Purchasing life insurance in your 40’s can be complicated. It’s never a fun shopping trip, but it’s one that you can’t afford to skip.

The older you get, the more expensive the premiums on your life insurance become. If you are in your 40s, your spouse may have several big financial responsibilities to take care of in your absence.

There are a lot more people that rely on your income than there were 20 years ago. Life insurance is even more important now than it was back then.

These responsibilities can be a burden for your family if you are unprepared.

Here are a few examples of some of those responsibilities:

- Day-To-Day Expenses of Your Household

The key is knowing exactly what your family needs. A single person may only need a large enough policy to settle any debts and pay for the funeral.

A person who has four children and a spouse will need to make sure their sum replaces any lost income as a result of their passing, as well as set their family members up for success in the future.

Before you purchase a life insurance policy, sit down and think about how many people rely on your income and how long they will need it.

Are your children still living in your home, or are they off in college with their own jobs? The answer to this question is greatly going to impact your insurance needs.

Table of Contents

What Type of Insurance Is Right for Me?

There are many options to choose from when selecting life insurance.

Whole Life Insurance

You can go with a permanent policy such as a whole life policy. This type of policy will be more expensive, but they are guaranteed till age 100 if you keep paying the monthly premium.

They also have a cash value savings component. Here is an example of how much a $250,000 whole-life plan would cost.

As you can see, this policy will set you back $3,440 per year for a $250,000 policy. This is a lot of money for someone to have to pay for life insurance. Typically, this is why I’m not a big fan of whole-life insurance.

If you’re in good health and can pass a routine medical exam, then term life will be the cheaper option. Sure, it’s nice to have a policy that you know will never expire, but that comes at a serious cost. If you like the comfort of the permanent premium, they are a great option but not the cheapest.

No Medical Exam Life Insurance

No exam plans are also an option for people in their 40s.

There are a lot of carriers who sell no exam policies for those in their 40s (and even much older). Are they a good option for you? Probably not, but it depends on what you’re looking for.

Do you want cheap rates? Don’t buy a no-exam policy. Companies have lowered their no-exam policies, but they are still more expensive.

One of the most common myths we hear is in regards to being approved for life insurance, especially for middle-aged applicants.

A lot of our customers assume they will be declined because they have some severe health problems. Sure, for some applicants, this might be true, but in the vast majority, it isn’t.

Even if you’re in your 40s and you have been diagnosed with serious health complications, there are still companies that might offer you regular protection. Let us help you find one of those carriers.

Regardless, if you can’t be accepted for a normal plan with a medical exam, you shouldn’t go without life insurance.

As a last resort (if we can’t find you ANYTHING else), we can find a guaranteed issue policy. Acceptance is guaranteed. No exam, no questions, just standard coverage at a higher price.

Term Insurance in Your 40’s

Term insurance can be a simple and easy investment to secure your finances in the case of your absence. Even though you may now be in your 40s, term life insurance is still quite reasonable. In most cases, applicants are shocked at how cheap a term life policy can be.

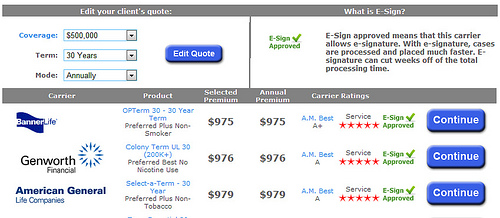

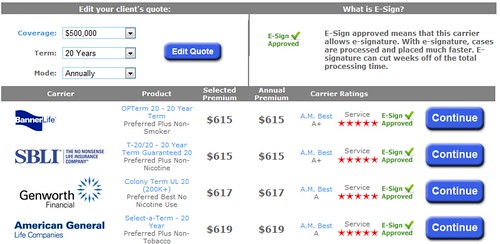

Here are a few examples of how much a $500,000 policy would cost.

$500,000 / 30 Year Policy

$500,000 / 20 Year Policy

How Long of a Term Do You Need?

That’s the common dilemma that most 40-year-olds face when it comes to buying life insurance. Do you need a 30-year policy to cover you until you are in your 70s? Or is buying a 20-year policy sufficient?

Here are a few factors that you have to consider when deciding how long of a policy you need. If you can afford it, we usually advocate purchasing the longer policy.

Why do we suggest a 40-year-old buy a 30-year policy? First of all, people are living longer. This is a fact you can’t ignore. The other is purely determined by the amount of 60+ year-olds that contact our office to purchase term life insurance.

Because of that, it makes sense to take out the 30-year term policy and then just stop paying on it if, at some point, you decide you don’t need it anymore.

There is no policy that works perfectly for everyone. There are several different kinds of life insurance policies that you have to consider.

Each of them has advantages and disadvantages that you’ll have to weigh. Because each person and family has different needs, everyone is going to require a different policy.

40 Years Old Is Not Too Late to Buy Life Insurance

Just because you are 40 years old doesn’t mean it’s too late to purchase term life insurance. You can even purchase life insurance in your 50s, but why wait? You still have many good years ahead of you.

The longer that you wait to apply for the policy, the more expensive your monthly premiums are going to be. Don’t let an unexpected death put your family under loads of debt that you left behind for them.

One life mistake that you can make is not having life insurance. If you were to pass away, all of your family is going to be left with all of your debt.

Your mortgage, student loans, credit card bills, hospital bills, and much more. You could leave your family with thousands and thousands of dollars in unpaid expenses.

Would they have the money to pay for all of those bills? All of that debt can add tremendous stress and discomfort to a family that is already in a difficult place as they struggle through the loss of a loved one. This is where life insurance can be one of the most important policies you’ll ever buy.

The Cost Of Life Insurance

Yes, your premiums are going to be higher in your 40s than they were when you were 20, but that doesn’t mean your insurance policy has to break the bank. Don’t fret. We’ve researched a few ways to keep those monthly payments low.

Stop smoking. Tobacco use is the number one culprit in raising your quoted rate. Sometimes, you’ll see insurers charge you double the average price if you answer yes to the tobacco question. Always be truthful when applying, but it’s best to kick that habit a year before making a big purchase.

One of the best ways that you can get the lowest insurance rates is to get quotes from several different companies before you choose the plan that works well for you and your family. Each company is different, and all of them are going to have different monthly premiums, even for the same plan.

Every insurance company has a different rating system. If you aren’t happy with the quotes you get from one company, you should always get quotes from multiple companies first.

Now that you have some basic rates, I hope you are able to make a better choice when it comes to protecting your family in the case of an unexpected event.

The Bottom Line – Term Life Insurance For 40-Year-Olds

Purchasing life insurance in your 40s is a pivotal decision that hinges on various factors, including family needs, health status, and financial responsibilities.

While aging can drive premiums higher, there remain affordable options like term insurance that offer considerable protection.

Understandably, determining the length of a policy is a significant concern; however, considering our increased lifespan, opting for a 30-year term can be financially astute.

- Turning 40 isn’t a deadline—it’s an urgent reminder. The longer you delay securing a policy, the pricier it becomes, risking leaving your family grappling with debts amidst the emotional turmoil of loss. Prioritize their future well-being by making an informed choice today.

My husband is 46 yr old we have two boys age 12yr old and a 14yr old and Iam 50 what type of life ins I should have.

@ Miriam It really depends on what your goals are and how much income protection you feel you need. If you contact our office we can assist you in determining how much life insurance you need.