If you have diverticulosis (and want to apply for life insurance, you need to show the insurance companies that your condition is under control.

When treated properly, diverticulosis is quite manageable but it can very serious if left untreated.

To get the best possible rating, your application should put the insurance underwriters’ minds at ease.

To help you put together an effective applicant, we briefly explained the underwriting guidelines for someone with diverticulosis. Much of this is similar to diverticulitis.

If you have a health problem, like diverticulosis, you might assume that you have problems getting affordable life insurance coverage, but don’t worry, there are several options for quality life insurance protection.

Table of Contents

Life Insurance Underwriting for Diverticulosis

When you apply for life insurance, your agent will ask you several questions about your diverticulosis. Be ready to answer:

- When were you diagnosed with diverticulosis?

- How frequent were your attacks?

- When was the most recent attack?

- Did you ever need surgery for your diverticulosis?

- Have you recovered from your treatments or are you still having attacks?

- Have your diverticulosis led to any complications like abscesses, fistulas, or internal bleeding?

- What medications are you taking for your condition?

Common medications for diverticulosis include: Ciprofloxacin, metronidazole, piperacillin, tazobactam, and various other antibiotics. All these medications could be insurable depending on the severity of your condition.

Hopefully you can show the insurance company you have your diverticulosis under control. Never lie or leave information out of your application. If underwriters don’t have a clear picture of your condition, they could get worried and decline your application.

Life Insurance Quotes With Diverticulosis

Diverticulosis on its own is not a fatal condition. The reason it’s an issue for life insurance is because the attacks from diverticulosis can lead to serious internal damage if the condition is not treated properly. A good strategy is to wait at least a year after your last attack before applying. This will help your rating because it shows insurance companies that you recovered without any major problems.

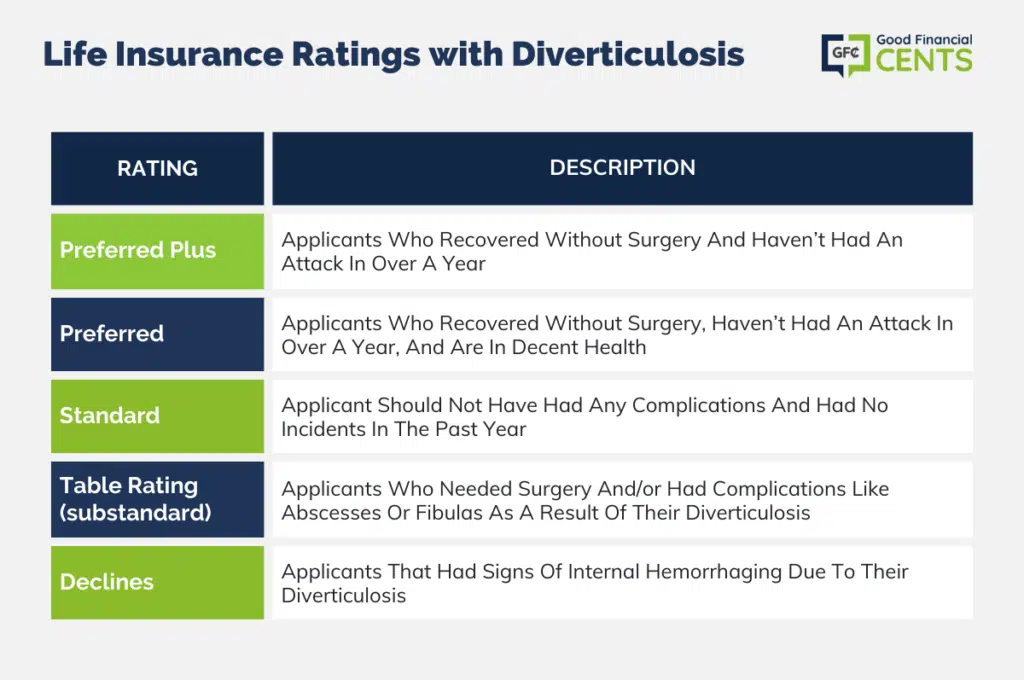

The carrier will want to know whether you need surgery for your diverticulosis. While each company has slightly different rules, here are the general underwriting standards:

- Preferred Plus: Possible for applicants who recovered without surgery and haven’t had an attack in over a year. Applicants should also be in perfect health otherwise and will need an evaluation like a colonoscopy to show that there are no complications.

- Preferred: Rating for applicants who recovered without surgery, haven’t had an attack in over a year, and are in decent health. A bit less strict than the preferred plus rating so applicants can have some small health issues like being a little overweight or having slightly high cholesterol.

- Standard: Best rating for someone who needed surgery to recover from diverticulosis. Applicant should not have had any complications and had no incidents in the past year.

- Table Rating (substandard): Rating for applicants who needed surgery and/or had complications like abscesses or fibulas as a result of their diverticulosis. An applicant’s rating will depend on how long it’s been since an incident, how serious the surgery was, and whether the applicant has any other health issues.

- Declines: Applicants that had signs of internal hemorrhaging due to their diverticulosis.

Diverticulosis Insurance Case Studies

A little preparation makes a big difference. To show you this point, we’re going to show you two different examples of clients we’ve worked with.

Case Study: Male, 45 y/o, non-smoker, diagnosed with diverticulosis at age 42, condition went away that year without surgery, no complications or other health issues

Besides his case of diverticulosis, this applicant was in great health. By maintaining his healthy lifestyle, he was able to prevent any attacks from happening again and his diverticulosis went away after a prescription of antibiotics. However, when he applied for life insurance, he got a standard rating. While this isn’t a bad rating, we thought this client could do better.

We suggested he request a colonoscopy to confirm that he was healthy and had absolutely no complications from his past condition. By applying with this new information, this applicant received a preferred plus rating, the best possible rating with the highest discount.

Case Study #2: Female, 59 y/o, non-smoker, diagnosed with diverticulosis at 56, needed surgery to treat her condition, last incident was at 57.

Before her life insurance application, she wasn’t making the best choices for her health. She had a poor diet and this eventually led to diverticulosis. When she was diagnosed, she didn’t follow her treatment properly and this led to abscesses that needed surgery. After the surgery, she started improving her lifestyle, and that prevented any further problems.

This also scared her into applying for life insurance at 57, when she ran into a couple of problems. Insurance companies denied her application because of her poor health history and because it was too soon after her surgery. We recommended she try again now at 59. While this on its own may have been enough, we also suggested she ask her doctor for a letter to show the insurance company her improved health. After she did this, she applied and got a Substandard level 1.

As you can see, you can still get life insurance at a great price even with diverticulosis. Your preparation ahead of time will make a big difference. To improve your chances, you should consider working with a professional.

Strategies to Improve Your Insurance Eligibility With Diverticulosis

Navigating the life insurance application process with a health condition like diverticulosis can be challenging. However, implementing strategic measures can enhance your eligibility and the likelihood of securing a policy that meets your needs. Here are some strategies to bolster your insurance eligibility:

- Proactive Medical Management: Regularly consult your healthcare provider to manage your condition effectively. Ensure that your diverticulosis is well-controlled through medications and lifestyle modifications.

- Detailed Medical Documentation: Maintain comprehensive and up-to-date medical records. Clear documentation illustrating the management of your condition can be instrumental in supporting your application.

- Healthy Lifestyle Practices: Adopt a healthy lifestyle that includes a balanced diet and regular exercise. Demonstrating a commitment to your overall health can make you a more attractive candidate.

- Consider Timing: Aim to apply when your condition is stable, preferably after a significant period without attacks or complications. Timing can influence the underwriters’ assessment of your risk level.

- Consult Specialized Agents: Seek assistance from insurance agents who specialize in high-risk cases or have experience with diverticulosis. Their expertise can guide you in presenting a strong application, increasing the chances of approval.

By adopting these strategies, you can position yourself more favorably in the eyes of insurance underwriters, improving the likelihood of securing a satisfactory life insurance policy.

Independent Agents for Diverticulosis

Finding life insurance with diverticulosis can be difficult, but it’s not impossible. You’re going to have to do some extra work to ensure you’re getting an affordable plan to protect your family.

Sure, you can do all of the searching and work yourself, but it’s a long ordeal. Instead of having to go through the work alone, why not have a partner? This is why you should team up with one of our agents.

We aren’t the standard agent you’ve talked to before. Unlike your average broker who is contracted with one company, we don’t have those restrictions. We can work with some of the best companies on the market. Through the years, we’ve built a lot of strong relationships with various carriers and we know the companies who are going to give you the cheapest protection.

If you want to team up with our agents, either give us a call or fill out the form on the side. It’s as simple as that.

Bottom Line: Diverticulosis & Life Insurance

Securing life insurance with diverticulosis requires a strategic approach. Ensuring the condition is well-managed, maintaining detailed medical records, adopting a healthy lifestyle, and timing your application can significantly improve your eligibility.

Collaborating with specialized agents, particularly those experienced with high-risk cases, can guide applicants through the intricacies of the process. Despite the challenges diverticulosis presents, with proper preparation and expert guidance, obtaining satisfactory life insurance is attainable. Remember, informed decisions and professional assistance are paramount to success.