Do you ever feel like you can only learn things the hard way?

That you were told what to expect in certain areas of life but couldn’t fully understand until experiencing it firsthand? I know I do. My most recent first-hand lesson was just a few months ago – planning my wedding.

I’ve heard that weddings are hard, but I never could have truly grasped the amount of turmoil they can cause in your life without going through it myself.

Between the money, the time, and the inevitable disagreements on how it should look, where it should be, and how many people should be invited, it can feel nearly impossible to get through.

By the time my husband (it still feels weird to say that word!) and I got to the other side, we were convinced that nothing we went through together could ever be that hard again. We were lean, mean, conflict-busting machines.

…and then it came time to sit down and work on our finances together. We had planned to do this prior to the wedding, but with both of us working at startups (read: long hours) and planning a wedding from across the country (SF to NY), we just didn’t have the bandwidth to talk about our finances.

So we saved the couple’s finance talk until after the wedding. Not exactly the best strategy…

Now, my husband and I are working to find a middle ground after spending the past few months in married life and getting ready for some big changes ahead.

In the process, I’ve learned a lot about what we should have done, what we still need to do, and how others can make this road a bit smoother in their own lives.

Read on for my firsthand guide to newlywed couple budgeting!

Table of Contents

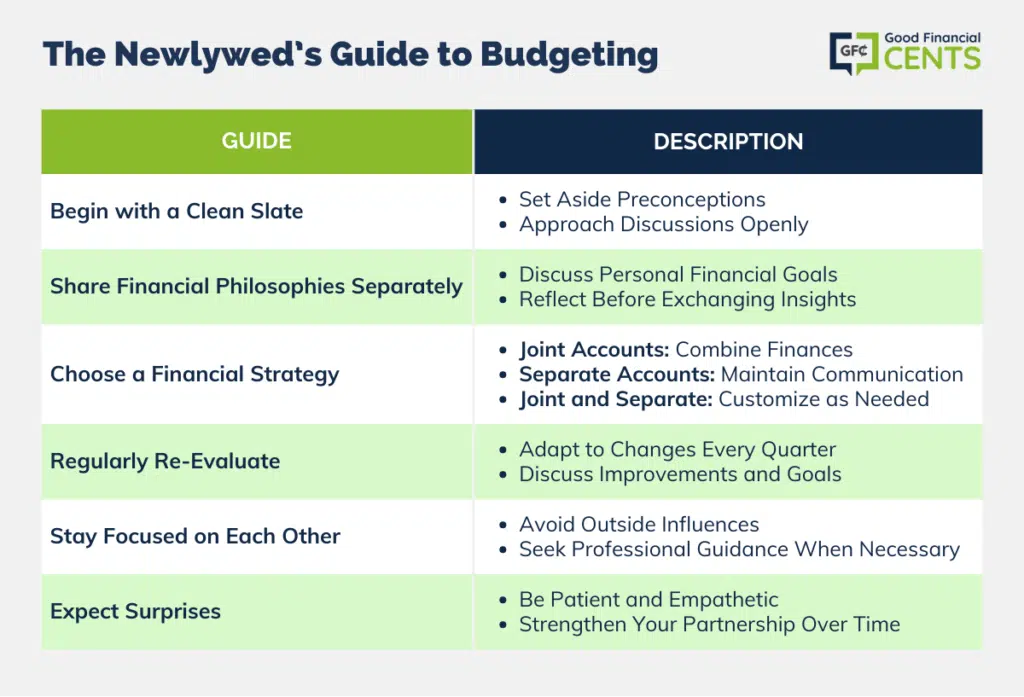

Start the Talk On a Clean Slate

When Matt and I sat down for the finance talk, we had a bit of background to help us out. I mean, I write about the topic every day! I even read my blog posts to him each night for one final edit before they go out (and yes, the ReadyForZero content team regularly teases me about this ritual).

But we realized that this background hurt us more than it helped us. We both had preconceived notions and judgments about the other’s spending style that completely blocked us from being able to listen to each other.

So all that time, we thought we knew enough to get the talks going quickly and easily – we were actually operating at a great disadvantage.

The only way you can have a productive talk when starting to discuss your finances is to do it with a clean slate. How can you do that?

Present Your Financial Philosophies to Each Other Separately

Talking about both of your financial philosophies at the same time sounds like an efficient practice, but in my experience, that was not the case. Matt and I spent so much time trying to defend and prove our theories to be better than no actual communication or understanding happened.

Mind you – our conversations don’t normally go this way. We usually love to exchange ideas and learn from each other. But as 30-year-olds who’ve already had years to form our financial plans on our own, it was harder to come together than we imagined.

That’s when we decided the only way to properly listen is to present our financial philosophies separately.

Then, take a few days and let the information simmer in your spouse’s brain. People rarely want to change their ideas or practices right after hearing a new idea. But a few days of thinking and adapting the ideas to their brain could lead to a shift to a new way of thinking.

The next week, do the same with your spouse’s financial philosophy and give him or her the same amount of time and contemplation that he or she gave to you. After another week, it’s time to convene again.

What did you think could be useful about your spouse’s plan? What practices make you uncomfortable? Sit down and list out all of these things so you two can get closer to coming together on a plan.

Yes, three meetings to even find a middle ground sounds like a lot. But coming together on a financial plan simply can’t happen overnight for most couples. Take the time early on to thoroughly discuss, and you’ll be better prepared for smooth sailing for the rest of your lives.

Decide on a Strategy

By now, you two should have a good idea of how you each came to your individual plans. Next, it’s time to decide on a strategy together. First and foremost, are you going to do joint accounts, separate accounts, or a mixture of both?

You may have had an idea of what you’d want before you got married, but these talks may end up taking you in a different direction. So keep an open mind and choose the plan that’s most logical – not what sounds the best.

Joint Accounts

Deciding to budget jointly means you’ll combine your individual funds into a brand new bank account with both of your names on it and use that only moving forward.

You could also do the same with credit accounts, utilities, and any other bills you’re responsible for. You would track your portfolios together using a tool like Empower, too.

In order to keep things streamlined, you will want to appoint someone to either be in charge of balancing the budget and paying the bills or split the tasks.

You definitely don’t want to miss a payment because you thought your spouse was going to make it, so make sure you assign jobs and stick to them.

REMEMBER:

Separate Accounts

Another option is to try separate accounts. You can still keep your family’s financial house in order this way if you keep the lines of communication open.

The key is to stay on top of what your task is. Who’s going to pay the mortgage, and who’s going to make sure you’re saving for education and retirement?

As long as you have a plan that you both can stick to for reaching your goals, then separate accounts should not be a hindrance.

Caveat:

You are a family now and need to plan and achieve your financial goals together, so full disclosure is a must if you’re going to do separate accounts.

Make a master list (kept under lock and key since it has sensitive information) of all of your accounts, bills, etc.

You should also include information such as how to access these accounts, due dates, and how to make payments in case there’s an emergency and one of you has to take care of it.

Joint and Separate Accounts

Finally, you could try joint and separate accounts. What you manage jointly and keep separate is up to you. You might find that you like paying large bills like a mortgage together and smaller incidentals like coffee and entertainment separately.

However, just like with keeping separate accounts, this will only work if you’re still working together on reaching your goals as a family. Practice full disclosure and grant each other access to your accounts so one of you can step in and make payments or deposit funds in case of an emergency.

If you’re not sure which method you want to go with, I would recommend an online bank like Capital One 360. You get an incredibly flexible set of online accounts. You could have two individual checking accounts, one main savings account, and several sub-accounts all under the same login.

Not to mention, you’re getting a fantastic interest rate on both checking and savings. With multiple accounts and sub-accounts, you could track everything individually, separately, or jointly.

Ultimately, Matt and I have decided to try the joint and separate method. We found that being on our own for nearly ten years before meeting and getting married made it quite challenging to completely give up the methods we’d developed to keep our finances in order.

Plus, we’ve historically had opposite views on finances and are coming to realize that neither is right or wrong – but we do need more time to experiment and find the right balance to fit our needs as a couple.

After a few more months, we could end up putting it all together or maybe decide we like keeping our spending money separate to keep some independence day to day.

And since things do change over time, it’s important to…

Re-Evaluate Your Plan Quarterly

No matter what you and your spouse decide on doing now, odds are a few months of practice that could change things a bit. Maybe you tried joint accounts, but you were always butting heads on who did what.

Or you could have tried separately, but time showed you would rather fully combine finances. The only thing that you can expect in couples’ finances is the unexpected.

After you have a plan to get started with now, set a calendar date and reminder in exactly three months to go over your plan. And another for three months after that, and so on.

Talk about how each of you felt while following the plan – were there things that started to bother you over time? Things you could improve upon? You could even talk about what you’ve learned from each other and hope to maintain as you go.

The more you open up about what you’ve liked about your spouse’s ideas, the more likely your spouse is to do the same.

Once you’ve checked in on the actual process of working on the finances together, you’ll want to check in on your goals. A lot can change in three months, including your top priorities. Review your short and long-term priorities and decide if they’re still in the right place.

Bonus – Now that you’re married and have a budgeting partner, you also have an accountability partner! Hold each other to your goals to make sure that you’re not choosing short-term happiness over long-term gains.

Keep Your Eye on The Prize – Each Other

Just like planning a wedding, one of the hardest things about couples budgeting is outside influence. Your family and friends may ask you questions about how you’re managing your finances together, or they may even want to offer advice.

Just remember that no one can truly understand your mutual needs better than each other at this point. You’ve spent weeks or maybe even months making this plan while others are on the outside looking in.

Stay focused and confident on what you’ve decided, and don’t allow outside influences to create conflict.

So what happens if you really do need advice?

Find a professional to speak to together.

Then, you can share with the professional all of the information you’ve compiled during your talks, and he or she can create a strategy that works best for you. Since a financial planner isn’t a loved one but rather an objective third party, he or she has no reason but to keep your best interest in mind.

Financial planners can also help you see the long-term picture and learn about how your current actions affect your future.

For example, at ReadyForZero, we always try to focus on this type of financial education and teach people important lessons like how student loan interest works, how car loan interest works, and how mortgage interest works because we know how much impact these things can have.

Carrying debt can have a damaging effect on your long-term financial picture if you’re not careful.

Financial planning as a couple isn’t easy and can’t be done overnight. There are a lot of things to get used to as a newlywed, and this can be one of the hardest!

Again, you should expect the unexpected – finances are more personal than they are pragmatic. In order to ensure that this doesn’t come between you, take your time, show patience, and come to decisions that show each other empathy, respect, and understanding.

Then, no matter what happens in the future, you’ll already know how to take the challenge on as a strong, collaborative unit.

Battle buddies!! LOL I absolutely love hearing the both of you. I love that part on how you really pushed the whole “it’s OUR money, not my money, even being the the bread winner.” I’m curious, how would you suggest getting over that obstacle in a marriage? Mandy should come on alot more. 🙂

Loved this segment! My boyfriend and I have lived together for 5 years with separate finances and never had a money talk. Now that I’m out of school and we are starting to purchase things for our house, look to buy a new house etc being on the same page is critical. Thanks for all the great info, it will be a

Great starting point 🙂

I think this is a very tricky area – budgeting after marriage or as a couple because if both people have different financial philosophies, they are in for a not-so-wonderful roller-coaster ride. Even if you communicate your spending and saving priorities to your partner, it is very difficult for both people to reach a compromise in practice (though it all sounds to easy on paper). These things take time but after several years of marriage, changes begin to emerge, and hopefully disagreements fade away.

You’re right about it being tricky, Tammy! Being a newlywed myself, I too am hoping that it gets easier over time :).

I think the hardest part was just opening the lines of communication regarding budgeting and finances. Once we both spilled out everything life became much easier, and much more transparent. It’s important not to judge each other, and know when to help. It may take some time but it’s quite worth it in the end.

I totally agree, Chris. It is so hard to get the discussion going and especially to do so without judging each other. My mistake was thinking that it could all get figured out with one talk and when we had no resolution four hours later I realized that it will take time, whether we like it or not. Once we realized our approach can evolve over time the way our relationship does, it became a lot easier to find middle ground.

We’ve been together for years and married for one month only. We do have a joint account (the business account) and also separate accounts we use personally. We do practice full disclosure and talk about our saving goals, things we need to guy/wish to buy in the future, how to handle the upcoming birth etc.

It sounds like you two have a great system going! (And congrats on your marriage 🙂 ). Did you run into any roadblocks or things you wished you would have done differently when setting up your budget? Or was it pretty seamless since you’ve been together for awhile?