Among all the questions surrounding the world’s leading cryptocurrency, is Bitcoin safe may be the most unsettling. That’s because there’s no easy answer to that question.

Not only is there the risk of losing money from dramatic price swings, but fraud and scams are on the rise. That’s hardly surprising, given that Bitcoin is now more valuable than ever.

The Federal Trade Commission reports that crypto-related scams are on the rise across the board. Since the start of 2021, 46,000+ have reported losing over $1 billion in crypto scams.

Statistics like that make it clear that crypto investors need to take whatever steps are necessary to make Bitcoin safe – or at least safer.

Table of Contents

- What Is Bitcoin?

- What Is a Blockchain and What Does It Have to Do With Bitcoin?

- What Are the Risks Associated With Bitcoin?

- What Are Common Myths About Bitcoin?

- What to Consider Before Buying Bitcoin

- How to Keep Your Bitcoins Safe

- Where to Hold Bitcoin

- Bottom Line: Bitcoin Safety in 2024: Assessing Risks

What Is Bitcoin?

Bitcoin is a cryptocurrency, which is the term used to describe a decentralized digital currency.

Launched in early 2009, Bitcoin was the first cryptocurrency and has since grown to be the largest and most widely tracked of the many thousands that are available.

As a cryptocurrency, Bitcoin uses cryptography to keep its network – the blockchain – secure. It’s a public ledger, accessible to all participants, that tracks and records all transactions, as well as account balances.

When Bitcoin was originally issued, it was limited to no more than 21 million coins, most of which are already in existence. The process of increasing the number of coins is known as mining.

Miners are the people who verify Bitcoin transactions on the blockchain. For their services, they’re paid in Bitcoin. As they are, the new Bitcoin is “mined” into existence, increasing the overall supply.

What Is a Blockchain and What Does It Have to Do With Bitcoin?

The blockchain can be thought of as the network, or operating system Bitcoin works within. The blockchain exists entirely on the Internet and provides a record of all transactions on the network using Bitcoin.

The blockchain makes it possible to view and verify transactions, even without the identities of the parties involved.

The blockchain enables Bitcoin transactions that take place without the use of an intermediary, like a bank.

Each person participating in the network is assigned a private key, which is a string of at least 30 alphanumeric digits that are created by a mathematical encryption algorithm.

The personal key enables each participant to transact in Bitcoin. Without it, the user loses all access to the network.

What Are the Risks Associated With Bitcoin?

Given all the excitement surrounding the rapid run-up in the price of Bitcoin in the past few years, many are unaware of the risks – and there are plenty. Below is a list of nine of the most common risks, but there are certainly more.

1. Wild Value Fluctuations

Because of the speculative nature of Bitcoin, the price can rise 100%, then lose 75% in the same year.

Since it’s most exciting for investors to pile in at or near market tops, the possibility of taking the long ride down the opposite side of the slope is very real. Bitcoin may be profitable, but it’s anything but stable.

2. Transactions Aren’t Private

It may be more private than credit card transactions, but it’s not completely private, either. Each user is assigned a personal key for making transactions.

Though the key doesn’t readily identify you to the casual observer, it can be traced by a determined individual or organization.

3. Theft of Your Private Key

If a thief gains access to your private key, he or she may be able to make transactions that will drain your Bitcoin balance.

4. You Can Lose Your Private Key

Just as people sometimes lose account numbers and passwords, you may also lose your private key. If you do, there will be no recourse to recover your loss. Once your private key is gone, so is your crypto.

5. You Can Lose Your Cold Wallet

Storing your Bitcoin in a cold (external) wallet is the most secure way to hold it. But if you lose the wallet, you’ll also lose any Bitcoin stored on it.

6. The Exchange Where You Hold Your Bitcoin Could Get Hacked

Anywhere holding anything of value is a natural target for hackers. Just as hackers gain access to bank and credit card records, they can also hack into a crypto exchange.

The exchange may put a stop to the hack, but any crypto stored on the platform that’s stolen will be gone forever.

7. Phishing Schemes

If you have an email address, you’re familiar with this technique. A hacker poses as an organization you work with and requests access codes and even your private key. Thinking it’s a legitimate request, you supply the information.

But once you do, the thief can clean out your account.

Any institution you do business with on a regular basis will have any necessary access codes, as well as information about you. The fact that the information is being requested is the sign of a scam.

8. Illegitimate Vendors

Any time you’re dealing with an individual, merchant, or other organization that insists on being paid only in Bitcoin, it’s a red flag. It’s likely a scammer is looking to receive payment – without delivering a product or service – in a transaction that will be nearly impossible to trace. Think of it as the perfect crime.

9. Broker/Exchange Failure

Though it hasn’t been an issue so far, it is possible for a crypto exchange to fail and shut down its website. If it does, any crypto you have stored on the exchange will be lost.

This is an outstanding time to point out that crypto exchanges are not protected against broker failure by FDIC or SIPC. Unlike banks and brokerage firms, if a crypto exchange fails, no government agency will step in and reimburse you for your losses.

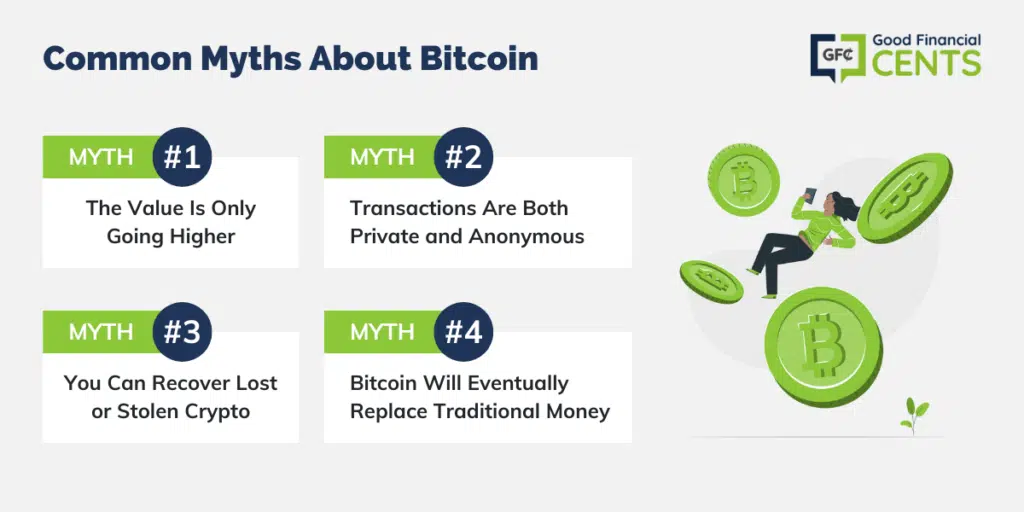

What Are Common Myths About Bitcoin?

As Bitcoin has exploded in price to levels not imagined just a few years ago, myths about this crypto abound. Some of the more common ones include:

- The value is only going higher. That Bitcoin has seen a dramatic rise in price up to this point is indisputable. But no one can guarantee the value will rise forever.

- Transactions are both private and anonymous. Each is only partially true, but should mostly be ignored. Each transaction completed creates a permanent record on the blockchain.

And since it’s tied to your personal key, it can be traced back to you. But at the time of the transaction, third parties won’t know it’s you personally.

- You can recover lost or stolen crypto. Nope, once Bitcoin is lost or stolen, it’s gone forever. And no insurance program will bail you out.

- Bitcoin will eventually replace traditional money. This is highly doubtful. Throughout history, multiple means of payment have existed. Today, we can transact using cash, checks, credit and debit cards, electronic transfers, or wire transfers.

Adding crypto to the mix may be nothing more than expanding the menu of options available.

There’s yet another common claim that may be part myths and part potential reality, and that’s that Bitcoin may eventually be made illegal. The concern stems from the fact that crypto will compete with national currencies, which won’t be tolerated by governments.

While it is a possibility, and a recent article reports the banning of crypto by more than 50 countries, it’s more likely major world governments will develop some sort of coordination between national currencies and cryptos.

It is certainly a development to keep an eye on, but it doesn’t seem at all imminent.

What to Consider Before Buying Bitcoin

The first consideration is your risk tolerance. This centers not only on the price volatility of Bitcoin but also on the unique security concerns it involves.

If you generally have a low tolerance for risk, you probably won’t want to invest in Bitcoin, or even consider it for transactions. Consider 9 investing alternatives best.

But even if you do have a sufficient risk tolerance, you’ll need to be prepared for the ride ahead. That means, first and foremost, investing no more in crypto than you can without keeping yourself awake at night.

Price gyrations with Bitcoin are severe and can test the nerves even of someone with the highest risk tolerance.

You’ll also need to be fully prepared to study the risks associated with crypto. In this guide, we’ve provided known threats and their solutions up to this point. But crypto, including Bitcoin, is still evolving. That means there will be new threats and new solutions.

You’ll need a keen desire to take whatever steps are necessary to protect both your investment and your transactions if you decide to invest in Bitcoin in 2024.

How to Keep Your Bitcoins Safe

There is no 100% secure way to protect yourself from all potential threats. But maintaining good practices – just the way you do with banks, credit cards, and brokerage accounts – can go a long way toward preventing most threats.

Below are eight strategies you can use to keep your Bitcoins safe:

1. Never Invest More Than You Can Afford to Lose

Because of the volatility, Bitcoin should never occupy more than a low single-digit percentage of your total investment holdings. And never think of crypto as a substitute for an emergency fund.

2. Use a “Cold Wallet”

You may want to use a hot wallet (one provided by the crypto exchange) if you are a short-term trader. But all other balances should be held in a portable device, like a USB stick.

3. Store Your Cold Wallet and Private Key Safely

The cold wallet should be kept someplace secure, like a fireproof safe. Your private key is much too long to be committed to memory, and should also be stored securely.

Storing it on a portable media device and keeping it in a safe is a good strategy. Meanwhile, never, ever share your private key with anyone – even with family.

4. Keep Bitcoin Held on a Crypto Exchange to a Minimum

Maintain only enough for trading purposes and immediate transactions. The rest should be held in a cold wallet.

5. Maintain Adequate Computer Security

You’re probably already doing this to protect bank and brokerage information. But you’ll also need to think about protecting your online Bitcoin transactions.

6. Never Respond to a Phishing Scheme

If an email or phone call requests your personal key or account access codes, it’s a scam. Hang up, delete the email, and never click through to any URLs it contains.

7. Only Do Business With Trusted Parties

If you’ve never done business with someone, and they ask for payment in Bitcoin only, end the transaction. Bitcoin lost in a transaction is not recoverable.

8. Hold Your Crypto on Established Crypto Exchanges

Since there is no insurance backing up these exchanges, you’ll need to use careful judgment in deciding which to invest with. Like transactions, crypto lost in an exchange failure is not recoverable. Check out our recommended best crypto exchanges before diving in.

Where to Hold Bitcoin

As an entirely new asset class, Bitcoin and other cryptos are not yet available through banks and popular investment brokers.

Instead, you’ll need to invest through what are known as cryptocurrency exchanges. Those are platforms that act something like stock markets for crypto.

Below are three of the most popular crypto exchanges. We’re also including one popular investment trading app where you can trade crypto along with other investments.

eToro

eToro is an international investment brokerage, currently being used by more than 20 million investors worldwide. Though they offer all kinds of investment securities globally, the platform is currently available only as a crypto exchange for US-based investors.

They offer trading in 27 cryptos, with fees ranging between 0.75% and 5.0%, depending on which crypto you’ll be trading in.

When you open an account, you’ll have access to a $100,000 virtual trading account. That will allow you to learn how to trade without using real money. They also offer their copy trading program that allows you to see what other investors on the platform are doing. You can then copy their trading strategies, at least until you develop your own.

Coinbase

Coinbase is one of the largest crypto exchanges in the world, offering one of the broadest service packages in the industry. You can begin investing with no more than $2 and have access to trading in 70 different cryptos.

They offer a two-tiered trading fee structure. You can either trade at a flat rate, starting as low as $0.99 per trade, or on a percentage basis, which ranges from 0.05% to 4.00%.

Coinbase gives you the option of either using their digital wallet or using your own. They also offer a Visa debit card where you can earn up to 4% cashback when you use the card for purchases.

Robinhood

Robinhood is the lone investment broker on this list, which comes with both advantages and disadvantages.

On the advantage side, you can engage in commission-free trading of stocks, options, and exchange-traded funds on the platform.

You can also take advantage of commission-free trading of seven of the most popular cryptocurrencies. That’ll give you an opportunity to hold traditional investments and crypto in the same account.

The primary disadvantage is that you can only buy and sell crypto on the app. You can’t attach a digital wallet and move your crypto to another exchange.

Also, you can’t access your crypto balance, either with a loan or a credit or debit card. Robinhood is set up strictly for crypto investing and does not offer services the way the crypto exchanges do.

Bottom Line: Bitcoin Safety in 2024: Assessing Risks

In the dynamic landscape of 2024, the safety of Bitcoin investing is a complex matter.

The cryptocurrency’s soaring value has been accompanied by heightened risks, including fraud and scams, as evidenced by a staggering $1 billion in losses due to crypto-related scams since 2021.

Bitcoin’s decentralized nature and blockchain technology underpin its security, but vulnerabilities persist. Its wild price fluctuations and susceptibility to hacking and phishing underline the need for cautious investing.

Myths abound, including the idea of perpetual value growth and total anonymity. To venture into Bitcoin, understanding risks, maintaining low exposure, using cold wallets, safeguarding private keys, and engaging only with reputable parties are paramount.

As the crypto world evolves, vigilance and prudent measures become crucial for safeguarding both investments and transactions.

Leave a Reply