Being a parent can be one of the most rewarding and difficult times of your life.

You’re no longer responsible for just yourself, but for the life of your child as well. This brings a lot of new worries and aspects that you had never thought of before.

We quickly found that out with our first child and was then reinforced with our second and third.

Buying life insurance can help make that time a little easier, whether you want to leave something behind for your family when you’re gone or need to secure a policy for your children. Knowing what kind of policy you need is invaluable to ensuring that you have exactly what you need for the years ahead of you, whether your children are still at home or have left the nest.

Table of Contents

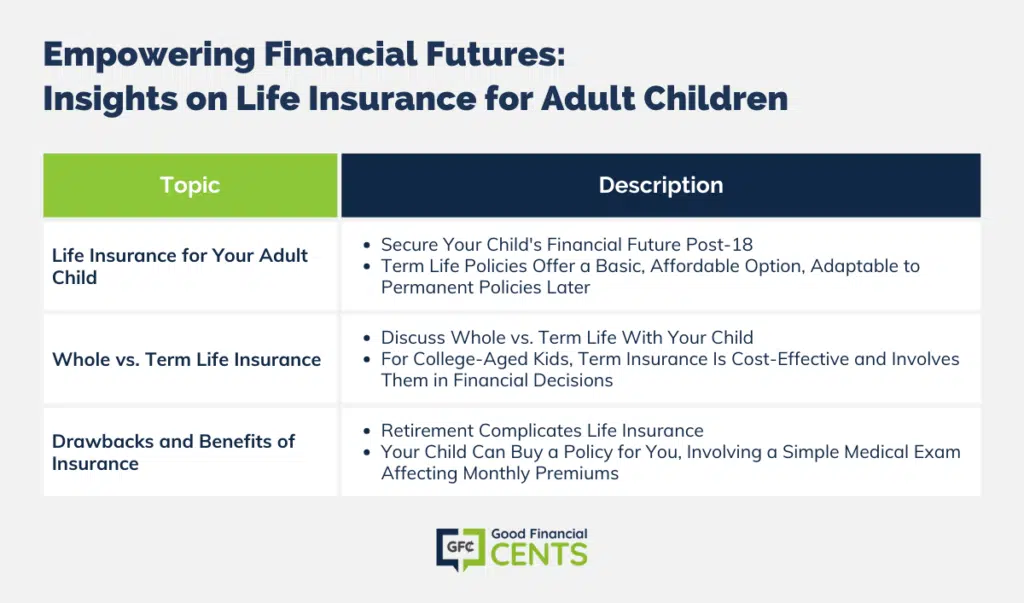

Life Insurance for Your Adult Child

Even when a child turns 18, financial responsibility doesn’t end for the parent, especially for those with college-bound children. When they’re out on their own, it’s more important than ever to have a life insurance policy ready. Term life policies are basic and always good for children leaving home for the first time.

With a term life policy in place, they can change to a permanent policy when they find a career and can begin paying the premiums on their own. Whole life, universal life, and variable universal life policies can also be helpful, and some companies will allow you to change the policyholder from yourself to your child. Handing over control of your child’s life insurance policy to them is a great way to teach them about being responsible with a policy, something that you might need one day.

Whole vs. Term Life Insurance

If you’re looking to apply for an insurance policy for your adult child, there are several different things that you should talk about first. Sure, it probably isn’t going to be the most fun conversation, but it’s an important one to have. Before you take out the policy, discuss the different life insurance options such as whole life vs term life with your child. Talk about the pros and cons of a term versus a whole life insurance. Get their input on the decision, because more than likely they will be paying for the plan eventually.

In most cases, a term insurance policy is going to be the cheapest, especially for your college-aged kids. Because most young adults are in excellent health with no health conditions, they pose very little risk to the insurance company. With most insurance policies, you’ll be able to get a plan for your child for less than $20 a month, maybe even $10. Sounds like a great investment for the peace of mind it will bring.

Drawbacks and Benefits

Retirement brings both benefits and drawbacks and makes getting life insurance more difficult than before. Thankfully, your child can purchase a policy on your behalf. Most companies simply require them to fill out an application and a medical examination before they can be insured, and there are a number of policies available for accepted applicants.

The medical exam isn’t as scary as it sounds. The insurance company will send out a paramedic to take basic vitals like your weight, blood pressure, a blood sample, and a urine sample. You will also have to answer a health questionnaire. These questions will be basic questions about your health and any chronic conditions that you may have and also about your family history. The medical exam will have a significant impact on the monthly premiums of the life insurance policy.

In this case, since the policy will be for your parents, the insurance company will require that your parents take the medical exam. If they have any chronic health conditions or diseases, it could cause your monthly premiums to go up. If their health is poor, you can always go with a plan that doesn’t require a health exam. These plans are more expensive, but just about anyone can be accepted.

Life Insurance for Parents

Term life, universal life, and whole life policies are all fantastic choices for children who are looking at life insurance policies for senior parents. A term life policy can help for short periods of time, and will save money; whole and universal life policies are still permanent, covering the insured client until the day they pass on.

If you’re looking to save money, term life insurance is probably the best option, but be warned, it is only effective for the listed time, after that you’ll no longer have coverage on the insured person. You will pay more for your whole life, but a lot of consumers enjoy knowing that the plan will never expire and they will always have life insurance coverage.

All of these policies are a great way to cover any expenses left behind in case of a tragedy. Without one of these policies, you could be left with thousands of dollars in unpaid debt. Losing a parent is a difficult time to get through, don’t make it worse on yourself by having piles of bills that you have to pay for.

Term Life

Choosing the right type of policy can be difficult, and many factors should be taken into account, though most companies will approve a $100,000 policy with no difficulties, a more expensive policy will require justification, which they call “insurable interest”. As the child of the parent, showing this interest will be simple and you shouldn’t have any problem. You only have to show that you would suffer financially if the insured person were to die, in this case, you would because of having to pay the final expenses.

Whether you’re searching for a policy for your child, or helping your child find one for you, life insurance for parents is an important aspect of life that will always come into play.

Navigating Life Insurance for Parents

| Aspects | Descriptions |

|---|---|

| Types of Life Insurance Policies | • Icons Representing Term Life, Whole Life, and Universal Life • Choose Based on Coverage Needs and Preferences |

| Coverage Period and Cost | • Comparison Chart Showing Term Life as Cost-Effective for a Specific Period, Whole Life as More Expensive but Permanent |

| Financial Impact Without Insurance | • Piles of Bills and a Sad Face Without Life Insurance, Contrasted With a Secure Family With a Life Insurance Policy |

| Insurable Interest and Policy Approval | • Approval Stamp on a $100,000 Policy, With Insurable Interest Criteria Highlighted • Demonstrating Financial Impact Secures Approval |

| Importance of Life Insurance | • Heartfelt Image of a Family With the Text “Life Insurance: Securing Your Family’s Future.” |

Deciding How Large of a Policy You Need

After you decide what type of policy you’re going to purchase as well as the life insurance company, it’s important to decide how much you’ll need. You need to find a balance between having enough coverage and not paying too much in monthly premiums. The best way to do this is to talk with your parent about how much debt they would leave at their passing. Things like mortgages, car payments, credit card bills, funeral costs, etc. should all be calculated to see how large of a policy you’ll need to apply for.

If anyone relies on the income of the insured person, you should also take that into account. If your parents are still working and the other spouse needs that income to survive, you should calculate the annual income with the life insurance policy.

Getting Lower Life Insurance Rates

If you’re looking to get the lowest life insurance rates (and who isn’t?), then there are a few things that you can do to make sure you’re getting the most for your money. The easiest way to save money on the policy is to get the plan from the insurance company that you already hold plans with. Having more than one plan with the same company tends to get you a multi-policy discount. The more policies you have, the more you save. The company that you already have policies with should be the first place you start when looking to buy an insurance policy for your parents.

With that being said, don’t automatically purchase a policy from the company you already know. Even with the multi-policy discount, there could be lower rates available for you and your loved ones. Shopping around for your policy is an excellent way to ensure that you’re getting the most bang for your buck. Because each company is different, they all will have different rates for your policy. Each of them has different standards for their policies.

Conclusion

Life insurance is an important purchase in all stages of life. If you’re planning on buying a policy for your child or a parent, it’s a great way to provide security and peace of mind for you and your loved ones.

Every year we hear countless stories of parents and children who lost a loved one. These stories are difficult to hear, but not having life insurance makes those times even more difficult. Not only are you emotionally strained because of the recent loss, but all of a sudden you’re financially strained. The bills keep piling up and you have no way to pay for them.

Sure, nobody wants to think about the awful things that could happen to you or your family, but discussing these difficult topics is one of the best things you can do