According to information from the National Highway Traffic Safety Administration (NHTSA), motorcycle riders make up more than their share of fatalities from traffic accidents nationwide each year.

This is partially because motorcycles are less visible to other drivers, thus making them susceptible to collisions with other cars. Motorcycles are also not as crashworthy as other vehicles that are fully enclosed, and motorcycle drivers are simply more vulnerable to bad weather or poor road conditions as well.

While you can’t protect yourself against every peril that comes with owning a motorcycle, you can make sure you have adequate insurance coverage that protects you against losses related to property damage and bodily injury.

This guide will go over the basics of motorcycle insurance policies, what these policies cover, and tips you can use to find the right policy for your needs.

Quick Guide to Motorcycle Insurance

How Does Motorcycle Insurance Work?

Motorcycle insurance works similarly to insurance you purchase for a car or even your home.

Once you agree to the terms of your policy and begin paying your insurance premiums, you’ll receive coverage for damages to you, your motorcycle, or other people incurred while you’re on the road.

Typically, you’ll have the option to pay your motorcycle insurance premiums once per month in one larger payment every six months. If you have automobiles, a home, or a rental property to insure, you may also save money by bundling all your policies with a single insurer.

For the most part, applying for an auto insurance policy is a simple process. You can visit an insurance agent in person in some cases, but most companies that offer motorcycle insurance let you apply for a policy and get a free quote online.

Standard Coverage for Motorcycle Insurance

The main coverage you should focus on with any motorcycle insurance policy is liability protection against personal injury or property damage.

You’ll want to make sure your policy includes coverage that pays for damages you may cause to other people’s property while you’re on the road, but you may also opt for coverage that kicks in to pay for your own personal property damage or injuries.

Most states require motorcycle riders to pay for both bodily injury and property damage liability coverage. Also, note that individual states post their own minimum coverage requirements, like the ones you’ll find when you purchase an auto insurance policy.

You can buy a policy with higher motorcycle coverage limits than your state mandates, but more coverage typically comes with a higher monthly premium. Then again, having more auto insurance protection on your side can have a profound impact on your finances if you’re in an expensive accident with considerable bodily injury or personal property damage to you or others.

Generally, each state sets three different minimum requirements for motorcycle insurance. Not only do they set a requirement for bodily injury and property damage liability, but they’ll list separate required minimums for bodily injury protection and property damage coverage.

Those are just the minimums, as we mentioned, so keep in mind that you can beef up your policy if you feel comfortable carrying coverage with higher limits.

Also, note that some states require liability coverage for passengers on your motorcycle while others do not. If policies you’re considering don’t offer this coverage as standard, you may want to purchase it separately if you frequently carry a passenger on your motorcycle.

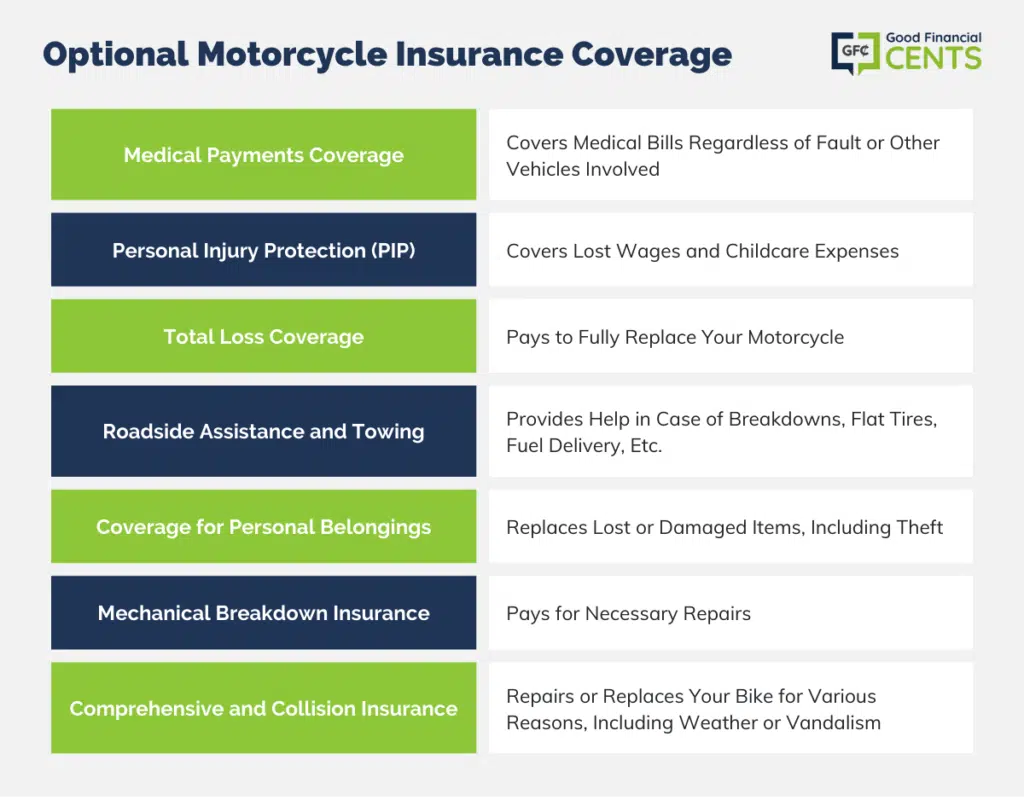

Optional Motorcycle Insurance Coverage Options

While minimum state coverage insurance for your motorcycle may be all you can afford, you’ll likely sleep better at night if you have an insurance policy that covers a broader range of perils.

After all, riding a motorcycle can be dangerous in some cases, and having insufficient insurance coverage can leave you vulnerable if you’re in a pricey accident with lots of damage or injuries.

Here are some of the optional coverages you can and should consider as you shop for motorcycle insurance:

Medical Payments Coverage

Since there are plenty of ways to get seriously injured on a motorcycle, it can make sense to pay for additional medical payments coverage.

This type of coverage will kick in to cover your medical bills in the event you’re in an accident — even if you’re not at fault or if your accident doesn’t involve another vehicle.

This type of coverage is optional, as we mentioned, and some motorcycle riders choose not to purchase it if they feel their personal health insurance coverage is adequate.

Personal Injury Protection (PIP)

This type of coverage is similar to medical payment reimbursement except for the fact that it applies to a wider range of losses.

For example, PIP coverage can kick in to replace lost wages in the event you’re in an accident and unable to work or pay for childcare expenses if you need help caring for your family after a collision.

Total Loss Coverage

Depending on which insurance companies offer motorcycle insurance in your state, you may be able to purchase total loss coverage that will pay to fully replace your motorcycle regardless of how much you owe (minus your deductible).

This type of coverage is especially important if you owe more than your motorcycle is worth on your loan. Without it, you may wind up receiving less than you owe on your motorcycle if it’s totaled in a crash but still be required to pay off your total loan amount.

Roadside Assistance and Towing

Just like with auto insurance, it’s possible to pay extra for the peace of mind you get with roadside assistance or towing coverage.

This motorcycle insurance add-on can be immensely helpful if you find yourself stranded on the side of the road and need your motorcycle moved to the closest repair shop right away.

Note that some roadside assistance policies will even assist you with a flat tire, battery failure, or fuel delivery.

Coverage for Personal Belongings

In addition to buying coverage for your motorcycle, you may want to purchase coverage that can replace personal belongings carried on your motorcycle.

This coverage may not be important if you only ride your motorcycle for short trips through the country or around town, but it can be crucial if you take long road trips on your bike and carry clothing, electronics, and priceless personal possessions.

Personal belongings coverage will typically replace your belongings if you’re in an accident and they’re lost or damaged, but it will also kick in if your items are stolen.

Mechanical Breakdown Insurance

This type of coverage can kick in to pay for specific repairs required for your motorcycle to operate normally.

This type of coverage is different from insurance that pays for medical bills or property damage liability since it can be used when your motorcycle breaks down for any covered reason.

However, it can help you save considerable sums of money if your motorcycle breaks down and you face a pricey repair bill.

Comprehensive and Collision Insurance

Finally, don’t forget that you can upgrade your motorcycle insurance policy to include comprehensive and collision insurance coverage. These coverage options work to repair or replace your bike if you’re in an accident or your motorcycle sustains some damage after you cover your deductible.

Comprehensive coverage can be important for motorcycles since there’s a greater chance your bike can be damaged for reasons outside of a collision with another vehicle. Comprehensive coverage can pay for damages caused by weather or vandalism, for example, and it applies even when your bike is safely parked.

Like other types of insurance coverage available for motorcycles, collision and comprehensive coverage can come with varying limits, and you may have the option to beef up your policy in exchange for a higher motorcycle insurance premium.

How to Find the Right Motorcycle Insurance Policy

Shopping for motorcycle insurance is just like shopping for auto insurance.

You’ll be better off if you compare policies from at least 2 to 3 different issuers, and it’s important to read over all policy details and understand all types of coverage you’re buying before you pay your first month’s premium and sign on the dotted line.

While you will likely want to know your state’s minimum required coverage amounts, keep in mind that you’ll have better protection if you buy a policy that includes higher coverage limits than required and some add-ons that make sense, considering how much time you spend on your bike.

If you always have a passenger along for the ride, for example, you’ll want to make sure you have passenger liability coverage on your policy. If you usually ride with a suitcase of important personal belongings, you’ll want to have coverage that will replace them in the event of an accident or theft.

Also, keep in mind just how expensive medical expenses could be if you or someone else is gravely injured in an accident with your bike. Purchasing medical payment coverage and personal injury protection (PIP) could provide you with peace of mind in the end — even if you wind up paying more for the added protection.

The Bottom Line – What Does Motorcycle Insurance Cover

Motorcycle insurance is crucial for protecting against property damage and bodily injury, given the vulnerability of riders in accidents. Basic motorcycle insurance works similarly to car insurance and can often be bundled with other policies for savings. States have minimum coverage requirements for bodily injury and property damage liability, but additional coverage can provide better protection.

Optional coverages include medical payments, personal injury protection, total loss coverage, roadside assistance, coverage for personal belongings, mechanical breakdown insurance, and comprehensive and collision insurance. It’s essential to compare policies from multiple insurers and understand the coverage details to find the right motorcycle insurance.