Michigan has the dubious distinction of having the highest car insurance premiums in America. That makes finding the best car insurance in Michigan an absolute priority. After all, if you’re an average household, car insurance is one of the biggest expenses in your budget.

While we haven’t relied entirely on low premiums in determining the best car insurance in Michigan, we’re happy to report that all seven companies we’ve listed have average premiums that are lower than the statewide average. But just as important, each also qualifies based on several criteria apart from premium alone.

You’ll need to determine which company will be the best for you. The only way to do that is by getting quotes from several of the best providers. Use the quote tool below from our car insurance partner:

Table of Contents

The Most Important Factors When Deciding on Car Insurance in Michigan

There’s no question, that buying car insurance is a complicated process. Not only do you have to comply with state regulations, but you also have to build a policy around your driving profile and preferences.

To help you do that, we recommend using the following strategies:

- Get quotes from multiple providers. Even if a friend or family member recommends a certain company, you owe it to yourself to check out several carriers. That’s the best way to find the policy that will provide the most comprehensive coverage at the lowest cost.

- Get the most coverage you can afford. This is more important in Michigan than most other states, because of the potential for unlimited liability. Even if getting the minimum coverage will make you “legal”, it may do you little good if you’re determined to be at fault in an accident. The injured party can sue you for amounts that easily exceed minimum coverage limits.

- Raising your deductible is one of the best ways to lower your premium. Just make sure you have sufficient additional funds in emergency savings to cover the higher deductible in case you’re involved in an accident.

- Take advantage of every discount a company has available. Get a list of those discounts and see which ones you can qualify for. Take advantage of each one that applies to you. It can make a real difference in the amount of premium you pay.

The 7 Best Car Insurance Companies in Michigan

We’ve listed what we believe to be the seven best car insurance companies in Michigan. But that doesn’t mean the top companies on the list will be the best ones for you. Most car insurance companies have areas where they outperform the competition. You should work with the company that best fits your needs.

Author’s Pick:

Below are descriptions of what we believe to be the seven best car insurance providers in Michigan. Our ranking is based on objective factors, and not on personal opinion. We’ve also indicated why each company made our list and included a section under What Holds It Back to list any apparent weaknesses in their product offering.

Special Mention: USAA — Best for Members of the Military (But Not Available to the General Public)

Before we get into our list of the best car insurance in Michigan, we want to give a special mention to USAA. It’s not included on our list but only because it’s not available to the general driving public. It’s strictly for active and retired members of the US military and their families. For that reason, we had to leave it off our list.

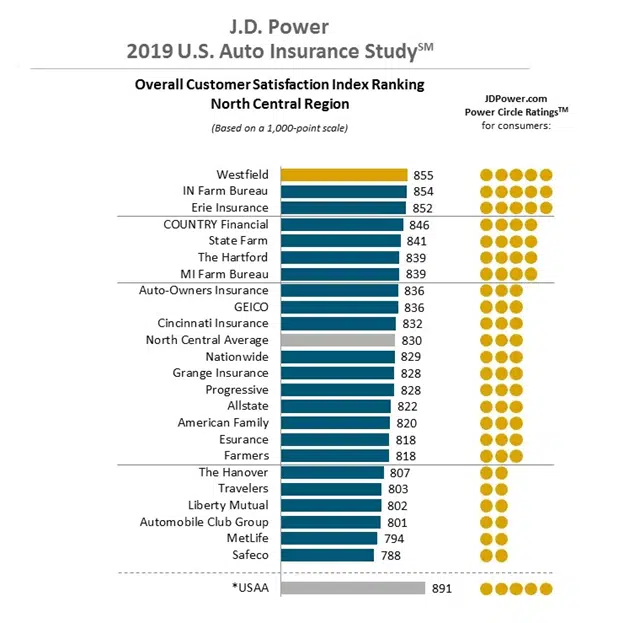

But if you’re a current or former member of the military, USAA will almost certainly be your best choice for car insurance. They have the highest customer satisfaction rating on the J.D. Power Customer Satisfaction Survey of all carriers in the state, at 891 out of 1,000 points. They have an A++ rating on financial strength, the highest provided by the insurance industry rating service, A.M. Best. And they also have one of the lowest statewide average premiums in Michigan, at $$968 per year.

1. GEICO

The Basics:

| Policy Options | Safety equipment New Vehicle Good driver (five years accident-free) Drivers over 50 Seatbelt use Defensive driving Driver’s education Good student Federal employees Membership & Employee (in up to 500 groups) Emergency deployment Military Multi-vehicle Multi-policy |

| Discounts | Safety equipment New vehicle Good driver (five years accident-free) Drivers over 50 Seatbelt use Defensive driving Driver’s education Good student Federal employees Membership & Employee (in up to 500 groups) Emergency deployment Military Multi-vehicle Multi-policy |

Premiums: $1,013 (THE lowest average premium on our list)

Customer satisfaction rating: 836 (#8 on the J.D. Power Survey, tied with Auto-Owners)

Financial strength rating: A+

Why It Made the List

GEICO has the lowest statewide average premium on our list and ranks a respectable #8 in customer satisfaction. But it also has a long list of both policy options and discounts that give you a better opportunity to customize your policy than most other insurance companies do.

They’re also a frequent company on our “best for” list above, coming in as our top choice as best overall, cheapest overall, highest customer satisfaction, and best for young drivers, senior drivers, and drivers with one moving violation.

What Holds It Back

Our one criticism of GEICO is that there’s no indication they offer gap coverage on loans or leases. Gap coverage will pay the difference between the outstanding loan or lease balance and the value of your vehicle if it’s totaled in an accident. It’s an important coverage on any vehicle that’s leased or has a loan on it of greater value than the vehicle itself.

2. Auto-Owners Insurance

The Basics:

| Policy Options | Classic cars Converted for modified vehicles Road trouble service New car replacement Rental car coverage Additional expense – to cover the cost of your stranded away from home Diminished value – protects your vehicle value if it declines even after repair Loan/lease gap coverage Personal Automobile Plus – create a package of 10 optional coverages for one competitive rate; includes identity theft, rekeying locks, replacing your cell phone and more |

| Discounts | Multi-policy On-time payments (36 months or more) Paperless billing Multi-car Good student Student away at school Teen Driver Monitoring Paid-in-full premium Advance quote Vehicle safety features Favorable loss history |

Premiums: $1,669 (2nd lowest average premium on our list)

Customer satisfaction rating: 836 (#8 on the J.D. Power Survey, tied with GEICO)

Financial strength rating: A++

Why It Made the List

Auto-Owners Insurance has the second-lowest statewide average premium on our list and is tied at #8 with GEICO in the all-important category of customer satisfaction. They also have the highest financial strength rating of any auto insurance company on our list, at A++.

Auto-Owners also has a long list of policy options and discounts. The Personal Automobile Plus Package enables you to build a policy with as many as 10 coverages, all at a very competitive rate.

What Holds It Back

The major disadvantage for auto owners is that the company operates in only about half the states. That means there’s an excellent chance you’ll need to change auto insurance providers if you move outside Michigan. That’s certainly not a significant immediate problem, but as mobile as Americans are it may be a consideration, especially if you have the type of occupation that requires periodic relocation.

3. Progressive

The Basics:

| Policy Options | Gap coverage Medical payments Rental car reimbursement Roadside assistance Custom parts and equipment value Rideshare coverage Mexico auto |

| Discounts | Snapshot app ($145 average discount) Bundle auto and property Name Your Price Tool (enter your desired premium, and Progressive will design a policy) Multi-policy (5% average discount) Multi-car (12% average discount) Continuous coverage Good student Distant students (more than 100 miles from home) Homeowner (average discount nearly 10%) Online quote (4% average discount) Sign online (8.5% average discount) Paperless Pay in full Automatic payment Deductible savings bank (the deductible on your collision and comprehensive is reduced by $50 for every claim-free policy period, which is six months) Small accident forgiveness – premium won’t be increased for a claim of less than $500 Large accident forgiveness – no rate increase in an accident if you have been a customer for a least 5 years, and no accidents for the past 3 years |

Premiums: $1,885 (4th lowest average premium on our list)

Customer satisfaction rating: 828 (#12 on the J.D. Power Survey, tied with Grange Mutual)

Financial strength rating: A+

Why It Made the List

Progressive has the fourth-lowest average statewide premium on our list. That’s probably because it has more discounts than any other car insurance company in America. That means you’ll have an excellent opportunity to customize your policy to fit your driver profile and personality like a glove.

The most interesting discount may be the Name Your Price Tool, which enables you to build a policy around the amount you’re willing to pay for your premium. That gives you greater control over your premium than what you’ll get with most competitors.

What Holds It Back

Progressive places only #12 in customer satisfaction, in a tie with Grange Mutual. That’s only slightly below the average customer satisfaction rating for the North Central States. But we’d feel better if it ranked at least in the top 10.

4. MetLife

The Basics:

| Policy Options | Rental car coverage Personal injury protection (PIP) New car replacement Major parts replacement Glass repairs without a deductible Roadside assistance Towing and labor coverage Legal defense costs if your sued, with up to $200 per day in lost wages due to court proceedings Loan/lease gap coverage |

| Discounts | Deductible Savings Benefit (your deductible is reduced $50 every year you don’t make a claim, to a maximum of $250) Defensive driver training course discount (up to 7%) Superior Driver Discount (earn up to 12% if all drivers in your household have outstanding driver records) MetRewards (earn up to 20% if you are claim-free and violation-free for five years or more) Multi-policy when combined with homeowner’s insurance (10%) or when combined with life insurance (5%) Good student (up to 15%) |

Premiums: $1,337 (2nd lowest average premium on our list)

Customer satisfaction rating: 794 (#22 on the J.D. Power Survey)

Financial strength rating: A

Why It Made the List

Not only does MetLife have the second-lowest statewide average premium on our list, but it also ranks as our top choice for urban drivers. As a largely urban state, MetLife will be a serious contender for most Michigan residents. The company also offers an impressive list of policy options, including new car replacement, major parts replacement, glass repairs without a deductible, and legal defense coverage.

What Holds It Back

MetLife ranks a disappointing #22 in customer satisfaction. That can indicate possible issues with the handling and payment of claims.

5. Grange Insurance

The Basics:

| Policy Options | Loan/lease gap coverage Full glass repair Rental car reimbursement Roadside assistance Pet injury and mobile device Original equipment manufacturer coverage Personal umbrella coverage |

| Discounts | Multi-policy Multi-vehicle Paid in full Advance quote Safe driver Good student Student away at school Legacy loyalty Accident forgiveness |

Premiums: $2,299 (5th lowest average premium on our list)

Customer satisfaction rating: 828 (#12 on the J.D. Power Survey, tied with Progressive)

Financial strength rating: A-

Why It Made the List

Grange Insurance has the fifth-lowest statewide average auto insurance premiums on our list, but they offer some strong policy options, like full glass repair, pet injury, and mobile services, original equipment manufacturers coverage, and personal umbrella coverage.

What Holds It Back

Grange Mutual ranks only #12 in customer satisfaction, putting it just below the statewide average. Also, the company operates in only 13 states, which once again creates the likelihood you’ll need to change auto insurance providers if you move to one of the 37 states where they don’t offer coverage.

6. Nationwide

The Basics:

| Policy Options | Medical payments Towing and labor Rental car expense (loss of use) Personal injury protection (PIP) Gap coverage Roadside assistance Vanishing Deductible (earn $100 off your deductible for each year of safe driving, up to $500) Total loss deductible waiver (deductible is waived in the event of a total loss) |

| Discounts | Multi-policy Multi-vehicle SmartRide monitoring app Accident-free Automatic payment Paperless documents Good student Defensive driving (complete a state-approved course for drivers 55 and over) Anti-theft Safe Driver (free of major violations or at-fault accidents for at least five years) Affinity member (extends to hundreds of alumni associations, professional groups, sports groups, and special interest groups) Accident Forgiveness – your rate won’t increase due to a first at-fault accident or minor violation |

Premiums: $2,567 (7th lowest average premium on our list)

Customer satisfaction rating: 829 (#11 on the J.D. Power Survey)

Financial strength rating: A+

Why It Made the List

We like Nationwide because of its Accident Forgiveness provision, which will not increase your premium due to a first at-fault accident or minor violation. But we also like the Vanishing Deductible, which reduces your deductible for collision and comprehensive by $100 per year for each year of safe driving. If you start with a $500 deductible, you’ll have no deductible at all after five years.

What Holds It Back

Nationwide only ranks #11 in the J.D. Power Survey for customer satisfaction in Michigan, which could indicate potential issues on the claim side, with both customer service and payments.

7. Auto Club Group (AAA)

The Basics:

| Policy Options | Pet protection Personal injury protection (PIP) Medical payments Loan/lease gap coverage Car rental coverage Custom, electronic or extra equipment coverage Extended Exterior Repair Option (OEM) (pays for repairs and exterior parts using new original equipment replacement parts on vehicles 10 years old or less) |

| Discounts | Education and occupation discount Safety equipment Multi-vehicle Multi-policy (homeowners or life) Pay-in-full discount AAADrive (driving monitoring app discount) |

Premiums: $2,446 (6th lowest average premium on our list)

Customer satisfaction rating: 801 (#21 on the J.D. Power Survey)

Financial strength rating: A-

Why It Made the List

AAA is hardly the lowest-priced company on our list, premium-wise. But its statewide average premium is still more than $150 lower than the Michigan average. The company also offers some interesting policy options, including pet protection, custom electronic or extra equipment coverage, and their extended exterior repair option.

What Holds It Back

AAA ranks #21 in the J.D. Power Survey for customer satisfaction in Michigan, which hints customers are not entirely satisfied with either customer service or payments – or both – when it comes to filing claims.

How We Found the Best Car Insurance in Michigan

To come up with our list of the best car insurance in Michigan, we’ve used five independent criteria to make that determination.

Policy Options

Policy options are a major criterion in determining the rank of a car insurance company. Since each person has a unique driver profile, options will enable you to create a custom-designed policy that will fit your needs and preferences. The more policy options offered by a company, the higher their rank.

Discounts

Discounts figure significantly into premiums charged by insurance companies. But since they vary from one company to another, both in-kind and by amount, you may pay less for a policy with one company than another just based on stronger discounts. That may be true even if one company has a lower base premium rate than another. It’s yet another way drivers can customize their car insurance policies.

Premiums

While recognizing that premiums are a major consideration in determining the best car insurance in Michigan, we caution that they should not be the sole determining factor in the company you choose. If a company has very low premiums, but a poor record paying claims, they may fail to provide the promised coverage in your time of need.

There are at least 30 companies providing car insurance in Michigan. Some are among the 10 lowest in premiums, but we’ve excluded them from our list because of either low financial strength ratings, or their absence on the J.D. Power U.S. Auto Insurance Study. Absent solid evidence of a company’s ability and willingness to pay claims, we’ve excluded them from our list.

We used average premiums only as a starting point. These were derived from The Zebra, which is determined to be a reliable source of pricing information.

Customer Satisfaction Rating

Customer satisfaction isn’t just about customer service. More importantly, it emphasizes the customer’s experience with each company when it comes to the all-important category of paying claims. After all, it doesn’t matter how cheap the company’s premium is, or how many options or discounts they offer if they are uncooperative when it comes to paying claims. That’s because claims are the whole reason for having car insurance in the first place.

To make a reasonable assessment of this all-important category, we’ve used the J.D. Power U.S. Auto Insurance Study, released in June 2019. More specifically, we’ve relied on the Overall Customer Satisfaction Index Ranking – North Central Region, which includes Michigan.

Insurance Company Financial Strength

Financial strength indicates an insurance company’s ability to meet its financial obligations, which includes its ability to pay claims. Cheap car insurance will do little more than satisfy the minimum legal requirements in Michigan but could leave you with unpaid claims.

For that reason, we’ve included only companies rated either “Superior” or “Excellent” for financial strength by the insurance industry rating service, A.M. Best.

Their ratings for companies with financial strength of “Good” or better are as follows:

Superior: A+, A++

Excellent, A, A-

Good, B, B+

We have not included any companies rated lower than “A/A-”.

What You Need to Know About Car Insurance Laws in Michigan

Car insurance laws and requirements vary from one state to another. Laws required by the Michigan Department of Insurance and Financial Services are as follows:

State Minimum Insurance Requirements

The minimum Ohio car insurance requirement is “20/40/10”, broken down as follows:

- Bodily Injury: $25,000 for injury or death to one person as a result of an auto accident.

- Bodily Injury: $50,000 for injury or death to more than one person as a result of an auto accident.

- Property Damage: $25,000 per accident for property damage in another state.

- Personal injury protection (PIP): Pays medical expenses and lost wages regardless of who is at fault in an accident.

- Personal Protection Insurance (PPI): A provision covering up to $1 million for damage your car does in Michigan to other people’s property or to their properly parked vehicles.

Optional car insurance coverage under Michigan law includes:

- Uninsured motorist (UM) – covers you, your family, and your passengers for bodily injury caused by an at-fault uninsured motorist.

- Underinsured motorist (UIM) – covers you, your family, and your passengers for bodily injury caused by an at-fault motorist who lacks sufficient coverage.

- Collision – pays for damage to your vehicle if you are at fault in an accident.

- Comprehensive – pays for the damage to your vehicle from non-moving hazards, like falling trees, theft, or vandalism.

- Rental reimbursement – pays for a rental car while your vehicle is being repaired due to an accident. Roadside assistance.

- Gap coverage – pays the difference between reimbursement for a totaled vehicle and the balance owed on the loan or lease.

- Limited property damage/“Mini-tort” coverage – if you are determined to be 50% or more at fault in an accident and damage to the other driver’s vehicle is not completely covered by his or her policy, you can be sued for up to $1,000 in damages. This provision covers those damages.

Note that collision, comprehensive, and gap coverage will generally be required on any vehicle on which you have a loan or a lease.

Why Is Car Insurance in Michigan the Most Expensive in the Country?

Michigan is one of about a dozen states that require no-fault insurance coverage. Under no-fault provisions, you must collect damages from your own insurance company, regardless of who is at fault in the accident. There are also limits on instituting lawsuits.

However, Michigan has a complicated car insurance system. It requires all drivers to carry personal injury protection (PIP) coverage, which is expensive because the state guarantees unlimited lifetime medical benefits for car insurance victims.

It also provides coverage for the driver and any passengers in his or her vehicle for medical expenses. Other states that require PIP coverage put limits on the benefits that can be paid, which reduces premium costs. But this is not the case in Michigan.

Michigan State Car Insurance FAQs

What are the penalties in Michigan for driving without car insurance?

First, you can be sued and held personally liable for an at-fault accident. You will also not be eligible for coverage for medical expenses, loss of wages or services, or any other no-fault benefits.

You can also face a fine of up to $500 and/or jailed for up to one year.

Is group auto insurance available in Michigan?

Yes, this is a unique provision to the state. But you can obtain auto insurance through an eligible group based on the insurance company’s underwriting rules. Group coverage is typically available through employers or associations with the club or organization.

What do I do if I’m not eligible for car insurance coverage in Michigan?

You can apply to the Michigan Automobile Insurance Placement Facility (MAIPF) through any car insurance agent. It’s a program set up for those drivers determined to be ineligible for coverage due to a high-risk driver classification.