Most parents want to name their children as beneficiaries of their trust and/or retirement accounts.

Children without financial experience are often not mature enough to handle large amounts of money left to them, and by law – minors cannot manage an inheritance without an adult administering the assets until they reach the age of majority in their state, anyway.

It is best to choose someone over the age of 18 (or 21, depending on the state the minor lives in) to become the professional trustee of your minor’s inheritance until they are old enough to manage it themselves.

If a minor is named the beneficiary and receives property or money, the minor will not have the authority to take control of that property or those finances until he or she reaches the age of 18 or 21 (depending on the laws of the minor’s state).

Minors cannot legally enter any contract or receive property until they are adults.

The exact details of what happens to the inheritance will also depend on the laws of the state where the minor lives, as well as the amount of the inheritance.

Table of Contents

- Legal Framework and Age Considerations

- Rules on Minors of Beneficiary Individual Retirement Accounts (IRA)

- UTMA/UGMA Accounts: Safe Havens for Minor’s Assets

- 529 College Savings Plans: Investing in Education

- Inheritance Under $20,000

- Guardianship: A Legal Safeguard for Significant Inheritances

- Let the Judge Decide

- Navigating the Tax Landscape

- Conclusion

Legal Framework and Age Considerations

The law is clear that minors, defined as individuals below the age of majority (18 or 21 in most U.S. states), cannot independently manage an inheritance.

Consequently, an adult custodian or trustee must oversee and administer the assets on their behalf until they reach legal adulthood. It is a crucial responsibility, necessitating the selection of a trustworthy and financially savvy individual, typically over the age of 18 or 21.

This person’s role involves managing the assets, making prudent investment decisions, and ensuring that the funds are used in the minor’s best interest.

Rules on Minors of Beneficiary Individual Retirement Accounts (IRA)

There are special rules involved in naming a minor as the beneficiary of an IRA. If the money is left to a minor, he or she will need to set up a beneficiary IRA in their name with a custodian who is over the age of 18.

The custodian of an IRA is like a trustee. The custodian is then in charge of withdrawals from the IRA to the minor.

The financial institution holding the IRA will most likely allow the minor to choose whoever he or she wants as their custodian.

If you don’t want to leave it up to your minor child to choose his or her own custodian on an IRA inheritance, name the custodian in your beneficiary document now.

There is no legal law that forces the financial institution to honor the request of the custodian, the chances are good that they will anyway just because you’ve indicated it in the paperwork.

Special Considerations for IRA Beneficiaries

When a minor is named as the beneficiary of an Individual Retirement Account (IRA), unique rules apply. The minor must establish a beneficiary IRA, with an adult acting as the custodian. This custodian oversees withdrawals and ensures compliance with tax laws and regulations.

Financial institutions usually allow the minor to nominate their custodian, but to prevent any potential issues, parents can and should specify their choice of custodian in the beneficiary documentation.

UTMA/UGMA Accounts: Safe Havens for Minor’s Assets

UTMA (Uniform Transfers to Minors Act) and UGMA (Uniform Gifts to Minors Act) accounts offer a legal framework for minors to receive gifts and inheritances. They enable assets to be held in the minor’s name while an appointed custodian manages them until the child comes of age.

These accounts are often utilized for smaller inheritances, usually below $20,000. Any adult, but usually a relative, can set up these accounts and act as the custodian, managing the assets and using them for the child’s benefit.

Importantly, these accounts offer a simpler alternative to trusts and guardianships, reducing the need for legal and court involvement.

529 College Savings Plans: Investing in Education

Some jurisdictions also provide the option of placing a minor’s inheritance into a 529 college savings account. This not only earmarks the funds for educational purposes but also offers potential tax advantages.

The growth of investments within a 529 plan is tax-free, provided that withdrawals are used for qualified educational expenses. This makes it an attractive option for families looking to invest in a child’s future education while enjoying tax benefits.

Inheritance Under $20,000

If a minor receives property or money valued at $20,000 or less, many state laws will allow an adult to request the minor’s inheritance to be paid in an account in the minor’s name under either the Uniform Gifts to Minors Act (UGMA) or the Uniform Transfers to Minors Act (UTMA).

The adult is generally the minor’s grandparent, aunt, or uncle.

In some states, money can be left to a minor in a 529 account in the minor’s name.

Inheritance Over $20,000

If the state the minor resides in does not allow inheritance money or property to be placed in a UTMA, UGMA, or 529 account, or if the value of the inheritance is greater than $20,000 – then a guardianship must be established for the minor through the court system.

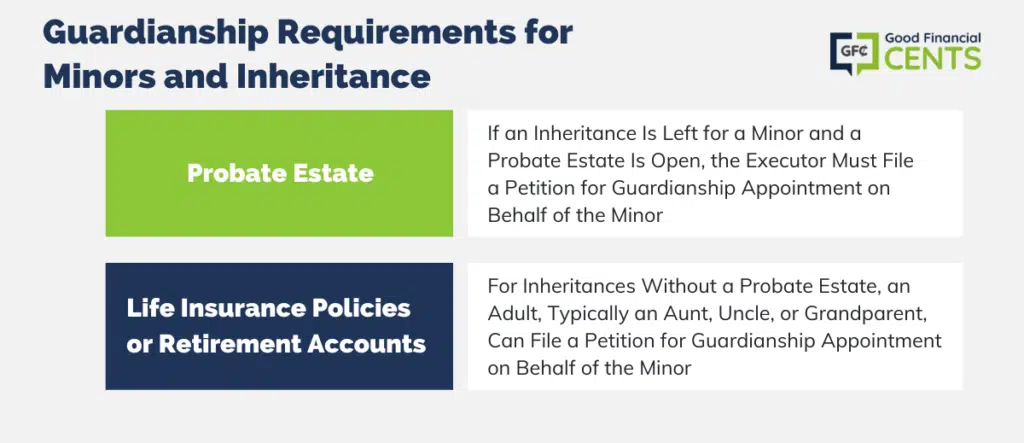

- Probate estate – if an inheritance was left for a minor and a probate estate has been opened; then the executor of the estate is required to file a petition for the appointment of guardianship on behalf of the minor.

- Life insurance policies or retirement accounts – for inheritances that do not have a probate estate, an adult can file a petition for guardianship appointment on behalf of the minor. The adult to file the petition is normally an aunt, uncle, or grandparent of the child.

Guardianship: A Legal Safeguard for Significant Inheritances

For larger inheritances or in situations where UTMA/UGMA accounts and 529 plans are not applicable, establishing legal guardianship becomes necessary. This process involves the court system and requires appointing a guardian to manage the assets on behalf of the minor.

Whether the assets are part of a probate estate or come from non-probate sources like life insurance policies or retirement accounts, a responsible adult, often a close relative, must petition the court for guardianship.

A judge will ultimately decide, taking into consideration all relevant factors, including the child’s age and preferences.

Let the Judge Decide

A judge will decide who to appoint as the guardian for the minor, through a court hearing where all interested parties have the opportunity to testify as to who they believe should be appointed guardianship of the minor’s inheritance until the child reaches the age of 18 or 21, depending on the state he or she lives in.

If the child is over the age of 12 or 13, he or she will also have a say.

Navigating the Tax Landscape

Both UTMA/UGMA accounts and trusts have specific tax implications. For UTMA/UGMA accounts, the “kiddie tax” rules may apply, taxing the child’s unearned income at the parent’s marginal rate if it exceeds a certain threshold.

Trusts also bring tax considerations, as the income generated within the trust can be subject to taxation, and distributions from the trust may have tax implications for the beneficiary.

Engaging with a tax professional is crucial to navigate these complexities and ensure a tax-efficient approach to safeguarding a minor’s inheritance.

Conclusion

Ensuring financial stability and security for minor beneficiaries is a multi-faceted challenge, necessitating a comprehensive understanding of the legal frameworks, financial mechanisms, and tax implications involved.

By leveraging UTMA/UGMA accounts, and trust accounts, and being mindful of tax considerations, parents and guardians can establish a solid financial foundation for their children.

Seeking professional advice is imperative to navigate this intricate landscape and make informed decisions that align with the minor’s best interests.

This information is not intended to be a substitute for specific individualized tax, legal, or investment planning advice. We suggest that you discuss your specific legal issues with your attorney.