On paper, making extra payments on a low-interest mortgage makes no sense at all. After all, the returns you can achieve from investing will almost always be worth more than any interest you save by becoming debt-free.

So, why would anyone pay off mortgage debt any faster than they have to? When you consider the fact that the stock market typically returns around 10%, paying off a 30-year home loan with a rate that’s below 4% seems foolish at best.

And, that’s just the stock market we’re talking about. What about Bitcoin and other cryptocurrencies?

The reality is, Bitcoin alone has multiplied in value several times since the beginning of the pandemic. Where a single Bitcoin was worth $10,764 in September of 2020, values have easily grown 5X since then.

Still, my wife and I have decided we absolutely want to pay our Nashville home off faster than we have to. This is despite the fact we would almost certainly score a higher return by investing when compared to the interest we save.

But sometimes, a decision like this isn’t all about the numbers. It’s also about peace of mind, stability, and personal preferences toward debt in general.

So, why are we taking the steps to pay off our mortgage early? I break down all the details and strategies we’re considering below.

Our Mortgage Details

Table of Contents

My wife and I moved from Illinois to Nashville, Tennessee in the summer of 2017. It’s was a scary move. Probably the scariest decision we’ve ever made as a family. This picture of the moving trucks showing up doesn’t truly capture how terrified we both were:

We started building a home there pretty much right away, and we secured our mortgage in January of 2018.

Interestingly, this move took us from almost debt-free to nearly $1 million dollars in debt! That’s because our old house in Illinois was almost paid off, and because we started the whole process over during our move. If you want to learn more why we made the move, you can check out the YouTube video here:

Ultimately, the total price for our new home worked out to $955,165.10. After putting down two separate deposits of $75,000 and paying closing costs, our new VA home loan started with a balance of $843,511 and an interest rate of 3.625%.

This made our mortgage payment balloon to $4,397, which is a lot higher than any mortgage payment we have had in the past. Of that amount, $630 went into our escrow account for taxes and insurance each month.

If we decided to make the minimum payment on our 30-year home loan, the total amount paid in (including principal and interest) would work out to $1,384,863.44.

This means we would wind up paying $541,596.33 in interest alone!

We decided we don’t want to pay quite that much interest. We also know there is no way we want to owe mortgage payments 25+ years from now.

With that in mind, here are some of the early mortgage payoff scenarios we started considering:

Option 1: Making an Extra Payment

One of the most popular strategies for paying off a mortgage early involves making an extra payment each year. This strategy lets you pay your house off earlier than normal, but it’s not so aggressive that you have to sacrifice other financial goals.

When I ran the numbers for our mortgage, I found that making an extra payment of $4,397 per year would cut around four years off our repayment timeline and reduce our total interest paid to $456,442.

That means making an extra payment on our mortgage would save us around $85,154 in interest payments over time.

Knocking four years off our mortgage is good but we have goals of paying our home much faster. Since making an extra house payment a year didn’t cut it, I was curious to see what would happen if we made a double payment each year.

By making an extra $8,800 ($4,397 x 2) payment each year it did reduce our mortgage loan down another 3 years (so 7 years total). The total interest paid would be reduced to $395,763 or a savings of $145,833.

That’s a huge savings but still not fast enough for us. But I think you can see that making an extra payment (or two) is a solid way to save a ton of interest on your mortgage and pay your house off faster.

Wealth Tip: Making an extra payment each year on your mortgage can dramatically reduce your loan and save you thousands of dollars of interest.

Option 2: Refinance Our Mortgage

On April 30, 2021, I contacted a mortgage broker to find out how much interest we could save if we took steps to refinance our home loan. Based on our current loan amount, which was $794,000 at the time, refinancing to a 15-year home loan with an interest rate of 2.375% would increase our monthly mortgage payment to $5,798.95.

However, I was pretty put off by all the fees involved in refinancing, which you can see clearly in the screenshots below:

Not only were they asking for an origination fee and appraisal fees, but they wanted to charge processing fees, underwriting fees, and other fees galore. I would also have to pay a second VA funding fee in order to use my VA loan benefit.

Then there’s the hassle and stress involved in refinancing a mortgage. People who have refinanced in the past already know what I’m talking about!

But, even with the fees involved, this option can still lead to huge savings over time. Considering a new 15-year home loan of $794,000 with an interest rate of 2.375%, total interest paid works out to just $150,588 and some change.

That’s more than $390,000 in interest savings when you compare to just making the minimum payment on our mortgage for 30 years!

Btw, if you are considering refinancing your mortgage, always – and I mean ALWAYS – get at least two quotes from different mortgage brokers. And don’t assume the bank you’ve been with all of your life is going to give you the best rate.

Seth Burstein, the CEO of Fortunately.io shared on episode 92 of the Good Financial Cents podcast a crazy story about the rate his bank offered him when he was refinancing his own house. I promise you it’s worth listening to:

Option 3: Make a Large One-Time Payment

While not everyone has the desire (or the means) to make a lump sum payment on their mortgage, this is the option we’re considering right now. In the meantime, we’re also paying extra on our mortgage every month.

This decision isn’t one we’re taking lightly, but it’s one that seems to make sense based on where we are in our journey to wealth and our eventual retirement.

Of course, I feel blessed to be in a financial position that we can take a lump sum on our mortgage without sacrificing our other financial goals. In the end, we decided we wanted to pay an extra $100,000 toward our mortgage in a single payment.

But, where is the money coming from exactly?

First off, it’s important to know that we have ample cash on hand to survive an emergency. In fact, we have around three to four years of spending and bills socked away, which should be more than enough to handle something like surprise medical bills or a drop in income. I’m fine with all of that, and I’m also unwilling to deplete our emergency savings in order to pay off our mortgage.

So, I started searching elsewhere. When I started looking at where I would feel most comfortable pulling our money from, I took a cold, hard look at some of our investments. I instantly knew I wanted to leave our crypto accounts alone, so that left me with a few other places to choose from.

First off, I own some Facebook stock in a joint account with my wife. My original purchase was in 2012, and I bought 250 shares for $25.97 each.

Obviously, the company has morphed into a new one called Meta by now, and shares of the stock are selling for a lot more than I paid. In November of 2021, in fact, stock in Meta was selling for $335.89 per share.

I didn’t want to sell all of my Meta stock, but I knew I was comfortable selling some of it. Ultimately, I decided to go with some advice from my CPA, which he called the 50% rule. The rule basically works like this: If you’re not 100% certain on how much you want to sell, then sell half, or 50%. That way, you’ve locked in some profits, and you can’t be too mad at yourself if the price continues to go up.

Once I made the sale of half of my Facebook stock, I had secured $40,000 of the $100,000 lump sum payment I wanted to make toward our mortgage. From there, I had to figure out whether the rest ($60,000) was going to come from.

That’s when I looked at another investment account I have with the Robinhood investing app. This is an account I started building with dividend stocks several years ago. While my initial investment involved $100,000 in dividend stocks, I ultimately invested another $100,000 for a total of $200,000.

Eventually, I got bored buying dividend stocks and realized I could also buy cryptocurrency through Robinhood. From there, I purchased Dogecoin, Bitcoin, and Ethereum through the app.

Between all of the holdings, we were up between $80,000 to $85,000 in a fairly short amount of time. I know I said I didn’t want to sell any of our crypto assets, so you’re probably wondering why I ended up selling the crypto I had with Robinhood. I ultimately made this move because, unlike other platforms that let you buy and sell crypto, Robinhood doesn’t have its own wallet. That means you don’t have any way to earn interest on your crypto holdings.

Either way, I ultimately found the other $60,000 for our mortgage by selling my dividend paying stocks and taking some profits from crypto. And that’s how I came up with $100,000 to throw at our mortgage right away.

What About The Extra Annual Payments?

In addition to making a lump sum payment on our mortgage, we’re also planning to make an overpayment on our mortgage every month. And, this is where being a business owner can be a lot of fun.

For the past few years, for example, we’ve had all our kids on our business payroll since they each play a role within our social media presence and even our ads. Being on payroll has allowed my two oldest sons to boost their savings and also max out their Roth IRAs. My younger two are also adding money to their Roth IRAs on a monthly basis, although we haven’t maxed them out yet.

In the meantime, my wife is also on the payroll since she is an integral part of our business as well. Between the two of us, we have been maxing out our 401(k) plans for the last several years. This wasn’t always the case, but we really ramped up our savings when the business took off six or seven years ago.

Also note that we have had a profit-sharing 401(k) plan the entire time, so we have been able to contribute a lot more than the average person can contribute to a 401(k). To give you some perspective on how much we’ve been able to save in our self-directed 401k plan with profit sharing here’s how much we were able to fund in 2020:

Over time though, some of our priorities have changed, and we have taken a deeper look at our finances as a whole. After looking at our retirement accounts and how much we’ve been paying our kids, we came to the conclusion that we really, truly want to pay off our home and become debt-free.

We decided to make a few specific moves as result:

- We are going to cut back on our 401(k) contributions

- We’re reducing payments to our kids

I’m calculating that this will free up anywhere from $80,000 to $90,000 per year we can use to pay off the house early. If we redirect some other funds toward this goal, I feel confident we can pay an extra $100,000 per year toward our mortgage until we’re entirely debt-free.

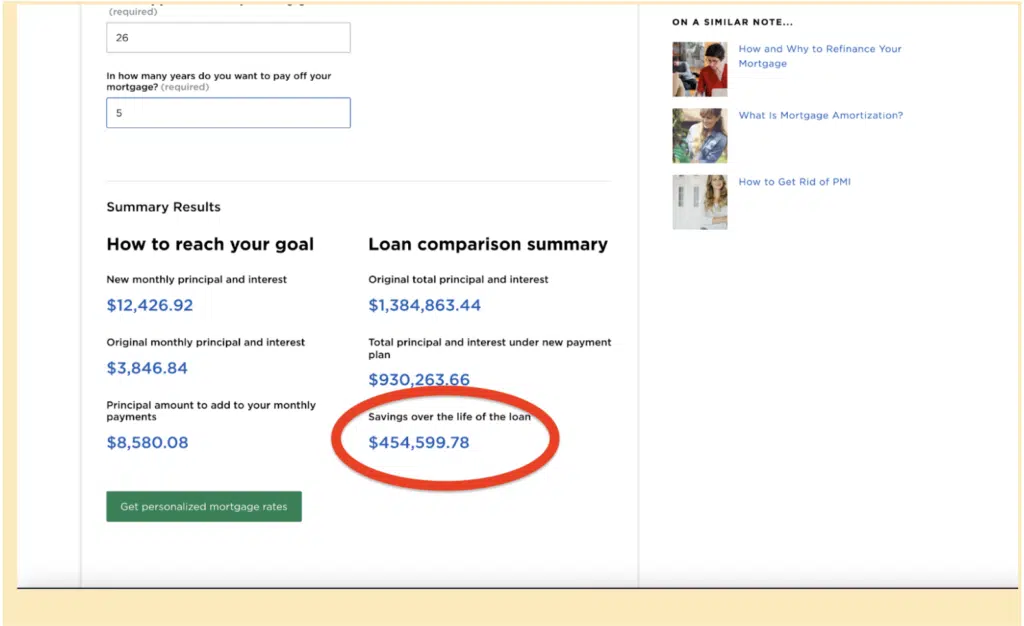

If we take this step and pay an additional $8,580 toward our mortgage each month after making the $100,000 lump sum payment, we should save $454,599.78 in interest on our home loan!

That’s a huge amount of savings, but this is about more than that.

Paying an extra $100,000 toward our mortgage each year will also help us become entirely debt-free in five years!

Why We’re Ditching Our Mortgage Early

When it comes to the great mortgage payoff debate, there are a lot of conflicting opinions out there. For some people, it’s all about the math, and they would much rather invest their extra cash for the long-term. But for others, the math doesn’t matter nearly as much as the peace of mind they get from becoming debt-free.

I asked a group of other business owners for their thoughts on paying off their mortgage early, and their answers were all over the place. While people had different reasons for paying off their home loans ahead of time, everyone seemed to agree the peace of mind they get is more important than the math.

Here are a few responses from the pay off your mortgage early camp:

“We’re also actively pouring into our housing cost to have no mortgage in about 6 years from now. (Hopefully faster) While rates are stupid low right now here are the main reasons we want no house payment:

1. Timing: our house will be paid in full about the time our kids are leaving for college. It gives us extreme financial flexibility to then help them transition to adulthood.

2. Our Age: We’ll be early 40’s with no house payment. We can pour the money that was going to a mortgage payment into our investment strategy during the greatest income earning years of our lives with plenty of time for compounding to assist into retirement.

3. Freedom/Flexibility: with no major housing expense or consumer debts, our overhead/operating costs are minimal. If we want to take time off work to travel, have a catastrophic event, or weird market events occur, we don’t need to worry about paying for a basic necessity in life.” – Casey Lewis, Real Estate Coach

“After paying off all other debt and building my full emergency fund, I got super focused on paying off my mortgage. I threw every bit of extra I had at it. By getting focused on that 1 thing, I was able to pay off $140k mortgage in 3.5 years. All of this as a single mother of a daughter with special needs. My daughter and freedom were my reasons!” – Ann James

“Did it in 2016 on our San Diego house. Total peace of mind thing for us, knowing that we’d never owe anyone any money ever again. Sold that house in 2019 and paid cash for our dream property in GA. Not an ounce of regret. We were otherwise debt free for many years before that and were maxing our retirement accounts. Now just throwing all that money into other investments.

I’m an accountant by trade and “know” the math but still believe it was the best choice for us.” – Alise Brockman Jackson, Money Coach

Why Paying Off Your Mortgage Early Isn’t a Great Idea

Not surprisingly, plenty of other people disagree with the premise of paying off a mortgage early completely. Either they would rather invest their money for potentially higher returns, or they don’t want their extra cash “locked up” where they can’t get to it easily.

“In this environment, I would never pay off my mortgage.” – Larry Ludwig, Affiliate Marketing Expert

“We decided to not pay off our mortgage early because we feel the pros outweigh the cons pretty heavily when looking at the numbers.

When we bought our house we actually only put 10% down and took on PMI because we could earn more in the market than what the % was on PMI.

I actually called this morning and we are in the process of getting a new appraisal to get PMI knocked off after a year of owning the house and making minimum payments.

Pros of not paying off early:

1) We earn 8% in the market investing our money vs. 3% paying off our mortgage early.

2) Our money is far more liquid via investments than tieing it up in a mortgage. We can use this money to acquire/start new businesses, invest in short-term rental properties, etc.

3) We are young and want to leverage our time and high-risk tolerance while it makes the most sense.” – Kelan Kline of The Savvy Couple

All of these reasons make sense to me, but the difference in opinions really underscores why we call it “personal finance.” The decision to pay off your mortgage early is a personal one, and it doesn’t really matter what anyone else thinks.

I could make a huge list of bullet points describing every reason making extra mortgage payments feels right, but it all boils down to the peace of mind it brings.

Nothing in life is certain, and I’m not a proponent of living in fear.

However, I do believe in hedging my bets and focusing on areas of my life I can control.

I can’t really control whether my business model will even be relevant five or ten years from now, but I can easily control how much effort I put into paying off the one huge debt we have.

So, that’s what we plan to do — we’re paying our mortgage off over a five-year period while we continue to invest. Five years from now, I feel confident we’ll be glad we did.

No such thing as a free lunch, so you’re simply managing the perceived downside by paying off early, not building wealth or optionality…and remember, you’re not “debt-free” once you pay off your house…property taxes and maintenance still remain. If you can’t sleep at night with a mortgage, then that would imply that you don’t believe you have short term cash available for unknowns…that won’t go away with or without a mortgage…that is more an emotional issue with “having enough”.