Imagine you’re a small business that wants to raise (A LOT) of capital from potential investors.

In the past, there were strict regulations, mounds of paperwork, and an uphill battle in trying to find people who would actually invest in your company.

That was then, this is now. Introducing crowdfunding…

The Business Start-up Act, otherwise known as the Crowdfund Act, is a new provision of the JOBS Act that was enacted on April 5th.

This act allows for what’s called crowdfunding, which is the ability of a company to raise money through large numbers of people.

As it stands, a small business will be able to raise $1 million in capital in any one-year period by selling securities, but without having to go through the pain and anguish of registering with either State or Federal regulators.

This can be potentially huge for small businesses that have trouble acquiring traditional financing from local banks and financial institutions.

In the digital age, this can be that much more monstrous in that it removes restrictions on start-up companies seeking investors over the Internet.

As you can imagine, this can be a really exciting thing for investors, with over 6.7 million new small businesses being launched each year.

But also can be very scary as the potential for fraud is very real.

Table of Contents

Who Can Invest?

The JOBS Act does limit the amount an individual investor would be able to invest through crowdfunding in any one-year period.

- An investor who’s making less than $100,000 per year can only contribute the greater of $2,000 or 5% of your annual income or net worth. Please be advised that your home residence will be excluded.

- For investors who are making more than $100,000, your percentage goes up to 10%.

If you classify as an accredited investor, meaning that you’ve made $200,000 a year each of the prior two years or have a net worth of at least $1 million, then as of now there are no limitations.

Investor Categories and Investment Limits

| INVESTOR CATEGORY | LIMIT |

|---|---|

| Less Than $100,000 | $2,000 or 5% Of Annual Income/Net Worth, Excluding Residence |

| More Than $100,000 | 10% Of Annual Income/Net Worth |

| Accredited Investor | No Limitations if Annual Income |

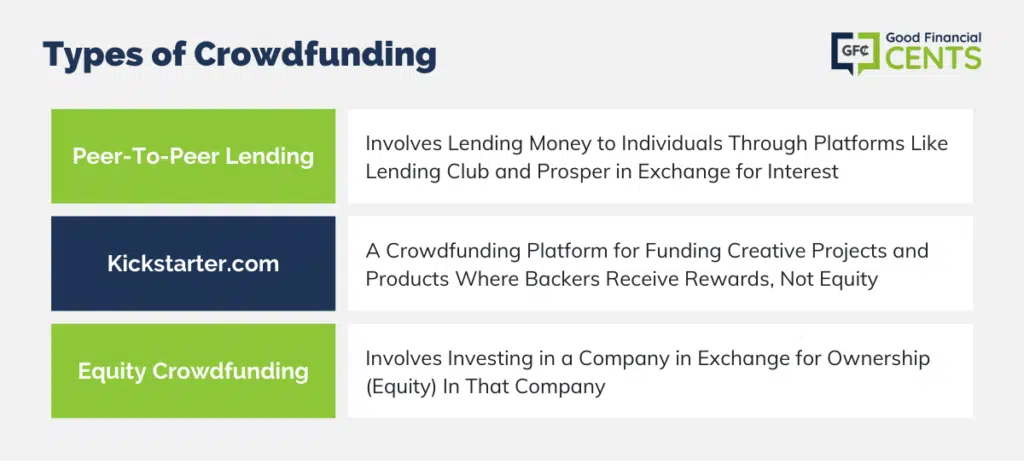

Types of Crowdfunding

Crowdfunding is a concept that excites me, but I fear many will be taken advantage of chasing unrealistic returns.

One of the crowdfunding concepts that I’m currently enjoying is peer-to-peer lending. Peer-to-peer companies like Lending Club and Prosper are a great way, in my opinion, to make a good rate of return while crowdfunding other people’s debt.

You can read more about them in the Lending Club review and Prosper review posts.

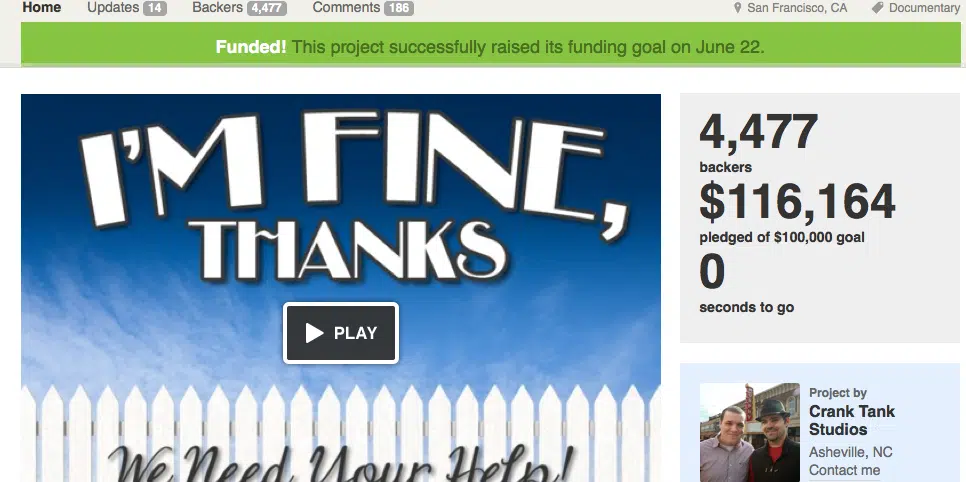

Another form of crowdfunding that’s exciting for a lot of people is a website named Kickstarter.com. A good friend of mine, Adam Baker, raised over $100,000 to help fund his documentary project, I’m Fine Thanks.

I’m sure Adam would agree that without the Kickstarter.com platform that allowed him to take his message on a global scale, he never would have been able to fund his dream.

The big differences between Lending Club, Prosper, and Kickstarter.com are that peer-to-peer lending is crowdfunding for debt and Kickstarter.com is funding for what is considered to be rewards. There is no equity in either one of these. With crowdfunding there is.

What You Need to Know About Crowdfunding Investing

I was recently contacted by a crowdfunding site that wanted to guest post here on the blog. Conveniently enough I had just read an article on crowdfunding and was intrigued to learn more about it so it was very good timing.

Instead of a guest post, I had them answer some questions regarding crowdfunding so that both you and I can learn something.

The following questions are answered by Daniel Hirsch, Managing Partner of First Line Capital, the company that launched IPOVillage.com. IPO Village is just one of hundreds (possibly thousands) of crowdfunding sites that are popping up all over the web.

I am in no way endorsing them, so don’t treat this article as such.

Can You Provide a Basic Overview of What Crowdfunding Is and What’s Changed in the Jobs Act?

In short, crowdfunding is when a company reaches out to the public – or the crowd – seeking investors to raise money for their business. In the past, to raise capital from the public, a private company was only able to offer investment opportunities to accredited investors.

The JOBS Act is proposing to change this requirement and allow companies to raise a limited amount (amount not yet to be defined) from non-accredited investors as well, with the hope of stimulating small business investment. (Please note that this is a very brief description of the JOBS Act.)

How Do Crowdfunding and the Jobs Act Impact the Average Everyday Investor?

Everyday (non-accredited) investors (including penny stock investors, mom-and-pop investors, first-time investors, and even more seasoned investors) had not previously had the opportunity to invest in private companies on a large scale. With the JOBS Act, this is to change.

Moreover, with crowdfunding, exclusive IPO investing opportunities can now go to the masses – which is the purpose of IPOVillage.com.

This a major game changer for the investment world as “open-door” access is now being granted for the everyday Main Street investor into the most exclusive of Wall Street offerings, resulting in retail investors and the everyday “Joe” being able to get in on the ground floor of new IPO investment opportunities. These opportunities were once only made available to “exclusive institutions and sophisticated investors”.

What Are the Advantages And/Or the Risks With Crowdfunding?

The advantages of crowdfunding are simple, large numbers of private companies can solicit a large number of investors. Good for small companies as it gives them a new and large source of potential capital. Good for investors because they now have the freedom and opportunity to invest in small companies at an early stage.

On the downside, investors have limited data and information on their investments both pre and post-investment. Additionally, an exit strategy for the investor is vague as there is no market for the shares they are purchasing.

What Is IPO Village and How Is It Delivering Benefits to the Everyday Investor?

IPO Village is solely focused on crowdfunding for public companies. When a company goes public and registers shares with the SEC and FINRA this is called an IPO. In the past, companies would go public and sell their shares (at a steep discount) to underwriters, who then sold the shares to their preferred clients who then sold their shares via the stock market.

With IPO Village, companies doing their IPO can now reach out directly to investors and cut out all the middlemen. This offers many benefits:

- As IPO Village is a public service site that does not charge fees, every dollar invested goes directly to the company. This benefits the company and the investor.

- Investors get to invest in IPOs at pre-IPO prices (no discounts to underwriters and their clients).

- By reaching out to the public, there should be a larger shareholder base which should lead to healthier trading of the stock in the future.

- As a public company, there are numerous safety advantages to the investors. Firstly, information. All public companies are required to file quarterly and annual reports that delve into the financials of the company, the management of the company, the major risk factors facing the company, the company’s strategic plans going forward, and much more. Additionally, all financial statements are reviewed by an approved independent auditor.

With So Many Crowdfunding Sites Popping up on the Web, How Is an Investor Supposed to Know How Similar One Site Is to the Next?

Good practice when they have to select between actual companies to invest in. The following words are framed in my office

“Due diligence, due diligence, due diligence… review it once, review it twice, review it three times.”

You always conduct some form of due diligence. In this case, you want to scour Google for reviews from previous investors on any particular platform. There are many such blogs reviewing and rating the plethora of platforms out there. Even reach out to them directly when convenient, to discuss their experiences.

Additionally, it is critical to review the founders and management team. Don’t just be satisfied with the short bios they post (if they do at all). Google them … learn as much as you can.

If you are bold enough, work up a list of questions and send it to them directly. Obviously, the level of due diligence should always be commensurate with the level of investment (use your common “cents”).

Since It Seems That This Act Applies to Startups, Isn’t There a Real Concern for Investors Since Statistics Say Half of All Small Businesses Fail in the First 5 Years?

This is simply the old “risk/reward ratio” that all investors have applied throughout history. Every responsible investor that takes they’re investing seriously, should be diversifying their portfolio. In essence, diversification boils down to allocating the appropriate portions of your available investment capital into several diverse/distinct risk categories (and therefore, obviously distinct return categories).

The lower the risk, the lower the return… the higher the risk the higher the return. All investors want at least that remote possibility of realizing a true upside potential. In order for that to even be in the cards, one must extend the diversification to a minor allocation towards higher risk-higher reward-type investments in the portfolio.

Final Verdict on Crowdfunding

As I previously mentioned, crowdfunding can be exciting for those who are tired of traditional investing and looking for alternatives to the stock market. But the scariest truth about crowdfunding is how easy it will be – almost too easy – for a business to raise money from potential investors. Potential investors will probably not do their homework and due diligence before making an investment.

A fellow financial planner and blogging CFP Neal Frankle of Wealth Pilgrim shares these sentiments in his post “What Is Crowdfunding and Why it Stinks Bad“. Here’s a comment from his post:

I don’t like this investment alternative because most small businesses fail and because most investors don’t have the training to spot the few diamonds in the rough. As a result, I believe most people who invest in these ideas will lose money.

I think Neal is spot on and you’ll soon see a special on 60 Minutes on how innocent ignorant investors were taken advantage of by some crowdfunding scheme.

Nonetheless, it looks like crowdfunding is on its way in so you better be ready and start doing your homework if you think you want to take part.

0 Comments