Many seniors have misconceptions about the differences between Medicare and Medicaid eligibility benefits.

Throw in long-term care insurance, and the water gets even more muddier. Even as a Certified Financial Planner, it’s tough trying to stay on top of all the issues concerning seniors.

To help clear some of the mental fog that comes along with these issues, I decided to bring in a subject matter expert to help out. Tiffanny Sievers, Attorney at Law and founder of SI Elder Law has been kind enough to share her expertise on the differences between Medicare and Medicaid and how seniors can plan for their later years. Here’s what she had to say….

Table of Contents

- 1. What Steps Can One Take to Prepare for Dealing With Elder Issues?

- 2. How Long Will Medicare Cover Nursing Home Costs?

- 3. What Is the Difference Between Medicare and Medicaid? Common Misconceptions?

- 4. How Much Does It Cost to Be in a Nursing Home?

- 5. What Are the Ways to Pay For Nursing Home Costs?

- 6. What Hope, if Any, Is There for Those Who Didn’t Plan?

- 7. Anything Else?

- Bottom Line: Understanding Medicare and Medicaid Benefits

1. What Steps Can One Take to Prepare for Dealing With Elder Issues?

In order to properly prepare for elder issues, an individual first needs to have a good foundation of good planning documents. This means having a Power of Attorney for Property and a Power of Attorney for Health Care.

These documents allow someone you pick to make property and health care decisions for you when you are unable to do so yourself. Second, they need to be prepared for an untimely death. It is better to plan when you are healthy than when you are sick.

Of course, meet with an attorney and that attorney can help you decide what documents you will need to make sure that your wishes are carried out after your death, such as a last will and testament or trust. Third, meet with your financial advisor to determine what investments will give your beneficiaries the best tax benefits and make sure that you have enough Life Insurance to pay for your burial expenses.

Finally, you need to make sure that you have enough assets to avoid running out of money. Once you run out of money, you run out of options. One needs to meet with an elder law attorney, like myself, to make sure that your assets are properly placed to avoid running out of money if one needs long-term care either at home or in a nursing home.

2. How Long Will Medicare Cover Nursing Home Costs?

In a nursing home, Medicare will cover the first 20 days at 100% and then the next 80 days at 80% if you continue to improve medically. After the first 100 days, no matter how much improvement you make, Medicare will stop paying, and you must either move out or find some other way to pay.

3. What Is the Difference Between Medicare and Medicaid? Common Misconceptions?

Almost everyone over the age of 65 is on Medicare and it doesn’t matter what your assets are. However, you must qualify for Medicaid, Medically and financially. Medicaid will only pay if you have limited assets. This means that after Medicare stops paying, you have to spend down your assets until you are just about broke before you qualify for Medicaid.

4. How Much Does It Cost to Be in a Nursing Home?

Nursing homes in Southern Illinois cost between $2,200 and $5,500 a month. In Chicago, one month is $7,500 and up. Assisted Living Ranges from $1,500 to $4,500 a month. Private caregivers in your home range between $ 3,000 and $12,000 a month, depending on how much care is needed.

5. What Are the Ways to Pay For Nursing Home Costs?

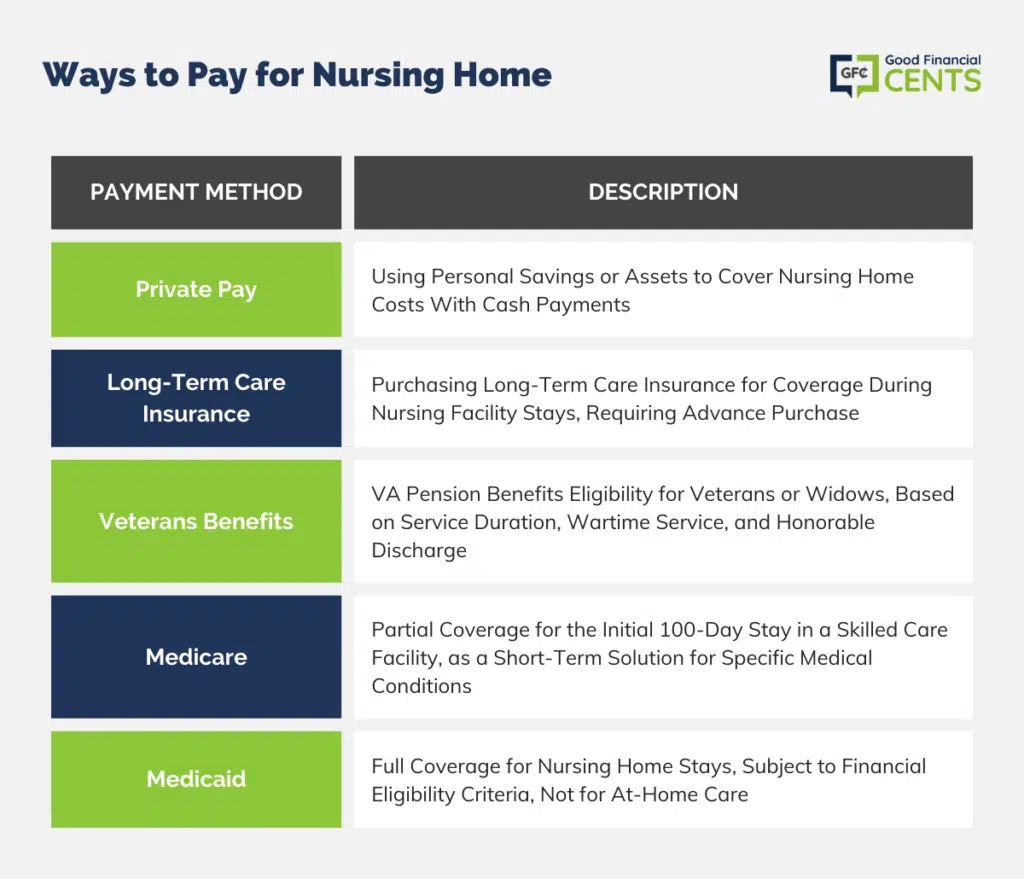

In my opinion, there are five ways to pay for nursing home costs:

1. Private Pay – with good old fashion cash.

2. Long-Term Care Insurance – If you have bought “nursing home insurance,” the policy will pay a certain amount of money per day for your stay in a nursing facility. You must have bought a policy before you needed nursing home care.

3. Veterans Benefits – The Veterans Administration offers VA Pension benefits for Veterans or Widows of Veterans if you meet three criteria:

- Served at least 90 days of active duty

- One of those days was during a period of war

- Were something other than dishonorably discharged from the military

4. Medicare – as discussed above, will only pay for part of the first 100-day stay in a Skilled Care Facility.

5. Medicaid – Medicaid pays for your entire stay at a nursing home or supportive living facility. It does not pay for care at home.

Medicaid, unlike Veterans benefits, does not pay a cash benefit but only pays directly for services. In fact, you will never receive any cash from Medicaid. Medicaid has no limit; it will pay for any kind of care that you need. For example, Medicaid will pay for the removal of a splinter or for open heart surgery, no matter the cost.

In order to qualify for Medicaid there are asset and income limitations. If you are married, the community spouse cannot have more than $130,000 plus a house in assets. If you are married, the community spouse will get to keep about $3,700 a month of the couple’s combined income. Whatever income the couple has over $3, 700 the nursing home will be awarded.

If you are single, you must have less than $2000 in assets and all of your income will go to the nursing home less than $30 a month. What SI Elder Law does, is help protect assets so that you can be on Medicaid and not be completely broke.

In most cases, SI Elder Law can save half of your assets once you are in a nursing home and you will receive Medicaid benefits. The sooner that you call SI Elder Law the more money that we can save.

6. What Hope, if Any, Is There for Those Who Didn’t Plan?

With the current laws right now in Illinois, if you haven’t done any planning and are already in a nursing home, I can save half of your assets. The sooner you get to me the more money that I can protect. For some of my clients, I am able to protect everything.

7. Anything Else?

Remember, that any transfer of assets, if not done the correct way can give you a big penalty period and that might have been avoidable. It is best to talk with an Elder Law attorney before moving any assets so that you get the shortest penalty period possible or avoid a penalty period at all.

If anyone is already facing the possibility of nursing home care, I offer a free consultation in my office to see if there is anything that I can do to help.

Bottom Line: Understanding Medicare and Medicaid Benefits

Understanding the distinctions between Medicare and Medicaid is crucial for seniors planning for future healthcare needs. Medicare provides limited nursing home coverage, whereas Medicaid offers more comprehensive care, but with financial and asset restrictions.

Proper preparation, including establishing Powers of Attorney for property and health, and meeting with elder law attorneys, can ensure adequate asset protection and funding for potential long-term care. Notably, even without prior planning, expert advice can still protect substantial assets.

Asset transfers require careful consideration to avoid penalties. It’s paramount to consult experts early in the process to maximize benefits and protection.