When I first arrived at basic training, I was assigned a battle buddy. Every soldier was.

A “battle buddy” was an individual that we had to know everything about. We had to know where they came from, where they were born if they had any siblings, what their favorite food was, how they lost their virginity, and if they liked tacos with or without onions.

They expected that we knew all this, and we would constantly be quizzed by the drill sergeant, ensuring that we took the time to get to know our battle buddy.

Table of Contents

The battle buddy was also responsible for making sure that we were in formation on time, we were wearing the right uniforms, that our canteens were filled, that our bunks were made to the drill sergeant’s satisfaction, and that our boots were shined. If either one of us didn’t meet any of these standards, then we were both punished.

It was brutal.

The significance of having a battle buddy was important, though. If you should actually be sent into battle, you would want to make sure you could depend and count on that soldier to be there for you. You should be able to count on them when you need them and know that they will always have your back, no matter what.

In relation to your financial life, it’s important to have a similar type of battle buddy, especially if you are trying to get out of a low spot, like getting out of debt. It’s difficult to get out of debt especially without having some sort of battle buddy that leads you through the trenches.

The total opposite of a battle buddy is what we call a “blue falcon” (also called a “buddy fudger”). Blue falcons are those who only care about themselves and would often get the platoon in trouble. Think of the movie Full Metal Jacket. Private Pyle is the epitome of a blue falcon. We had a few of those in basic training, and I had to complete many pushups because of them.

If you made the choice to get out of debt or if you’re aiming for another financial goal, it’s important to have at least one solid battle buddy on your side.

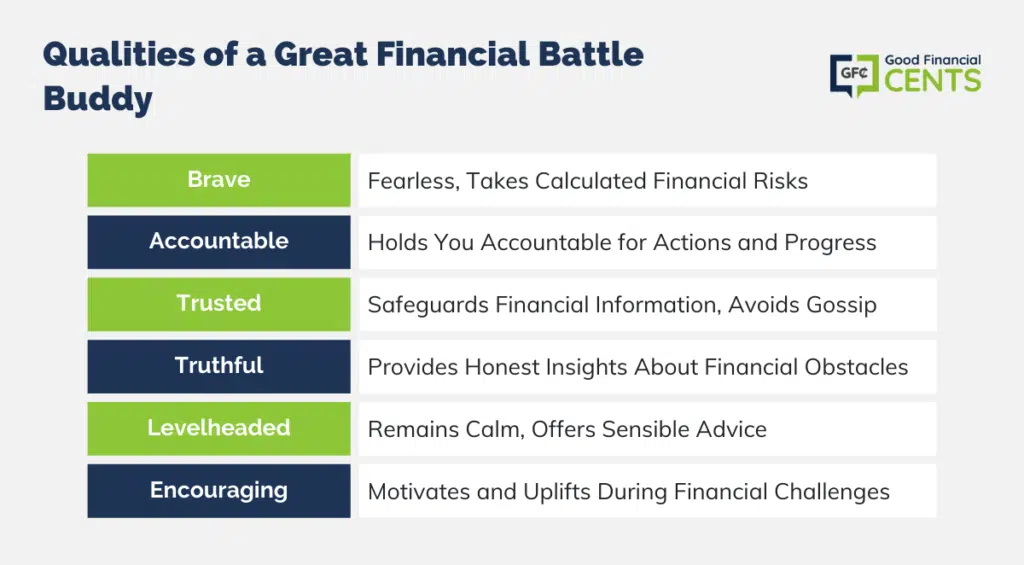

The 6 Qualities of a Great Financial Battle Buddy

If you’re trying to determine if someone can pass the test of being a true battle buddy, take a look at the important qualities of a battle buddy below that form the acronym “B.A.T.T.L.E.” (nifty, eh?). Does your financial “battle buddy” have these qualities? If not, they might be a blue falcon instead.

B-rave

Financial battle buddies are brave. Really brave. They take money to a whole new level. They’re not afraid to combine finances with their spouse, stick to a strict budget, or make sacrifices in the short term for their long-term financial success.

Why does it matter that your battle buddy is brave? Because like it or not, they’re going to influence you with their own behavior. If they’re not brave enough to face up to their own financial woes, what makes you think you’ll learn anything from them?

There’s a distinction, however, between being brave and being stupid. Those who are brave take calculated risks. They’re certainly risks, but they have a good chance of having a high reward. Let me give you a few examples of the difference between being brave and being stupid.

It’s a brave thing to start taking steps to starting a new career. Education is one of the best investments. By saving and spending a little money on education, you can land a new career with better pay. Income is a powerful tool to help you build wealth.

It’s a stupid thing, though, to borrow a bunch of money to start a new business when you have no proof that the concept has a high likelihood of working out.

For example, let’s say you want to start a flamingo petting zoo in your hometown. You’ve never heard of one before, but you decide to fund the operation with credit cards. This, my friend, is stupid. Instead, do some research and see if people really want to pet flamingos. And when you start the business, pay for it with your own money, not someone else’s money.

A-ccountable

Financial battle buddies also need to be accountable for their actions – and they need to hold you accountable, too.

Does your battle buddy hold you accountable? If you make mistakes, do they make you fess up or do they let it slide?

Make sure that you make yourself open to their accountability. Tell your financial battle buddy that you welcome them to hold you accountable. Ask them to call you randomly to check up on your progress. Ask them to point out your financial downfalls. Even ask them to approve purchases over a certain amount or certain types of purchases if you’re trying to curb a spending problem.

T-rusted

If you have a true financial battle buddy, are you trusting them with the knowledge of your entire financial situation? If not, it’s probably a bad sign that you can’t trust them with that information.

Battle buddies can – and should – be trusted with everything. You should feel comfortable, for example, explaining to them how much debt you have, what your credit score is, how much you have saved in the bank, how much you have invested for retirement, and so forth.

How do you find a trustworthy person? Find someone who doesn’t gossip about others. If they’re not gossiping about others, most likely, they won’t gossip about you – especially if you’re doing the right thing anyway. 😉

T-ruthful

Your financial battle buddy should also be truthful with you about your situation. When they are holding you accountable, do they tell you the whole truth about your financial obstacles? Ask them to be upfront with you about everything. If they don’t, you’ll miss out on opportunities to make the most out of your money.

Truth is a powerful tool in your battle buddy’s belt. Consider maps, for example. On the battlefield, maps are crucial in that they help you know where you are in relation to enemy territory. Having a true picture of your financial situation will help you get from where you are to where you want to be – without walking into a trap.

Battle buddies provide an accurate picture of where you’re at so that you can find the path forward toward a successful mission.

L-evelheaded

Battle buddies are calm and sensible. They’re calm in that they don’t freak out when they hear about your dire financial situation. Instead, they provide sensible advice and consistently deliver what you need to hear.

If your so-called “battle buddy” influences you to spend more, there’s a problem. For example, if you think that your coworker or friend who always asks you to go out to Happy Hour or to go shopping is a good financial battle buddy, think again.

Remember, battle buddies know your financial situation inside and out. If they know your financial situation and are wishy-washy with their advice, it’s time to find a more levelheaded friend who can help you do the right thing.

Those who aren’t levelheaded are just blue falcons in disguise.

E-ncouraging

Great financial battle buddies lift you up and encourage you on your journey.

Imagine traversing the battlefield, and your so-called “battle buddy” starts whimpering, “You’re not going to make it. Turn back. There’s no hope for you.” Um, that’s depressing. You might actually be tempted in that situation to turn back!

Instead, even when you get knocked down, your battle buddy will say things like: “It’s just a little scratch, keep going! You can make it! Have you come all this way to give up now? No. You’re a warrior and you’re not going to give up on my watch! Forget about it!”

Your financial battle buddy is there to encourage you when you fall off the budgeting bandwagon, for example. Remember, if you don’t keep going, that’s guaranteeing and solidifying failure.

Perhaps you’ve been to a concert and heard a musician make a mistake. Maybe they hit the wrong key or belted out the wrong lyric.

It’s the same way when your battle buddy sees you wanting to quit: it’s disappointing to them. At the slightest detection of your hesitation to continue, they lift you up and push you to keep going.

Final Thoughts – Have You Chosen Your Financial Battle Buddy?

If you haven’t chosen your financial battle buddy yet, please do. It’s worth it. But make sure they have these qualities first. You don’t want someone who doesn’t know what they’re doing or talking about.

Remember the qualities of a good financial b.a.t.t.l.e. buddy. Are they brave? Are they accountable? Are they trusted? Are they truthful? Are they levelheaded? Are they encouraging? If anyone is lacking in even one of these areas, it’s best to find someone else who can help you actually achieve your financial goals. The last thing you want is someone’s inexperience hurting your chances of future financial success.

Identify your battle buddy, watch each other’s backs, and start your journey to financial freedom – together.

This is brilliant. I hadn’t thought about having someone like this for finances, but it makes perfect sense. As I work my way out of student loan debt from law school, it would be incredible to have a battle buddy who knows it all. Maybe even a fellow blogger since the passion and commitment will be there. I think it will be really helpful.