Welcome to another Ask GFC! If you have a question that you want answered you can ask it here. If your questions get featured on GFC TV or the GFC Podcast, you are the lucky recipient of a copy of my best-selling book, Soldier of Finance, and a $50 Amazon gift card. So what are you waiting for? Ask your question now!

With so many people moving from one job to another, losing their jobs, or working for employers who are bought out by others, this has become a common and important question. Since there are several good options, the answer isn’t always clear.

Table of Contents

I received a question on this topic from reader Dionicio F., and I want to tackle it since it’s a similar question that so many others have:

Hi Jeff:

The company where I work had been sold and I need to move my 401(k). What is the best option to move my 401(k)? To a Traditional IRA, ROTH IRA or leave the 401(k) account active? What are the tax consequences of moving it to any of those accounts?

Thank you Jeff, I really enjoy your blog.

Dionicio is facing the increasingly common situation where one employer is merged into another organization, causing a change over in the previous 401(k) plan. It’s likely that the new owner has offered the option to employees to roll their plans over into the plan of that organization, but it’s also possible that the new owner does not have a retirement plan. Either way, Dionicio is at a crossroads as to what to do with his existing plan.

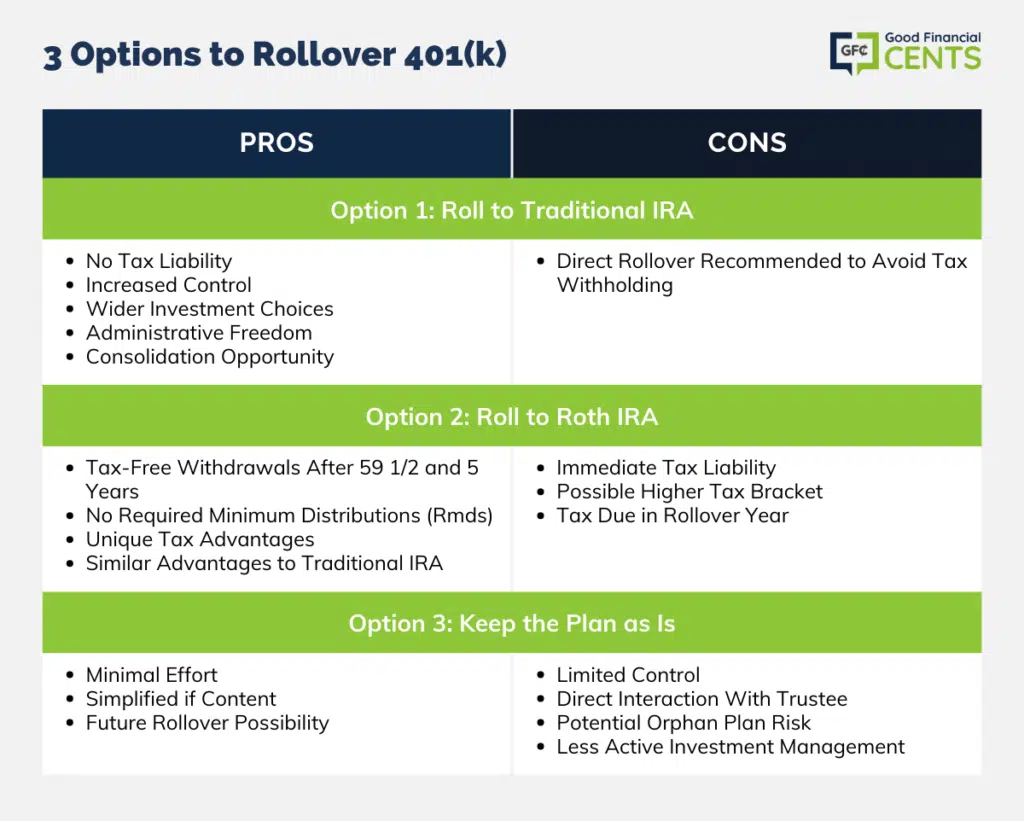

Dionicio has listed three options:

- Move the plan into a traditional IRA

- Move the plan to a Roth IRA, or

- Leave the account exactly where it is

There are positives and negatives with each option, so let’s take a look at each individually and see if we can provide Dionicio with some direction.

Option 1: Roll the 401(k) Over to a Traditional IRA

Rolling over a 401(k) plan to a traditional IRA is probably the most common option used, and there are plenty of good reasons for this.

First, by rolling over the 401(k) into a traditional IRA, no tax liability is created. This is unlike the rollover into a Roth IRA, where you have to pay ordinary income tax on the amount of the rollover (we’ll get into the details of that in the next section).

Second, you will be moving money out of the 401(k) plan – where it is probably being directly managed by a third party – and into an IRA, which is self-directed. That will give you more control over how the money is invested.

Third, investment options within IRAs are close to unlimited. This is particularly true if you roll the money into a typical investment brokerage account, which will offer the widest variety of investment choices. By contrast, 401(k) plans typically have very limited investment options. They may restrict you to just a few mutual funds or ETFs and even prohibit you from investing in entire asset classes, such as real estate investment trusts, commodities, or options.

Fourth, you will effectively be the administrator of the plan. That means that you will be able to transfer the account to another broker or even take distributions at your own discretion. A 401(k) plan generally has specific requirements and restrictions in order to take distributions and never gives you the option to change trustees.

Dionisio – or anyone else’s, for that matter – may also offer an opportunity to consolidate various retirement plans. For example, if he already has a traditional IRA account setup, he can eliminate the 401(k) plan by rolling it over into the IRA. This is much easier to do with an IRA than it is with an existing 401(k), where such consolidations are usually not permitted.

Be sure to do a direct rollover between retirement plans. Mechanically, there are two ways to accomplish a retirement transfer – direct and indirect. Under a direct transfer, the trustee of the original plan transfers the funds directly from the old account into the new one. Using the indirect method, the money is distributed to you, and you then have 60 days to deposit the money into the new plan, or the distribution will be subject to ordinary income taxes plus a 10% early withdrawal penalty (if you are under age 59 1/2).

You should always want to do a direct transfer in order to avoid the tax bite. First, most trustees will require a withholding amount for taxes on an indirect transfer. If the trustee withholds 20% of the plan balance, you will only be rolling over 80%, which means taxes and penalties will be required on the amount withheld. The alternative will be to cover the amount of the withholding out of other assets so that you can complete the full transfer. But you can avoid that whole mess by doing a direct transfer instead since there will be no withholding and no chance of creating a tax liability.

Option 2: Roll the 401(k) Over to a Roth IRA

Not surprisingly, rolling over a 401(k) into a Roth IRA has basically the same advantages as doing a rollover into a traditional IRA. There is one major exception, and that is in regard to income taxes. And the news here is both bad and good.

Let’s start with the bad news.

Whenever you roll over funds from any tax-deferred retirement plan into a Roth IRA – which is referred to as a conversion – you will incur ordinary income taxes on the amount transferred. If you are in the 25% tax bracket and you do a rollover of $100,000 from a 401(k) plan into a Roth IRA, you will incur a tax liability of $25,000.

In fact, it may be higher than that since the amount of the distribution will be added to your regular income and will probably push you into a higher tax bracket. Worse, the amount of the tax will be due in the year when the rollover takes place. This happens because you are moving money from a tax-deferred account to what will ultimately become a tax-free account.

Roth IRA accounts are funded with after-tax income. That means that there is no tax deduction for the contributions that you make. But similar to all other retirement plans, investment income on a Roth IRA accumulates on a tax-deferred basis. However, once you reach the age of 59 1/2 – as long as the Roth IRA has been in place for at least five years – withdrawals from the plan are taken tax-free. This includes both your contribution amounts and the cumulative investment earnings on the plan.

In effect, the rollover amounts from other plans into a Roth IRA are treated like contributions. That means that there are no tax advantages to making those contributions. But since the amount in, say, a 401(k) plan was accumulated with pretax contributions, the rollover from the 401(k) to a Roth IRA is treated like a distribution from the 401(k). That means that ordinary income tax will be due on the amount of the rollover. However, no 10% early withdrawal penalty is imposed, even if you are not yet 59 1/2.

Tax-free distributions are the powerful advantage that Roth IRAs have over virtually every other type of retirement plan. The taxes that you pay in order to do the conversion from the 401(k) plan to the Roth IRA are the price that you pay for the tax-free status of the account once you begin taking withdrawals.

There’s one other advantage that’s completely unique to Roth IRAs. They are the only retirement plan available that does not involve required minimum distributions or RMDs. All other retirement plans require that you begin taking distributions once you turn age 70 1/2. The distributions are generally based on your life expectancy at that time. But Roth IRAs do not require RMDs, giving you complete control over the plan for virtually your entire life.

Option 3: Keep the Plan Exactly Where it is

This is probably the least desirable option. That’s because 401(k) plans offer you the least amount of account control, and the most limited investment options.

But there’s still another disadvantage. Once you leave the employer, or particularly if the plan is no longer associated with an employer, the plan can become even more distant. For example, if you have a problem with the account or you want to access the money, there is no employer acting as an intermediary. You will have to deal directly with the plan trustee, which removes the leverage that an employer has. In cases where the employer no longer exists, the 401(k) plan could become something of an orphan plan for the trustee who manages it.

However, if you are happy with the 401(k) plan as it is, there may be no compelling reason to move it. This is particularly true if you have no interest in managing the investments in it or you have no immediate need to withdraw any money.

Keeping the plan where it is will also make it easier to roll it over into the 401(k) plan of another employer. Most will not permit you to roll over IRA funds into a 401(k), but nearly all will permit a direct 401(k)-to-401(k) rollover.

For Dionicio – or anyone else facing a decision to move a 401(k) plan – it’s a matter of considering what is most important to you and which rollover option will work best within your own preferences.

The Bottom Line – What’s the Best Option to Rollover My 401(k)?

Dionicio’s dilemma of managing a 401(k) amidst a company merger mirrors a quandary faced by countless employees in today’s fluid job market.

Each option he considers – transferring to a traditional IRA, a Roth IRA, or leaving the funds in the existing 401(k) – has distinct advantages and drawbacks. Traditional IRAs allow tax-free rollovers and more investment freedom, while a Roth IRA demands up-front taxes but offers tax-free distributions and no obligatory withdrawals.

Retaining the 401(k) may simplify future rollovers to a new employer’s plan, though it might also constrain investment choices. Ultimately, the decision hinges on an individual’s financial goals, willingness to manage investments, and tax planning strategy.