To remain completely safe and protected in any situation, insurance is a necessity. A lot of people think about life insurance as a financial tool that protects them and their families. It’s one of the best decisions that you can make to protect your loved ones if you were to pass away. Not having life insurance can be one of the worst mistakes that you can make.

This may be obvious for many people, but it applies to more than one individual. Life insurance can also be used as a tool in businesses.

A business requires insurance to avoid legal and financial issues that could threaten to shut everything down.

Security insurance can offer help to keep people employed and the business running, no matter what problems the company may face in the future.

Having business insurance keeps everyone safe from the disasters that could happen. These may cover many different things, but there is one thing that they all have in common, which is the total protection of both the business and everyone who works there. This helps to avoid problem areas and holes that could otherwise cause the business to shut down.

Table of Contents

Knowing what is out there and how they can benefit the company as a whole is an important step to ensure everything runs as it should, if not better than it did for years.

Buy-Sell Life Insurance

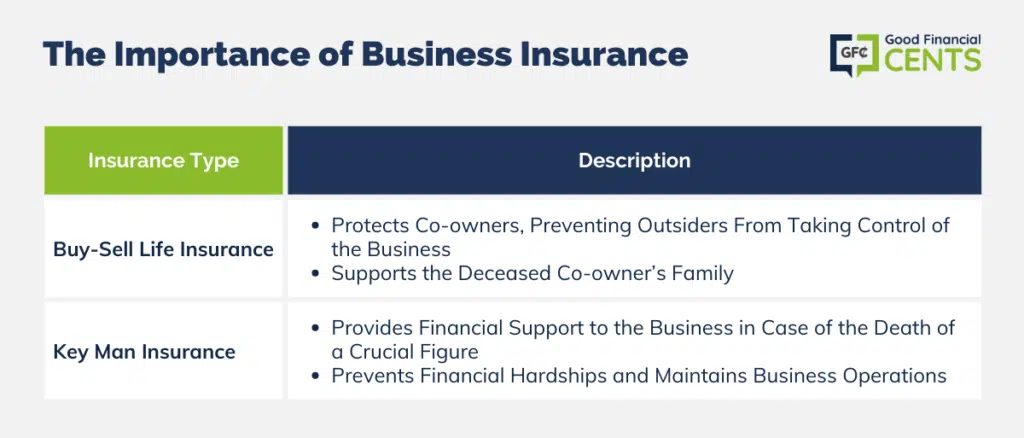

One type of insurance that every company must consider is buy-sell life insurance. When the owners buy this for themselves, they can have peace of mind for the future. If one owner were to die, the other owner could then purchase their share of the company. This gives the deceased’s family the money they need and avoids possible problems within the business.

Since new owners can be disastrous, even if they are family, this prevents their takeover and the fall of the company after such a tragic event. With others who invest their time and money into the company, this also keeps them interested and free of worries.

This is a great way that owners can protect themselves, and they can know that their family and business will be secure if anything were to happen to them. You’ve worked hard to make your business successful, don’t let all of that work be wasted.

This can also be a very affordable life insurance policy for the business to take out.

Key Man Life Insurance

Another type of insurance to consider is key man insurance. With most companies, there are several people who matter a lot and keep the company up. When this person passes, the company may suffer as a result.

Whether this is someone high up, like an owner or investor, or an employee whose contribution cannot be replaced, having insurance on them can save the company from going under.

The Importance of Business Insurance

Keeping a business up and running takes money. Business life insurance, and insurance for those who are important in the company, can keep everything in the green if something tragic were to occur. With the death of a co-owner, buy-sell life insurance can help the other owner avoid dangers. This makes sure no one else can come in to become a majority owner and that the family of the deceased is well cared for with the passing of a loved one.

Key man insurance is another type that can keep everything moving smoothly. If someone important were to die, this insurance gives the business money so that the person’s absence does not create a financial hole. These keep businesses afloat in dark times, helping to ensure everyone is free from worries.

The Advantages of Key Man Insurance

If you’re a business owner or a co-business owner, imagine a scenario where something tragic happens to you or your business partner. What would happen to the business? Would your family be left with business debt or personal debt? Would your business partner be able to recover from losing you? These are a lot of questions that most business owners never consider.

Maybe it isn’t an owner; maybe it’s a key employee, an adviser, or someone else. Regardless of who it is, losing someone inside of your business can be devastating, it could even cause your business to close. Key man insurance can help protect you against these losses and give you the funds you need to replace that person, outsource the job, or find a way to get the business running again.

Aside from deciding which type of policy you need for your business, you also have to determine how large of a policy you’ll need. There is no “perfect number”, especially when it comes to key man insurance policies. A lot of this decision is going to depend on how important that person is, what their duties entail, how much it would cost to replace them, have their job completed otherwise, and how much you pay that person. While there is no magic number, most insurance agencies agree that anywhere from 5 – 10 times that person’s annual salary is a good target for your insurance policy (this is the most that the majority of insurance companies will approve).

Bottom Line – Getting a Business Insurance Policy

Getting a key man insurance policy, or any other type of business insurance is just like getting a typical life insurance policy. You’ll submit an application with basic information about the person you are insuring.

There is going to be several different questions that you wouldn’t see with a normal insurance policy. The insurance company will need to know basic information about the business, like when it started, what type of business you run, how much the net worth is, and what type of rationality the insured person has.

If you’re looking to buy a business insurance policy or even a traditional policy, we can help. Our agent are experienced in every type of insurance policy and they can answer your questions and point you in the direction of the policy. There are hundreds of companies that offer different insurance plans, it can be difficult choosing which one works well for you and your business. Let us give you the lowest rates from the best-rated companies in the U.S.

When you run a business, or you are a vital part of that business, the main goal is to make sure that you’re making money. You want to keep your profits up and your expenses down. Regardless of the size of your business, you don’t want to have to pay more for insurance than you have to.

One of the best ways to ensure that you’re getting the best rates possible is to compare several different companies before you choose one that works for you. You could spend hours researching companies in your area and calling dozens of insurance agents, but your time is valuable and we know that. Let us do all of that work for you. Fill out the quote form and we can give you some of the lowest rates in your area based on your specific situation.