Identity Theft is increasingly becoming a common crime because of unassuming people who take little care of their personal information.

It is easier for Identity thieves to assume one’s life, especially now with all the new technologies readily available to them to commit the crime.

Once an ID thief possesses your personal and financial information, even from a simple source like a bill or a driver’s license, your identity can successfully be stolen.

For people victimized by the crime, it will be extremely difficult to recover because of the repercussions that it causes to other aspects of their lives. Stolen money can be earned back in time.

Reputation is harder to restore.

The ID thief can commit other criminal acts while pretending to be you; it can cause problems with your personal relationships, financial institutions, or, worse, the government.

Table of Contents

Online Identity Theft

Identity theft has been occurring long before the advent of cyberspace. The online version of this crime is quite similar to the offline version, but always more convenient and a great deal faster.

When before, a thief could only focus on one victim at a time; today, a single click of the mouse can affect millions of lives. The phishing scheme, for example, requires an ID thief to pose as a representative of a trusted company or organization already affiliated with the victim.

The victim usually receives an email that deceivingly looks similar to the real thing and will ask for highly sensitive information about an account with them, such as passwords and account numbers, for a supposed verification process.

If the victim makes the fatal mistake of divulging the information, the thief can begin to wreak havoc by accessing those accounts and even opening new ones under the victim’s name for whatever purpose they desire.

While the authorities are already aggressive in cracking down on crime violators for persecution, especially with Internet fraud, it is still up to the public to protect themselves first and foremost.

Taking extra precautions and advancing your knowledge about Identity Theft is still your best bet in preventing potentially damaging loss.

Below are some great tips to protect yourself from identity theft and being scammed:

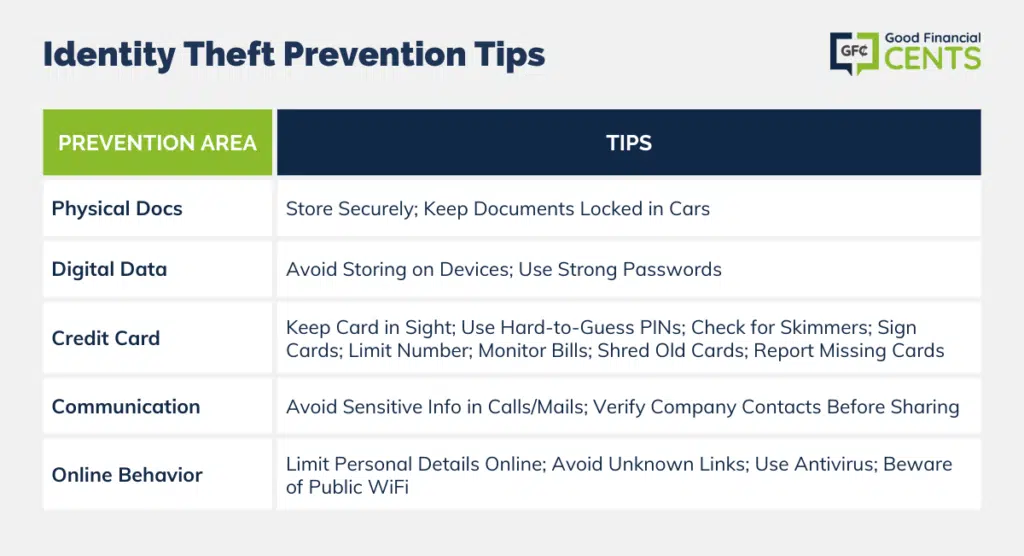

Identity Theft Prevention Tips

1. Keep a hard copy of all important personal information in a secure location. It can help you track or cancel your accounts should your documents get lost or stolen.

2. Never let your credit card out of your sight or leave your personal documents in inaccessible places. Be wary of people who have access to your personal information, even in retail shops and restaurants.

If you need to leave documents inside your car, it should be kept in a lockable glove compartment or in the trunk.

3. Do not store personal information on notebooks, laptops, mobile phones, or other gadgets that can be used by somebody else, easily misplaced, lost, or stolen. If you cannot avoid it, secure all your personal information with a password.

4. Never disclose your credit card PIN to anyone. Choose PIN numbers difficult to guess- those that don’t include birth dates, maiden names, pet’s name, usual number combinations, and so on.

5. When entering your PIN at ATMs and in stores, cover with your hand and be observant of your surroundings.

Make sure that there is surveillance around and that nobody is watching you do your transactions at the ATM. Make sure that there are no unusual devices, such as a card skimmer, illegally attached to the ATM.

6. Always sign the back of your new credit card as soon as you receive it. This will make it difficult for an ID thief to impersonate you in an immediate verification of any transactions.

7. Reduce the number of credit cards you have been issued and only carry those that you intend to use. Shred the credit cards you don’t need after you call customer service to cancel them.

8. Check bills every month and make sure that all the charges are legitimate. Immediately report any unauthorized transactions to your bank or credit card company and ask for an investigation.

9. Destroy any old and expired credit cards. Shred or incinerate everything that bears your personal information before disposal; these include bills, statement letters, and even receipts.

This would prevent thieves from knowing your habits, your normal whereabouts at a specific time, or other information, which can help them steal your identity.

10. Immediately report credit cards that are missing. If you have applied for a credit card that did not arrive on time, contact your credit card company and relay the problem as soon as possible. The reason for this is ID thieves can intercept them; the sooner you act, the lesser your risk.

11. Never respond through postal mail or over the phone when dealing with sensitive information. Scammers will do anything they can to get something from you, even if it means eavesdropping on all your phone conversations or transactions.

Your credit card company will never call you and ask you to verify your information. If you receive a call from the credit card company, hang up and call the number on the back of the card so you know you’re talking to the company and not a scammer.

12. Do not submit personal details over the internet, like your date of birth, home or mailing address, and phone numbers, especially on social networking sites. Do not give your private details to anyone who sends you an email or links to unsecured websites.

13. Do not click on photos, videos, or advertisements on unknown websites or social networking sites. Ensure that you have software protection against antivirus and antimalware installed on your computer devices and that it is kept up to date.

14. Be careful with public WiFi hotspots like at a coffee shop. WiFi hotspots won’t have secure internet, and inputting your personal information when connected can put your information at risk of being snooped by someone at the coffee shop.

Avoid Common Identity Theft Scams

The FBI has a great website dedicated to common fraud schemes. Make sure you don’t fall for them. Always take any email or phone call you get with a grain of salt.

If someone asks you to deposit a check and then Western Union the money to somewhere in Africa, don’t do it. (Yes, people fall for this.)

If you receive a call from one of your financial institutions, be sure to get off the phone quickly without giving away any identifying information, then look up the correct phone number online (or on the back of your card) and call back directly.

What to Do if You Think Your Identity Has Been Stolen

Think your identity has been stolen? Here are 3 steps to take:

Check Your Credit Report

If you fear your identity has been stolen — maybe you got a call from your credit card company about a bunch of fraudulent charges they caught — the first thing you need to do is to check your credit report.

There are many services that can help you keep tabs on your credit report:

- AnnualCreditReport.com is a free website that the government requires the credit bureaus to set up. You are allowed one free credit report every 365 from each of the 3 credit bureaus. The bureaus share information, so there is usually no need to check all three reports at the same time.

If you spread out your free reports to once every four months, you’ll be able to monitor your credit much more closely.

- Identity Force – is an identity theft protection service. They monitor all three of your credit reports, your credit score, and even the black market for personal information to make sure your identity isn’t compromised.

- Credit Karma is a free service that gives you not only a free credit report but also a free credit score. You’ll be able to see if any accounts have been opened in your name and if any fraudulent accounts have late or missed payments, which would bring down your credit score.

- Credit Sesame is a service that lets you access a free credit report each month. Plus, they help you find ways to save money on the loans you have and increase your credit score over time.

Once you have your report you need to review it to make sure that all of the accounts that are open on your report are actual accounts you opened. If not, your identity has most likely been stolen, and you’ll need to take further steps.

Alert Your Financial Institutions

If you suspect your identity has been stolen, you need to contact all of your financial institutions to let them know to put a fraud alert on your account. That means you have to call every bank, credit union, and credit card company that you have accounts with.

You will also have to call the institutions where unauthorized accounts have been opened in your name and get them to close them. Often, they will require you to have a police report to be able to do this.

Freeze Your Credit

Lastly, you can freeze your credit with each of the credit bureaus. Experian has a good explanation of how to freeze your credit. You normally have to pay a nominal fee to each credit bureau to lock down your credit report.

However, doing this will make it impossible for anyone — including you — to open new lines of credit in your name. To get a new line of credit in the future, you will have to pay another nominal fee to unlock your credit report.

This is a great way to keep your financial history safe. It can’t prevent your personal information (like your social security number) from being stolen, but it can make having that information useless because the identity thief can’t open up accounts in your name.

The Bottom Line – How You Can Avoid Falling for the Latest Identity Theft Scam

In an era where identity theft is rampant, safeguarding one’s personal and financial data is paramount.

The integration of technology into our daily lives, while offering convenience, also presents opportunities for cybercriminals to exploit unsuspecting individuals. It’s essential to understand that the onus of protection lies with the individual.

By adopting vigilant habits, such as monitoring financial statements, using strong passwords, and being cautious about sharing personal information online, we can significantly reduce the risk.

Furthermore, educating oneself about common scams and staying updated on protective measures is the best defense.

If suspicious activities arise, swift actions like checking your credit report and alerting financial institutions can mitigate potential damage. The key is proactive prevention.

While it is true that identity theft for malicious purposes has assumed endemic proportions, it is equally heartening to know that there are several safeguards to keep one’s personal information secure. Being vigilant against prying eyes and therefore not yielding to unscrupulous elements is the modern mantra these days.