Editor’s note: Lending Club no longer offers peer-to-peer lending on its platform.

LendingRobot is a service that fully automates peer-to-peer (P2P) lending platform investments. The service is available for individual investors and is both cost-effective and easy to use. LendingRobot attempts to bring superior returns at low risk by combining cloud technologies with machine learning algorithms. The platform is an SEC Registered Investment Advisor, able to provide investment guidance.

The platform concept started in 2013 when Emmanuel Marot and Gilad Golan began developing a script to automate their own investments in Lending Club. Eventually, they also added support for Prosper Marketplace. The platform was publicly launched in April 2014 and then added Funding Circle to the mix in 2015.

What has developed from this evolution is a platform that assists individual investors in acquiring and managing their loan investors on three of the prime P2P lending platforms on the web. In effect, LendingRobot is a robo-advisor for peer-to-peer lending investing. The service has continued to grow steadily.

Table of Contents

How LendingRobot Works

Investors begin by linking their Lending Club, Prosper or Funding Circle accounts to a single LendingRobot account. You add your API credentials to LendingRobot. In this way, LendingRobot enables you to automate investing on all three platforms, if that’s what you choose to do. The platform can even create an account with each of those three P2P lenders if you don’t already have an account established with them.

You can choose the type of investment strategy that you want to use, conservative or aggressive. The platform even has a “slider” that lets you adjust the risk level in your portfolio. You can also use the “advanced mode” feature to specify multiple rules for your investments on both the primary and secondary markets. You can even use LendingRobot if you want to invest on your own and use the service to help you manage your portfolio of notes.

LendingRobot scans new loans as they appear, and will automatically invest your idle cash. It also has the capacity to sell your notes, if that’s what you choose to do. You will receive a daily summary report that will keep you informed of the activity in your account.

LendingRobot Tools and Features

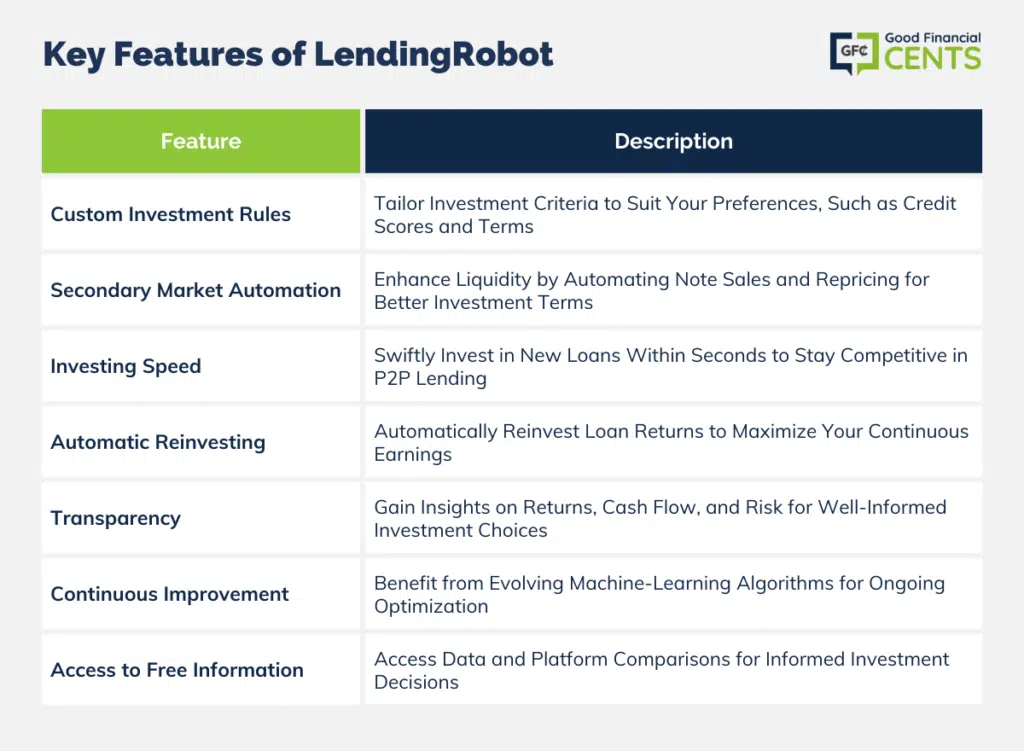

LendingRobot has a wide range of benefits available for P2P investors.

Create custom investment parameters. LendingRobot enables you to create investment rules, based on their proprietary research, that will enable you to pinpoint the types of loans you want to invest in. You can choose certain credit score ranges, loan terms, and debt-to-income ratios – the choices are nearly endless.

LendingRobot secondary market. One of the fundamental limitations that P2P investment has had up until now is the lack of liquidity. That is, once you purchase loans or notes, you have to hold them for the duration of the term. There is often no secondary market for the loans and notes that you purchase on most platforms.

But LendingRobot uses unique secondary market automation that puts thousands of notes for sale and reprices them on an ongoing basis until the target price is reached. This will be an advantage to you as an investor, both with selling loans and notes that you no longer want to hold, but also in buying existing loans and notes under more advantageous circumstances.

LendingRobot accomplishes this by adding any notes that you want to sell with Lending Club’s secondary market partner, Folio Investing. LendingRobot will gradually lower the price point on the notes for sale over a term of five days until all notes are sold. This will enable you to liquidate an entire portfolio of notes in a matter of days.

You will also have the option to purchase notes on the secondary market through Folio, giving you an opportunity to purchase them at a discount, and for a greater profit when they finally pay off. This will become an increasingly important feature as P2P investing matures.

Investing speed. LendingRobot needs only seconds between the time a new loan comes on the market, and the service is able to invest in it. Since competition for the best notes in the P2P space is becoming increasingly intense, that kind of speed will give you the advantage of being able to get to the most desirable investments in the least amount of time. As more money pours into P2P lending investments, this will be an increasingly critical advantage for the individual investor.

Automatic reinvesting. Another limitation of P2P investment is that as notes pay off, your investment position declines. Staying fully invested is a huge task when you try to do it manually. But LendingRobot offers continuous reinvesting of loan proceeds. That will maximize the money in your portfolio that will be invested and earning interest on a continuous basis. This is another critical advantage for individual investors when it comes to P2P investing.

Transparency. LendingRobot enables you to see expected returns, cash flow forecasts, and the risk profile of a given portfolio. That will give you an opportunity to measure expected performance from various portfolio mixes. And that will help you to create the best portfolio for your investment needs.

LendingRobot is getting better. LendingRobot represents a new concept in the automation of P2P investing – which itself is only a few years old. The point is, while LendingRobot’s machine-learning algorithms are the result of years of research in data science and optimization, the system is continuing to learn and grow. You can be part of that growth.

Lots of free information. The site provides a wealth of information covering an overview of the P2P lending industry, including statistics in regard to Lending Club, Prosper, and Funding Circle. This enables you to see comparisons between the three platforms side-by-side, to help you decide where best to invest your money.

For example, the comparison chart indicates that you can invest with Lending Club or Prosper if you are not an accredited investor, but you can’t with Funding Circle. That’s the kind of information that you need readily available in one place.

They also provide you with performance charts, that show how each platform’s returns compare with both the marketplace average and with US bonds. There’s even a list of the latest loans available with both Lending Club and Prosper.

Is LendingRobot Right For You?

P2P investing is simple in concept but can become complicated in execution. Since you need to spread your investment capital across so many notes in order to achieve a reliable level of diversification, you virtually must automate the process. LendingRobot handles that for you and has the advantage that it can be used across three of the most popular P2P platforms on the web.

We generally think of investing in fixed-rate assets as being the low-maintenance part of an investment portfolio – and that’s exactly what it should be. LendingRobot lets P2P investing be low maintenance.

There are a couple of caveats I would like to point out. The first is the potential that automation could cause you to underestimate the risk involved in P2P investing. You are, after all, investing in unsecured loans for people with varying degrees of credit, as well as a wide range of employment and income situations. That is an inherently risky investment, and automation should never cause you to underestimate that risk.

The second is the secondary marketing feature available through Folio Investing. Don’t get me wrong, it’s a great feature to have. But at the same time, you don’t want to over-rely on it either. The service is currently available only on Lending Club, not Prosper or Funding Circle, though that may change in the not-too-distant future.

Even on Lending Club, there may be some limitations to secondary market transactions. Lending Club makes the following statement in that regard: “Note Trading Platform was designed to provide investors with the chance to realize some liquidity in transactions with other Lending Club members”. It’s also important to understand that notes are more likely to sell at a discount than at a premium, so it may prove to be primarily a market where you can unload unwanted notes but do so at a loss.

It’s equally important to realize that notes cannot be sold on the secondary market if they are in default or charge-off status.

That said, the secondary market can be a major advantage to you as a buyer, for all the same reasons that is not necessarily a failsafe for you as a seller. It represents a real opportunity to buy notes for below – maybe substantially below – par value. And that will add a gain on the payoff of the note to the interest you’re collecting on it. That’s a double win!

If you are an active investor in Lending Club, Prosper, or Funding Circle, you need to give LendingRobot a serious look. It offers a real opportunity to take this growing and profitable asset class and set it on automatic pilot. It offers a serious chance to increase your rate of return on investment while reducing the risk of default.

Conclusion

LendingRobot has emerged as a revolutionary platform in the burgeoning world of P2P lending, streamlining the investment process for individuals across multiple major platforms. By harnessing advanced machine learning and cloud technologies, it provides a comprehensive robo-advisory service for peer-to-peer lending investments, allowing investors to achieve greater diversification, speed, and transparency in their portfolio management.

While P2P lending inherently carries risks associated with unsecured loans, LendingRobot’s continuous reinvesting, transparency features, and secondary market opportunities present a compelling proposition for investors in this space. However, as with all investments, potential users should approach with caution, ensuring they fully understand both the platform’s capabilities and the associated risks.

How We Review Brokers and Investment Companies:

Good Financial Cents conducts a thorough review of U.S. brokers, focusing on assets under management and notable industry trends. Our primary objective is to offer a balanced and informative assessment, assisting individuals in making informed decisions about their investment choices. We believe in maintaining a transparent editorial process.

To achieve this, we gather data from providers through detailed questionnaires and take the time to observe provider demonstrations. This hands-on approach, combined with our independent research, forms the basis of our evaluation process. After considering various factors, we assign a star rating, ranging from one to five, to each broker.

For a deeper understanding of the criteria we use to rate brokers and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Product Name: LendingRobot Product Description: LendingRobot is an advanced peer-to-peer (P2P) lending platform automation service, aiming to optimize returns for individual investors through the use of cloud technologies and machine learning. As an SEC Registered Investment Advisor, the platform offers seamless integration with major P2P platforms like Lending Club, Prosper, and Funding Circle. Designed to streamline and enhance the investment process, LendingRobot is a modern-day robo-advisor in the P2P lending space. Summary of LendingRobot Emerging in 2013 from the innovative endeavors of Emmanuel Marot and Gilad Golan, LendingRobot set out to redefine the P2P investing landscape by introducing automation and intelligence. Investors can link their accounts from Lending Club, Prosper, and Funding Circle to LendingRobot, enabling a unified investing experience across these platforms. Users can define their investment strategies ranging from conservative to aggressive, adjust risk levels using an intuitive slider, and set multi-faceted rules for both primary and secondary market investments. With features that automatically scan and invest in new loans, as well as tools for selling notes, LendingRobot has positioned itself as a comprehensive solution for maximizing P2P investment returns. Pros Cons

Lending Robot Review

Overall