With mortgage interest rates hovering at record-low levels, there’s never been a better time to refinance than right now. There’s also never been more options as to where and when to refinance your mortgage. There are hundreds of mortgage lenders operating nationwide, most providing their services online.

A large number of mortgage lenders is a complete win for you as a homeowner. If you want to refinance, you’ll have dozens of lending options to choose from. That will give you an opportunity to choose the refinance lender with the best combination of a low rate, low closing costs, and fast, efficient service.

Before Refinancing Your Mortgage

Compare Mortgage Rates

Table of Contents

On the surface, comparing mortgage rates is a simple process. All you need to do is go online and see what rates are being offered by lenders.

Easy enough, right?

Well, it may not be quite that simple. In an effort to be as competitive as possible, mortgage lenders advertise the lowest rates they’ll charge to the most qualified borrowers.

Unfortunately, that may not be you. Most qualified refers to borrowers with excellent credit, very low debt-to-income ratios, and larger loans that do not exceed 80% of the value of their homes.

If you depart from any of the above criteria – even a little – you may not qualify for the best rates advertised.

For example, rather than just accepting published interest rates at face value, you may need to complete some sort of preliminary application. That will include indicating the loan amount you intend to borrow, the value of your home, your estimated credit score range, your income, and non-housing debts.

The application may also ask if you’ve filed for bankruptcy or foreclosure within the past seven years, if you have any outstanding judgments or tax liens, or if you’re required to pay alimony or child support.

Though the information requested can seem invasive, the more you provide, the more accurate your loan quote will be.

This is also the time to understand that there’s a difference between getting a loan quote and getting a pre-approval.

If you’re just looking for rate estimates, all you’ll need is a loan quote. But you won’t need a preapproval until you settle on a lender. You can choose a lender based on having the best interest rate and closing costs for your financial profile, then make an application for pre-approval, or even go directly to a full mortgage application.

With today’s emphasis on online applications, getting rate quotes and completing an application has never been easier.

Where Do I Compare Mortgage Rates?

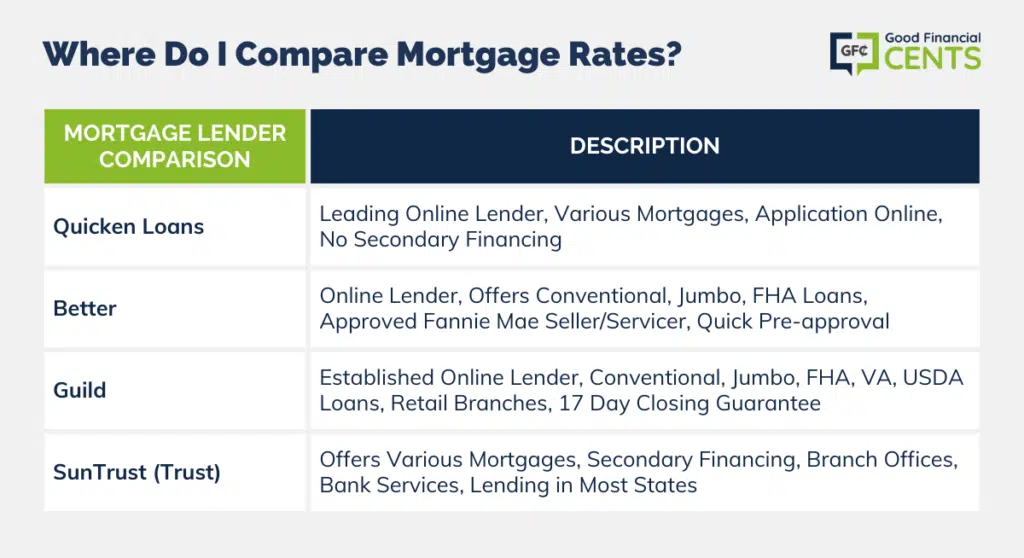

One of the best ways to compare mortgage rates is by using a mortgage aggregator site. Examples include LendingTree. But those sites will provide you with only a “high altitude” view of what’s available. If you want more accurate quotes, you can get them by going to direct lender sites.

Recommended examples include the following:

Quicken Loans

Quicken Loans has rapidly grown to become America’s largest mortgage loan originator. Though Quicken Loans has been around for a while, they’re perhaps best known for their online portal, Rocket Mortgage. The two companies are one and the same.

They provide all types of mortgages, including conventional, Jumbo, FHA, and VA loans. Financing is available for both purchases and refinances and with both fixed rates and adjustable-rate mortgages (ARMs).

The entire loan application can be completed online. The application process is sped up by the fact that the company is often able to instantly verify employment and income with major employers.

The main disadvantage of Quicken Loans is that they don’t offer secondary financing, like home equity loans or home equity lines of credit (HELOCs).

Better

Better began operating in 2014 and is another all-online mortgage lender. Much like Quicken Loans, they also offer conventional, Jumbo, and FHA (but not VA) mortgages. Those loans are available as both fixed-rate and ARMs. And again, like Quicken, they don’t offer secondary financing.

But where Better differs from Quicken Loans is that they can offer financing from any one of 17 of the top mortgage providers in the country. That said, Better is an approved Fannie Mae seller/servicer, which means Better will service your loan even though it’s funded by another lender. (However, as is typical with mortgages, your loan may be transferred to other servicers in the future.)

When you make an application on the website, you can receive a pre-approval letter in as little as 24 hours.

Better currently lends in 46 of the 50 states. They currently do not lend in Hawaii, Massachusetts, New Hampshire, or Nevada.

Guild

Guild is one of the better-established online lenders, having launched operations way back in 1960. Based in San Diego, the company provides conventional, Jumbo, FHA, VA, and even USDA loans (for rural properties). Both fixed rates and ARMs are offered. And much like the other lenders on this list, they do not offer secondary financing.

Even though Guild functions as an online mortgage lender, they have retail branches located in 31 states. One of the major benefits of working with Guild is their 17 Day Closing Guarantee. If you qualify for the program, they pay $500 toward your closing costs if your closing is delayed due to lender issues.

One disadvantage with Guild is that they don’t provide interest rates on the website. You’ll need to contact a loan officer to get those. Customer service for new loans is available Monday through Friday, from 8:00 AM to 5:00 PM, Pacific time.

Suntrust

Suntrust provides mortgages through SunTrust Bank, which is currently changing its name to Trust. The name change owes to a merger between SunTrust and BB&T, which gives the company the advantage of having branch offices in 17 states.

SunTrust provides all types of mortgages, including conventional, Jumbo, FHA, VA, and USDA loans. Those are available in both fixed-rate and ARMs. But one advantage SunTrust has is that they do provide secondary financing, including home equity loans and home equity lines of credit. They even provide construction and renovation loans.

Still, another advantage is that as a bank, SunTrust provides personal and business banking services, as well as credit cards, loans, wealth management, and investment and retirement services.

SunTrust is available for lending in all states except Alaska, Arizona, and Hawaii. Mortgage rates are currently posted on the websites for both SunTrust and BB&T banks.

What Are the Types of Mortgages?

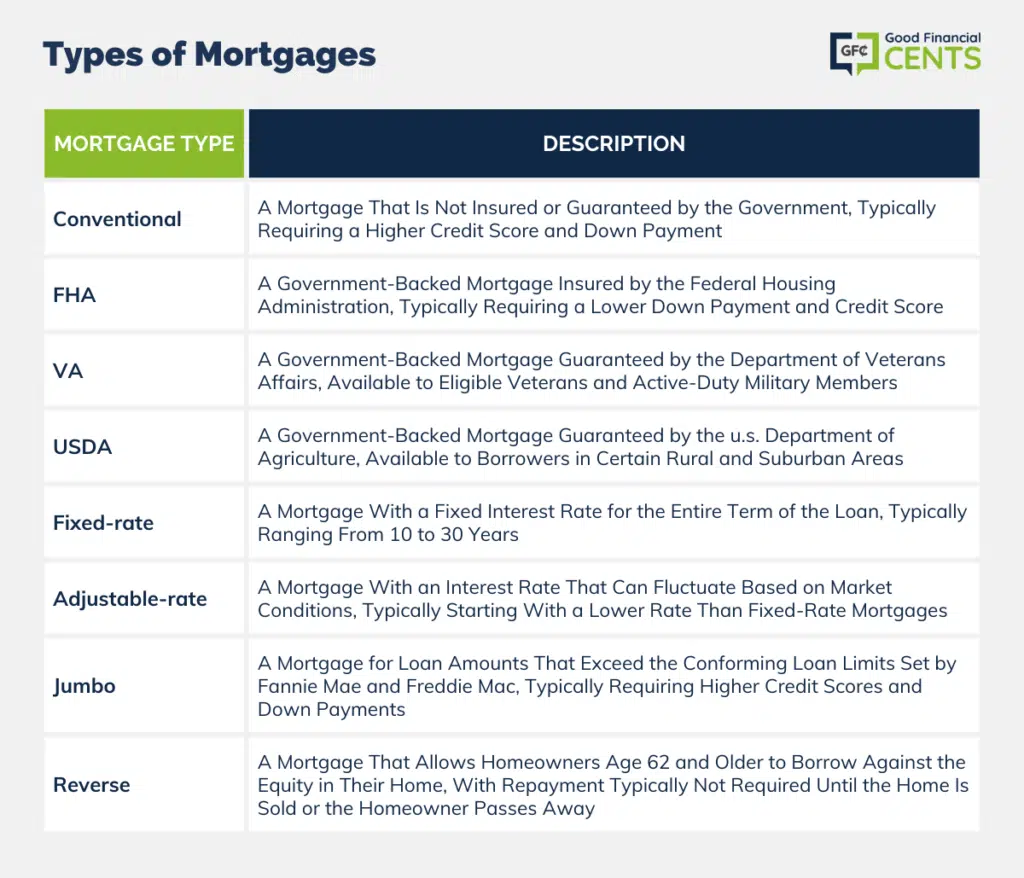

There are four primary mortgage types:

Conventional

These are mortgages funded by Fannie Mae and Freddie Mac, which are government-chartered agencies established to provide mortgage funds.

Conventional mortgages generally require at least fair credit, with a minimum credit score of 620. Though they offer mortgages with down payments of as little as 3%, you’ll be required to pay private mortgage insurance (PMI) if you make a down payment of less than 20%.

Though conventional mortgages can be used for owner-occupied homes, they’re also available for second homes and even investment properties.

Maximum loan amounts for conventional mortgages in 2024 are as follows:

Maximum Baseline Loan Amount for 2024

| Units | Contiguous States, District of Columbia, and Puerto Rico | Alaska, Guam, Hawaii, and the US Virgin Islands |

| 1 | $726,200 | $1,089,300 |

| 2 | $929,850 | $1,394,775 |

| 3 | $1,123,900 | $1,685,850 |

| 4 | $1,396,800 | $2,095,200 |

Jumbo

These are loans issued by banks and other financial institutions, other than Fannie Mae and Freddie Mac. They’re sometimes referred to as “non-conforming” because they’re not subject to agency guidelines. Instead, those guidelines are set by the lender providing the loan.

Essentially, Jumbo mortgages are available in amounts exceeding those provided by Fannie Mae and Freddie Mac. Loan amounts can even exceed $1 million.

Because these are larger loan amounts, they’re also considered higher risk. That means you’ll need good or excellent credit and a larger down payment (or home equity on a refinance) than will be required on other loan types. They’re typically available for owner-occupied homes and vacation homes, but often for investment properties as well.

FHA

These are mortgages that are insured by the Federal Housing Authority (FHA). FHA doesn’t actually make the loans – they simply insure them against default. That encourages lenders to make loans to borrowers who might not qualify for conventional financing.

FHA loans are subject to conventional loan limits. They typically require a minimum down payment of 3.5% of the purchase price (or home equity for a refinance). However, the advantage of FHA is that they tend to be more flexible with both credit and income.

The disadvantage is that they’re available only for owner-occupied properties, but not second homes or investment properties. There’s also no Jumbo loan equivalent for FHA mortgages.

You can read more about FHA loans in our post: What are First-time Homebuyer Programs?

VA

Much like FHA loans, VA mortgages are insured by the Veterans Administration, but not funded by the agency. VA loans are set up solely for active duty US military members and eligible veterans. They provide 100% financing of owner-occupied homes.

While VA loans are generally available up to conventional loan limits, it is possible to get a VA Jumbo loan. If you do, you’ll need to make a down payment equal to 25% of the amount by which the loan exceeds conventional loan limits.

How to Find the Best Mortgage Refinance Companies

Since most mortgage lenders now operate either partially or entirely online, you can start the process by going to a lender’s website. Once there, you can either get loan quotes, apply for a pre-approval, or even make a full application.

The online pre-approval process may be simple, but you’ll need to be prepared to provide documentation supporting the information you claim on your application.

That will include income documentation, such as recent pay stubs, W-2s, and even tax returns if you’re self-employed or have rental property. For down payment funds, you may also need to provide copies of recent bank statements. The more documentation you’re able to provide upfront, the faster the pre-approval and full application processes will be.

You should be aware that the number of funds you’ll need to verify with the lender will need to be sufficient to cover any closing costs associated with the loan. The lender will provide you with an estimate of the funds needed for closing, including the closing costs and any required escrow allowances.

What are the closing costs of a refinance? They generally range between 2% and 4% of the new loan amount. However, the costs can either be added to the new loan amount or covered by the lender through what is known as lender-pay closing costs. This is an arrangement in which the lender will charge you a slightly higher interest rate to cover any necessary closing costs.

Final Thoughts on When to Refinance Your Mortgage

Amid historically low mortgage interest rates, the timing for refinancing is ideal. Multiple lenders offer online services, expanding homeowners’ options. Differentiating factors for selecting a refinance lender include low rates, minimal closing costs, and efficient service. Comparing mortgage rates online is essential, but qualification criteria differ. Mortgage aggregator sites like LendingTree and direct lender websites assist in obtaining accurate quotes.

Prominent online lenders include Quicken Loans, Better, Guild, and SunTrust, each offering distinct advantages. Understanding mortgage types – conventional, Jumbo, FHA, VA – aids decision-making. Fixed-rate and adjustable-rate mortgages are options, along with specialized types like reverse mortgages. Documentation and funds verification streamline the online pre-approval process.