This is a guest post by Hank Coleman who writes about personal finance, investing, and retirement on his blog, Money Q&A. Hank shares his story about how he and his wife decided to become landlords.

I will tell you that I don’t know the first thing about this topic, so I would encourage anyone that is considering it, to read this first before becoming a landlord.

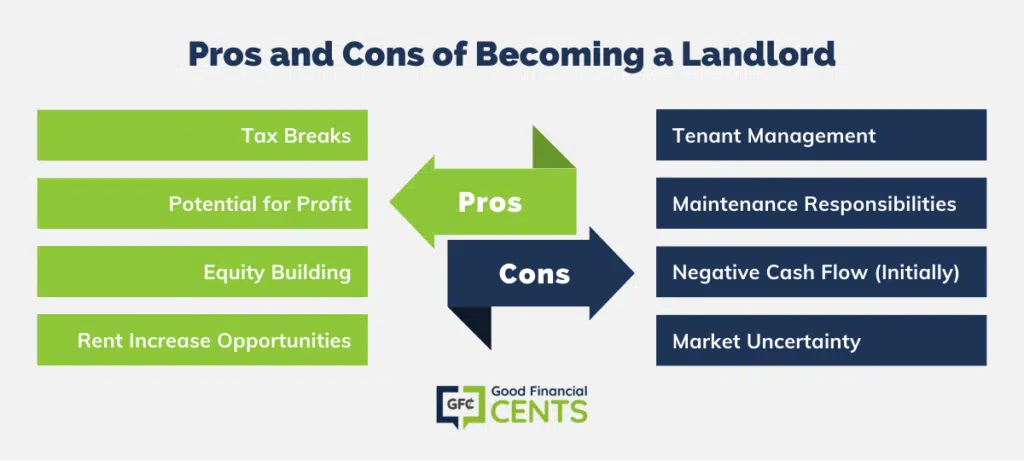

I know there are pros and cons to becoming a landlord, so weigh all your options before diving in. Enter Hank…..

Many corporations in America require their employees to move every so often in order to give them career progression, new opportunities, and challenges as they move up the ranks.

My employer is no different and recently told me of an impending move.

Like many Americans, I’m faced with a daunting choice.

Do I try and sell my home or become a reluctant landlord?

The anxiety of losing large sums of money or equity is one of the greatest fears for most homeowners with an impending move. I wanted to share with you some of my family’s thought processes as to how we came to our decision to become landlords for the first time instead of selling.

It wasn’t an easy decision, and everyone’s situation is different. You have to look at it almost like a business and weigh the costs and benefits of your decision before taking the leap.

Table of Contents

The Drawback of Selling Our Home

There are several drawbacks to selling our home. Even though my wife and I live in an area of the country that has not seen the dramatic nosedive in real estate values, we have not seen any appreciation in our home’s value either.

We could sell our house for pretty much the exact same price that we purchased it for four years earlier. The real problem with that scenario is that it is dramatically still a buyer’s market when it comes to buying and selling a home.

The buyers call all the shots, and they can make a lot of demands. Most sellers can expect to pay most if not all of the closing costs for both parties.

They can also see demands for fixing up the home or even large price reductions. Trying to negotiate with a buyer will not do much good either because there are so many houses still currently on the market.

A buyer can literally go down the street in most cases and find a more accommodating seller who needs to close in a hurry.

The Benefits of Being a Landlord

Now, you may be thinking to yourself that you don’t want to be a landlord. I really don’t want to be one either and have to deal with finding tenants, evicting them when they don’t pay, checking credit reports, fixing broken toilets, showing my house to potential renters, and all of that other garbage.

That’s why I hired a property management company to do all of that for me. But, I do want to increase my family’s net worth over the long-term, and owning real estate even if it is just adding one house every few years or so is one way to continue to build wealth.

There are other financial benefits of being a landlord too that many people may not immediately associate with the job. Like any homeowner, landlords enjoy many tax breaks.

In fact, there are more tax breaks for rental real estate owners than regular homeowners. Landlords are eligible to deduct the costs of operating their new rental business from their taxes.

You can deduct the cost of things like your property manager’s fee, maintenance costs, insurance, mortgage interest, home warranties, and a host of other expenses that start eating into your profit.

Renting Our Home at a Loss

Even renting out your home at a loss may be a better option than selling it outright. Of course, most of these calculations depend on your individual situation, your mortgage, how much down payment you used, and a host of other factors.

For my wife and I, the comparable for renting a home like ours was $1,300 per month in rent. Currently, our mortgage, PMI, insurance, and property taxes cost $1,350 per month.

Additionally, we chose to use a property management company to help us rent our home, and they charge 10% of the monthly rent ($130 in our case).

So, right off the bat, we have a negative cash flow of $180 that we are paying out of pocket every month. But, I’m very happy doing so, and I will tell you why.

Using a closing cost calculator, I can estimate that it will cost me about $14,000 or more in real estate brokerage commissions and fees to sell my $200,000 home.

If I am losing $180 per month or $2,160 per year, it would take me about six and a half years to equal that $14,000 upfront cost.

It is the difference between dying a thousand cuts or getting my head chopped off in one fell swoop. I’ll wait for the market out. Eventually, home values in America will start to rebound…eventually.

Just like home values, rents will not stay low forever either. In fact, rents in America a rising year after year.

There is nothing holding me back from raising the rent on my home in a few years and generating positive cash flow later.

Almost anything is better in my book than losing $14,000 upfront and watching almost every penny of my equity disappear by selling.

According to the US Labor Department, rents across America have been rising 2.4% year over year, and that data is not even adjusted for inflation. At that rate alone, I could raise the rent to $1,500 over the next six years just to keep up with the times.

Eventually, your home could become a mini pension fund during retirement. At our current rate of repayment, my wife and I will have our home paid off thanks to the help of our renters at about the same time that we will be retiring to play golf and live on the beach.

Even if I still charged $1,300 per month at that same house 26 years from now, the $1,170 after paying the property manager will be pure profit every month straight into our pockets.

A few more homes providing passive income like that would allow me to completely replace my pre-retirement income. While becoming a landlord is not a dream occupation that everyone aspires to, it is not something to be completely dismissed before you even consider it.

There are great opportunities to choose something other than simply selling your home, taking a big financial hit, and moving on.

Pros and Cons of Becoming a Landlord

Everyone’s situation is different. Some people thrive on being their own landlord, finding tenants, and being handy with a hammer. Some people want to get out of a house or an area at all costs and do not mind eating the closing costs in order to do so.

Everyone has to make their own choices in the best interest of their family, but I wanted to let everyone know that they should not feel backed into a corner.

There are other options out there rather than simply succumbing to the realization that you have to lose money in order to move to a new home or a new city. All it may take in your situation is a little bit of cost-benefit analysis on which course of action is right for you and your family’s well-being.

Hank Coleman is currently an officer in the US Army and also spends his free time as a finance writer who has written extensively for many financial websites and publications in addition to his own blog, Money Q&A.

Hank has a Master’s Degree in Finance, a Graduate Certificate in Personal Financial Planning, and is currently studying and constantly putting off taking the Certified Financial Planner exam.

His dream is to one day retire from the Army, open his own financial planning firm, and try to be just like his CFP® Idol, Jeff Rose.

The Bottom Line – Why My Family Decided to Become Landlords

The benefits of being a landlord, including potential tax breaks and long-term wealth building, outweigh the immediate cash flow loss. Rather than succumbing to selling your home at a loss, consider the alternatives.

With careful analysis and a forward-thinking approach, you can transform your property into a long-term financial asset, contributing to your retirement income. Each situation is unique, so take the time to evaluate the best path for your family’s financial well-being.

This is such a helpful post. Thank you! My husband and I are in the market for a bigger house since this pandemic truly showed us that we need space for everyone, especially for our aging elders, that eventually might have to live with us. Anyway, we have our current townhouse, which we only have 9 yrs to pay off. Rentals in our area are hot right now. Although, we will need to sell our current home to be able to cover the full 20% down on the next house we plan to purchase, my husband also suggested to maybe just rent out our townhouse and just take part of the down payment we need from our 401K. I’m not sure if that’s a good idea, since I grew up with a mindset of not touching our 401k until we retire. (Long ways away)

With every reason you mentioned in the beginning of not wanting to be a landlord, that’s my current fear right now. I have no idea how to be one, esp fearful of finding the right tenants to take care of our house. Yikes!

You think it’s wise to still rent it out? We’re not rich, but we’re also not working from pay check to pay check… let’s say we learn our lesson to save for emergencies. But now faced with do we sell or do we rent it out is what’s been in our minds lately. Sellers are not okay with a contingency also so we’re also trying to rush to get our house ready. More of what your thoughts or any wise advise from anyone who already have a great experience on this is appreciated. Thank you in advance!

Prospective landlords should also realize that whether they have one property or 10, this is a business. And to be successful, they must view it as such. It also means taking on a lot of responsibility, both when buying the property and while owning it. Still, it is a risky and concentrated bet, just like any other business startup.

George Lambert

Author, What You Must Know BEFORE Becoming a Greedy Landlord. How to build a portfolio of investment properties for an income that lasts a lifetime.

I agree with waiting for the house prices to rise instead of selling my property off now and weathering a major financial blow. The economy these days is inclined towards renting out instead of selling. The taxes also favor the former.

This is a great post!! I think renting a home instead of selling it in this economy is a great idea, if you can afford it. I may one day be in your same position and will probably end up renting my property. I have been helping my parents with their rentals, but they don’t have a property manager. It is such a headache and takes so much time. I will definitely hire a property manager. Thanks again for the info.

Thank you so much, Jeff, for allowing me to guest post today on Good Financial Cents. I really appreciate it.