The Rising Need for Alternative Health Coverage

At a time when health insurance premiums are going through the roof, and it seems as if medical expenses are getting harder to cover, people are becoming increasingly keen to learn about alternative ways to handle health coverage.

One of the best ways available is through health savings accounts, commonly known as HSAs.

These plans are often available through employers, though not everyone participates in them.

Part of the reason for this is that an HSA represents an additional expense.

Not only are you paying for your health insurance, but you must also fund your HSA. In many households, that creates a budget squeeze.

We received an Ask GFC question on this very topic:

“Jeff, what recommendations do you make to your clients when they are seeking to create a balanced budget while factoring in HSAs in a high deductible health plan? Please advise.”

I’ll get into the budget aspect of an HSA, but first, let’s take a look at the basics for the benefit of those who don’t know what they’re all about.

Table of Contents

What Is an HSA?

HSAs were first created in 2003. In effect, they are employer-sponsored savings accounts that are designed specifically to pay for health care costs. They are typically set up under employer-sponsored cafeteria plans, in which you can select from a menu of employee options that you consider to be valuable and are willing to fund.

Though they are most often offered by employers, you can also set up an individual HSA through a bank or brokerage firm that offers the plan.

The contributions that you make to an HSA are tax-deductible, much like IRA and 401(k) contributions. The money can even be invested to earn more money, and those earnings accumulate on a tax-deferred basis.

Withdrawals can be made to cover qualified medical and dental costs only. That means you won’t be able to allow the money to grow and then withdraw it for unrelated purposes.

HSA’s are designed specifically to work in conjunction with high deductible health insurance plans. The funds that are contributed to the HSA can be withdrawn and used for such expenses as copayments, health insurance deductibles, and even certain health insurance premiums.

A limitation is that you are not eligible for an HSA if you are either on Medicare or you can be claimed as a dependent on someone else’s tax return.

HSAs do have contribution limits. For 2024, they are $4,150 for individuals with self-coverage only and $8,300 for individuals with family coverage.

Contributions can be made either by you as the plan participant, your employer, or by a combination of both. So if you are an individual with family coverage, and your employer pays $3,000 for the plan, your maximum contribution will be $4,750, for a maximum total of $7,750.

You can make contributions to an HSA right up until the tax filing deadline for the previous year. For example, you can make a 2023 contribution as late as April 15, 2024.

Earlier, I mentioned that HSAs are designed to be used in conjunction with health insurance plans that have high deductibles. There are two such deductible levels, one for individual coverage and the other for family coverage. Those deductibles are as follows:

- Individual/self-only health insurance – A minimum deductible of $1,300 to a maximum of $6,550.

- Family coverage – A minimum deductible of $2,600 to a maximum of $13,100.

The basic idea behind HSAs is that your contributions to the plan go to cover the higher deductible, which enables the premium on a health insurance policy to be lower.

What Are the Benefits of an HSA?

HSAs have several benefits, apart from the fact that your contributions to the plan are fully tax-deductible and can earn investment income on a tax-deferred basis.

Withdrawals From the Plan Are Tax-Free. But only if they are used for qualified medical purposes. This can be a major benefit to someone who can’t deduct medical expenses, either due to the fact that they are unable to itemize their deductions on their tax return or they don’t qualify to deduct medical expenses.

That second point needs some explanation. Even if you do itemize on your tax return, medical costs can only be deducted to the extent that they exceed 10% of your adjusted gross income.

What that means is that if you make $100,000 per year, your medical costs will be deductible only to the extent that they exceed $10,000. Unless you experience a medical catastrophe, it’s unlikely that they will reach this level.

One other important limitation: any funds withdrawn from an HSA that are used to pay for non-medical expenses are subject to both ordinary income tax and a 20% penalty. So if you have any idea about using the money for some other purpose, forget about it – the tax costs are too high.

HSA Funds Can Accumulate in the Plan. With the high cost of healthcare, it’s entirely possible that your out-of-pocket medical expenses will exceed the amount of contributions that you can make to the HSA in any given year.

However, unused contributions can be rolled forward from year to year. That means, for example, that you might accumulate $20,000 in the plan over a three-year period. That would give you a generous resource for a year in which your medical costs are particularly high.

HSAs Are Portable. If you’ve built up a balance in an HSA with an employer, the plan comes with you even if you leave that company.

Using an HSA to Create a “Backdoor Medical IRA”

Since you can build up an HSA balance much like you can build up a retirement account, an HSA has the potential to become something of a medical IRA. This is particularly true if your participation in the plan starts when you are very young and healthy and unlikely to make many withdrawals from the plan. The account balance can continue to grow steadily from a combination of contributions and investment earnings.

As an example of the potential of how this could play out, the Employee Benefits Research Institute (EBRI) reported the following:

“A person contributing for 40 years to an HSA could save up to $360,000 if the rate of return was 2.5 percent, $600,000 if the rate of return was 5 percent, and nearly $1.1 million if the rate of return was 7.5 percent, and if there were no withdrawals.”

Now that’s an incredibly optimistic projection.

But it shows what could happen if you were to invest in an HSA for 40 years – at a healthy rate of return – but without ever making any withdrawals. Still, the analysis raises an interesting possibility.

One of the biggest – and certainly the most unpredictable – expenses in retirement is healthcare. That’s because healthcare expenses are rising relentlessly, and the need for services increases with age. It can be very difficult to factor healthcare costs into your retirement planning.

But that’s where an HSA as a medical IRA becomes an interesting possibility. Even if you can never reach the high account balances cited by EBRI, but you do manage to accumulate, say, $100,000 or more in your HSA, you’ll have plenty of money available to pay for uncovered medical expenses.

This can include expenses such as prescription medications (including insulin), the cost of certain health insurance premiums, payments for long-term care, as well as co-payments and deductibles under your health insurance plan.

In this way, an HSA that accumulates money over the long term can offset one of the major expenses of the retirement years. Even if it cannot be used to pay for general living expenses, the ability to pay for healthcare costs will be significant.

Building an HSA Into Your Budget

Finally, let’s get to the reader’s primary question – creating a balanced budget while factoring in HSAs in a high-deductible health plan.

Whether you are eligible to contribute up to $4,150 or $8,300, it will represent an additional expense in your budget. Remember, the HSA contribution is over and above your basic health insurance premium.

This can create a problem in a lot of budgets. After all, any money that you contribute to an HSA is money that is not going to other purposes, including savings and investments.

But there are a few factors working in favor:

- HSA Contributions Are Tax-Deductible. If you are in a combined federal and state income tax bracket of 30%, you will only be effectively contributing 70% of the amount of your contribution out of your own pocket. The government will cover the rest.

- Your Employer May Make Some or All of the Contribution. Whatever they will pay will be that much less than you will have to contribute.

- An HSA Will Allow You to Take a Higher Deductible. That means that your basic health insurance premium will be lower. The savings on the premium should cover a good part of the cost of funding your HSA.

- You don’t have to make the maximum contribution. If you can’t afford to make the maximum, contribute whatever amount you are able to do comfortably.

- HSAs Are Cumulative. During stretches, when you are healthy and not filing claims, the account will quietly build up. Even if your contributions are relatively small on an annual basis, it can seriously add up over several years.

- Join An HSA After a Major Pay Increase. Probably the best time is after you get either a large raise, a promotion, or a new job at substantially higher pay. You can dedicate the additional income to the HSA.

- Fund an HSA With Small Pay Raises. Let’s say that you earn $50,000 and you get a 2% pay increase, equal to $1,000. Make that contribution to an HSA for the following 12 months. Do the same with the next pay increase and each year until you reach the maximum HSA contribution limit.

If you set it up right, you’ll hardly notice that you are even making contributions to an HSA. The payoff is that you will be covering what is perhaps the biggest contingency expense that most of us will face, and that’s a major medical event.

The peace of mind that you will gain from that kind of benefit will certainly be worth the inconvenience of carving out an extra space in your budget.

Comparisons With Other Healthcare and Savings Options

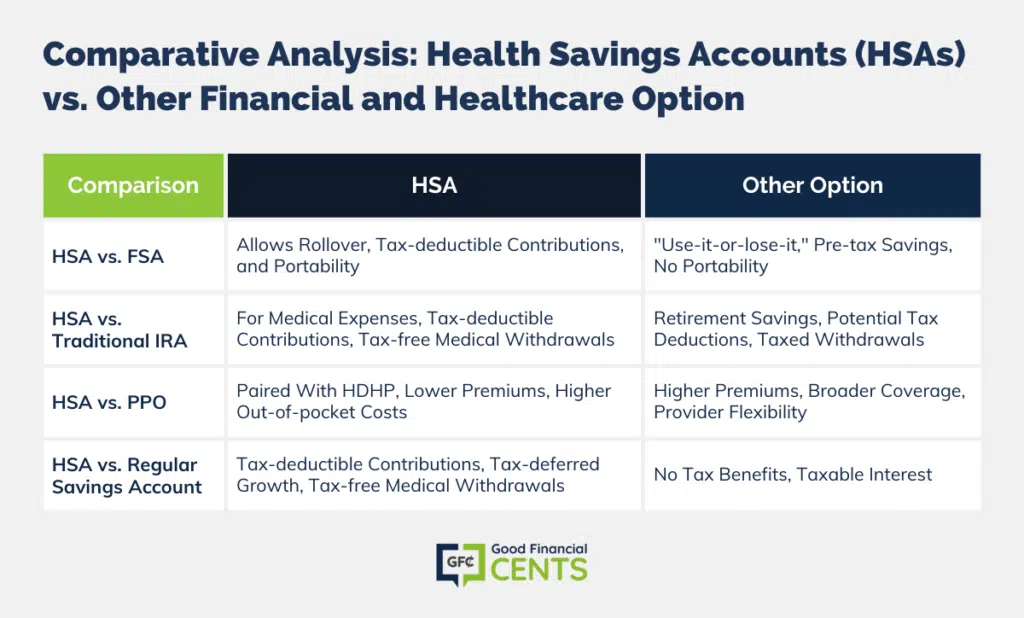

As you consider an HSA’s role in your financial and healthcare planning, it’s essential to understand how they compare to other healthcare and savings vehicles. Here’s a brief overview of how HSAs stack up against some other popular options:

1. HSA vs. FSA (Flexible Spending Account):

- HSA: Allows you to roll over unused funds from year to year, offers a tax deduction for contributions, and can be combined with investment options. They are also portable, meaning you can take them with you if you change jobs.

- FSA: Typically, FSAs are “use-it-or-lose-it” accounts, meaning unused funds do not roll over to the next year (though some plans allow a grace period or a small rollover). They provide pre-tax savings, but you can’t take an FSA with you if you change employers.

2. HSA vs. Traditional IRA:

- HSA: Designed specifically for medical expenses, contributions are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

- Traditional IRA: Primarily a retirement savings account, contributions may be tax deductible, but withdrawals in retirement are taxed as ordinary income. Early withdrawals can be subject to penalties, though there are exceptions for specific situations.

3. HSA vs. PPO (Preferred Provider Organization):

- HSA: HSAs are typically paired with high deductible health plans (HDHPs), which often have lower monthly premiums than PPOs but higher out-of-pocket costs until the deductible is met.

- PPO: These plans often come with higher monthly premiums but provide broader coverage without needing to meet a high deductible first. They offer flexibility in choosing healthcare providers.

4. HSA vs. Regular Savings Account:

- HSA: Contributions are tax-deductible, funds grow tax-deferred, and withdrawals for medical expenses are tax-free.

- Regular Savings Account: No tax benefits for contributions or withdrawals, and interest earned may be taxable.

When comparing HSAs to other options, consider your current health needs, potential future medical expenses, and your overall financial situation. An HSA is not a one-size-fits-all solution, but for many, it can be a versatile and beneficial tool in both healthcare and financial planning. Evaluate the pros and cons of each option and consult with a financial advisor to determine the best fit for your circumstances.

The Bottom Line – Ask GFC 023 – Fitting an HSA Into Your Budget

Incorporating a Health Savings Account (HSA) into your financial landscape is not just a prudent step toward managing potential medical expenses but also an avenue for significant tax advantages and future savings.

With medical costs continually on the rise, HSAs offer a cushion against unforeseen health-related expenses while simultaneously offering a potential nest egg for healthcare in your golden years.

By strategically fitting an HSA into your budget, you not only safeguard your finances against unexpected medical costs but also invest in the promise of a secure and worry-free future. Embrace the HSA’s multifaceted benefits and fortify your financial well-being.