Having life insurance can help to ensure that loved ones and survivors will not need to face unnecessary financial hardship – even if the unexpected occurs.

That is because the proceeds from a life insurance policy can be used for a variety of different things, including the payment of debt, as well as the payment of ongoing monthly bills.

Depending on the type of life insurance policy you have, you may also be able to use the plan as a financial vehicle to build up tax-deferred savings.

These funds could be put towards the payment of a child or grandchild’s college education, the supplementing of future retirement income, or any other need that you may have at that time.

Before you purchase a life insurance policy, though, it is important that you ensure that you are moving forward with the proper type of coverage for your needs, as well as the right amount. That way, loved ones can have the peace of mind that they deserve.

It is also essential to make sure that the insurance company you purchase your coverage through is secure and stable financially, and that it has a good reputation for paying its claims out to policyholders. One insurance carrier that meets these criteria is ING Reliastar.

Table of Contents

The History of ING Reliastar

Over the past few years, ING Reliastar has undergone many fundamental changes – with one of them being the company’s name and branding.

Now known as Voya Financial, Inc., this new look, and feel of the company took place gradually between 2010 and 2014. But the company’s overall history dates back much further than that.

Back in 1928, the Security Life of Denver Insurance Company was established as a life and health insurance carrier. Several years later, in 1940, the company expanded into the group insurance and reinsurance arena.

Then, in 1977, the company became a part of the Nationale-Nederlanden, and in 2004, Southland Life of ING Group was added to Life of Denver.

Over the years, several other mergers and acquisitions took place, including the 1979 acquisition of Life of Georgia by Nationale-Nederlanden (which was subsequently sold in 2004), and the acquisition of Equitable of Iowa in 1997 by ING. (Equitable was initially founded back in the year 1867).

ReliaStar’s predecessor, Northwestern National Life Insurance Company, was founded in the year 1885, and it grew into one of the largest U.S. financial services companies, offering life insurance, annuities, mutual funds, reinsurance, and group insurance products.

Additional acquisitions of CitiStreet and Aetna Life Insurance Company continued to aid in the growth efforts of the company.

However, in 2010, as part of the company’s “Back to Basics” effort, ING Group sold the United States group reinsurance business to Reinsurance Group of America, Inc. The company then set out to re-brand itself, officially becoming Voya Financial, Inc. in 2014.

ING Reliastar Life Insurance Review

Today, Voya Financial helps Americans with planning, investing, and protecting their savings to retire better.

The company has a clear mission of making a secure financial future possible – one person, one family, and one institution at a time. The firm’s overall mission is “To be America’s Retirement Company.”

Voya currently serves nearly 6 million individual retirement plan investors and more than 52,000 institutional clients.

The company offers a broad range of financial savings and protection vehicles, including annuities, investment management services, employee benefits, and life insurance.

As of 2023, Voya Financial, Inc. had a total of $790 billion in total assets under management and had a market cap of approximately $6.96 billion.

The company brought in about $6.60 billion in revenues in the twelve months ending June 30, 2023. Voya is ranked as #567 on the 2023 Fortune 500.

Voya Financial is also known for its commitment to serving the communities in which it serves. In its 2023 annual Employee Giving Campaign, Voya witnessed a record-breaking 81% employee participation rate.

These employees engaged in events promoting nonprofits, successfully raising over $5.5 million for charitable causes.

In addition, Voya has earned numerous awards and accolades over time, including being named as one of the Top Green Companies in the U.S. in 2016, being named as a 2017 World’s Most Ethical Companies (by Ethisphere Institute), and as a top five retirement plan provider (based on number of plans and participants) by the Pensions & Investments Defined Contribution Record Keepers Survey in April of 2016.

Insurer Ratings and Better Business Bureau (BBB) Grade

Based on its financial strength and stability, as well as its timely payment of benefits to its policyholders and beneficiaries, Voya Insurance and Annuity Company has earned high ratings from the insurer rating agencies.

These include the following:

- A2 from Moody’s

- A from Fitch

- A from A.M. Best Company

- A from Standard & Poor’s

Also, even though the company is not currently an accredited company through the Better Business Bureau (BBB), the BBB has assigned Voya a grade of A+ (which is on an overall grade scale of A+ to F).

Over the past three years, Voya has closed out a total of 27 customer complaints (of which five have been closed out within the previous 12 months).

Of the total 27 complaints, 18 regarded problems with the company’s products and/or services, another 4 dealt with advertising and/or sales issues, three had to do with billing and/or collection issues, one dealt with delivery issues, and another one was related to guarantee / warranty issues.

Life Insurance Plan Options Offered By ING Reliastar

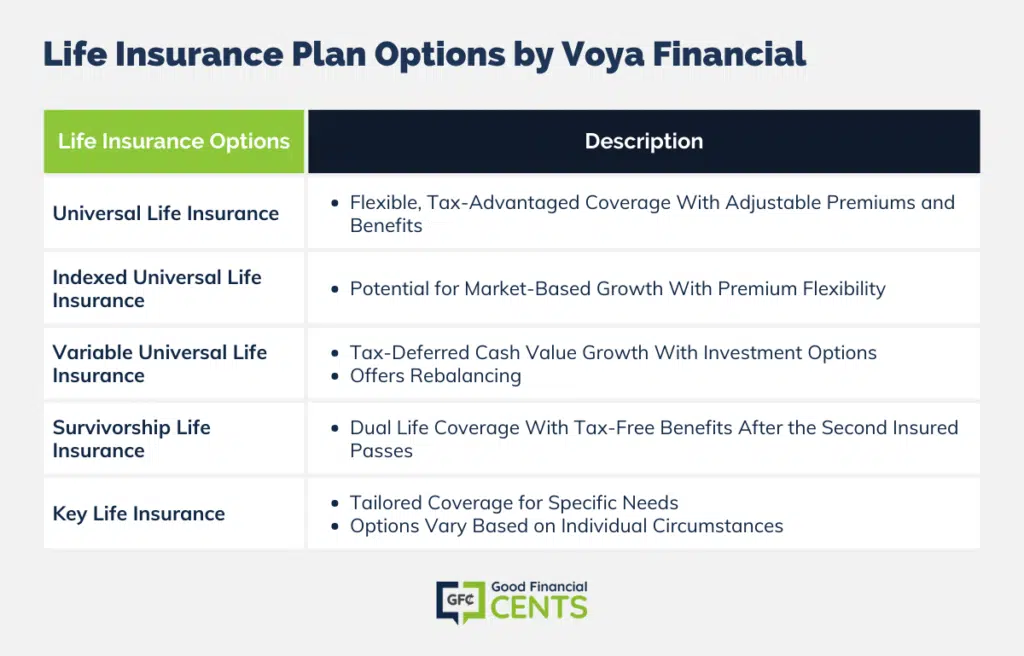

Voya Financial offers an extensive list of different life insurance products from which to choose. This can be beneficial for its customers, as they can obtain the coverage that best fits their specific needs.

These policies include:

- Variable Universal Life Insurance

With a universal life insurance plan, the policyholder will be covered with a death benefit.

They will also have a cash value component of the policy where funds can grow and compound on a tax-advantaged basis and are not taxed unless or until they are withdrawn. (The death benefit is, however, paid out income tax-free to the policy’s beneficiary).

With universal life insurance, the amount and the frequency of the premium payments may be altered to meet the policyholder’s needs (within certain guidelines).

Likewise, the death benefit may be adjusted up (with evidence of insurability), or down, depending on the needs of the policyholder and the beneficiary over time.

Voya Financial offers two regular universal life (UL) policies, including the Voya Universal Life – CV, and the Voya Universal Life – CV NY (which is offered only in New York).

The Voya Universal Life – CV policy may be well suited for those who want life insurance protection, as well as funds for supplementing retirement income down the road.

This plan may also be a viable option for business owners who are seeking to overcome the “contribution limits” that are imposed on qualified retirement plans, as well as those who want to recruit and retain executives, board members, and directors for their company.

Voya’s indexed universal life is also a permanent life insurance product. Here, however, the cash value of the policy will have its return based on the performance of an underlying market index, such as the S&P 500.

This means that there is the opportunity to obtain greater growth than that of a traditional universal life insurance policy – but when there is a negative index performance, the principal in the account will remain safe. These policies also have flexibility regarding the premium payment.

The Voya Indexed Universal Life Global Choice and the Voya Indexed Universal Life – Global Choice NY, are offered by the company.

These plans may be a good fit for those who want to choose from multiple strategies using global indices for optimizing their policy’s index crediting potential.

Another type of universal life – variable universal life insurance – is also offered by Voya. With this kind of coverage, money that is in the policy’s cash value component can grow tax-deferred using variable investment options.

Here, using asset allocation strategies, the cash value can be diversified to help match the policyholder’s risk tolerance. The policy also offers automatic rebalancing, to help with maintaining the policyholder’s specified asset allocation.

Voya offers the Voya Variable Universal Life – CV plan, and the Voya Variable Universal Life – DB.

The CV option has a focus on maximizing long-term growth potential with the allotted investment options, and the DB plan has more of a focus on death benefit protection, as well as the potential to grow the policy’s cash value.

Voya’s survivorship life insurance policies offer the opportunity to cover two lives – often for a premium that is less than purchasing two separate policies. This option provides an income tax-free death benefit that is paid out to named beneficiaries after the second insured dies.

There are also policy loans available via the cash value so policyholders can access funds when they are needed – and for any purpose.

Voya offers two survivorship life insurance policy options. These include the Voya Strategic Accumulator Survivorship Life, and the Voya Survivorship Variable Universal Life – CV.

Both plans can safeguard two lives under one single policy, and they can boost cash value for other financial needs while the insureds are living.

Other Products and Services Available

In addition to life insurance coverage, Voya Financial has a wide array of other goods and services available.

These include the following:

- Employee Benefits

- Workplace Retirement Plans

- IRAs (Individual Retirement Accounts)

Also, because people are (on average) living longer today than ever before, there is a growing concern about having enough income to last throughout retirement.

But an annuity can help to alleviate this worry. That is because annuities offer a lifetime income feature, which will continue to pay out an income stream for as long as an individual life – regardless of how long that may be.

Voya offers several different types of annuities. These include:

Many of the annuities that are offered through Voya Financial also come with additional guarantees, such as available funds if the annuitant is diagnosed with a terminal illness, and if he or she must be confined to a nursing home facility.

How to Get the Best Premium Quotes on Life Insurance Coverage From ING Reliastar

If you are seeking the best premium quotes on life insurance coverage from ING Reliastar / Voya Financial – or from any insurance carrier, it is recommended that you work with an independent life insurance agent or broker.

That way, you will be able to compare plans and prices more quickly, and from there you can determine which will be the best for you.

We can assist you with getting all the unbiased information that you need to make a well-informed purchase decision.

We are an independent life insurance brokerage, and we work with many of the top life insurance carriers in the marketplace today.

If you are ready to move forward with the process, then all you should do is just simply click here and fill out the form.

We understand that purchasing life insurance can be somewhat confusing. There are many different policies and companies to choose from, and you want to ensure that you make the right choice. So, contact us today – we’re here to help.

How We Review Insurance Companies:

Good Financial Cents systematically reviews U.S. insurance companies, emphasizing policy offerings, customer experiences, and overall reliability.

Our goal is to present a balanced and comprehensive perspective to potential policyholders. Editorial transparency remains a cornerstone of our approach.

We actively collect information from insurance companies and place significant weight on customer feedback. By integrating this feedback with our research, we can offer a well-rounded evaluation.

Each company is then rated based on multiple criteria, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate insurance companies and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

ING Reliastar Life Review

Product Name: ING Reliastar Life

Product Description: ING Reliastar Life is a well-established life insurance company offering a wide range of life insurance products to ensure financial security for individuals and families. Their offerings encompass term, whole, and universal life insurance policies tailored to meet diverse needs. With its rich heritage, the company is deeply committed to providing reliable protection for its policyholders.

Summary of ING Reliastar Life

ING Reliastar Life, a stalwart in the life insurance industry, prides itself on delivering tailored insurance solutions to match various life stages and financial goals. Their term life insurance provides affordable, temporary coverage for those looking for short-term financial protection. In contrast, their whole life insurance ensures lifelong coverage with the added benefit of cash value accumulation. For those seeking flexibility in premium payments and death benefits, the company’s universal life insurance stands out as a notable option. With a focus on customer-centricity, ING Reliastar Life continues to innovate and offer products that resonate with the evolving needs of modern policyholders.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Diverse Portfolio: ING Reliastar Life boasts a wide array of life insurance products, catering to various client requirements.

- Reputation and Experience: With a longstanding presence in the market, the company is known for its credibility and expertise.

- Flexible Solutions: The company’s universal life insurance offers a level of flexibility that is appealing to many customers.

- Sound Financial Ratings: ING Reliastar Life historically has had strong financial ratings, reflecting its stability and reliability.

Cons

- Digital Offerings: Compared to some newer entrants in the market, their online tools and resources might be limited or less intuitive.

- Policy Cost: Some customers may find their premiums slightly higher than competitors for similar coverage.

- Complex Policy Terms: Some of their policies, particularly the universal ones, can be complex and might be daunting for new insurance buyers.

- Customer Service Variation: Depending on regions and representatives, there can be variability in the quality of customer service.