We talk a lot about retirement plans here on Good Financial Cents, but one part of the retirement subject we don’t discuss enough is 401(k) vesting.

Not all plans have it, but many do. And some have very generous employer matches, making the question of 401(k) vesting an important one.

An Ask GFC reader asked the following question:

“I am a 401(k) Plan participant which has a graded vesting schedule of 6 years. I have completed 4 years and am not working with the company since 2005. I am 55 years old. Am I 100% vested for employer’s contribution?”

I’m going to jump right to the answer to the reader’s question, and I’ll explain the details of that answer as we go along.

Since the reader was in a plan that had a graded vesting schedule of six years, and he only completed four years of service, he will be vested in just 60% or 80% of the employer matching contributions to his plan, depending on how the employer counts a year of service.

Now let’s get into the details of how that comes about.

Table of Contents

What Is 401(k) Vesting?

401(k) vesting simply refers to ownership of the funds within a retirement plan. Employee contributions to a retirement plan are always 100% vested.

This means the employee contributions belong solely and entirely to the employee. That’s as it should be, since the contributions are made from the employee’s own earnings.

But the question of 401(k) vesting enters the equation when an employer offers matching contributions to the plan.

Many employers do offer a plan match, and the specific terms vary with each plan. For example, one plan may offer to match 50% of the employee’s first 6% of salary contributions.

If the employee contributes 6% of his or her paycheck to the 401(k) plan, then the employer will match at up to 3% of the employee’s salary, for a total of 9%.

Other companies might match 100% of the employee’s contribution, up to say 8% or 10% of the employee’s salary.

It is that employer match and not the employee’s contribution to the plan, that is typically subject to 401(k) vesting provisions.

What Is a 401(k) Vesting Schedule?

There are various ways 401(k) vesting takes place. And exactly how it works mechanically depends upon the provisions within the retirement plan itself.

It is even possible for an employer to offer an immediate 100% vesting of all employer-matching contributions, though this is fairly rare.

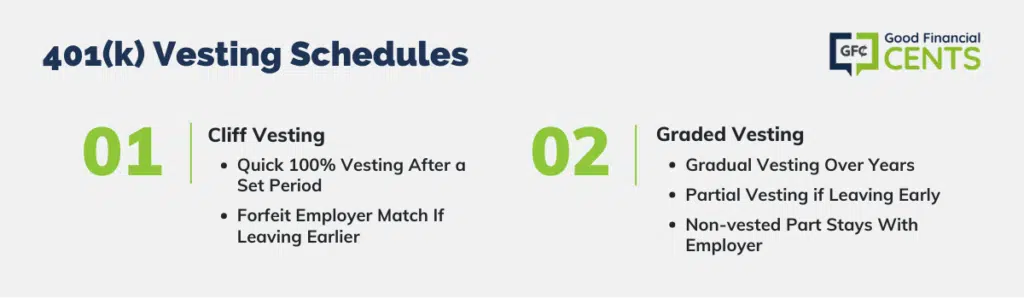

More often, 401(k) vesting is subject to a vesting schedule. This schedule takes one of two forms, cliff vesting and graded vesting.

Cliff Vesting

Cliff vesting is pretty much what the term implies. That is, all of the vesting takes place at a certain point in the vesting schedule. For example, employer matching contributions may be entirely non-vested for the first two years that the employee participates in the program.

But after that two-year timeframe, the employee becomes 100% vested in year number three.

On the opposite end of the spectrum, once you clear the non-vested term, 100% of the employer match becomes vested with you as the sole owner of the funds.

Graded Vesting

Graded vesting is a process in which vesting takes place on a gradual basis. Under the graded method, 401(k) vesting takes place incrementally and over a period of several years.

Here’s an example of how graded vesting works:

- Year 1 of employment, 0% vesting

- Year 2 of employment, 20% vesting

- Year 3 of employment, 40% vesting

- Year 4 of employment, 60% vesting

- Year 5 of employment, 80% vesting

- Year 6 of employment, 100% vesting

Graded vesting has the advantage if you leave the employer after the first year of employment, but before the end of the second, you will at least have 20% of the matching contributions vested.

Graded vesting leaves you in a situation where your employer match has two parts – the vested portion and the non-vested portion. For example in the fourth year of employment, 60% of the employer match would be vested, and therefore fully owned by you.

However, the remaining 40% will continue to be owned by the employer. Since it represents non-vested funds, you will forfeit that amount in the event you leave the company – even though the balance will still show as being part of your 401(k) plan.

Fortunately, most 401(k) plan statements will break out your plan balance in three parts – your contributions to the plan (fully vested), the vested portion of employer matching contributions, and the non-vested portion of employer matching contributions.

One Other Important Point About Vesting:

The vesting schedule doesn’t restart with each matching contribution – it’s cumulative. This means once you clear the time requirement, all employer-matching contributions are fully vested.

Exceptions to 401(k) Vesting Rules

Though cliff vesting and graded vesting are the typical vesting schemes, there are two exceptions to the rule:

1. All employees must become 100% vested by the time they attain normal retirement age under the plan, or

2. When the retirement plan is terminated by the employer

That provides an obvious advantage to anyone who takes a new job shortly before retirement age.

In that situation, if you took a job with the company at age 62, and participated in its retirement plan – which set the retirement age at 65 – you would be 100% vested in the employer matching contributions upon turning 65.

This would of course also protect you in the event you are participating in a plan with an employer match, and the employer either terminated the plan or went out of business.

What Does It Take to Become 100% Vested?

In addition to requiring you to work a certain minimum number of years for the company, the employer can and usually does define the terms of that employment.

Within the plan, employers typically require a minimum number of hours worked in any year of participation. This is generally a minimum of 500 hours per year, but it could be as high as 1,000 hours per year.

In addition, some plans may count years of service in different ways. For example, a company could consider years of service based on your start date.

In that way, the exact years of service you would need to work would be unique to you, based on your hire date.

More typically, an employer will use calendar years. In that situation, they will count as a full year any year in which you have worked the minimum required number of hours.

For example, if they require 1,000 hours per year, and you were hired on May 1, the partial year would count toward your years of service as long as you completed at least 1,000 hours during that partial year.

These are just examples of typical 401(k) vesting requirements. The specific requirements will vary with each employer, as the IRS gives employers considerable leeway in determining the details of the retirement plan that they are sponsoring for their employees.

What Does It Mean to be “Fully Vested”?

In the simplest terms, being fully vested means you as the employee have full ownership of the funds in your retirement plan.

If you have met the requirements for vesting – whether the method is cliff investing or graded investing – and all funds within your retirement plan are fully owned by you.

This includes both your own employee contributions to the plan, as well as any and all employer matching contributions.

There are at least two major advantages to being fully vested:

- Terminating your employment.

Whether you leave your employer voluntarily, or you are fired, 100% of the funds in your retirement plan will come with you.

If you do leave the company, you are then free to roll the 401(k) proceeds over into a traditional IRA, convert the balance to a Roth IRA, or roll the plan over into the retirement plan of your next employer.

- Taking a loan against your retirement plan.

The IRS allows you to take loans of up to 50% of the vested balance of your retirement plan up to a maximum of $50,000. Naturally, the higher your 401(k) vesting is, the larger the loan amount you can take.

| As an example, let’s assume you have $50,000 in your 401(k) plan, which is comprised of $30,000 in employee contributions, and $20,000 in employer matching contributions. Your company plan uses graded vesting, and you’ve been working with the company for four years. In this case, 60% of the employer match is vested, giving you a total vested balance of $42,000 ($30,000 + $20,000 X 60%). |

Since the IRS allows you to borrow up to 50% of your vested plan balance, you can take a loan for as much as $21,000. But if you are with the employer for at least six years, you would be fully vested in the plan.

That would enable you to borrow up to $25,000, which is equal to 50% of the total value of your 401(k) plan.

One Other Important Note in Regard to 401(k) Plan Loans:

For this reason, you may find that your employer doesn’t offer a 401(k) plan loan option.

What if You Don’t Have Full 401(k) Vesting?

The short answer is you don’t have full ownership of your 401(k) plan balance.

No matter how much money your 401(k) plan may have, you only actually own the amount that represents your own contributions to the plan, as well as any amount of employer-matching contributions that have been vested.

But there are two important points to remember about 401(k) vesting.

The first is it’s found money. It’s always worth getting, but if you don’t get it – because you terminated your employment – you really haven’t lost anything either. But it’s usually worth staying with an employer to get full 401(k) vesting, especially if you’re just a year or two away from it.

The second point relates to the employer. Employers offer 401(k) plan contribution matches as an additional benefit to their employees. They are well aware of the fact that a good employer match provides a strong hiring incentive.

But since they are also anxious to minimize employee turnover, they use 401(k) vesting schedules to make sure their people stay around for a few years.

It works in both cases. As an employee, the employer match is a definite wealth enhancer. And from an employer standpoint, it’s a major reason why you are likely to stay with your employer for at least a few years.

And once you’re fully vested, it’s all yours. That’s one of the best retirement deals there is.

Final Thoughts on Ask GFC 032: How Does 401(k) Vesting Work

401(k) vesting often takes a backseat despite its significant implications. Vesting essentially signifies ownership of the funds within your retirement plan, especially employer contributions.

Vesting schedules, commonly categorized as a cliff or graded vesting, involve meeting specific criteria, including years of service and a minimum number of work hours annually.

Full vesting offers distinct advantages, granting complete control over plan funds, facilitating smooth job transitions with rollovers or conversions, and enabling plan loans, albeit dependent on employer policies.

In contrast, partial vesting restricts access to vested employer contributions, emphasizing the importance of patience when approaching full vesting.

Employers, aware of the allure of generous matching contributions, utilize vesting schedules strategically to promote employee retention.

I was a a part time employee for a company 16 years .

I participated in the company’s 401k plus employer match.

For years my statements had said I was fully vested on the employee. Portion as well as the employers portion . When I resigned from the company I instructed them to pay all sums. At that time. I received a letter stating that during my 16 years of employment I had only wired the required 1000 hour each year for which. I had only 2 years we’re i worked the minimum 1000 hours. I wired consistently the whole 16 years. Does being on call count as well. There were. Many weeks when I scheduled myself to be ready to wor but was called off due to lack of wor.

I have been denie$14,000. . Do I have any recourse

Signed Robin Alegria

If a former employer has merged with a larger company (aka acquired by), and that employer changed from Fidelity accounts to Voya, new plan name, etc… is that the same as “termination of the plan”? They are arguing with me over whether or not I was truly fully vested in my match when I tried to move my funds to my new employer. Thanks!

Hi Kelly – That’s a real technical issue. You may have to go back to the rules of the old plan and see if you were vested. But generally speaking when one company acquires an old one, the retirement plans merge seamlessly. But it depends on terms of the merger agreement. If it’s a large amount of money, you may even want to consult with an employment attorney. But see what you can find out on your own before putting out the money for a lawyer.

If I am terminated…without cause…fired because of “downsizing”…and I am only 80% vested, do I lose the other 20% even though I am discharged and do not resign?

PFS

Hi Preston – Unfortunately yes. The reason for the separation doesn’t matter.

If I am only 20 percent vested, and my employer takes the 80 percent after termination. Are they entitled to interest that was made on there matching contribution? After all it was my investment choices that made them any extra money. If that is the case, theoretically they could end up getting back more than they put into my 401k ?

Hi John – I don’t think so, but I must confess I don’t know the answer to that. It may vary by plan, so check the literature for you plan.

I am taking a new job with a company at age 67 (I am full retirement age). Will the company be obligated to consider me to be 100% vested with regard to 401K company match? Thank you, Cliff Huss

Hi Cliff – As long as the company has set the retirement age at something before age 67 you should be fully vested going forward. But check with the plan administrator to make sure that’s the case.

I was “Fully Vested” through my companies 401K. I am trying to roll everything to a Traditional IRA. They sent me a form to fill out that forfeits my rights to the money the company contributed. The only money the company said I’m entitled to is the money I contributed. In the forms they provided me it also says I am fully vested, but if I move the money out of their control I lose the employer contribution. Is this correct? Since, I was fully vested I should receive my contributions plus the company’s contributions to roll over to a Traditional IRA?

Thank you for any guidance in this situation.

Hi Jessica – That’s really strange. Fully vested means the money is yours. Call the plan administrator and get a clarification. If that doesn’t work out, it ight be worth having a consultation with an attorney who specializes in retirement plan issues. If the employer contribution is a lot of money, it may be worth getting an attorney involved. It doesn’t sound right at all, but the IRS gives employers a lot of flexibility in managing these plans, so I don’t want to say it’s impossible.