The Dow Jones Industrial Average is heading for an imminent change with the expected bankruptcy filing of auto giant General Motors. With the falling out of the once legendary blue chip stock, many of my clients have inquired as to how companies get listed on the Dow Jones Industrial Average and when are they replaced. I thought I would give a brief background on the origin of the Dow Jones, with the current holdings as well as what it takes to be listed.

Table of Contents

What Is the Dow Jones?

It never fails that every day I get the question, “How did the market do?” or “How’s the market doing?”. The market that everybody is always referring to is the Dow Jones Industrial Average. The Dow (for short) was founded on May 26, 1896, initially only having 12 companies from important American industries (hence: “Industrial” average). The Dow currently reflects the top 30 U.S. Companies across its various industries.

To compute the Dow that you hear about each day, a lengthy geometric formula is used that takes the price-weighted stock price of each company and divides it by the “DJIA divisor”. The divisor is a number that is constantly adjusted to reflect stock splits, mergers, and dividend payments.

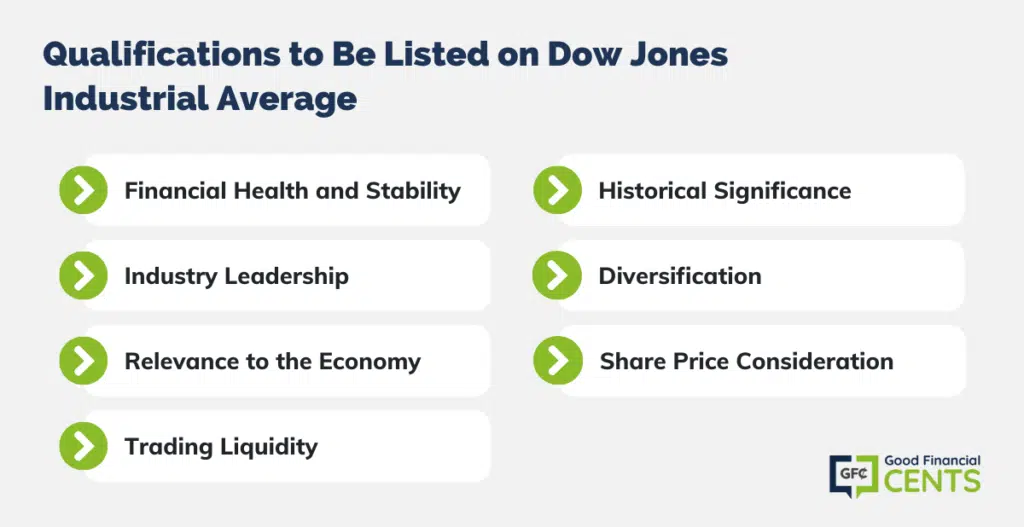

Qualifications to Be Listed on Dow Jones Industrial Average

To earn a coveted spot on the Dow Jones Industrial Average (DJIA), companies must meet specific criteria that reflect their significance within the American economy and financial markets. While there are no hard and fast rules, several key qualifications are considered when selecting or replacing a DJIA component.

The most common criticism of the Dow is that it only represents 30 companies yet it’s recognized as “The” market indicator. Even though the S&P 500 represents the top 500 US companies and is a better reflection of our economy, when people ask me about the “market”, I assure you it’s not the S&P 500.

- Financial Health and Stability: The DJIA comprises established, financially stable companies. Firms with a history of profitability and sound financial management are more likely to be considered.

- Industry Leadership: Companies representing various industries are included in the DJIA to provide a broad economic snapshot. A prospective addition should be a leader or prominent player in its sector.

- Relevance to the Economy: DJIA components should reflect the overall health and trends of the U.S. economy. This requires that companies have a substantial impact on the nation’s economic landscape.

- Trading Liquidity: Stocks selected for the DJIA must be actively traded with sufficient liquidity to allow for meaningful price representation.

- Historical Significance: The Dow values continuity and stability. Companies considered for inclusion often have a longstanding history and reputation for innovation and growth.

- Diversification: To maintain a balanced representation, the DJIA avoids overconcentration in any single industry. A candidate should offer diversification benefits.

- Share Price Consideration: The price of a stock plays a role in DJIA calculations. A high share price allows for accurate price-weighted calculations, making it more attractive for inclusion.

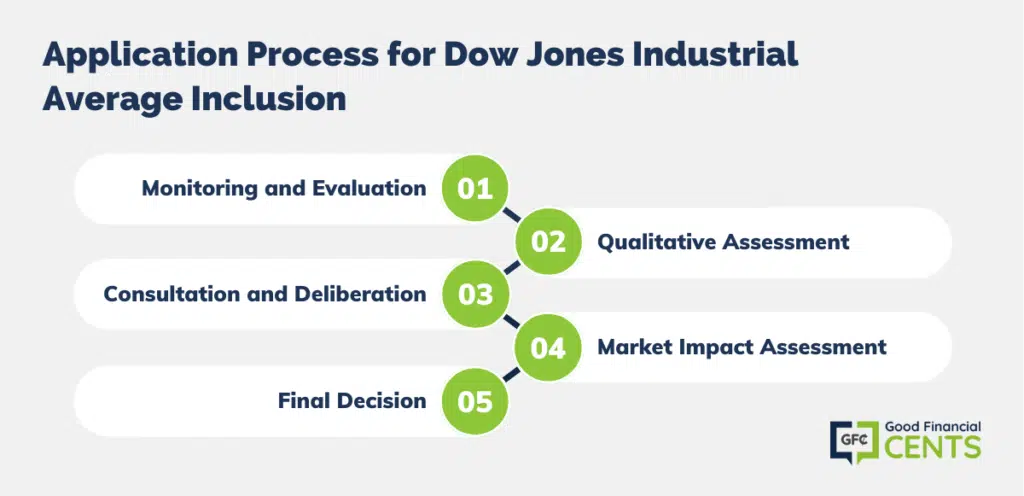

Application Process for Dow Jones Industrial Average Inclusion

The process of joining the prestigious Dow Jones Industrial Average (DJIA) is a rigorous and selective one. While there isn’t an official application process like a traditional job application, companies are considered for inclusion based on a combination of factors that reflect their significance within the American economy and financial markets.

1. Monitoring and Evaluation: The DJIA’s selection committee continuously monitors the stock market and identifies potential candidates for inclusion. Companies often come to their attention through market trends, financial performance, and industry prominence.

2. Qualitative Assessment: The committee conducts a qualitative assessment of prospective candidates. This evaluation considers the company’s financial health, industry leadership, historical significance, and overall impact on the U.S. economy.

3. Consultation and Deliberation: The committee, comprising experts and analysts, engages in consultation and deliberation to reach a consensus. They weigh the pros and cons of adding a specific company, considering factors like diversification and relevance to the broader market.

4. Market Impact Assessment: Adding or replacing a company on the DJIA can influence market sentiment. The committee assesses how the decision may impact investor confidence and market stability.

5. Final Decision: Once a decision is reached, the committee announces the addition or replacement of a DJIA component. This decision is made with the goal of maintaining the index’s accuracy and reflecting the ever-changing dynamics of the U.S. economy.

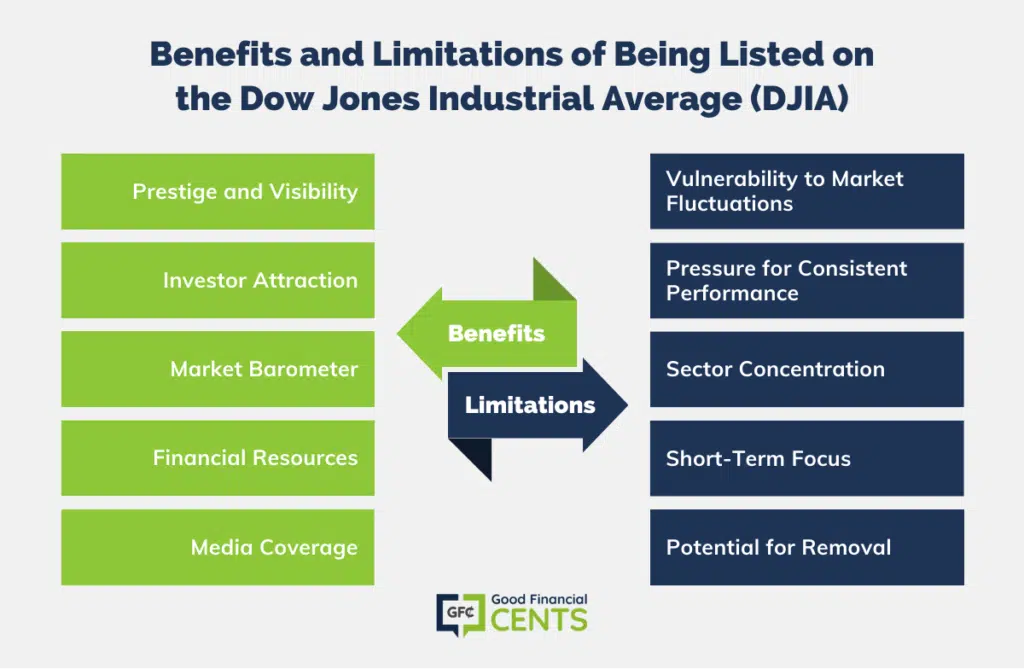

Benefits and Limitations of Being Listed on the Dow Jones Industrial Average (DJIA)

Benefits

- Prestige and Visibility: Inclusion on the DJIA is a mark of prestige, signaling to investors, analysts, and the public that a company is a significant player in the U.S. economy.

- Investor Attraction: DJIA-listed companies often attract a broader range of investors, including institutional investors and index-tracking funds, leading to increased liquidity and potentially higher stock prices.

- Market Barometer: Being part of the DJIA means a company’s performance is closely monitored as an indicator of the broader market, which can boost its profile and credibility.

- Financial Resources: The increased attention can facilitate access to financial resources, making it easier to raise capital or secure favorable lending terms.

- Media Coverage: DJIA companies receive extensive media coverage, helping them reach a wider audience and strengthen their brand recognition.

Limitations

- Vulnerability to Market Fluctuations: DJIA-listed companies are subject to the volatility of the broader market, which can lead to sharp fluctuations in their stock prices.

- Pressure for Consistent Performance: The constant scrutiny means that companies are under pressure to maintain consistent financial performance, which can be challenging in a dynamic economy.

- Sector Concentration: The DJIA aims for diversification, but some sectors may be overrepresented, exposing companies to sector-specific risks.

- Short-Term Focus: Quarterly earnings reports and stock price performance often take precedence, potentially discouraging long-term strategic investments.

- Potential for Removal: Companies may be removed from the DJIA if their financial health deteriorates, leading to a loss of prestige and investor confidence.

Current Holdings Dow Jones

Here’s a look at the current holdings in the Dow Jones:

| Company | Symbol | Industry | Date Added |

|---|---|---|---|

| 3M | MMM | Diversified industrials | 8/9/1976 |

| Alcoa | AA | Aluminum | 6/1/1959 |

| American Express | AXP | Consumer finance | 8/30/1982 |

| AT&T | T | Telecommunication | 11/1/1999 |

| Bank of America | BAC | Institutional and retail banking | 2/19/2008 |

| Boeing | BA | Aerospace & defense | 3/12/1987 |

| Caterpillar | CAT | Construction and mining equipment | 5/6/1991 |

| Chevron Corporation | CVX | Oil and gas | 2/19/2008 |

| Citigroup | C | Banking | 3/17/1997 |

| Coca-Cola | KO | Beverages | 3/12/1987 |

| DuPont | DD | Commodity chemicals | 11/20/1935 |

| ExxonMobil | XOM | Integrated oil & gas | 10/1/1928 |

| General Electric | GE | Conglomerate | 11/7/1907 |

| General Motors | GM | Automobiles | 8/31/1925 |

| Hewlett-Packard | HPQ | Diversified computer systems | 3/17/1997 |

| The Home Depot | HD | Home improvement retailers | 11/1/1999 |

| Intel | INTC | Semiconductors | 11/1/1999 |

| IBM | IBM | Computer services | 6/29/1979 |

| Johnson & Johnson | JNJ | Pharmaceuticals | 3/17/1997 |

| JPMorgan Chase | JPM | Banking | 5/6/1991 |

| Kraft Foods | KFT | Food processing | 9/22/2008 |

| McDonald’s | MCD | Restaurants & bars | 10/30/1985 |

| Merck | MRK | Pharmaceuticals | 6/29/1979 |

| Microsoft | MSFT | Software | 11/1/1999 |

| Pfizer | PFE | Pharmaceuticals | 4/8/2004 |

| Procter & Gamble | PG | Non-durable household products | 5/26/1932 |

| United Technologies Corporation | UTX | Aerospace, heating/cooling, elevators | 3/14/1939 |

| Verizon Communications | VZ | Telecommunication | 4/8/2004 |

| Wal-Mart | WMT | Broadline retailers | 3/17/1997 |

When Does a Stock Get Dropped From the Dow?

A stock is dropped from the Dow Jones when it seems warranted. As mentioned before, General Motors is presumed to be soon removed from the Dow especially if it files for bankruptcy. A likely candidate to join GM is (former) banking giant Citigroup. Here are some of the more notable changes in recent history:

- September 22, 2008: Kraft Foods replaced AIG (American International Group)

- February 19, 2008: (My wife’s b’day 🙂 Chevron and Bank of America replaced Altria Group and Honeywell

- April 8, 2004: Pfizer, Verizon, and AIG replaced International Paper, AT&T, and Eastman Kodak

Who Will Replace GM?

There aren’t any preset rules on how a company gets replaced on the Dow. Looking at past replacements, typically the Dow does not replace an existing company with another in its same industry. Currently, there are several speculations on which company is going to replace them. A few possibilities include: Cisco, Visa, Amazon, Wells Fargo, and mother Google. Time will tell.

Update: Cisco and Traveler’s Co. will be replacing GM and Citi at the end of trading on June 8, 2009.

Bottom Line: Getting Listed on the Dow Jones Industrial Average

Earning a coveted spot on the Dow Jones Industrial Average (DJIA) is a testament to a company’s financial health, industry leadership, and overall relevance to the U.S. economy. While there are no fixed rules, the selection process involves meticulous monitoring, qualitative assessment, consultation, and a keen eye on market impact. Being part of the DJIA brings prestige, investor attraction, and increased financial resources but also entails the pressure for consistent performance and exposure to market fluctuations.

The DJIA, despite representing only 30 companies, remains a prominent market indicator, distinct from the broader S&P 500. Companies listed in the DJIA enjoy visibility and media coverage, but they must navigate short-term focus and the potential for removal if financial health falters.

As General Motors faces potential removal, the Dow’s ever-evolving composition reflects the dynamic nature of the U.S. economy. Speculation surrounds its replacement, with past trends suggesting diversity in industry representation. Ultimately, the DJIA remains an influential barometer of the American market, reflecting its enduring significance in the world of finance.