In the world of business finance, a Merchant Cash Advance (MCA) presents a route for businesses to receive quick funds. This alternative funding model is particularly attractive to small and medium-sized enterprises (SMEs) that need access to capital but may not qualify for traditional bank loans. However, as with any financial product, it’s important to weigh the benefits against the potential drawbacks. This article aims to offer a comprehensive analysis of the pros and cons of utilizing a Merchant Cash Advance.

Table of Contents

Understanding Merchant Cash Advances

Before delving into the pros and cons, it’s important to understand what an MCA is. A Merchant Cash Advance is a form of financing where a business receives a lump sum of cash upfront in exchange for a percentage of its future credit card sales. The provider of the MCA is repaid by taking a daily or weekly share of the business’s credit card transactions until the advance, along with any fees or interest, is paid in full.

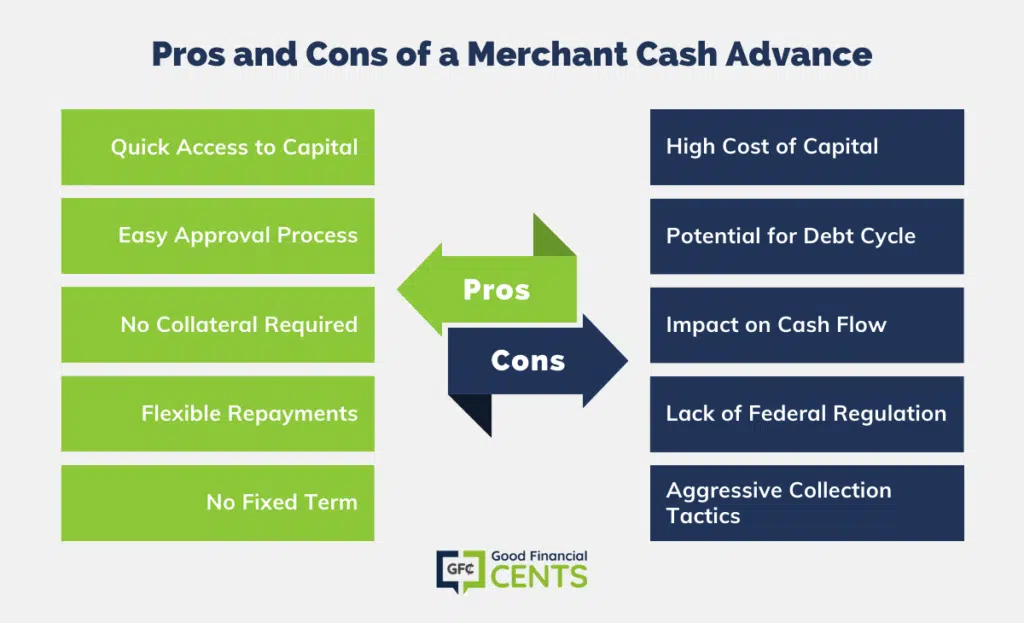

Pros of a Merchant Cash Advance

1. Quick Access to Capital

One of the most significant advantages of an MCA is the speed at which funds can be accessed. Businesses can often receive cash within a few days, which is crucial in situations where immediate capital is needed for emergencies or to capitalize on time-sensitive opportunities.

2. Easy Approval Process

MCAs typically have a simpler and less stringent approval process compared to traditional bank loans. Providers are more interested in the consistent volume of a business’s credit card sales than in its credit score. This makes it an appealing option for businesses with less-than-perfect credit histories.

3. No Collateral Required

MCAs are unsecured loans, which means that business owners don’t have to put up collateral. This eliminates the risk of losing valuable assets if the business cannot make the payments.

4. Flexible Repayments

Repayment is based on a percentage of daily sales, so it fluctuates with the business’s cash flow. During slower periods, the business pays less, which can relieve financial pressure when sales are down.

5. No Fixed Term

An MCA doesn’t have a fixed term for repayment. The advance is paid back when the business makes sales. This can be particularly beneficial for businesses with unpredictable sales patterns.

Cons of a Merchant Cash Advance

1. High Cost of Capital

The biggest downside of an MCA is the cost. MCAs can have very high fees, often leading to annual percentage rates (APRs) that can be much higher than other types of financing. This high cost of borrowing can significantly eat into a business’s profit margins.

2. Potential for Debt Cycle

The ease of access to funds and the high cost can sometimes lead to a cycle of debt. Businesses may find themselves taking out additional advances to pay off the first, leading to a slippery slope of continuous borrowing.

3. Impact on Cash Flow

While flexible repayment terms can be beneficial, the daily or weekly withdrawals can also impact a business’s operational cash flow. This can become problematic, particularly if the business has other fixed expenses to cover.

4. Lack of Federal Regulation

MCAs are not loans; they are considered commercial transactions. As a result, they are not subject to the same regulations that govern traditional lenders, which could mean fewer protections for the borrower.

5. Aggressive Collection Tactics

Some MCA providers have been known to employ aggressive collection practices if a business fails to make the required sales to repay the advance. This can include filing confessions of judgment that can bypass the traditional court system if a business defaults, leading to rapid and severe consequences.

Things to Consider

For a business considering an MCA, it’s essential to conduct due diligence. Business owners should:

- Understand the Terms: Read the fine print and make sure you understand the factor rate, holdback percentage, and any additional fees.

- Calculate Total Costs: Work out the APR and total amount you will pay back, and assess whether the cost is worth the benefit.

- Consider Alternatives: Look into other financing options such as bank loans, business lines of credit, or SBA loans, which may offer lower interest rates and more favorable terms.

- Plan Cash Flow Management: Have a strategy in place to manage cash flow effectively, ensuring the daily or weekly payments don’t disrupt operations.

Conclusion

A Merchant Cash Advance can be a lifeline for a business in need of quick funding, but it comes with significant risks. High costs and the potential impact on daily operations mean that it’s not a decision to be taken lightly. Business owners must carefully weigh the pros and cons and consider whether an MCA is the best financing option for their immediate needs and long-term financial health. Professional financial advice is always recommended when considering any form of business financing.

Excellent points; it seems that careful business control can utilize these quite effectively.