Where investors use crypto exchanges as trading platforms to buy, sell, and trade various cryptocurrencies, the best cryptocurrency wallets give them a place to store their digital assets. This distinction is important since crypto exchanges don’t always offer the best security, and since having a digital wallet ensures you always have exclusive access to your own private keys.

That said, the best crypto wallets all work differently, and some offer more security features and services than others. If you’re ready to move your crypto from an exchange to a crypto wallet where you have more control, read on to learn about our top picks.

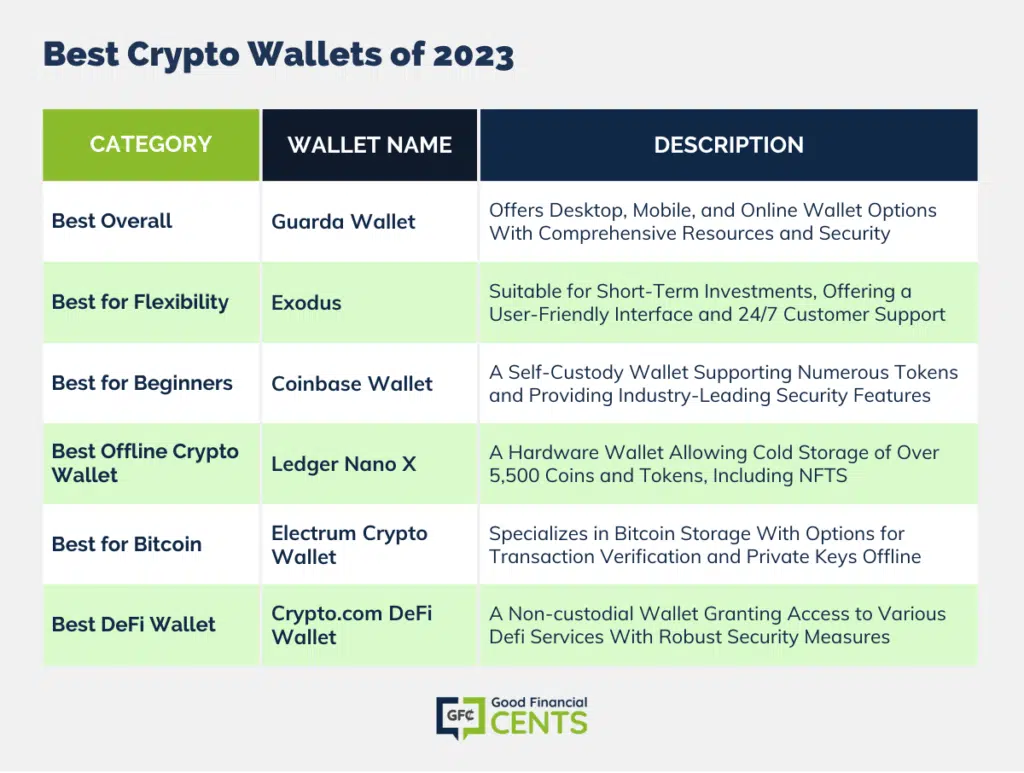

Our Picks for Best Crypto Wallets

- Guarda Wallet: Best Overall

- Exodus: Best for Flexibility

- Coinbase Wallet: Best for Beginners

- Ledger Nano X: Best Offline Crypto Wallet

- Electrum Crypto Wallet: Best for Bitcoin

- Crypto.com DeFi Wallet: Best DeFi Wallet

Best Crypto Wallets – Reviews

Guarda Wallet lets users set up a desktop wallet, a mobile wallet, or an online wallet for their crypto. Each type of wallet is entirely free to use for storage and can be downloaded from the Guarda website. Once the wallet is set up, customers can earn interest on their crypto deposits or stake crypto in order to build streams of passive income.

Guarda customers also have access to a broad range of resources, including a Guarda Academy learning center and a Knowledge Base customer support portal. Privacy and security are also a key focus for Guarda, and this wallet lets users own and fully manage their private keys and user data. Custody-free service from Guarda also makes your fund management much easier and faster, and your private data is never stored on the company servers.

If you’re interested in short-term investing and you’re hoping to turn a profit by holding crypto for a while, the Exodus wallet could work for your needs. Its desktop wallet app offers a user-friendly interface that’s perfect for beginners, and customers never pay any fees for receiving crypto. This wallet is perfect for HODLing (holding on for dear life), but it’s also ideal if you want to send, receive, and exchange Bitcoin and 180+ cryptocurrencies with a platform that has top-notch security features.

Coinbase is easily one of the best crypto exchanges available today, yet the fintech company also offers its own crypto wallet for storage. This wallet lets users store all their cryptocurrency and NFTs (non-fungible tokens) in one place, and it supports hundreds of thousands of tokens around the world. The Coinbase wallet also lets you explore the decentralized web using your favorite mobile device.

This crypto wallet is a self-custody wallet as well, meaning that you have complete control over your crypto and private keys. The company also offers industry-leading security, including multi-signature and 2-factor authentication support. Also, note that the Coinbase wallet offers an easy-to-navigate user interface that makes it perfect for beginners and experienced crypto traders. Finally, its app has connectivity to most major bank accounts.

The Ledger Nano X is a hardware crypto wallet that offers cold storage you can hold in your hand. This wallet lets you store and manage more than 5,500 coins and tokens including Bitcoin, Ethereum, XRP, and more. It’s Bluetooth-enabled, and you can also use the Ledger Nano X to store your NFTs.

This wallet is different from software wallets that store your crypto data and keys on your desktop or your mobile device. Instead, this crypto wallet is a physical product that is built on a versatile security operating system called BOLOS. Investors can also grow their crypto by staking their Tezos, Tron, Cosmos, Algorand, or Polkadot directly in the Ledger Live app on Android or iOS, or they can use the wallet to hold crypto for long-term growth.

If you’re learning how to invest in Bitcoin and you want a secure place to store your digital assets, the open-source Electrum Crypto Wallet may be what you need. We chose it as the best Bitcoin wallet because this software wallet verifies that your transactions are on the Bitcoin blockchain, and lets you split the permission to spend your coins between several wallets for maximum flexibility. You have the option to keep your private keys offline and go online with a watching-only wallet, and you can even see your funds recovered with a secret phrase.

With all this being said, Electrum is only supportive of Bitcoin. This means it’s not the best option if you are looking for ways to invest in various cryptocurrencies like Ethereum, Dogecoin, Cardano, or Polkadot.

The Crypto.com DeFi wallet is a non-custodial wallet that grants access to a full suite of DeFi services within a single platform. Users get full control of their crypto and their keys, and they can easily manage more than 100 types of coins including Bitcoin, Ethereum, Cosmos, Cronos, and more. Crypto.com also makes it easy to import your existing wallet with a 12/18/24-word recovery phrase.

This crypto wallet lets you send crypto with ease, and you can also earn interest on more than 35 tokens you hold with the platform. Investors can also swap DeFi tokens directly from the DeFi Wallet. Also note that Crypto.com encrypts your private keys locally on your device using Secure Enclave, which is protected by Biometric and 2-factor Authentication.

Crypto Wallets Guide

The leading crypto wallets make it easy to store your digital currency in a safe and secure environment. They’re different from wallets offered as part of cryptocurrency exchanges in that these are dedicated products with robust security measures and tend to be targeted less by crypto hackers.

Read on to learn why cryptocurrency may be one of the best long-term investments available today, and why you should store your crypto in a wallet instead of an exchange.

What Are Crypto Wallets?

Where traditional wallets store your cash and your credit cards, a crypto wallet serves as a crypto portfolio, storing the private keys to your crypto, any NFTs you have, and other digital assets. If you lose the private keys to your crypto, you lose access to your money. A crypto wallet helps ensure that never happens since it can safely and securely store this private data where only you can access it.

How Do Crypto Wallets Work?

When someone sends you digital currency, regardless of whether it’s Litecoin, ERC-20 tokens, Dogecoin, or Bitcoin cash, you need two digital codes to perform the transfer of ownership: a public key that’s automatically generated by the crypto wallet provider and a private key that only you should know.

Either way, crypto wallets store your private keys, which are required to unlock access to your crypto and other digital assets. These wallets also offer beefed-up security features that can protect your digital assets and keep your crypto working on your behalf.

- Related: 4 Ways I’m Making Money with Crypto

Types of Crypto Wallets

There are three major types of crypto wallets, and each type comes with its share of pros and cons.

- Software wallets must always be connected to the internet, which is why they’re also called hot wallets. The most common types of software wallets include web wallets, desktop wallets, and mobile wallets.

- Hardware wallets store your private keys on a physical device that you purchase and store on your own. Most cold storage wallets look and act similar to a flash drive, which you can connect to your computer when you need to access your crypto.

- Paper wallets store your private keys on a physical piece of paper, often through printed-out QR codes. This obviously creates a security concern, but paper wallets are popular for investors who don’t trust third parties to keep their crypto safe and secure.

Important Factors to Consider

As you learn more about crypto wallets, it’s fairly easy to figure out what you should be looking for as you choose one. Just like you would consider different factors if you were comparing the best robo advisors, here’s everything you need to factor in before you choose a crypto wallet.

- Crypto Security: The whole point of storing your crypto in a wallet is increasing security, so you want to make sure you choose an option that has the security features you want the most. In addition to encryption and other standard features, look for crypto wallets that offer multi-factor authentication.

- Investing Style and Goals: Some wallets let you store your crypto without giving up the chance to buy, sell, or trade crypto along the way. Many wallets even let you earn interest on your crypto deposits, so make sure to check for these features.

- Compatibility: Make sure any wallet you’re considering functions in a way that makes sense for you. For example, choose a crypto wallet that operates on a desktop or online if you prefer that option, or opt for a hardware wallet that lets you store your keys on a device. Also note that some software wallets are compatible with hardware wallets, which gives you the best of both worlds.

How We Found the Best Crypto Wallets of February 2025

To find the best digital crypto wallets and hardware wallets, we read through countless number of user testimonials and reviews. We focused on crypto wallets that are free to use for storage, but we also considered wallets that require the purchase of a hardware device. Other factors we considered include overall functionality, the ability to earn money via interest or staking, and the ease of use with which users can buy, sell, or trade their crypto assets.

- Guarda Wallet: Best Overall

- Exodus: Best for Flexibility

- Coinbase Wallet: Best for Beginners

- Ledger Nano X: Best Offline Crypto Wallet

- Electrum Crypto Wallet: Best for Bitcoin

- Crypto.com DeFi Wallet: Best DeFi Wallet

Leave a Reply