Annuities come in all shapes and sizes, but fixed indexed annuities are one of the more interesting types of annuities. They provide a unique combination of protection of principal, as well as the ability to earn investment returns that are higher than what you can get on fixed income investments.

The perfect investment? No investment is perfect, but let’s do some digging.

Table of Contents

What Are Fixed Indexed Annuities?

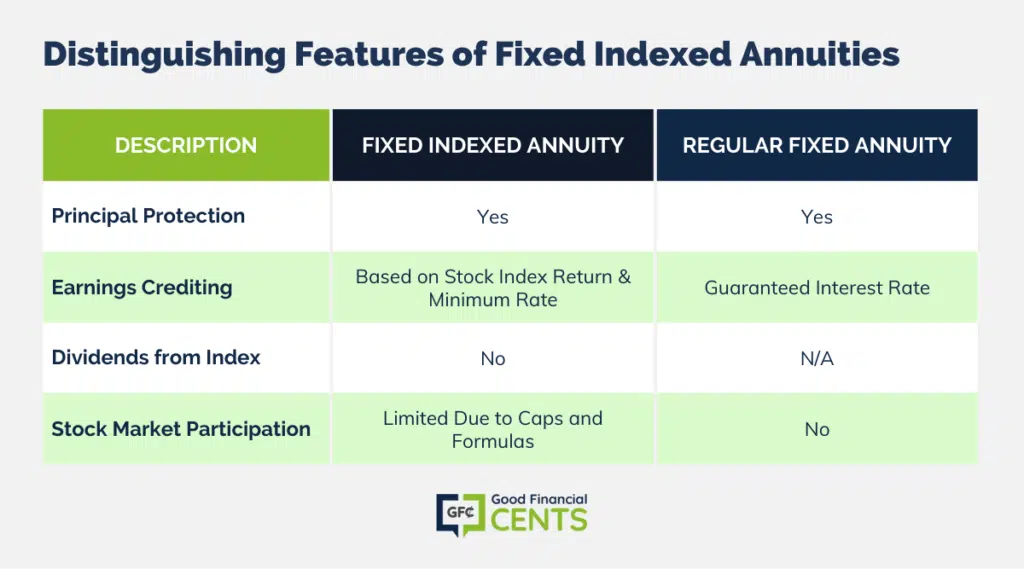

Fixed indexed annuities are actually considered to be a form of fixed annuities. The main difference is that fixed indexed annuities have a different way of crediting earnings to the plan.

Regular fixed annuities work to protect your principal balance, and provide stable returns. The insurance company guarantees a minimum interest rate. But fixed indexed annuities provide both safety of principal, as well as participation in a rising stock market.

A fixed-indexed annuity grows at the higher of either the return of a specified stock market index (net of certain expenses ) or the annual guaranteed minimum rate of return. And as the owner of a fixed indexed annuity, you’re guaranteed to receive at least the amount of your principal, plus investment returns, less any withdrawals.

But the arrangement does impose an important limitation. In a rising stock market, you will not fully participate in all of the investment gains of the underlying stock index. This is because there are caps imposed on fixed indexed annuities, as well as various formulas, spreads, and the fact that you will not receive dividends from the index.

This means that the returns on fixed indexed annuities are generally better than what you can get with certificates of deposit but not as good as what you can get with stock index funds.

How Fixed Indexed Annuities Work

When you open a fixed indexed annuity contract, you choose a term that represents the number of years until the principal in the annuity is guaranteed and the surrender period ends.

Fixed-indexed annuities include what is known as a participation rate. This is sometimes referred to as the indexed rate, and it represents the percentage that your annuity contract will grow, as a percentage of the increase in value of the underlying index.

For example, let’s say that you have a participation rate of 80%. If you have a fixed indexed annuity that is based on the S&P 500 index, and the index increases by 15% in one year, you will receive a 12% return on your investment (15% X 80%).

Because of the participation rate, you will never receive all of the returns that are being provided by the underlying index. If this sounds like it might be a deal breaker for you, consider that it is part of the price that you pay in order to make sure that your annuity doesn’t lose money. And in a bear market in stocks, that will look like a seriously valuable arrangement.

Dividends. Another apparent limitation of fixed indexed annuities is that you don’t actually receive dividends paid through the underlying index, the way you would if you were holding an index fund directly. But once again, this is part of the price that you pay for investing money in an equity investment in which you can never lose your principal investment.

Floor. This is term for the minimum guaranteed amount that will be credited to your account, even if the index that your annuity is tied to drops in value. It’s generally less than 2% per year, but it guarantees you won’t lose money in a down year in stocks.

Cap. This represents the maximum return that you can earn on your annuity in any given year. For example, if you have a 10% cap, and the underlying index increases by 15%, your earnings will not exceed 10% for the year. The difference is retained by the insurance company, and represents something of a cushion against down years in the market. In addition, the cap can reset each year of the annuity contract.

The actual amount of the cap varies between insurance companies, and between fixed indexed annuities. Some insurance companies have no cap at all. Also, there is usually a trade-off between the participation rate and the cap. For example, if there is no cap, then your participation rate may be limited to 50%. Alternatively, if there is a cap of say, 10%, the participation rate may be 80%. A 15% index return may pay you 8%, which is the 10% cap, X the 80% participation rate.

Annual reset. This insurance company can the cap and participation rate in each one year period. A longer-term reset – typically between five years and seven years – is a variation of the annual reset, is referred to as the point-to-point or term.

Annual high water mark with look back. This represents the highest anniversary value, which is used to determine the gain.

Monthly Averaging. In calculating the return on your annuity, the insurance company will average the return, based on the 12 monthly returns that you receive each year.

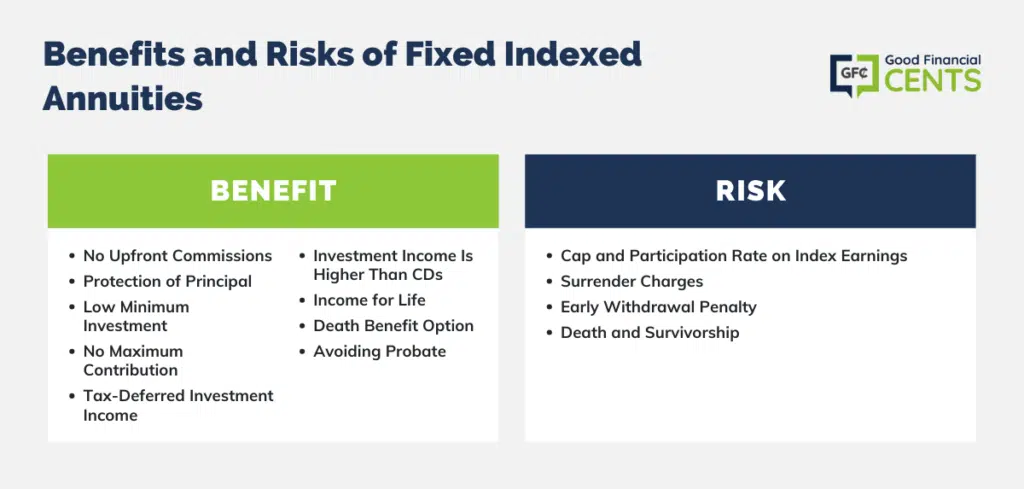

The Benefits of Fixed Indexed Annuities

Due to the benefits they offer, fixed indexed annuities are one of the better annuity types to have. Some of those benefits include:

No Upfront Commissions

No commission is charged when you purchase the annuity. Instead, the insurance company is compensated through a combination of the caps, the participation rates, and the investment spreads.

Protection of Principal

As discussed above, and despite the investment tie-in to the stock market, your principal is protected from declining markets, since you will receive the higher of the return on the stock index, or the guaranteed minimum interest rate. It’s like an elevator that can only go up.

Low Minimum Investment Requirements

You can generally purchase fixed indexed annuity contracts for as little as $5,000. That puts them within reach of both new and small investors. This is especially true if you are a small investor who is looking to diversify your investments, and want to add an asset to the mix that will not be subject to declines in value due to market factors.

No Maximum Contribution

Still another benefit: there is no maximum contribution – you can contribute as much as you like. This is entirely unlike tax-sheltered retirement plans, that have either percentage or dollar amount limits on your contributions.

Investment Income is Tax-Deferred

For this reason, a fixed indexed annuity works much like a Roth IRA. Though the contributions to the plan are not tax-deductible, the investment income earned on the contract is tax-deferred. That means that you will not have to pay income taxes on your investment income. No tax will need to be paid until you begin taking distributions from the annuity in retirement. And probably by then, you’ll be in a lower income tax bracket anyhow.

Investment income from fixed indexed annuities are typically higher than they are on CDs. The ability to earn the higher of the gain on the underlying index or the guaranteed minimum rate of return means that you will be earning more than you can on CDs and other fixed income instruments. This is a valid comparison, since fixed indexed annuities offer protection of principal, and are therefore considered safe assets.

Income for Life

A fixed indexed annuity can be setup to provide you with an income for the rest of your life. Once you reach retirement, the annuity can be setup to provide you with an income for the rest of your life. This is another reason why they are considered strong investments for retirement purposes.

Creating a Death Benefit

Annuities typically don’t pay a death benefit to your heirs. Once you die, the remaining funds in the contract revert to the insurance company. (This is the trade off to an income for life, in which the insurance company may have to pay you an income even if your contract is fully depleted.) But with a fixed indexed annuity, you can add a death benefit rider. You will pay an extra cost for the rider, but it will insure that you will have an investment that will both provide for you in life, and pass funds onto your loved ones upon your death.

Avoiding Probate

Probate is a legal process in which your estate must go through the courts in order to transfer assets to your heirs. It is also a time when non-heirs can stake a claim on your estate, or when named heirs can dispute the amount of their shares. The process can take months or even years to be completed, in addition to the fact that it will create potentially large legal expenses that will need to be paid out of your estate.

A fixed indexed annuity can pass without going through probate. Because the annuity is an insurance contract, the proceeds of the plan will pass directly to your name beneficiaries, completely bypassing the probate process. This of course is dependent on your adding the death benefit rider.

The Risks of Fixed Indexed Annuities

Like all annuities, fixed indexed annuities come with a set of risks. Some are associated with annuities in general, and others are specific to fixed indexed annuities.

Cap and Participation Rate on Index Earnings

If you’re thinking that the tie-in of a stock index with a fixed indexed annuity will work just like a pure index fund, you’ll be disappointed. As I described at the beginning, the investment earnings that you will actually receive in your annuity from the index will be limited to a certain percentage of the gain, either by the cap on investment earnings, or by the participation rate, which will restrict how much of the gain you will be credited with.

In most cases, the amount that you will actually receive is determined by a combination of both the cap in the participation rate. Suffice it to say that even in the strongest of bull markets, you will not receive the entire investment gain that the index produces. But remember once again, that those investment income limits are tied to the fact that your plan value will not decline in down years in a market.

Surrender Charges

If you take withdrawals from your fixed indexed annuity contract early, the insurance company will deduct surrender charges. The charges may apply to withdrawals that are based either on a certain percentage of the value of the contract, or even a flat dollar amount. The surrender charges will apply if your withdrawal exceeds those thresholds.

The surrender charges are steep. They’re commonly 10% of the amount of the withdrawal, and can go considerably higher under certain circumstances. The amount of time that your contract will be subject to surrender charges can range between five years and 14 years. Typically, the surrender charges work on a declining basis. For example, it may start out as 10%, but decline by 1% each year, until it falls to zero in the 10th year.

Early Withdrawal Penalty

In addition to the surrender charge, if you liquidate your annuity contract before you turn 59 1/2, you’ll be subject to the 10% early withdrawal penalty imposed by the IRS. The tax will be payable on the amount of the investment income earned in a contract, and not on the principal amount contributed to the plan. This is similar to the penalty that applies to early withdrawals from retirement plans.

The penalty tax owes to the fact that the investment income on your annuity accumulates on a tax-deferred basis. And since annuities have been established primarily for the purpose of retirement, the IRS imposes the penalty as a way of discouraging investors from withdrawing money from their annuities before reaching retirement age.

Death and Survivorship

One of the major benefits of a fixed indexed annuity is that it can provide you with an income for literally the rest of your life. It virtually eliminates the fear you may have of outliving your money. The insurance company will continue making income payments to you even if your contract has been exhausted. But there is a payback to that arrangement – any remaining value in the annuity contract at the time of your death will revert to the insurance company.

This should not be a problem if you have no heirs. And as noted earlier, under The Benefits of Fixed Indexed Annuities, a death benefit rider can be added at a small extra cost, so that there will be funds to pass on to your loved ones.

There’s one more risk that warrants a discussion all its own – though it isn’t as big a risk as it seems at first glance.

Fixed Indexed Annuities Are Not FDIC Insured

This is a situation that might spook a lot of investors, particularly those who are looking for a rock solid-safe investment. While bank investments, like CDs, are covered by FDIC insurance for up to $250,000 per depositor, no such government insurance exists for annuities. But that is not at all the scary situation that it might seem to be.

For starters, annuities are guaranteed by the issuing insurance company. You can further reduce the risk of default by checking the rating of the insurance company with A. M. Best. The higher the rating, the less likely the chance of the default.

Annuity defaults by insurance companies are extremely rare, but there are layers of safety in the event that it does happen. If an insurance company does fail, its assets and obligations are distributed to other companies in the state. Those companies continue to honor the terms of the annuity.

In addition, most states have guaranty associations that provide protection for annuity contracts. You can check with your state insurance commissioner to find out if your state has a guaranty association, and what the dollar limit of protection is.

Are Fixed Indexed Annuities Good for You?

Fixed indexed annuities are good for the investor who is looking for safety of principal, in combination with the ability to earn more investment income than fixed income investments pay. It’s that participation on the way up, protection on the way down feature of fixed indexed annuities that makes this possible.

Like all annuities, they are an excellent choice if you’re worried about outliving your money. The income-for-life provision will prevent that from happening.

Finally, fixed indexed annuities offer you an opportunity either to supercharge your current retirement contributions, or to play catch-up late in the game. That’s because there are no maximum contributions with annuities, and you can make contributions over and above your regular retirement contributions. Meanwhile, the annuity will grow through tax-deferred investment income.

Final Thoughts – Fixed Indexed Annuities

Fixed indexed annuities provide a balance between the security of principal and potential for higher investment returns. While they offer protection during stock market downturns, they also give a portion of the returns during market upswings. However, returns are capped and do not include dividends from the underlying index.

These annuities come with certain benefits such as tax-deferred growth and possible income for life. Yet, there are drawbacks like potential surrender charges and the fact that they aren’t FDIC insured. It’s essential to weigh the pros and cons to determine if they fit one’s investment strategy.