As the number of peer-to-peer lending sites has grown in the past few years, the loan types being offered are also expanding.

These sites are now providing the types of peer-to-peer loans that were once available only through traditional banks and loan sharks.

Find out more information here on “how do I get a loan?”, to help you with your decision making process!

What’s more, peer-to-peer lending is quickly democratizing the whole loan process. Borrowers come to borrow money, and investors come to lend it to those borrowers, each looking for an interest rate advantage that they cannot get with the banks and other sources. This is creating a growing interest in peer-to-peer lending for both groups.

This is the major advantage to borrowers, since the types of loans available, as well as the loan terms and amounts, are growing as the industry expands.

Table of Contents

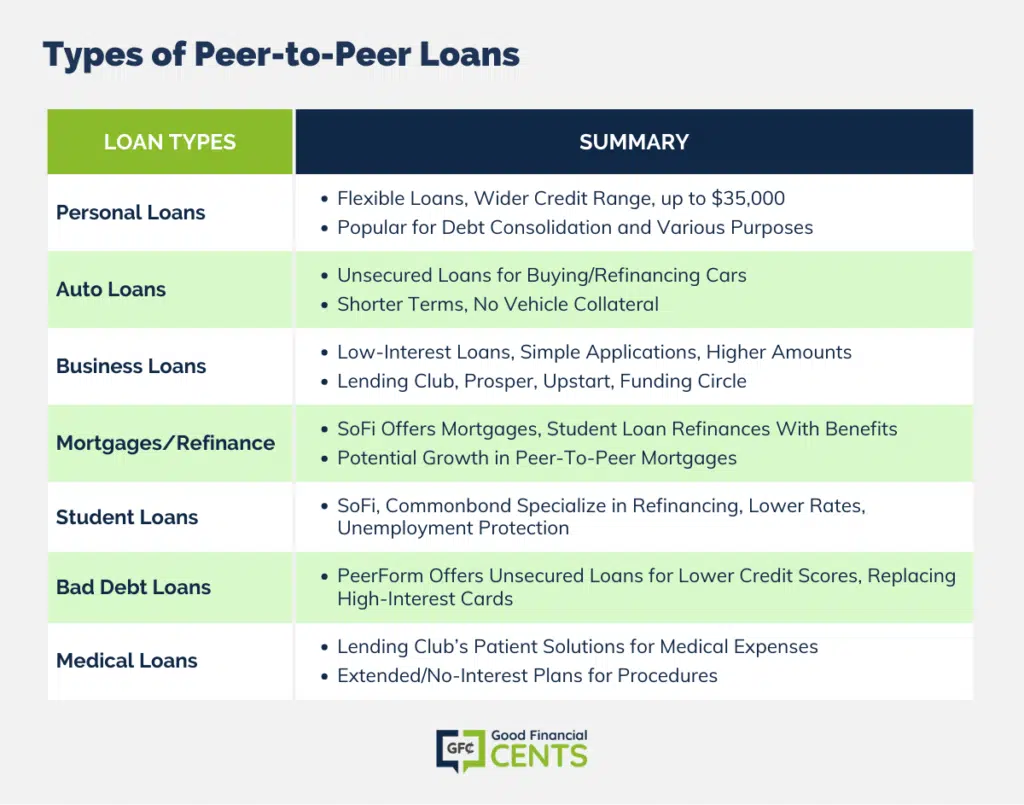

Here are the major loan types currently available from popular peer-to-peer lending sites.

Personal Loans

Personal loans are probably the most common loans provided by peer-to-peer lending sites. Flexibility is a major reason for this. Peer-to-peer lenders have fewer restrictions on loan funds than traditional banks do.

Credit quality is another factor. While banks tend to lend within very narrow credit score ranges, peer-to-peer sites will often extend loans to people with fair credit.

If you have excellent credit, you can typically borrow up to $35,000 on an unsecured loan with a term of anywhere from two years to five years. Interest rates start in the mid-single digits, which is a lot lower than what you’ll pay on credit cards.

Unlike lines of credit that are typically offered by traditional banks, peer-to-peer sites offer fixed-rate loans that will be completely paid in full within not more than five years. This will allow you to get out of debt faster than if you work out payoff strategies with individual revolving lines of credit.

Most peer-to-peer platforms will do personal loans. Lending Club is the largest peer-to-peer lending site, and they will do personal loans for debt consolidation, credit card balances, home improvement, car loans, and even loans for swimming pools (imagine a bank making a loan on that last one!).

The second largest lender is Prosper and they are highly competitive with Lending club.

If you are looking for a lending platform that will be able to fund your loan quickly, consider Avant. Through Avant, if your loan application is approved, you could get funds into your account as soon as the next business day if approved by 4:30 pm CST Monday – Friday.

Debt consolidation is one of the most common reasons people seek peer-to-peer loans. Such loans enable people who are struggling with high-interest rate credit card debt to consolidate several credit lines into a single fixed-rate loan, that will be paid off in five years or less. That offers borrowers a real opportunity to finally get out of debt completely.

Credit cards are revolving debt arrangements, where it’s possible that the borrower will never get out of debt since the monthly payments will always drop along with the lower loan balance.

There’s yet another reason why peer-to-peer debt consolidation loans are beneficial to borrowers. One of the biggest factors affecting credit scores is debt utilization on credit cards.

If the utilization rate is high, which is defined as anything more than 30% of your total available credit, then paying off your credit lines can be a way to improve your credit score within a few short months.

Several credit lines, some approaching the credit limits, can be replaced with a single-term loan. That seems to please the credit scoring algorithms!

Auto Loans

Auto loans are something of an unofficial loan type on peer-to-peer sites. You can borrow money to purchase or refinance a car, but the loan may not be officially a car loan.

For example, with Lending Club, you can borrow up to $35,000 on a personal loan, which you can use either to buy or refinance a car.

The rates being offered on car loans (or more specifically, on personal loans) may be higher than what you can get through your bank, but peer-to-peer sites have one advantage that bank auto loans don’t have: the loans will not actually be secured by your car.

That can be an important advantage too. As you almost certainly use your car in the production of income – either to commute to your job or to use for your business – it’s better to own the vehicle on a debt-free basis.

Still another advantage is that peer-to-peer loans generally extend to terms of not more than 60 months, or five years. Bank-provided auto loans are now running as long as 84 months, or seven years.

Though the monthly payment on a five-year peer-to-peer loan will be higher than it will be for a seven-bank auto loan, it will be far less likely that you will end up owing more on the loan than the car is worth at any time during the loan term.

Business Loans

Peer-to-peer lenders are rapidly filling the business loans niche. That’s a good thing too. While hundreds of banks advertise that they provide business loans, they tend to have tough lending criteria, require unimaginable amounts of documentation, and don’t make nearly as many loans as they say they do.

Peer-to-peer lenders are bringing all of the same advantages to businesses that they are bringing to other types of loans. That includes low interest rates, a simple application process, quick turnaround time, and greater credit flexibility.

It is often possible to get business loans on peer-to-peer sites that are completely unavailable from traditional banks.

Four of the more popular peer-to-peer sites that provide business loans include Lending Club, Prosper, Upstart and Funding Circle. Each offers different parameters for the loans that they will make to your business.

Loan amounts are another advantage, in that they are often higher than the amount you can get through a bank. For example, Funding Circle provides business loans for up to $500,000.

Most peer-to-peer lenders will also make loans that require no collateral. For example, Lending Club will loan as much as $100,000, while Prosper and Upstart will go to $35,000 – all requiring that no collateral be pledged as security for the loan. And when collateral is required, it is usually in the form of either a general lien on the business or on the business invoices.

Business loans are close to impossible to get from banks if you are a small business owner. Banks typically make loans available to large business enterprises, such as well-established publicly traded companies.

If you are a small, independent business, you may not have access to business loans from banks at all. For this reason, peer-to-peer business loans figure to grow steadily in the future.

Mortgages and Refinances

Mortgage lending has always been a complicated process. Still, peer-to-peer lending is moving into this type of financing, on both purchases and refinances.

Even though it specializes in student loan refinances, SoFi also makes mortgage loans available. They currently provide mortgages in 23 states, including the District of Columbia.

They will do mortgages on owner-occupied primary residences and second homes, including single-family homes, condos, townhomes, and planned unit developments (PUDs). Financing, however, is not available for rental properties or for co-ops.

You are generally required to make a down payment of at least 10% of the purchase price, however, mortgage insurance is not required, the way it typically is anytime you purchase a home with a down payment of less than 20%.

They do not charge origination fees on their mortgages, and you can generally close the loan within 30 days of application. All loans come with no prepayment penalty, and you can borrow as much as $3 million.

Mortgage lending is extremely competitive, and peer-to-peer sites are not yet as aggressive on pricing and terms as the industry standard. However, since P2P is a relatively new enterprise, it’s all in a state of flux, and if mortgage lending progresses the way other types of loans on the web, good things are coming!

Student Loans

Peer-to-peer lenders are perhaps more important when it comes to student loan refinances then for any other loan type. While you can get student loans from hundreds of sources, including banks and the federal government, finding lenders who will do a student loan refinance is tough. You can probably count the number of lenders who do on two hands.

Two of the most prominent lenders that provide student loan refinances are SoFi and CommonBond, and they’re both peer-to-peer lenders. In fact, both platforms specialize in providing student loan refinances.

Even if you have little interest in getting a loan from a peer-to-peer site, you will almost certainly come across these two platforms in your search for a lender who does student loan refinances.

One of the complications with student loan refinances is that while getting the original loans may not have required you to qualify, you will be required to be both credit– and income-qualified in order to do a student loan refinance. That’s where peer-to-peer sites can have a big advantage over traditional banks.

Not only does SoFi specialize in student loan refinances, but the entire platform has been set up specifically for that purpose. And this is where the peer-to-peer factor becomes even bigger.

SoFi was founded by people who are closely associated with the college community and have created the site to go beyond traditional lending. This is evident with the platforms underwriting criteria.

They don’t just look at income and credit, but also consider your career experience (some fields and jobs are viewed more favorably than others) and your education (your major field of study and education history).

You can refinance up to the full balance of your qualified education loans outstanding, and often do so at rates that are lower than what is offered by the banks. The site claims that their members save an average of $14,000 by doing a student loan refinance through the site.

CommonBond also specializes in student loan refinances and claims similar savings to what you can get with SoFi. You can refinance up to $500,000 in student loans, but again you must be credit- and income-qualified.

They charge no fees in connection to your refinance, except the interest that you pay on your loan. And again, that rate is often lower than what you can get from traditional banks.

Both SoFi and CommonBond offer unemployment protection. In the event that you become unemployed, they will suspend payments for up to 12 months.

SoFi will also provide job placement assistance, but you must provide evidence that the job loss was caused by no fault of your own.

With student loans growing exponentially in recent years, peer-to-peer sources should only increase in the years ahead.

Bad Debt Loans

It’s probably an exaggeration to say that peer-to-peer lending had moved into subprime loans. However, the industry is gradually making progress into making credit available to borrowers that banks might consider as having either fair or poor credit.

PeerForm is an example of such a P2P site. They will make loans of up to $25,000 available for borrowers with credit scores as low as 600. Loan APR’s range from 7.12% to as high as 28.09% for the lowest low grades.

What’s more, PeerForm makes its loans available on an unsecured basis. This gives you a source of credit that could conceivably replace high-interest credit cards.

In that same regard, PeerForm also makes installment loans available to replace your line of credit, making it easier and faster to get out of debt.

In addition, by using a single loan to pay off several credit cards, you can potentially increase your credit score almost immediately, which in itself will improve your situation considerably.

Medical Loans

Like student debt refinances, medical financing is becoming more important all the time. As deductibles and copayments rise, and as certain treatments and procedures are disallowed by traditional health insurance policies, the need for medical financing is growing.

Generally speaking, medical financing is available on peer-to-peer sites to cover the growing list of expenses that health insurance doesn’t cover.

Lending Club is one peer-to-peer site that is providing medical financing under their Patient Solutions program. The loan program is available to cover expenses for dental, fertility treatments, hair restoration, and weight loss surgery – procedures and treatments that are not normally covered by most health insurance policies.

Lending Club offers two plans, the Extended Plan and the True No-Interest Plan.

Under the Extended Plan, you can borrow between $2,000 and $50,000, at terms ranging from 24 months to 84 months. Loan APR’s are between 3.99% and 24.99%, based on the amount financed and your credit history.

Under the True No-Interest Plan, you can borrow between $499 and $32,000, but the loan purpose is limited to dental and hair restoration. The interest-free period ranges from six months to 24 months.

If you pay off the balance within the term, you will pay no interest. However, any balance remaining after the expiration of the promotional term will have a variable APR of 22.98%.

Peer-to-peer lending is growing in leaps and bounds, and as it does, there are more types of loans available than ever before. If you’re looking for a loan of any type, be sure to check out popular peer-to-peer lending sites to see what they have available.

Not only may you find a loan that you didn’t think was available anywhere, but you may find that you can get a lower interest rate for it than at any bank in town.

Final Thoughts on Types of Peer-to-Peer Loans

Peer-to-peer lending sites have expanded their offerings beyond traditional banks and loan sharks, providing various loan types. Borrowers and investors benefit from this democratized lending process. Personal loans offer flexibility and extend to people with fair credit. Auto loans are available for buying or refinancing cars without vehicle collateral.

Business loans offer low rates, quick turnaround, and greater credit flexibility. Mortgage lending, student loan refinances, and medical financing are also emerging. Peer-to-peer lending continues to diversify, offering borrowers opportunities they might not find elsewhere, often with lower interest rates than traditional banks.