After a major life event like bypass surgery, it’s understandable that you’d be in a hurry to buy life insurance as soon as possible. This is often a mistake. Life insurance companies will see your past surgery and this could prevent you from receiving a policy.

To qualify for insurance after a bypass, you need to plan right and fill out a good application. To get you ready, here is a review of the insurance guidelines for after-bypass surgery as well as some tips to help you with your application.

When you’re shopping for life insurance protection, there are dozens of different factors that you’ll need to consider. It can be confusing and difficult, especially if you’ve had bypass surgery in the past.

Table of Contents

Life Insurance Underwriting After Bypass Surgery

You’ll need to answer several questions about your bypass surgery for your application. You’ll need to answer:

- When did you have your bypass surgery?

- Why did you need to have bypass surgery? Was it an elective or emergency procedure?

- Have you ever had any other types of heart surgeries like a heart valve replacement?

- Were there any complications after the surgery like internal bleeding, cardiac tamponade, or a stroke?

- Do you have any other high-risk factors for heart disease like smoking, high cholesterol, or high blood pressure?

- Do you have a history of heart disease?

- What medications are you taking because of the bypass surgery?

Common medications for after a stroke include: Clopidogrel, Beta blockers, Nitrates, ACE inhibitors, and Lipids. None of these medications is going to cause you to be declined.

For life insurance underwriting, more information is better. If an underwriter felt your application was incomplete, especially after something major like bypass surgery, there’s a good chance you’d get a poor rating or a denial.

Life Insurance Quotes After Bypass Surgery

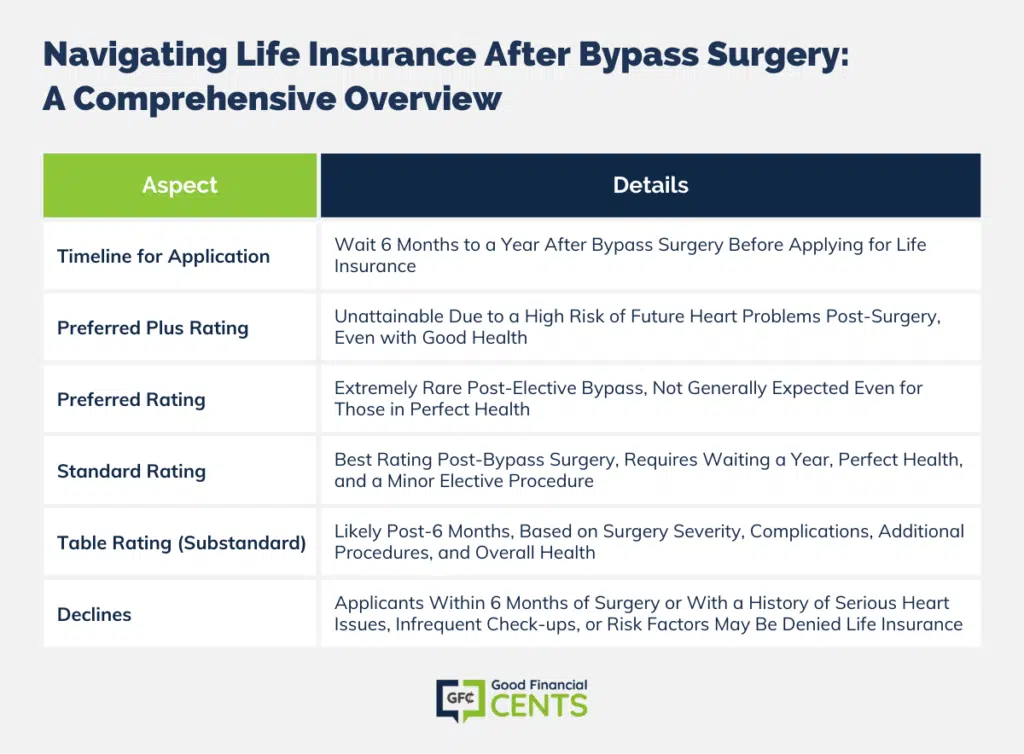

If you’ve had bypass surgery, it’s very important to delay your life insurance application for some time after your surgery. This is because life insurance companies typically deny applicants who just had bypass surgery; there are too many complications that can come up. It’s best to wait at least 6 months to a year before applying.

When you apply, insurance companies will review the details of your bypass surgery and your health. Your rating would depend on how well the surgery went as well as whether you are taking steps to avoid future heart problems. While each insurance company uses different standards, let’s give you some basic ideas on your classification:

- Preferred Plus: It’s not possible to get a preferred plus rating after bypass surgery, even if you are healthy and the procedure went well. There is just too high a chance of future heart problems for insurance companies to be willing to give the best rating.

- Preferred: Also usually impossible. In very rare cases, someone who had an elective bypass and was otherwise in perfect health might qualify for a preferred rating, but this is not something you should expect.

- Standard: The best rating for applicants after a bypass surgery. Applicants need to have waited a year after the surgery and be in perfect health otherwise. The bypass surgery also must have been a minor procedure, like elective surgery to get around a blockage early.

- Table Rating (substandard): A table rating is the most likely rating. Applicants should have waited at least 6 months after their surgery to qualify. Rating will depend on the severity of the surgery, whether there were any complications, whether the applicant had other procedures like a heart valve replacement and basic health info.

- Declines: Applicants that apply within 6 months of their bypass surgery. Also, applicants who aren’t regularly seeing their doctor, have a history of serious heart problems, and/or have heart risk factors like smoking or high cholesterol could also be denied.

Bypass Surgery Case Studies

If you’ve had bypass surgery, it’s very important that you plan your application right. To help you understand, here are some examples of clients we’ve worked with in the past.

Case Study #1: Female, 63 y/o, non-smoker, had bypass surgery for a small blockage at 61, tried applying right away and was denied, otherwise in good health.

This client had a small valve blockage a few years ago that she decided to remove through elective bypass surgery. Immediately after the procedure, she tried to buy more life insurance. Since she didn’t give any time between her procedure and her application, the insurance company denied her application. At this point, the client thought she couldn’t get coverage. After contacting us, we recommended she try again. Since she had waited the appropriate amount of time, she qualified for a standard policy this time around.

Case Study #2: Male, 57 y/o, needed bypass surgery at 54, former smoker, recently lost weight and reduced cholesterol levels, taking lipids for cholesterol.

Despite these improvements, this applicant still had trouble getting life insurance. After looking at his situation, we suggest he ask his doctor for a letter which shows his improved health. After he did this, he tried again and got a Table Level 2 plan.

As you can see from the examples, there are dozens of different factors they consider. There are no two applications that are the same, and every company is going to see you differently. Some insurance companies are going to view history with a bypass survey more favorably than other companies are going to. Finding the right company could be the difference between getting approved for affordable coverage or getting a plan that’s going to break your bank every month.

Getting Affordable Life Insurance Coverage After Bypass Surgery

As an applicant with a bypass surgery in the past, you’re going to be facing higher premiums. Just because of your surgery doesn’t mean you have to spend thousands and thousands on your coverage. Here are a few ways you can save money on your plan.

Using tobacco is hands-down one of the worst things that you can do for your life insurance premiums. Those cigarettes make your rates go up twice as much.

Because you already have a red flag on your application, you need to improve everything else. To do this, you need to commit to living a healthier lifestyle. This means being more active.

Comparing different policies is always going to be the best way to save money. As we mentioned, each carrier is going to use different standards. Some companies will offer you cheaper coverage. You need to find those companies.

Bottom Line: Heart Bypass Surgery & Life Insurance

Getting life insurance after bypass surgery is a challenge, but it’s a challenge many people can overcome. Take the time to research each company and figure out who has the most affordable plans for people with bypass surgery.

After surgery, waiting 6-12 months before applying improves approval chances, as insurance companies assess post-surgery complications risks. Comprehensive, detailed medical histories, highlighting improvements and medications, enhance application robustness.

Maintaining a healthy lifestyle, especially avoiding tobacco, can significantly lower premiums. Different insurance companies have varying criteria, thus shopping around is essential to find favorable rates and policies.

Each application is unique; hence, tailored strategies, possibly including professional consultation, can optimize the application, aligning it with insurers more open to bypass surgery histories.

Can i get life insurance and medical aid after i had bypass surgery 2 years ago

Had aorta replaced and 2 bypass. age is 71

My name is Micheal Timothy Derr. I had bypass 7 weeks ago. I have never smoked, drank, and I have always exercised and have lived a very healthy lifestyle. My father died of heart disease, so I genetically inherited coronary artery disease. I have only one vessel coronary artery disease and not multi vessel coronary artery disease. My carotid arteries are clean, and my peripheral arteries of my body are clean. Keeping healthy by eating well and exercising, has been my main gaol through my entire life. I am trying to get life insurance, so I can take care of my wife if something happens to me. I have been denied coverage as what is expected so early after bypass. Please help me to find affordable coverage. Initially, please call my wife, Cynthia Cosat, to let her know my options. She is a cardiac professional and can explain what has happened to me heath wise along with my current physical condition. Her number is 321-262-9556. Thank you.

@ Michael Please call our toll free # and we’ll do our best.