Bottom Line – How to Negotiate With Credit Card Issuers

When you’re dealing with credit card debt and trying to work things out, it’s all about keeping your cool and being smart about it. Sure, you gotta be patient, but there’s more to it. You’re kind of teaming up with those credit card folks, taking responsibility, and showing you’re in it for the long haul.

So, here’s the scoop – knowing your options is key. Stuff like making one big payment, setting up a plan, or even hitting pause for a bit can help you make the right move. And you’re not just winging it. You’re getting ready, talking it out, and staying on top of things. Because you’re not just looking for a quick fix; you’re eyeing a future where your money’s in better shape.

Credit’s a bit of a tricky beast, you know. It can be awesome, but it can also trip you up. Negotiating your way out of the mess is like grabbing the reins back. You’re working towards a better financial situation, leaving debt in the dust. It’s like a journey, making the switch from owing to owning the situation.