Today’s mortgage rates can have a huge impact on how much you pay for your home. While a competitive mortgage rate can help you lower your monthly housing payment, overpaying for a home loan can leave you paying more interest than you should.

Fortunately, mortgage rates today are considerably lower than they were just a few years ago.

This means you have the potential to lock in an exceptional mortgage rate right now, and this is true whether you are buying a home or refinancing a home loan you already have.

Ready to secure the best mortgage interest rates out there? Read on to learn what average mortgage interest rates look like right now, factors that impact rates, and how to make sure you qualify.

Table of Contents

- Current Mortgage Rates

- Types of Mortgages

- Average Mortgage Rates by Credit Score

- Mortgage Interest Rate and Costs for a $300,000 Mortgage

- Mortgage Interest Rate and Costs for a 15-Year Fixed-Rate Mortgage

- Will Mortgage Rates Go Down?

- How to Get the Best Mortgage Rates

- How Much Mortgage Can I Afford?

- Bottom Line: Today’s Mortgage Rate Landscape

- Frequently Asked Questions (FAQ)

Current Mortgage Rates

Here’s an important question you’ve probably been asking yourself: How do you know if you’re getting the best mortgage interest rates?

Generally speaking, you can gauge whether you’re getting a good deal by comparing today’s mortgage rates across the most competitive providers.

Meanwhile, you can check with government agencies to find out the average mortgage rates nationwide.

According to Bankrate, the average mortgage interest rate for a 30-year, fixed-rate home loan worked out to 7.53 as of September 5th 2023.

Note that mortgage interest rates are based on factors such as the prime rate, meaning they can fluctuate over time along with market conditions.

Also, be aware that you may qualify for a lower (or higher) mortgage interest rate based on factors like your credit score, where you live, and the type of mortgage you apply for.

Generally speaking, you’ll want to check mortgage rates with at least three or four of the best home loan providers to find the best deal.

By shopping around, you can compare lenders based on the mortgage rates they offer, the closing costs they want to charge, and other factors that can help sweeten the deal.

Types of Mortgages

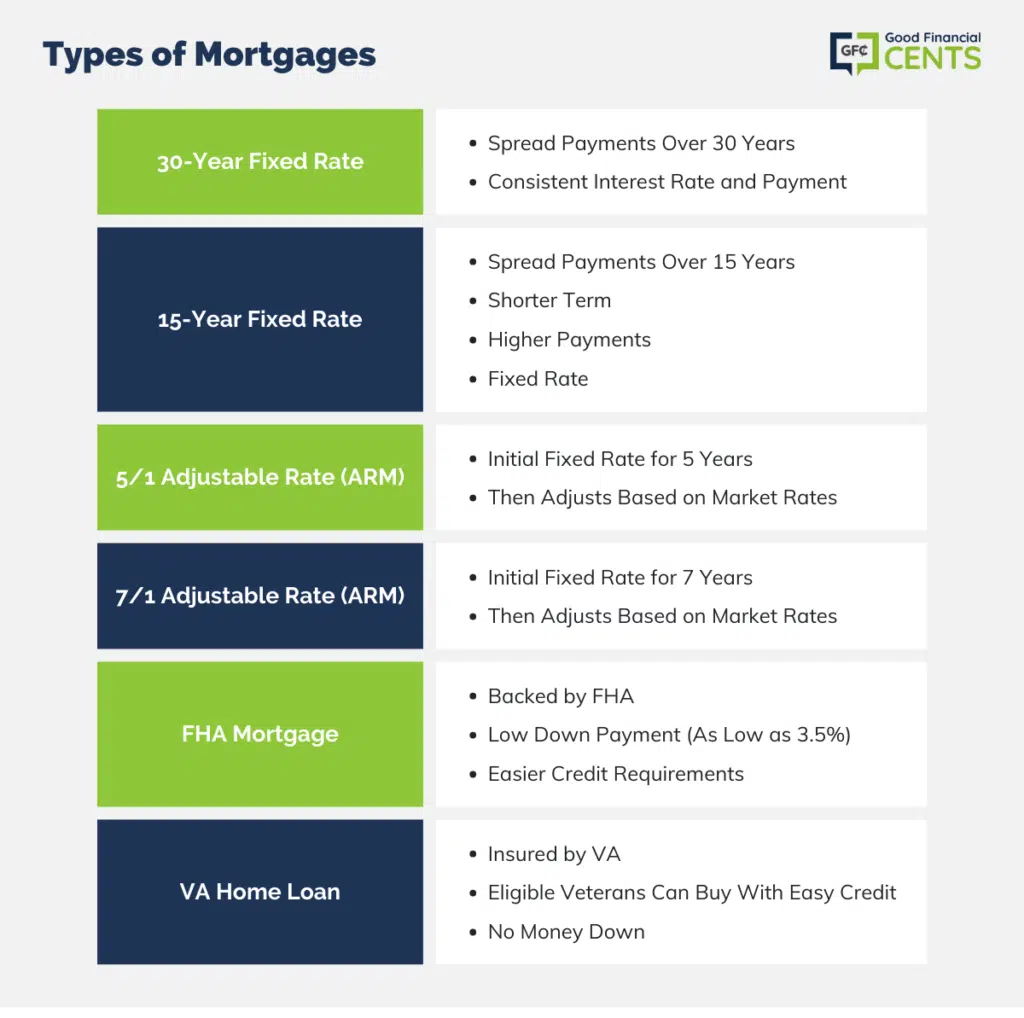

The type of mortgage you choose can play a significant role in the mortgage rates you’re eligible for.

While longer mortgages tend to charge higher rates, you may be able to secure the lowest possible interest rate if you choose a home loan with a shorter repayment timeline.

Likewise, variable interest rate loans that are based on market rates may offer lower initial rates right now versus fixed-rate loans.

What are the types of mortgages most consumers choose from? Consider the following types of home loans before you apply:

- 30-Year Fixed Rate Mortgage: This type of home loan is the most popular one out there today. With a 30-year fixed-rate mortgage, consumers can spread the payments on their mortgage out over 30 years.

During that time, the interest rate and principal and interest component of the mortgage will never change.

- 15-Year Fixed Rate Mortgage: With a 15-year fixed rate mortgage, consumers can spread their mortgage payments out over 15 years. This means they can cut their repayment timeline in half when compared to a 30-year loan, albeit with a larger payment as a result.

During the 15-year timeline, the interest rate and principal and interest component of the mortgage will never change.

- 5/1 Adjustable Rate Mortgage: With a 5/1 ARM, consumers get a fixed interest rate that is typically more competitive than market rates for the first five years of their loan. After that, the interest rate can go up or down based on market rates.

- 7/1 Adjustable Rate Mortgage: With a 7/1 ARM, consumers get a fixed interest rate that is typically more competitive than market rates for the first seven years of their loan. After that, the interest rate can go up or down based on market rates.

- FHA Mortgage: A FHA loan is backed by the Federal Housing Administration, and consumers can qualify with a low down payment (as low as 3.5%) and easier credit requirements.

- VA Home Loan: VA home loans are insured by the Department of Veterans Affairs, and they make it possible for eligible veterans to buy a home with easy credit qualifying and no money down.

Average Mortgage Rates by Credit Score

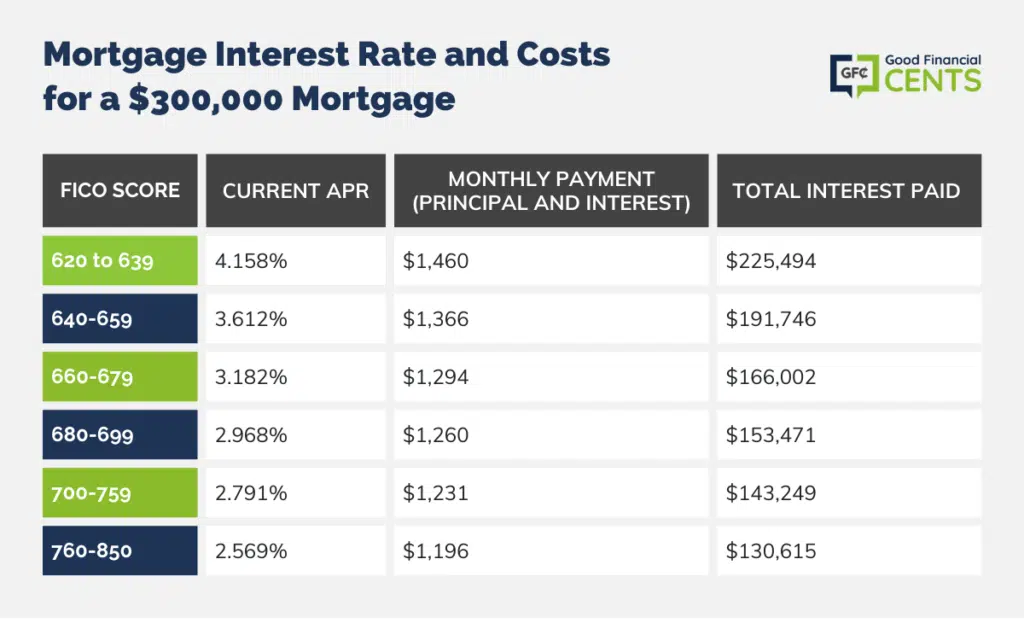

While an array of factors go into determining your mortgage interest rate, your credit score is one of the biggest details lenders look at.

Where a higher credit score and longer credit history can help you secure the lowest mortgage rates on the market today, it’s likely you’ll be stuck paying a higher rate if your credit is poor or just “okay.”

How much of a difference can your credit score make? According to myFICO.com, excellent credit can easily save you tens of thousands of dollars.

The myFICO.com loan savings calculator shows how much a mortgage will cost you, plus potential interest rates, based on your credit score rating and where you live.

We used the calculator to show the average interest rate nationally for someone in each credit score range. We also use the chart below to show how much interest someone would pay on a $300,000 home loan based on market rates.

Mortgage Interest Rate and Costs for a $300,000 Mortgage

The chart shows the current APR based on credit score, the monthly payment (P&I), and the total interest paid for a 30-year, fixed-rate mortgage for $300,000.

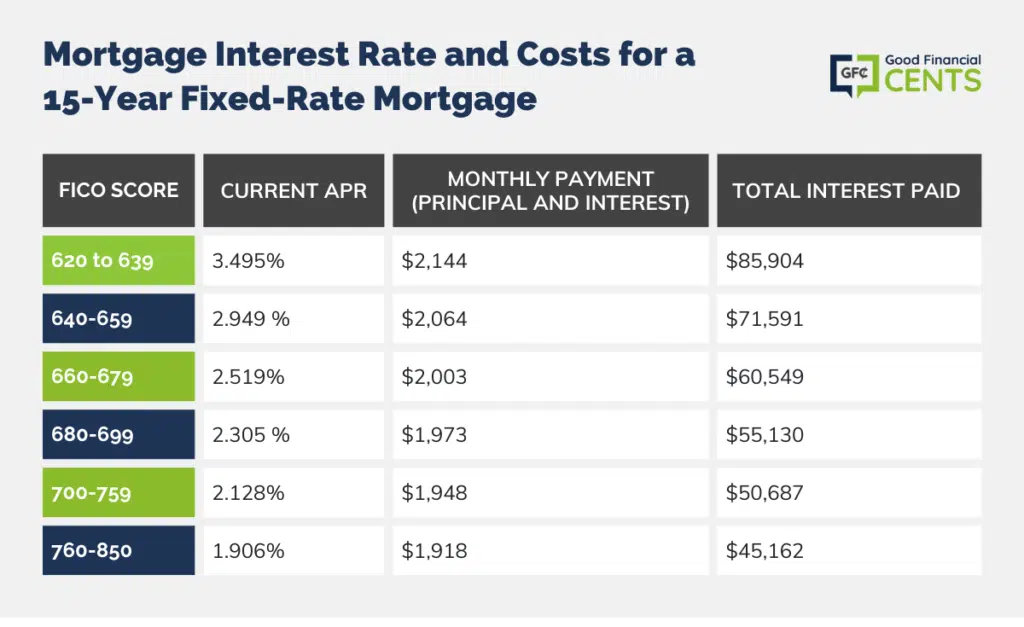

Mortgage Interest Rate and Costs for a 15-Year Fixed-Rate Mortgage

The chart shows the current APR based on credit score, the monthly payment (P&I), and the total interest paid for a 15-year, fixed-rate mortgage for $300,000.

Will Mortgage Rates Go Down?

While mortgage interest rates always have the potential to go up or down over time, it seems very likely mortgage rates are at or nearing the bottom right now.

This is based on the fact that historical mortgage rates have been higher for decades and that there’s not much room to drop from where we’re at.

How much were mortgage rates in the past? In October 1981, as reported by Freddie Mac, the 30-year fixed mortgage rate soared to its highest point at 18.4 percent. It then exhibited a fluctuating pattern, dropping to around 9 percent by 1986 and concluding the decade at 9.78 percent.

Rates have dropped dramatically since then, making now an excellent time to take out a new home loan or refinance a home loan you already have.

How to Get the Best Mortgage Rates

Getting the best mortgage rates isn’t rocket science, but you may have to put in a little upfront work. From improving your credit to paying down other debts, here are the most important steps you can take to get the best mortgage rates out there today.

Check Your Credit Score

First off, you should take the time to check your credit score. Doing so will help you see where you stand, which can help you gauge the quality of the mortgage rates you can qualify for.

Fortunately, there are several ways to check your credit score for free, including free credit websites like Credit Sesame. You can also get a free credit score and a look at your credit report from Experian.

Take Steps to Boost Your Credit

If you check your credit score and know for sure it needs some work, you should spend some time trying to improve it. There are several steps you can take to boost your credit, but the most important is making sure you pay all your bills on time.

Another step you can take is paying down unsecured debts like credit card debts. Doing so can help you lower your credit utilization rate — a move that makes you seem less risky to borrowers.

Pay Down Unsecured Debts

Paying down debt can potentially improve your credit score, but it can also help you qualify for a mortgage. Most lenders prefer to extend home loans to borrowers with a debt-to-income ratio (DTI) of 50% or less, and paying down debt can help you get there.

Consider a Shorter Repayment Timeline

You may be able to qualify for a lower mortgage rate if you’re willing to pay down your home loan over 15 years instead of the standard 30 years.

Your monthly payment will be higher, but you’ll save on interest and pay off your house twice as fast.

Save a Larger Down Payment

Having a large down payment can also help you qualify for better mortgage rates. Saving up a down payment of at least 20% is the best way to qualify for a competitive rate, and you can also avoid paying private mortgage insurance (PMI) with a down payment of that size.

Get Several Mortgage Rate Quotes

Finally, you should spend some time shopping around for a mortgage if you hope to get the best rates.

Generally speaking, comparing interest rates, closing costs, and additional charges from at least three or four different mortgage companies is the way to go.

You can easily compare mortgage rates from multiple providers in one place with a website like Credible.

How Much Mortgage Can I Afford?

While on the hunt for the lowest mortgage rates, you should also make sure you have a general idea of how much house you can afford. While this part of the process can be quite tricky, there are several rules of thumb you can keep in mind.

For example, there’s the “29/41 rule.” This rule states that your housing payment (including principal, interest, taxes, and insurance) should make up no more than 29 percent of your gross income and that your total debts should make up no more than 41 percent of your income.

With this rule, a couple with a gross monthly income of $10,000 (or $120,000 per year) would make sure their mortgage payment was no more than $2,900 and that their total debts were no more than $4,100 per month.

Meanwhile, someone with a gross monthly income of $5,000 (or $60,000 per year) would make sure their mortgage payment was no more than $1,450 and that their total debts were no more than $2,050 per month.

This rule is just one standard to keep in mind, but you should note that mortgage lenders may be willing to lend you more than you are comfortable with.

At the end of the day, only you know the monthly payment amount you can easily keep up. Make sure to run the numbers, take a look at your budget, and have a feel for how much you can afford.

Bottom Line: Today’s Mortgage Rate Landscape

Today’s mortgage rates can significantly impact the cost of homeownership. Luckily, rates are currently lower than in previous years, making it an opportune time to secure a favorable mortgage rate, whether purchasing or refinancing.

It’s essential to compare rates from various providers and consider government data on average rates. Credit score plays a pivotal role; higher scores often yield lower rates. Different types of mortgages offer varying terms, affecting rates.

While rates can fluctuate, historical trends suggest they are currently near the bottom. To secure the best rates, improve your credit, consider shorter repayment timelines, and save for a substantial down payment. Remember to calculate affordability using established guidelines.

Frequently Asked Questions (FAQ)

What are today’s mortgage rates?

Today’s mortgage rates can vary based on your credit score, where you live, and plenty of other factors. However, the Federal Reserve Bank of St. Louis reports the average mortgage interest rate for a 30-year, fixed-rate home loan worked out to 4.42% as of March 24th, 2022.

What are the best mortgage lenders?

There are plenty of excellent mortgage lenders in operation today. Some of the best companies to check out include Quicken Loans, Rocket Mortgage, Veterans United, LoanDepot, and Credible.

What credit score do I need to buy a house?

According to Rocket Mortgage, consumers with credit scores of 620 are most likely to qualify for a mortgage. However, FHA home loans are available for consumers with credit scores as low as 580. The same standard applies to most VA home loans.

Can I buy a house without a down payment?

FHA home loans let you purchase a home with a down payment as low as 3.5%. However, most conventional loans require a down payment of 5% to 15%. To secure the lowest mortgage rates and to be able to drop private mortgage insurance (PMI), you should save up a down payment of at least 20%.