When I first sat down with Jack and Peggy to talk about retirement, I noticed a sense of desperation right away.

Just two years away from his hopeful retirement date, Jack worried he may have to work forever. Peggy shuffled around in her seat with a wary look in her eye.

It was almost as if she hoped I would change the subject already – as if she didn’t want the help she so desperately needed.

Table of Contents

- How Supporting Adult Children Can Ruin Your Retirement

- 4 Reasons You Should Put Retirement Savings First

- Reason #1: Giving to Adult Kids Can Create Ongoing Dependency Issues

- Reason #2: You May Burden Your Children Later in Life

- Reason #3: You Can’t Borrow for Retirement

- Reason #4: You May Be Setting Your Kids Up for Failure Later On

- Final Thoughts – How Supporting Adult Children Can Ruin Your Retirement

The thing is, we all knew why they were there. They needed the help of a financial advisor, some third-party advice, and maybe even a dose of tough love.

Most of all, they needed a reality check.

Once I started asking questions, it didn’t take long to figure out the root cause of the myriad problems they were facing. First, the couple hadn’t saved nearly enough for retirement over the years, mostly due to a lack of planning. Worse, they had already refinanced their home four times and still carried a mortgage balance even into their 60s.

Between the two of them, they brought in a decent income but not much more. Jack still worked and brought in a regular salary, they said.

Meanwhile, Peggy brought in a lot less, basically “only enough for groceries.” Now that they were facing retirement, they worried about becoming ill, whether they could afford to stay in their home, paying for health care, and becoming a burden on their kids.

When asked how retirement might look, the couple agreed their future looked “frightening.” They wanted to retire, they said, but they weren’t sure if they could. And despite their best intentions, they didn’t have much of a plan to turn things around.

This is what it looks like when you actually reach retirement age without a plan.

The thing is, Jack and Peggy had one more detail to share – one detail that changed almost everything in my eyes.

For the last decade, the couple had been supporting their adult children – now ages 28, 26, and 21. On top of helping pay their college tuition, the couple had been covering some of their living expenses – including gas in at least one child’s car.

No wonder they weren’t getting ahead!

How Supporting Adult Children Can Ruin Your Retirement

Jack and Peggy are far from the only parents who have sacrificed their retirement goals to help adult children. A Pew Research Center poll, 39 percent of parents admitted helping adult children with errands, housework, and home repairs, while a full 48 percent admitted helping adult children financially.

For some parents, “helping” could mean offering an occasional loan. For others, it might mean full-fledged financial support. The circumstances that bring these situations into play are all different, but the outcomes are eerily similar. When parents put their own retirement savings and planning last, everyone suffers.

Obviously, it’s not the help itself that’s the problem. Offering adult children sound advice or emotional support is something every parent should strive for, no matter their age or financial situation.

“The main problem with supporting adult children that arises is the fact that, in many cases, the support of your children financially draws resources away from you, and you may need them later,” says Bellevue, WA Financial Advisor Josh Brein.

That’s right; the money is the problem – especially if there’s not enough to go around.

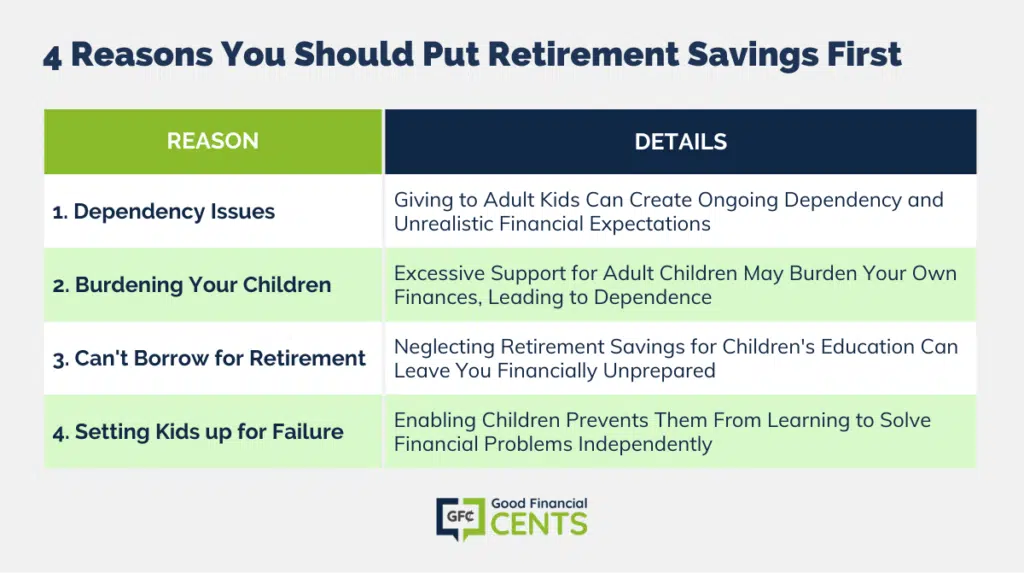

4 Reasons You Should Put Retirement Savings First

Jack and Peggy’s story should serve as a cautionary tale for anyone supporting adult kids to the detriment of their own savings goals. Because they helped their kids so much and so often, this couple missed out on tremendous retirement savings and growth – money they could have used to retire in peace. But what else can you learn from Jack and Peggy’s story? And what other consequences arise when you help adult children before your own finances are secured?

I reached out to several other financial advisors for their advice and experience with this issue. Why should parents fund their retirement before they consider helping their adult children with money? Here’s what they said:

Reason #1: Giving to Adult Kids Can Create Ongoing Dependency Issues

“One problem we have seen is that once the parent starts giving money to the adult child, the child expects it to continue,” says San Diego Financial Planner Taylor Schulte.

When you float an adult child’s living expenses in their early 20s, they might expect more of the same in their mid-20s. Eventually, they might even expect that spigot of cash to continue, relying on it as part of their regular income.

“It’s rare for the child to know a parent’s complete financial picture, so they just start to assume that there must be more where that came from,” he says. Heck, they might even assume your finances are in perfect shape and then use that line of reasoning to build a lifestyle that relies on financial padding from your coffers.

And it may not be their fault, either. After all, you created this monster, didn’t you?

No matter where the fault of dependency lies, the effects of long-term giving can be devastating for couples who aren’t putting their retirement savings first. By and large, the best thing you can do is avoid giving too much in the first place – especially if you can’t afford it.

Reason #2: You May Burden Your Children Later in Life

Jack and Peggy’s story illustrates this outcome perfectly. Because they helped their adult children with money all this time, they don’t have their own finances together. Now, what happens if one gets sick? If Jack can no longer work and provide an income? Under those circumstances, the couple themselves might need financial help.

“The best gift you can give your kids is your own financial independence,” says Portland financial planner Grant Bledsoe. “As a parent, it can be easy to delay your own gratification & retirement savings because you want to help fund your kids’ education. But at what cost? For many, helping out with tuition means shortchanging their own retirement and needing to rely on their kids financially 20 or 30 years down the road.”

Reason #3: You Can’t Borrow for Retirement

Many people help their adult kids with college expenses to help them avoid debt. The problem is, that they may sacrifice their own retirement savings in the process. This sets up an impossible scenario for parents who will eventually reach retirement age.

Sure, their kids may graduate college debt-free, but where is the retirement money going to come from?

Minnesota financial advisor Jamie Pomeroy likes to remind his clients of this simple fact:

“Students can take out a loan for college, but parents can’t take out loan for retirement.”

“Creating clear priorities is important,” says Pomeroy. “Families get into trouble when parents and students haven’t communicated the overall plan, students assume parents will pay, parents grudgingly do, and subconscious resentment ensues.”

Sacrificing one’s retirement while resenting your child’s education is not a wise plan, says Pomeroy. There’s nothing wrong with helping with college, but you have to put your own financial security first.

Reason #4: You May Be Setting Your Kids Up for Failure Later On

As the saying goes, “Give a man a fish and you feed him for a day; teach a man to fish and you feed him for a lifetime.”

“This applies perfectly to supporting adult children,” says Haynes. “Absolutely, you should help them, but more importantly, you should teach them so they can flourish and eventually provide for themselves.”

Remember, you won’t be around forever. If you never let your kids make their own mistakes – financially and otherwise – you may set them up for a world of hurt later on.

“Provide for your adult children, but don’t enable them,” says Haynes. “If it means turning the “loan spout” off, then so be it.”

Like it or not, the best lessons are often learned the hard way.

You won’t always be around to help. What then?

Final Thoughts – How Supporting Adult Children Can Ruin Your Retirement

As parents, we’re wired to love and support our kids. It’s natural for us to rush to help them, especially since we do so from the moment they are born. The problem comes when we carry that support well into adulthood – when we sacrifice our own financial goals and well-being to support kids who should learn to support themselves.

The point we all need to remember is, we’re not really supporting our children when we’re setting ourselves up for failure. That’s why we have to put ourselves first – not to be selfish, but to ensure the financial well-being of everyone in the family – not just the kids.

One financial advisor I spoke to, Joshua Brein, put it this way:

“Ever see how on an airplane they tell you to put your oxygen mask on and THEN help your kids fasten theirs?” he asks. “They tell you to do that because if you can’t breathe, then you’ll probably have a rough time helping someone else get their mask on.”

Think of this as a metaphor for helping your adult children financially, says Brein. Secure your breathing room first, then look for ways to help others.

This post originally appeared in Forbes.

Our parents brought us into this world, all the while supporting the system that made the price of property out of our reach. All while they creamed it, now charging youngsters rent so high, they bring in more from rental in one year than they paid for the property in the first place. In fact it is partly their fault we are struggling so much now. I don’t expect hand outs, but who else are we to turn to in this climate? Banks don’t want to throw money at us like they did our parents. I see your point to an extent. But parents can also take some responsibility for the children which they brought into this world. If we become successful we may be able to pay for their care. If not the government will have to foot the bill. Which actually the youngsters will be paying for indirectly anyway.

I moved out before I turned 18 (really bad idea, by the way) and had to learn how to manage finances on my own. My parents wanted to help at all costs, but as soon as I found my first “serious” job, I turned down their money. I didn’t even know what saving for retirement meant back then, but I knew taking their money is somehow wrong.

However, adults being financially supported by their parents is not uncommon. I know plenty of people who turn to their folks for help when they’re in a rot. It’s none of my business how others handle finances, but I can’t help but wonder what will they do when they’ll be forced to solve their own financial problems, like you mentioned.