First National Bank of Omaha is the official name, but the company goes by FNBO Direct Bank. The bank is a subsidiary of First National of Nebraska, which is a multistate holding company that’s headquartered in Omaha and has been around for at least 150 years. It is the largest privately owned bank holding company in the United States.

With $20 billion in assets, the bank has locations in Nebraska, Colorado, Illinois, Iowa, Kansas, South Dakota, and Texas. The bank employs about 5,000 people.

It has a strong presence as an online savings bank, but one of its best-known products is its credit card, which offers generous bonus points and a host of other benefits. FNBO Direct Bank also has a large number of innovative online services, such as BillPay, person-to-person payments, Visa Checkout, and integration with Apple Pay.

It’s a bank with a long history, while it sits on the cutting edge of 21st-century technology.

FNBO Direct Bank

Table of Contents

- FNBO Direct Bank

- FNBO Direct Bank PopMoney

- FNBO Direct Bank Online Checking account

- FNBO Direct Bank Online Savings Account

- FNBO Direct Bank Savings Certificates of Deposit (CDs)

- FNBO Tributary Funds

- FNBO Direct Bank ExtraEarnings Visa Card

- How to Open an Account With FNBO Direct Bank

- FNBO Direct Bank Pros and Cons

- Should You Use FNBO Direct Bank?

- The Bottom Line – FNBO Direct Bank Review

- How We Review Banking or Financial Institutions

Available Accounts: Individual and joint checking accounts, savings accounts, certificates of deposit, and investment funds. No trusts or retirement accounts.

Customer Service: Customer service is available by both email and phone. Representatives are available 24 hours a day, seven days a week.

Mobile Banking: FNBO Direct Bank’s mobile app is available to all customers. You can use the app to pay your bills and transfer funds on the go, as well as to check account balances and search your transaction history. You can view all accounts from the app, including checking, savings, CDs and credit card accounts.

The app also offers mobile check deposits. You simply choose the account where you want to deposit the funds, enter the amount, take photos of both the front and back of the check, and submit it. It will show up in your account when the check clears. But you can also view images of previous mobile check deposits on the app.

The Mobile Banking app provides a secure login with your user ID and password, as well as your four-digit passcode and Touch ID. Account information is never stored on your phone, and data transmission is encrypted with the same secure technology as they use for online banking. The app is available on both Google Play and the App Store.

Apple Pay: FNBO Direct Bank has integrated its credit card with Apple Pay. You can make secure payments at hundreds of thousands of stores and participating apps. Apple Pay is available for iPhone 6, iPhone 6 Plus, iPad Air 2, iPad mini 3 (and later), or your Apple Watch paired with iPhone 5, iPhone 5c, iPhone 6, or iPhone 6 Plus.

Account Security: FBNO Direct Bank uses a multi-layered security system to minimize threats to your banking activities. This includes:

- User ID and Password: Online account access is limited to those possessing the user ID and password associated with your account(s).

- Encryption: Encryption technology protects data in transit between your computer and our systems. The closed lock icon indicates a communication session is encrypted.

- Firewalls: Firewalls protect against unauthorized access to our systems.

- Virus Protection: Anti-virus protection technology detects and prevents recognized viruses from entering our computer network.

- Patching: Regular and consistent patching limits our systems’ vulnerabilities to cyber-attacks.

- Timeout: Our online system is designed to log you out automatically after several minutes of inactivity.

FDIC Insurance: As an FDIC participating bank, FNBO Bank provides $250,000 coverage per depositor on all savings products.

FNBO Direct Bank PopMoney

This is FNBO Direct Bank’s person-to-person payments system. It offers a simple and convenient way to securely send and receive money using any of your accounts with the bank. With it, you can send payments either from your mobile device or by email, from your account with the bank.

All you need is the recipient’s phone number or email address, and you can send the payment.

FNBO Direct Bank Online Checking account

FNBO Direct Bank Online Checking is a high-yield online checking account. You need a minimum of $1 to open an account, and a minimum of $0.1 to earn the APY. This gets around the higher minimum balances that are typically charged by other online banks that also offer high-yield checking accounts.

The current interest rate and APY on the Online Checking Account: is 0.65%.

The account has no monthly service charges, free incoming wires, and free stop payments. It also provides one overdraft forgiveness every 12 months.

Along with your checking account, you’ll also get a free FNBO Direct Visa Debit Card for all of your everyday purchases. The debit card comes with 24/7 worldwide access to over 2 million ATM locations. The bank does not charge fees on ATM withdrawals from other banks, although those banks or even the ATM operators may have their own fees.

The account also offers free debit card fraud monitoring, as well as free online banking, BillPay (see below), and free person-to-person payments with PopMoney.

BillPay

BillPay enables you to pay all of your monthly bills online. You can send payments to either an individual or a company that you do business with. You can even set up recurring payments so that you’ll never get another late penalty.

With BillPay, you never have to sit down and manually write out checks to make payments. You also save on postage, as well as a trip to the post office.

FNBO Direct Bank Online Savings Account

The FNBO Direct Bank Online Savings Account can be opened with as little as $1. And you only need $0.01 in order to earn the APY. There are no monthly fees or other charges associated with the savings account.

You can get access to your money anytime, with easy transfer options that enable you to send money to and from your accounts with ease and complete security. The FNBO Direct Bank Online Savings Account also comes with the PopMoney person-to-person payment system, which makes sending money fast and easy.

The current interest rate on the Online Savings Account: is 1.14%, with a 1.15% APY

FNBO Direct Bank Savings Certificates of Deposit (CDs)

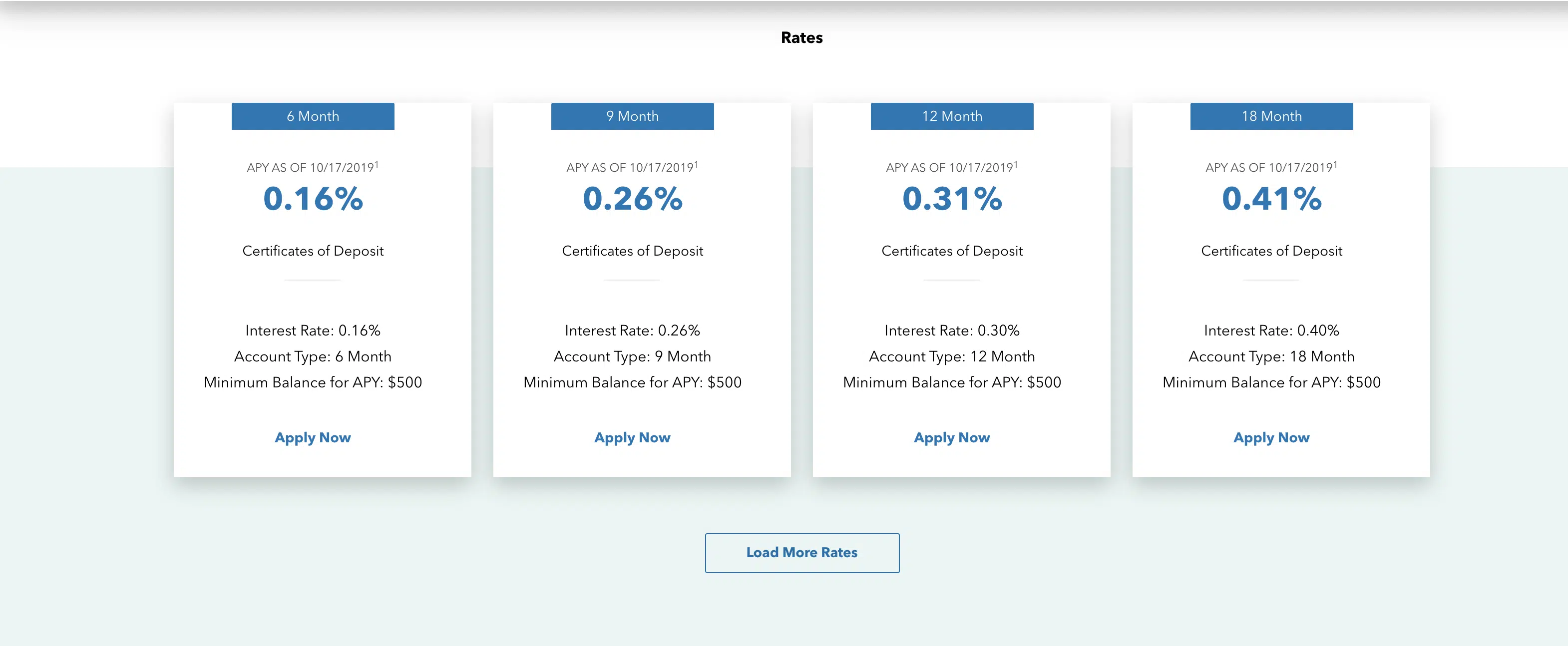

FNBO Direct Bank Certificates of Deposit require a minimum deposit of $500 for all certificates and are available in terms ranging from six months to 60 months. All feature guaranteed earnings and automatic renewals, though you always have the option to withdraw all of the funds in your CD at the time of maturity.

Interest on FNBO Direct Bank CDs is compounded daily and credited quarterly. Even if you close your account before the interest is credited, you will still receive the accrued interest up to the date of closure.

FNBO Direct Bank CDs will automatically renew at the time of maturity. But you will have 10 calendar days after the maturity date to withdraw funds from a CD, or completely close it out. There will be no penalty for the withdrawal or closure as long as it happens within the 10-day time limit.

The certificate will not automatically renew if either you withdraw funds on the maturity date, or if you provide written notice that you do not want to renew on or before the maturity date.

Prepayment Penalties on CDs

Like virtually every other bank, FNBO Direct Bank has penalties for early withdrawals on its CDs. Penalties are as follows:

- Terms of 0-3 Months Are Penalized All Interest Earned if Withdrawn Early (Minimum of 7 Days)

- Terms Over 3 Months up to 1 Year Are Penalized 3 Months of Interest

- Terms Over 1 Year Are Penalized 6 Months of Interest.

FNBO Tributary Funds

This is a unique product offered by FNBO Direct Bank, given that very few online savings banks offer non-bank investment products.

FNBO Direct Bank offers investments through its Tributary Funds affiliate, which is a family of mutual funds advised by Tributary Capital Management (also owned by First National Bank). Each fund is managed with a unique investment strategy that allows you to customize your portfolio to match your risk tolerance, time horizon, and investment goals.

You can invest in Tributary Funds by visiting the Tributary Funds website and opening an account, or through a First National Advisor, either through the Investments & Planning or Wealth Management tabs on the site. You can also invest in the funds through an investment brokerage account, such as TD Ameritrade, Charles Schwab, Pershing, or Fidelity.

Tributary Funds offer the following benefits:

- 6 Different Mutual Funds to Try and Help You Diversify Your Portfolio and Work Toward Reaching Your Goals

- Low Initial Account Minimums of $1000

- Simplification Through Automatic Investment Options – For as Little as $50 a Month

- Ownership by a Family-Owned Institution That Has Been in the Community for Over 150 Years

- Freedom to Create a Portfolio Tailored to Your Financial Objectives, Timetable, and Investment Risk Preference

The six different mutual funds include the following:

FNBO Direct Bank ExtraEarnings Visa Card

The FNBO Direct Bank ExtraEarnings Visa Card is one of the Bank’s most competitive products. It comes with an attractive interest rate of 12.99% APR. The card uses Chip technology, to give you an added layer of security. In addition, FNBO Direct Bank has partnered with FICO to provide its card members with their FICO score for free.

The card also comes with no annual fee, but you must have an FNBO Direct Bank checking or savings account in order to qualify for the card.

The card comes with Zero Liability protection, which means that you will not be liable for unauthorized transactions. It also comes with Fraud Monitoring, which means that your account will be monitored by the Bank, 24 hours a day, seven days a week, 365 days a year. If they suspect fraudulent activity on your card, you will be notified immediately.

The FNBO Direct Bank ExtraEarnings Visa Card also offers a generous reward points benefit. The reward points offer looks like this:

- Earn 2 points (1 point and 1 bonus point) for every $1 in qualifying purchases for the first 12 billing cycles after your account is opened.

- Continue to earn 1 point for every $1 in qualifying purchases after the first 12 billing cycles.

- Redeem your points by requesting a $25 deposit into your FNBO Direct Online Savings Account or Checking Account each time you accrue 2,500 points on your account.

Visa Checkout

Visa Checkout comes with your FNBO Direct Bank ExtraEarnings Visa Card. It offers a simple, fast and secure way to navigate the online checkout process. It provides you with the ability to pay with a single login from any mobile device. You can also guard your data behind multiple layers of security.

While you are making your purchases using Visa Checkout, you continue earning the rewards points provided by the FNBO Direct Bank ExtraEarnings Visa Card.

You can enroll in Visa Checkout with your FNBO Direct Visa card, then never have to re-enter your card or address information as long as you pay where you see Visa Checkout.

How to Open an Account With FNBO Direct Bank

To open an account with FNBO Direct Bank, you can apply online, and the entire process takes about 10 to 15 minutes. You must be a US resident, and at least 18 years old.

The following information will be required:

- Your Social Security or Tax ID number.

- Your Driver’s License or ID card issued by a State DMV.

- Employment Information including employer name, address, and phone.

- Information about any loans or mortgages you may have to help confirm your identity.

- To fund your account electronically, you will need your current bank account and routing numbers. You must use an account that allows electronic deposits and withdrawals.

You complete a brief application, confirm your identity, complete a signature card, customize your account, fund your account, then you’re on your way.

FNBO Direct Bank Pros and Cons

FNBO Direct Bank Pros

FNBO Direct Bank Cons

Should You Use FNBO Direct Bank?

FNBO Direct Bank pays interest on checking, savings, and certificates of deposit that are competitive with other online banks, and well above local banks. But this Bank offers other services that aren’t available with other online banks. These include investment funds and a very attractive credit card offer, complete with plenty of rewards points.

The Online Banking and Mobile Banking platforms have the kinds of features that you should expect to have with similar platforms but don’t often find with competitors. The combination of BillPay, PopMoney person-to-person payments, Apply Pay, and Visa Checkout put FNBO Direct Bank’s savings products on the cutting edge of the online and mobile banking universes.

The Bottom Line – FNBO Direct Bank Review

FNBO Direct Bank, a subsidiary of First National of Nebraska, stands as a reliable financial institution with a rich 150-year history. It has evolved into a dynamic online bank with assets totaling $20 billion, serving customers in multiple states. FNBO Direct’s online presence offers a range of benefits, including competitive interest rates on savings, user-friendly online and mobile banking interfaces, and a suite of innovative services like BillPay, PopMoney, Apple Pay, and Visa Checkout.

Moreover, the bank’s ExtraEarnings Visa Card offers appealing rewards and security features. While FNBO Direct Bank’s certificates of deposit may have some early withdrawal penalties, its Tributary Funds provide unique investment opportunities not commonly found among online banks.

In weighing the pros and cons, FNBO Direct Bank’s strengths in competitive interest rates, diverse services, and customer support make it a compelling choice for those seeking an online banking experience with a touch of traditional banking values.

How We Review Banking or Financial Institutions

Good Financial Cents undertakes a comprehensive review of banking and financial institutions, analyzing service offerings, customer satisfaction, and financial stability. Our intention is to provide readers with a balanced overview, aiding them in their financial journey. We consistently emphasize editorial transparency.

We source data from these institutions, reviewing account offerings and other key services. This data, when combined with our in-depth research, forms the foundation of our evaluation. Institutions are subsequently rated on a range of criteria, resulting in a star rating from one to five.

For further insight into the criteria we use to rate banking and financial institutions and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

FNBO Direct Bank Review

Product Name: FNBO Direct Bank

Product Description: FNBO Direct is a leading online bank known for its competitive savings rates and exceptional credit card offerings. FNBO Direct combines high-yield savings accounts with a range of credit card options, making it a compelling choice for individuals seeking to maximize their savings while enjoying the benefits of a premium credit card.

Summary of FNBO Bank Direct

FNBO Direct stands out in the banking industry for its focus on delivering attractive savings rates to customers through its online platform. The bank’s high-yield savings accounts offer a competitive APY, allowing customers to grow their savings faster than traditional brick-and-mortar banks. FNBO Direct’s user-friendly online interface makes it easy for customers to manage their accounts, transfer funds, and monitor their financial progress conveniently.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Competitive Savings Rates

- Diverse Credit Card Options

- User-Friendly Online Platform

- Strong Customer Service

Cons

- Limited Physical Presence

- Limited Branch Access

- Credit Card Eligibility Requirements