Life has its unexpected turns. You never know what’s going to happen tomorrow. You can’t predict the future but can plan for the worst.

Sometimes these are great, beneficial changes, but all too often, that is not the case. When this change is the sudden death of a loved one, the stress and sorrow attached can be major.

This goes even further than emotional, too, because of the high medical and funeral expenses, as well as the regular day-to-day costs that are now lacking because your primary breadwinner is longer here.

Everything together can lead some families to make decisions they did not want to make, like using funds initially reserved for their kids’ college or cutting back on basic expenses.

To stop these stresses and worries before they happen, many families need to consider short-term life insurance.

This is a great way to be insured for a short period, pay smaller amounts, and still have all of the life insurance coverage needed to keep the family safe.

Table of Contents

Why Consider Short-Term Life Insurance

Having life insurance, in general, is very important but, if you fear something in the near future or want to spend less for shorter coverage, short term might be the way to go.

This gives you the opportunity to protect your family in case your life is taken too soon so that they can remain financially stable.

Of course, it is important to remember that short-term life insurance is exactly as it sounds, short term, so you may not have it forever. Once its time comes to a close, you can renew it if you want to have it for a longer time.

The coverage for short-term life insurance is dependent upon the life insurance company providing it.

If you want to be insured for either natural or accidental death, make sure the one you choose covers it. Look into exactly what the specific plan offers and how it can benefit you and your family in the case of your death.

If you were to pass away tomorrow, how much debt would you leave behind to your loved ones? Would they be left with a mortgage payment and car loans?

For a grieving family, these bills can seem impossible to cover. Having a life insurance policy is the best way to make sure that your family has the funds they need to pay for any debts.

The other goal of life insurance is to replace your salary as we mentioned earlier.

While there is no exact number on how much you should get, it’s important that your family will have the money they need to get through this difficult time without wondering how they will pay for basic expenses.

These short-term policies are a great way to cover your family. In most cases, these policies are much more affordable than most applicants think. The biggest disadvantage to these plans is obvious, it’s short-term.

As we mentioned, once this plan expires, you’ll have to reapply for another type of life insurance policy. When you have to reapply, your rates are going to be higher because you’re older.

In some cases, it makes more sense to go ahead a find a longer policy term and save money in the long run. If the short term of the policy works for you and fits your needs, they are a perfect option

The Cost of Short-Term Insurance

As far as actual price, requirements, and other similar things you must know, you have to figure those out from your specific provider. There are some out there for which you may not qualify, making it important that you learn these things quickly.

Understand the requirements, costs, and facts before going in, lest you waste your time on something that will never happen.

The best way to get the lowest rates is to compare quotes with dozens of different companies before you choose one. Because there are thousands and thousands of life insurance companies, it’s important to find the one that offers quality insurance at an affordable price.

You could spend hours researching different companies and getting rates from each of them. We know your time is valuable, so let us do all of that work instead.

If you’re looking to save money, comparing quotes isn’t the whole way to save money. There are also several other ways that you can get lower rates and quality insurance that won’t break your bank every month.

One great way is to quit smoking. If you’re listed as a smoker on your application. If you want to get the lowest monthly premiums on your short-term insurance policy, quit smoking or other tobacco products and you’ll cut your premiums in half at least.

Our agents have an expansive knowledge of the life insurance field and they know which companies will give you the best rates. We can save you hours of frustration and questions. Simply fill out the quote form and the best rates will come to you.

No matter what you choose or where you go, making the decision to have short-term life insurance is a big, and very important, step to take. This keeps your family safe and secure in the event of your sudden death, taking the financial burden off them.

With its lower costs and the fact that it is only around for a short period of time, you have few worries about committing to something large and expensive. Every year there are countless families that unexpectedly (or sometimes expectedly) lose a loved one or family member.

Not only do they have to deal with all the emotional pain, but they also have to deal with financial stress that is placed on their budget.

For most people, purchasing a life insurance plan will eliminate these stresses and bring peace of mind knowing that your family will be taken care of after such an event.

This is a plan that can work for you and fit your life, all while protecting your family in case it is lost. If this is what you feel you need, begin looking into the companies and plans available.

Understand what you need, what is offered, and all of the information available to you to choose the best one.

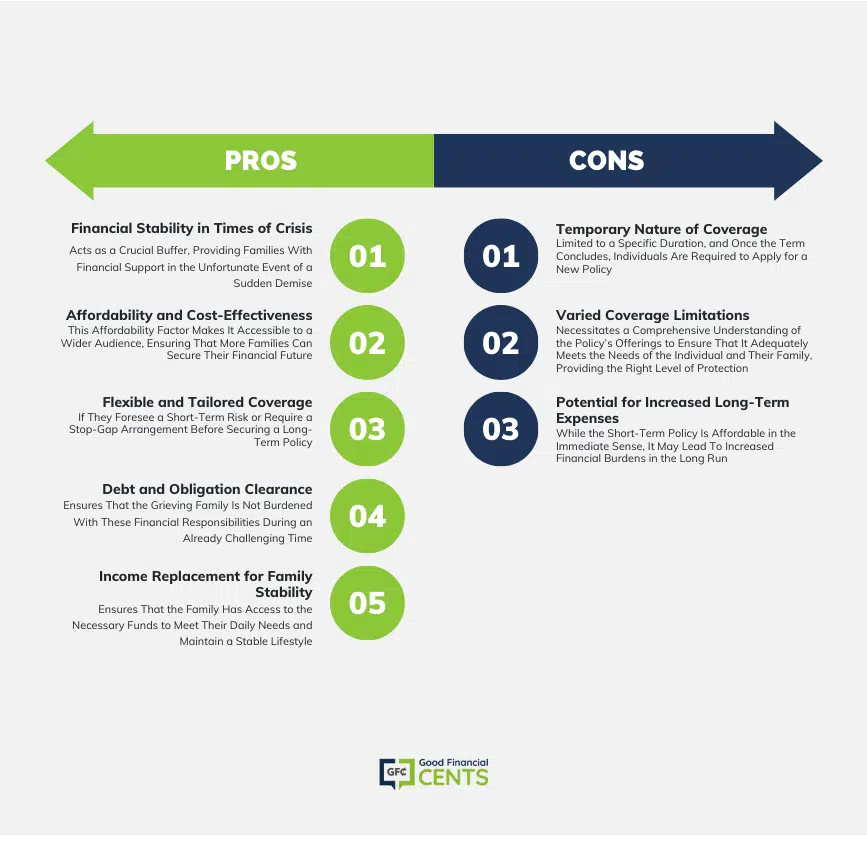

Pros and Cons of Short-Term Life Insurance

Pros

- Financial Stability in Times of Crisis: Short-term life insurance acts as a crucial buffer, providing families with financial support in the unfortunate event of a sudden demise.

This aspect is particularly vital if the deceased was the principal income earner of the family, as the policy helps cover daily living expenses, medical bills, and funeral costs, ensuring that the family does not have to make financially detrimental decisions.

- Affordability and Cost-Effectiveness: The premiums for short-term life insurance are generally lower compared to long-term alternatives, making it a cost-effective solution for individuals looking for temporary coverage.

This affordability factor makes it accessible to a wider audience, ensuring that more families can secure their financial future.

- Flexible and Tailored Coverage: Short-term life insurance is synonymous with flexibility. Individuals can opt for coverage that suits their specific needs, especially if they foresee a short-term risk or require a stop-gap arrangement before securing a long-term policy.

The option to renew the policy at the end of the term or transition to a different insurance product offers additional versatility.

- Debt and Obligation Clearance: The policy plays a significant role in settling any outstanding debts that the deceased might leave behind, including mortgages, car loans, and other financial obligations.

This ensures that the grieving family is not burdened with these financial responsibilities during an already challenging time.

- Income Replacement for Family Stability: Acting as a substitute for the deceased’s income, the policy aids in maintaining the family’s standard of living. It ensures that the family has access to the necessary funds to meet their daily needs and maintain a stable lifestyle.

Cons

- Temporary Nature of Coverage: The primary disadvantage of short-term life insurance lies in its temporary nature. Coverage is limited to a specific duration, and once the term concludes, individuals are required to apply for a new policy.

This often results in higher premium rates due to increased age and potential changes in health status.

- Varied Coverage Limitations: The extent of coverage is contingent upon the insurance company and the specific plan chosen.

It necessitates a comprehensive understanding of the policy’s offerings to ensure that it adequately meets the needs of the individual and their family, providing the right level of protection.

- Potential for Increased Long-Term Expenses: While the short-term policy is affordable in the immediate sense, it may lead to increased financial burdens in the long run.

The necessity to continually apply for new policies as one age or health status changes could result in significantly higher premium costs over time.

Conclusion

Short-term life insurance presents itself as an indispensable tool for ensuring financial stability during tumultuous times. It offers a balanced mix of affordability, flexibility, and financial support, acting as a critical resource for families dealing with the sudden loss of a loved one.

However, the temporary nature of the coverage, potential limitations in the extent of coverage, and the possibility of increased long-term costs necessitate a thorough analysis and understanding of the policy’s terms and conditions.

Making an informed decision, tailored to the individual’s unique circumstances and financial objectives, is paramount to maximizing the benefits of short-term life insurance while mitigating its potential drawbacks.