My Tool Kit: My Favorite Financial Resources

I get constantly asked the best tools to get out of debt, start a budget, open a Roth IRA, and keep track of your portfolio. No more stressing required. Everything you need is below.

Categories:

- Tracking My Finances

- Banking Tools

- Investing Tools

- Credit Cards

- Miscellaneous Tools

Financial Tracker

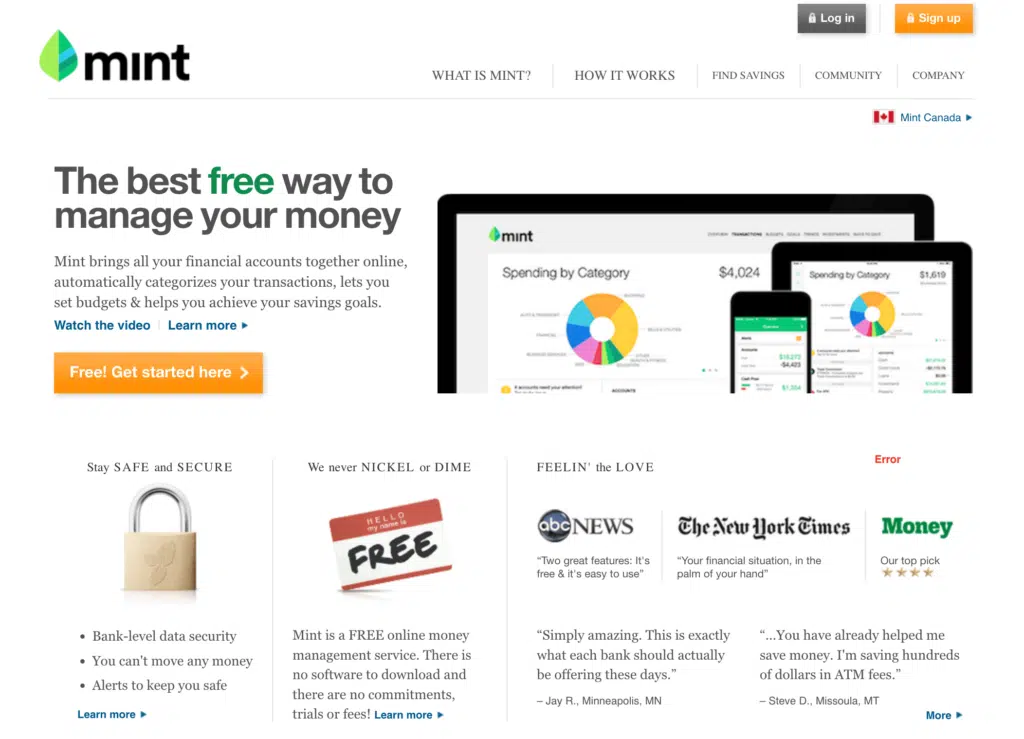

I’m personally not a big fan of budgeting, but I definitely see the importance if you’re struggling to get ahead. For those who find it challenging to stick to a budget or need a more structured approach to managing their finances, Mint.com can be a game-changer.

The platform offers intuitive tools and insights to help you track and manage your spending, ensuring you stay on top of your financial goals. And it’s 100% free!

Once you have learned about asset allocation and annual rebalancing you hit the frustrating wall of trying to track a portfolio that is shared across some or all of the following: Your or your spouse’s Roth or Traditional 401k, your or your spouse’s Roth or Traditional IRA, any pensions you have, or in normal taxable investing accounts.

You can manage the asset allocation within each of those individually, but seeing things on a large scale has been nearly impossible…

…until now. Personal Capital lets you tie in all of your investment accounts into one clear dashboard. Seeing the big picture with your whole portfolio has never been easier (unless you’ve been paying high fees for a financial advisor to handle this for you).

You can read our full review of Personal Capital, but we also did a video walk through of the tool:

Investing Tools

I use LPL Financial, M1 Finance, and Fundrise predominantly but have also tested out several online brokers (Webull, Robinhood, TD Ameritrade, Ally, etc)

lpo Financial was the brokerage firm that I use when I had my own wealth management firm so it made sense just to leave it there. M1 Finance offers several account types like joint and Roth IRAs but I primarily use them for my self-directed 401k.

Here’s a few articles and videos that share my M1 Finance portfolio and Fundrise account returns.

I’ve always been a big fan of alternative Investments so that’s why I like platforms like AcreTrader, Masterworks, and also Yield Street.

M1 Finance

M1 Finance is a unique robo-advisor that bring self-directed investing and automated management together, allowing you to open IRAs, rollover other accounts, and invest in ETFs and stocks, choosing from M1’s expertly picked portfolios or creating your own. The best part? There are zero trading and account management fees.

4.30%

Interest Rate

$0

Min. Initial Deposit

Life Insurance

It’s reported that over 55 million households don’t have enough life insurance coverage. Are you a statistic? We don’t want that…. Going without the right levels of insurance puts you and your family at great risk.

Typically for auto and home insurance we just go with the least expensive national brand. I got really frustrated on the life insurance side of things. Life insurance is one of the most critical insurance policies you can buy, but most people don’t. That’s what I started the Life Insurance Movement (see video) to bring attention to a need that many families ignore.

I bought my $2.5 million term life insurance through Banner Life. The only reason I chose them over any other carrier was their solid ranking AND they gave me the cheapest rate.

If you’re in good health, those are the only things you really need to consider when considering the top life insurance companies.

If you’re looking for a seamless online insurance, I’m a big fan of Ladder Life.