If you have read my posts on annuities in the past, you know that I’m not really a big fan of them. But deferred income annuities are an exception. They provide safety of principal, reliable investment returns, and an income for life – all of which is a hard combination to beat anywhere else. In addition, you can invest a portion of your 401(k) plan in one of these annuities, which will help to provide you with the income that you will need in retirement.

Table of Contents

What Are Deferred Income Annuities?

A deferred income annuity – which is sometimes called a longevity annuity – is a contract that you create with an insurance company, in which you give them a lump sum, it accumulates investment income, and is later distributed to you in the form of guaranteed lifetime income. “Later” can be as little as one year after you initiate the contract, or as many as 40 years if you’re in your 20s and setting it up for your retirement when you’re in your 60s.

Funds deposited into the plan are put into an accumulation account in your name. The insurance company then pays a fixed rate of interest on the plan. This rate of return is guaranteed by the insurance company for up to 10 years. After that, the rate of return is reset by the insurance company. The resets occur on an annual basis from that point on. However, the insurance company typically provides a minimum rate guarantee, ensuring that the return never falls below that rate for the life of the annuity.

Once the income distributions begin, you can set them up as either fixed or variable payments. Unlike immediate annuities, deferred income annuities require that a certain amount of time passes before income will be paid out.

This deferral, however, actually works to your advantage. First, it provides time for the investment earnings to accumulate and increase the size of the annuity. And second, it reduces the number of years that the insurance company has to make income payments, which will result in higher payments when payout time comes. It works very similar to traditional retirement savings plans, in that the longer that they can accumulate earnings, the bigger the plan will be, and the higher the distribution payments will be.

But one of the biggest benefits of a deferred income annuity is that it can protect you from the kinds of catastrophic investment losses that occur during stock market crashes. It can reduce a lot of the worry that people have about preparing for retirement, especially in those last years leading up to it.

How Deferred Income Annuities Work

When you initiate a deferred income annuity, you choose the date at which you will begin receiving income. The insurance company will guarantee you a certain amount of income at that time. However deferred income annuities typically allow you to make additional contributions, increasing both the size of the annuity and the income payments that you will receive.

Deferred income annuities are an excellent choice if you are not covered by a traditional pension plan, and wish to create your own personal equivalent plan. The sooner that you set up the annuity before you begin receiving income payments, the higher those payments will be.

For example, if you’re 65 years old, and have a life expectancy of 85, and you put $200,000 into an immediate annuity, you would receive about $10,000 per year of retirement income for the rest of your life.

But if you were to invest $100,000 in a deferred income annuity at age 45, and it grew to $500,000 by age 65, you would have an income of $25,000 per year for the rest of your life. And you will be doing that with a much smaller upfront investment.

There’s an important trade-off in regard to deferred income annuities that you need to be aware of. When you enter into such a contract, you forfeit the principal invested in the plan. The trade-off is that you are using that forfeiture to providing you with a guaranteed income for life. That means that while the annuity will provide you with an income for the rest of your life, once you die, none of the money invested in the plan will pass to your heirs.

However, many insurance companies do offer optional death benefit riders, that will provide a benefit to be passed on to your heirs. This benefit can be provided either in the form of a continuation of your guaranteed income for a specific amount of time – transferred to your heirs – or the full return of the initial premium that you invested in the annuity. A fee will be added to your annuity to cover the cost of this rider, though they are generally paid through a reduction in your income benefits.

There are other riders available as well. For example, in addition to a guaranteed income for the rest of your life, you can also arrange for that income to transfer to your spouse at your death. You can even arrange to have the benefits transferred to your heirs or a specific amount of time. Some provisions can provide you with a guaranteed income for a specific period of time. For example, if you select a guaranteed income for 30 years, and you die after 10 years, the income payments will transfer to your named beneficiaries for the balance of the 30-year term.

Whenever you take a deferred income annuity, or any annuity for that matter, be sure to explore all of the options that are available with the annuity, based on your own personal needs. Annuities can generally be customized to fit whatever your personal preferences may be.

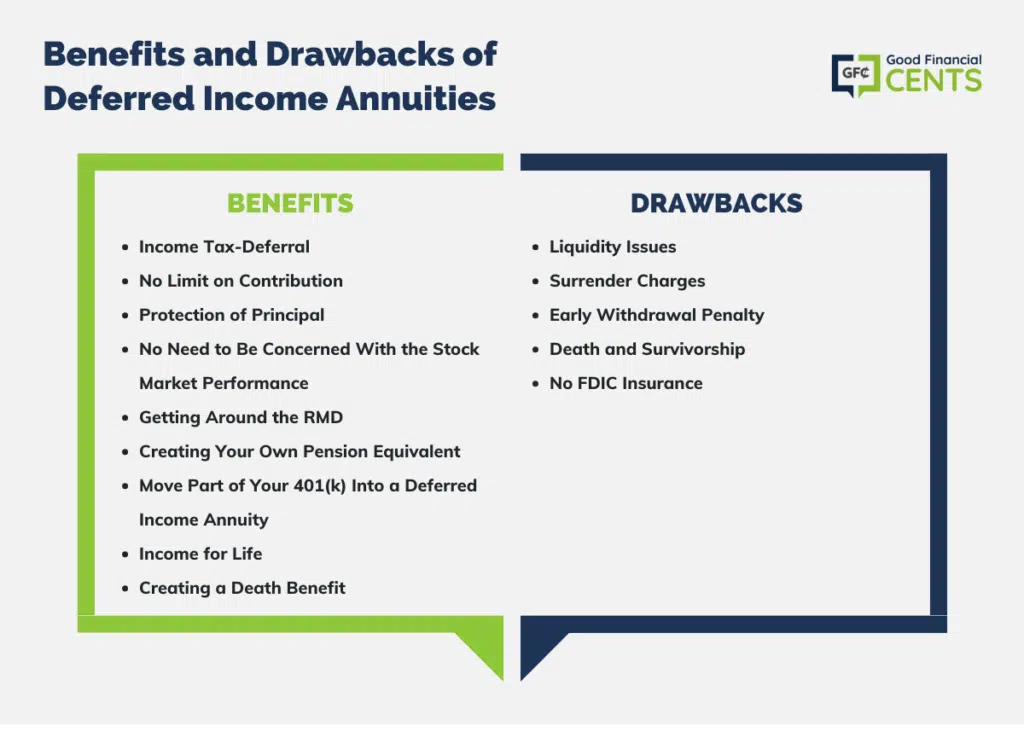

Benefits of Deferred Income Annuities

Deferred income annuities are one of the better investment programs for retirees. That’s because they offer the following benefits:

Income Tax-Deferral

Much like a tax-sheltered retirement plan, the investment income that you earn in a deferred income annuity enjoys tax-deferred growth. You will pay no tax on the amount earned, but withdrawals will be subject to income tax on the amount of investment income they include.

Contributions to a deferred income annuity work much the same as they do with a Roth IRA. The contributions themselves are not tax-deductible, but the investment earnings in the plan are tax-deferred.

No Limit on Contributions

You can literally contribute as much to a deferred income annuity as you like, as there are no legal maximums.

Protection of Principal

The money that you invest in a deferred income annuity is guaranteed, and thus not dependent on the movements of the financial markets. In that way, the annuity behaves more like a CD than a mutual fund.

You don’t need to be concerned with the performance of the stock market. Since the investment return on a deferred income annuity is set in the annuity contract, it is not dependent upon the stock market. You will get the agreed-upon rate of return, or the minimum rate guarantee, no matter what the stock market does.

Getting Around the RMD

With the exception of a Roth IRA, virtually all retirement plans are subject to required minimum distributions, commonly known as RMDs. That means that you must begin taking distributions from the plan no later than when you turn age 73. Distributions will be based on your life expectancy at that age and then adjusted in each subsequent year.

However, deferred income annuities are not subject to RMDs. You can plan to begin taking distributions at 75 or 80, as a way to preserve your income as your other retirement plans are gradually reduced by regular distributions. It’s an excellent strategy to prevent outliving your money.

Creating Your Own Pension Equivalent

If you don’t have the benefit of a traditional pension plan – and most workers today don’t – you can use a deferred income annuity to create an equivalent plan. By investing a certain amount of money into one of these annuities, you can virtually guarantee that you will have a certain level of income benefit in retirement. In this way, a deferred income annuity closely matches a traditional defined benefit plan.

You can move part of your 401(k) into a deferred income annuity. These annuities were first created in 2011, as a way to help retirees structure their 401(k) plans in such a way as to provide themselves with a reliable income. The 401(k) funds transferred into the deferred income annuity can begin to pay out income benefits immediately, or you can wait to begin taking payments at a later date – which will result in a higher monthly stream of income. This will ensure that you will continue receiving income payments from your 401(k) for the rest of your life.

Income for Life

One of the benefits of most annuities, and especially of deferred income annuities, is that you are creating an income stream that you will receive for the rest of your life. You can begin taking income payments at retirement, or you can continue to defer them until a later date. Either way, this will ensure that you never outlive your money.

Creating a Death Benefit

Like all annuities, deferred income annuities are a life benefit, and don’t generally provide a death benefit to your heirs. When you die, any funds remaining in the annuity contract revert to the life insurance company. This arrangement serves to counterbalance the income-for-life provision, in which the insurance company must continue paying you income benefits, even if the annuity should become exhausted.

However, you can add various riders to your deferred income annuity, such as a death benefit rider, that will pass a specified amount of money onto your heirs after your death. This will increase the cost of the annuity somewhat, but it will also guarantee that your annuity will provide both a life benefit to you and a death benefit to your heirs.

Risks of Deferred Income Annuities

Deferred income annuities do have certain risks. Some are specific to deferred income annuities, while others apply to all annuities in general.

Deferred Income Annuities Are Not Liquid

We touched on this earlier, but it’s worth reemphasizing. Money that is invested in a deferred income annuity is forfeited. While some deferred income annuities do provide limited options to withdraw funds from the plan, the distributions are usually subject to surrender charges, while the reasons for the withdrawal are limited. That means that, unlike more conventional investments, you will be unable to tap the plan when you need funds for other purposes. Deferred income annuities are long-term contracts established as permanent arrangements.

Surrender Charges

Withdrawals taken from your deferred income annuity contract will carry a surrender charge. The charge usually applies to withdrawals that exceed a certain percentage of the value of the contract, which is generally 10%. The surrender charge will apply if your withdrawal exceeds that percentage.

Surrender charges can occur if withdrawals are taken within a certain period of time, usually between five and 14 years. The surrender charge itself is typically 10% but works on a declining basis. For example, the surrender charge may decline by 1% per year, until after the 10th year it disappears completely.

Early Withdrawal Penalty

Just as is the case with a tax-deferred retirement plan, withdrawals taken out of your annuity before you reach the age of 59 1/2 will be subject to the IRS 10% early withdrawal penalty. This will be in addition to any surrender charge that may exist. The penalty, as well as ordinary income tax, will have to be paid on the portion of the withdrawal that represents investment income.

Death and Survivorship

As I mentioned earlier, the remaining balance in your annuity at the time of your death will revert to the insurance company, and not to your heirs. This is the payback for the promise of an income for life – the insurance company will continue making income payments to you even if your annuity contract balance has been completely used up.

However, there are various options that you can use, including a death benefit rider that will provide a death benefit to your heirs. It will cost you some extra money, but it will represent a workaround for the annuity value going to the insurance company.

No FDIC Insurance

Annuities are not covered by FDIC insurance, the way bank investments are. Instead, they are guaranteed by the issuing insurance company. The incidence of insurance company failure is extremely rare. But you can lower those chances by checking the company’s rating with AM Best. The higher the rating that they assigned to the company, the lower the chance that they will ever default.

You should also be aware that most states have guaranty associations that provide some protection in the event of a default by the issuing insurance company. Check with your state insurance commissioner to see if your state has it, and how much coverage they provide.

Are Deferred Income Annuities Good for You?

Deferred income annuities can provide something like a pension for investors who are not covered by a traditional defined benefit pension plan. Since the annuity will provide you with a fixed annuity payment for the rest of your life, it will work just like a traditional pension plan. And since they guarantee an income for life, you don’t have to be concerned with outliving your money.

They also offer you an opportunity to earn interest rates that are in excess of what you can generally earn on other fixed-income assets, such as certificates of deposit. And your principal value is always completely safe, so that you are not subject to the swings that take place in a financial markets.

And like all annuities, they provide you with an opportunity to save even more money for retirement, or to play catch-up if you are approaching retirement age with insufficient savings. Since there are no maximum contribution limits, you can contribute as much as you need to in order to provide for the type of retirement that you want.

If you don’t want to tie up your money, or risk losing access to the funds, you’ll probably want to avoid a deferred income annuity. And naturally, if you are a do-it-yourself investor, with a solid track record of success, you probably won’t be interested in this type of annuity either. It is, after all, a completely hands-off investment. Learn more about the difference between a 401k vs Roth IRA as you do your research and decide what is best for you.

Final Thoughts – Deferred Income Annuities

While many investors diversify their portfolios across various asset classes, there’s often a tendency to overlook the distribution phase of retirement planning. Deferred income annuities can serve as a strategic tool to enhance retirement income diversification. Not only do they promise a steady stream of income, but they also act as a hedge against market downturns and longevity risks.

By incorporating a deferred income annuity into your financial plan, you’re essentially buying peace of mind. Like any other financial product, however, it’s essential to understand its intricacies and assess if it aligns with your retirement goals before diving in.