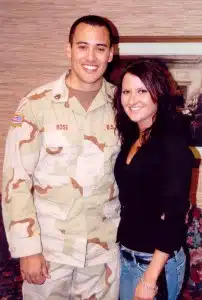

In January 2005, I left the comfort of my family, friends, and home to begin a 15-month deployment to Baghdad, Iraq.

Although I knew the difficulty and hardships that I would face, I also believed it would be an excellent opportunity for my wife and I to get a jump start financially.

You would think that being overseas and unable to spend as freely as you can in the States would give every soldier an opportunity to save some serious bucks.

Especially since the military really promoted all the extra money we would make with combat pay, hardship pay, imminent danger pay, hazardous duty pay, and family separation allowance.

All of which were federally tax-free while we were on the ground.

I guess that was their way of trying to take your mind off the fact that you were heading into a combat zone. But hey, I guess it never hurts to focus on something positive.

Nonetheless, many of the soldiers I deployed with were equally excited to sock away some cash while we were gone. Unfortunately, what I saw was a different picture.

Despite the excellent pay that we received, I saw many come away with nothing saved. In fact, I witnessed many coming home in more debt after deployment than before we left.

It made me contemplate what I did differently that allowed us to save and what future soldiers could do to maximize the money earned while in combat.

1. No Major Pre-deployment Debt

One thing that worked huge for us is that we didn’t incur a lot of unnecessary debt prior to being deployed. Many soldiers were buying brand-new laptop computers, high-tech electronics, and special ops gear before we left.

I could possibly justify the laptops, but most of the special military gear was a bit premature since we weren’t sure what the government was going to issue us. Most of it was just to look “Hooah” or have the “coolest” gear.

I called it the “Black Hawk Down” syndrome. You might not be Delta Force, but you’ll try and look the part. The two major expenses that I incurred prior to deploying were:

- Lasik surgery

- My wife’s engagement ring.

Our goal was to have those both paid off in the first couple of months, which we did.

2. We Had a Plan

As I stated above, we had a goal to take care of the Lasik surgery expense and the engagement ring as soon as we could.

Luckily, my wife and I had no student loan debt, and these were the only two items that were left to be paid off. Once we paid those off, our goal was to boost our savings and max out our Roth IRAs.

3. Automatic Investing

One thing that I’ve always been a big fan of when it comes to investing is systematic withdrawal. The concept of “out of sight, out of mind” works amazing for anybody who is trying to save.

We had it set up where each of us was depositing $100 a month into our Roth IRAs. Once we got our savings up, we were going to max out the remaining balance.

By setting up the automatic monthly withdrawals, it made it easier to write a check to make up the difference. The other benefit of automatic investing is dollar cost averaging, which takes the guesswork out of trying to time the market.

4. Be Ready for the Unexpected

When I left, my wife and I were renting out a home with friends of mine, so our expenses were exceptionally low. We had talked about buying a home once I got back, but that quickly changed.

Halfway through my deployment, a family friend had offered to sell his home to us for sale by owner at a very good price.

It was exactly what we were looking for and at a price that we couldn’t pass up. So, while serving my country in a foreign land, I purchased my first home.

If we hadn’t of made a plan, I don’t think financially we would have put ourselves in the position to purchase the home. I’m now thankful we did.

5. Limit the Unnecessary Purchases

You would think that being overseas you wouldn’t have a chance to really spend ‘any money. That is a major myth. The truth is that there are PX’s (Post Exchanges) readily accessible to any soldier.

There, you can buy electronics, snacks, souvenirs, magazines, books, etc. Also, the availability of the internet made online shopping a snap.

One example is a buddy of mine who special ordered a pair of Nike running shoes for $150. Since they were special orders, it would take an extra few weeks for the shoes to be shipped. He then ordered a regular pair of Nike running shoes at $140 to last him until the others came in.

Did I mention he already had a pair of Nike running shoes that were just fine? $300 later, he now had two pairs of brand-new Nike running shoes to go with the pair that didn’t need to be replaced. That might be an extreme example, but I have countless other soldiers wasting their money while overseas.

6. Excellent Supporting Cast

My wife was incredible at keeping track of our finances while we were away. Keep in mind we were just newlyweds, but we were able to get on the same page of what we wanted to accomplish financially.

You hear many stories of a soldier’s wife/husband spending money while the soldier is away. I can tell you for a fact that it happens.

We had many soldiers whose wives (we only had male soldiers, so sorry if I’m discriminating) went on shopping sprees with all the new money that was coming in.

I was very fortunate to have a wife who shared my vision in securing our financial future.

7. The Lottery Syndrome

Once we returned home, many who had been able to save some cash went on buying sprees. New cars, trucks, and Harley’s were quickly snatched up.

I even had another soldier who had reenlisted while were overseas and received a $15,000 tax-free bonus. All of which was gone in the first month of being home!

Any newly deployed soldier has an excellent opportunity to get on the right track while on deployment. Consider some of the steps that I did that helped us and apply those to your situation if you can.

More importantly, learn from the examples of those who fell into financial traps and avoid those situations.

This was a guest post that I had done on my buddy Patrick’s site, Military Finance Network. The original post title was Managing Money While Deployed. If you know of anyone who is a military member, past or present, I encourage them to check the site out.

Wanted to know while the soldiers are away in another country any thing they buy or stay in a hotel does the military re inburse them when they get home to the states???

I’m gonna be gone for plenty of time to save real well, but I’m 20 almost 21, single as hell, and absolutely NOTHING binding me up financially, no bills, nothing.

SO when I come back I have a lot to accomplish with the money I save, but as often as I hear being 20 and single is great for first deployments I also don’t get any advice, seemingly because everyone is married with their own apartment.

Also Nat Guard, so coming back home, hopefully with certificates or something to land a better job. What the heck do I do, what do I need to plan for, what’s realistic….

Hi CJ – You might want to set up an account with a robo-advisor like Betterment or Wealthfront. They handle all the investment management for you. All you need to do is fund the account. You can do that through direct deposit from your pay. And when you come back from deployment, the account will be there waiting for you.

Hello,

I’m currently serving overseas with the US Army as well. This is my first deployment and surprisingly I’ve been gone for 4 months and have $7,800.00 saved up already. I’m engaged back home, and have to find a house or apartment when I get home. I’m nervous I might just blow all the money I saved when I get home. Could you please e-mail me so i could talk to you about ideas and planning?

I have a question how do you get paid when your deployed overseas? Does it come back home to an account here in the states or are you able to get paid there? How does it work. Cuz I’m dealing with some a****** online with right now trying to get money out of me and he says he has no money cuz his funds are all tied up.

Hi,

My daughter is into a similar situation, when he did mentioned having trouble to get some money from his sister based in US to celebrate his birthday on tour base in UEA, my daughter did not wait to be ask and went in great doubts.

Can you please if you have an answer to reply to my similar question.

It would be greatly appreciated.

Thank you

I’m dealing with the same thing. He tells me he doesn’t get paid until he comes home from deployment.

Direct deposit to your bank account of choice, like any other paycheck. 1st and the 15h of each month.

I have met aperson line and says that he can’t access his money while deployed in Iraq is this true.

Can they actress there bank account why deployed

I also have a guy texting me and telling me he doesn’t get any money while he is on deployment and over seas .is that true.he says the army keeps his money.and he is always wanting me to send him money for minutes on his phone.i know for a fact the army isn’t going to treat these guys in a poorly manner.

Great article

I want to learn more about the IRA, I’ve been planning on doing that. Leaving for basic at the end of the summer.

Also, I never thought about how much money I will be getting to save while deployed..

great read, thanks!

Hi,

1st of all I would like to let you know that your article is true about how soldiers waste there money while deployed cause I used to be one of them on my first deployment in Iraq 05-06. Back then I was single now that I’m married with two kids and currently deployed to Afghanistan I’m pretty sure that I wont make the same mistake I did on my last deployment. But my problem right now is that the wife is going on a shopping spree time to time and I keep telling her that we need to secure our finance for the future and in respond to that is “ok babe I will” but she does it again. Do you have any idea on how to convince the wife? I mean I love her to death but I cant get through her thick skull! lol

Set up a separate account and give her a monthly budget allotment and place the remaining in a savings account which she can’t touch until you return.