When I became an accredited investor, I found myself among an elite group with the financial means and regulatory clearance to access investments that many couldn’t. This opened doors to exclusive realms like hedge funds, venture capital firms, specific investment funds, private equity funds, and more.

Even though I had this “exclusive access” it took me a while to start investing in alternative asset classes.

The Securities and Exchange Commission states that as an accredited investor, I possess a level of sophistication that equips me to craft a riskier investment portfolio than a non-accredited investor. While this might not be universally true for everyone, in my case, I had demonstrated the financial resilience to bear more risk (see barbell investing), especially if my investments took an unforeseen downturn.

Table of Contents

One of the intriguing aspects I discovered was that investment opportunities for accredited investors aren’t mandated to register with financial authorities. This means they often come with fewer disclosures and might not be as transparent as the registered securities available to the general public.

The underlying belief is that my status as a sophisticated investor implies a deeper understanding of financial risks, a need for less disclosure of unregistered securities, and a conviction that these exclusive investment opportunities are apt for my funds.

On a personal note, as a practicing CFP®, I haven’t always worked with accredited investors. Early in my career, I didn’t quite grasp the allure. However, as time went on, I began to see the broader spectrum of investment options available to accredited investors.

As I learned more the clearer it became why this realm was so sought after. The variety and potential of these exclusive opportunities were truly eye-opening, reshaping my perspective on the world of investing.

Introduction to Accredited Investors

An accredited investor is an individual or a business entity that is allowed to trade securities that may not be registered with financial authorities. They are entitled to this privileged access because they satisfy one or more requirements regarding income, net worth, asset size, governance status, or professional experience.

The concept of an accredited investor originated from the idea that individuals or entities with a higher financial acumen or more resources are better equipped to understand and bear the risks of certain investment opportunities.

Historically, the distinction between accredited and non-accredited investors was established to protect less experienced investors from potentially risky or less transparent investment opportunities.

Regulatory bodies, such as the U.S. Securities and Exchange Commission (SEC), have set criteria to determine who qualifies as an accredited investor, ensuring that they have the financial stability and sophistication to engage in more complex investment ventures.

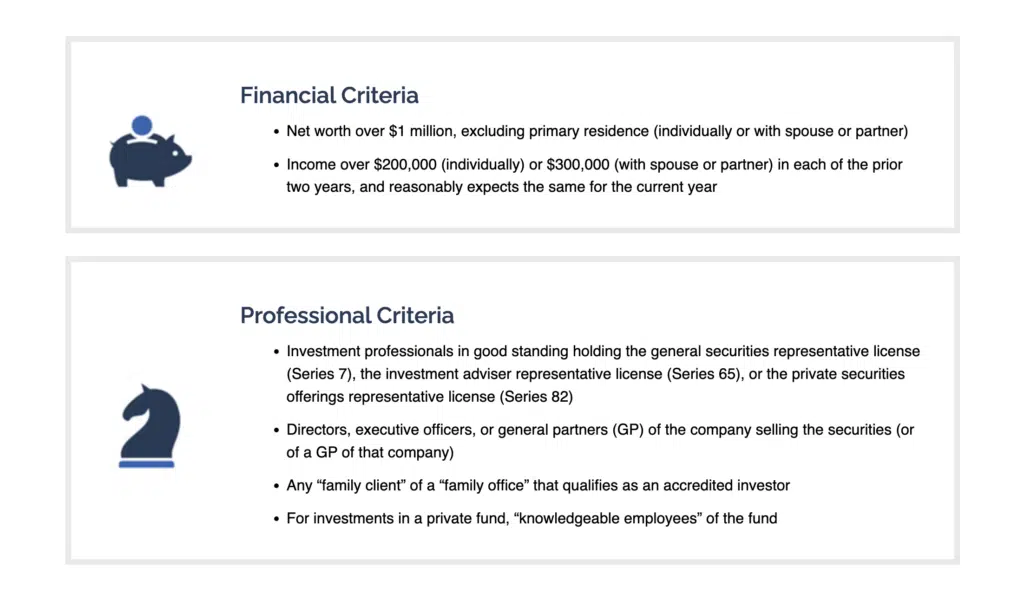

Criteria for Becoming an Accredited Investor

To be classified as an accredited investor, one must meet specific criteria set by regulatory bodies:

| Criteria | Description |

|---|---|

| Income Requirements | An individual must have had an annual income exceeding $200,000 (or $300,000 for joint income with a spouse) for the last two years, with the expectation of earning the same or a higher income in the current year. |

| Net Worth Requirements | An individual or a couple’s combined net worth must exceed $1 million, excluding the value of their primary residence. |

| Professional Credentials | Recent updates have expanded the definition to include individuals with certain professional certifications, designations, or other credentials recognized by the SEC. Examples include Series 7, Series 65, and Series 82 licenses. |

| Business Entities | Entities, such as trusts or organizations, with assets exceeding $5 million can qualify. Additionally, entities in which all equity owners are accredited investors may also be considered accredited. |

Best Investment Opportunities for Accredited Investors

Here’s a rundown of some of the top investments for accredited investors…

1. Fundrise

- Minimum Investment: $500

- Best for Newbie Investors

Fundrise has revolutionized the real estate investment landscape. By democratizing access to real estate portfolios, it allows individuals to invest without the complexities of property management or the need for vast capital. The platform’s innovative approach provides exposure to a traditionally lucrative, yet often inaccessible, sector of the market

Through Fundrise, investors can access a diversified range of properties, from commercial ventures to residential units. The platform’s expert team curates these portfolios, ensuring a balance of risk and reward. With its user-friendly interface and transparent reporting, Fundrise has become a top choice for many venturing into real estate investments.

How It Works

Investors start by choosing a suitable investment plan on Fundrise. Once invested, the platform pools the funds with other investors and allocates them across various real estate projects. As these properties generate rental income or appreciation in value, investors receive returns in the form of dividends or appreciation.

Pros & Cons

Pros

Cons

2. Equitybee

- Minimum Investment: $10,000

- Best for: Experienced Investors

Equitybee offers a unique platform that bridges the gap between private companies on the cusp of going public and potential investors. This innovative approach provides a golden opportunity for investors to tap into the potential of startups and other private firms before they make their public debut.

The platform’s primary focus is on employee stock options. By allowing investors to invest in these options, they can potentially benefit from their appreciation as the company grows. With a vast array of companies, from emerging startups to established giants, Equitybee presents a diverse range of investment opportunities.

How It Works

Investors browse available stock options from various companies on Equitybee. Once they choose an option, they invest their funds, which are then used to purchase the stock options from the employees. If the company goes public or gets acquired, the investor stands to gain from the increased value of these stocks.

Pros

Cons

3. Percent

- Minimum Investment: $500

- Best for Novice Investors

Percent stands as a beacon in the vast sea of the private credit market, illuminating a sector often overshadowed by traditional investments. This burgeoning market, valued at over $7 trillion, consists of companies borrowing from non-bank lenders. Percent offers a unique vantage point into this market, allowing investors to diversify their portfolios beyond typical stocks and bonds.

The allure of Percent lies in its ability to offer shorter terms and higher yields, combined with investments that are largely uncorrelated with public markets. This makes it an attractive proposition for those looking to step away from the volatility of traditional markets.

How It Works

Upon joining Percent, investors are presented with a plethora of private credit opportunities. After selecting an investment, funds are pooled with other investors and lent out to companies seeking credit. As these companies repay their loans, investors earn interest, providing a steady income stream.

Pros

Cons

4. Masterworks

- Minimum Investment: $10,000

- Best for Novice Investors

Masterworks paints a vivid picture of art investment, blending the worlds of finance and fine art. Traditionally, investing in art was a luxury reserved for the elite. However, Masterworks has democratized this, allowing individuals to buy shares in artworks from world-renowned artists.

The platform’s strength lies in its expertise. From authentication to storage, every facet of art investment is handled meticulously. This ensures that investors can appreciate both the beauty of their investments and the potential financial returns.

How It Works

After registering on Masterworks, investors can browse a curated selection of artworks. They can then purchase shares, representing a fraction of the artwork’s value. Masterworks take care of storage, insurance, and eventual sale. When the artwork is sold, investors share the profits based on their ownership.

Pros

Cons

5. Yieldstreet

- Minimum Investment: $15,000

- Best for: Advanced Investors

Yieldstreet stands at the intersection of innovation and alternative investments. It offers a smorgasbord of unique investment opportunities, ranging from art to marine finance. For those looking to venture beyond the beaten path of traditional stocks and bonds, Yieldstreet presents a tantalizing array of options.

The platform’s allure lies in its curated selection of alternative investments, each vetted by experts. This ensures that while investors are treading unconventional grounds, they’re not stepping into the unknown blindly.

How it Works

Investors begin by browsing through the diverse investment opportunities on Yieldstreet. After selecting their preferred asset class, their funds are pooled with other investors and allocated to the chosen venture. Returns are generated based on the performance of these assets, be it through interest, dividends, or asset appreciation.

Pros

Cons

6. AcreTrader

- Minimum Investment: $10,000

- Best for Newbie Investors

AcreTrader, as its name suggests, brings the vast expanses of farmland to the investment table. It offers a unique opportunity to invest in agricultural land, combining the stability of real estate with the evergreen nature of agriculture. With the global population on the rise, the value of fertile land is only set to increase.

The platform meticulously vets each piece of land, ensuring only the most promising plots are available for investment. This rigorous process ensures that investors are planting their funds in fertile ground, poised for growth.

How It Works

Investors peruse available farmland listings on AcreTrader. After selecting a plot, they can invest, effectively owning a portion of that land. AcreTrader manages all aspects, from liaising with farmers to ensuring optimal land use. Investors earn from the appreciation of land value and potential rental income.

Pros

Cons

7. EquityMultiple

- Minimum Investment: $5,000

- Best for: Experienced Investors

EquityMultiple is a testament to the power of collective investment in the real estate sector. By leveraging the principles of crowdfunding, it offers a platform where multiple investors can pool their resources to finance high-quality real estate projects. This collaborative approach allows for diversification and access to projects that might be out of reach for individual investors.

The platform’s strength lies in its curated selection of real estate opportunities, ranging from commercial spaces to residential properties. With a team of seasoned real estate professionals at the helm, EquityMultiple ensures that each project is vetted for maximum potential and minimal risk.

How It Works

Upon joining, investors can explore a variety of real estate projects. After committing to a project, their funds are pooled with other investors to finance the venture. Returns are generated through rental incomes, property appreciation, or the successful completion of development projects.

Pros

Cons

8. CrowdStreet

- Minimum Investment: $25,000

- Best for: Advanced Investors

CrowdStreet stands as a pillar in the commercial real estate investment domain. With its vast experience and industry connections, it offers a platform where investors can tap into prime real estate projects across the nation. From bustling urban centers to tranquil suburban locales, CrowdStreet provides a diverse range of investment opportunities.

The platform’s expertise ensures that each project is meticulously vetted, offering a blend of potential returns and stability. For investors looking to delve into commercial real estate without the hassles of property management, CrowdStreet is an ideal choice.

How It Works

After registration, investors can browse a myriad of commercial real estate offerings. Upon investing in a project, CrowdStreet manages the investment, providing regular updates and ensuring optimal project execution. Investors earn returns based on the project’s performance, be it through rentals, sales, or project completions.

Pros

Cons

9. Mainvest

- Minimum Investment: $100

- Best for Newbie Investors

Mainvest offers a refreshing twist in the investment landscape, focusing on the heart and soul of the American economy: local businesses. From quaint cafes to innovative startups, Mainvest provides a platform where investors can support and benefit from the growth of small businesses in their communities.

The platform’s community-centric approach ensures that investments are not just about returns but also about fostering local economies. For those looking to make a difference while earning, Mainvest presents a unique opportunity.

How It Works

Investors can explore various local businesses seeking capital on Mainvest. By investing, they essentially buy a revenue-sharing note, earning a percentage of the business’s gross revenue until a predetermined return is achieved.

Pros

Cons

10. Vinovest

- Minimum Investment: $1,000

- Best for Novice Investors

Vinovest uncorks the world of wine investment, offering a blend of luxury, history, and financial growth. Fine wines have been a symbol of opulence for centuries, and Vinovest provides a platform where this luxury becomes an accessible investment.

With a team of wine experts guiding the way, the platform ensures that each wine is not just a drink but an investment poised for appreciation. From sourcing to storage, Vinovest handles every facet, ensuring the wine’s value grows over time.

How It Works

After signing up, investors set their preferences and investment amounts. Vinovest then curates a wine portfolio based on these preferences, handling sourcing, authentication, and storage. As the wine appreciates, so does the investor’s portfolio.

Pros

Cons

11. Arrived Homes

- Minimum Investment: $100

- Best for Novice Investors

Arrived Homes offers a fresh perspective on real estate investment, focusing on the charm of single-family homes. While skyscrapers and commercial complexes often dominate real estate discussions, single-family homes offer stability, consistent returns, and a touch of nostalgia.

The platform’s strength lies in its focus. By concentrating on single-family homes, it offers investors a chance to tap into a stable real estate segment, benefiting from both rental income and property appreciation.

How It Works

Investors browse available properties on Arrived Homes. After selecting a property, they can invest in shares, representing a portion of the home’s value. As the property is rented out, investors earn a share of the rental income. Additionally, any appreciation in property value benefits the investors.

Pros

Cons

12. RealtyMogul

- Minimum Investment: $5,000

- Best for: Novice to Experienced Investors

RealtyMogul stands tall in the commercial real estate investment landscape. It offers a platform where diversification meets opportunity, presenting a range of commercial properties for investment. From bustling office spaces to serene residential complexes, RealtyMogul provides a plethora of options for investors to expand their portfolios.

The platform’s prowess lies in its dual approach. Investors can either dive into non-traded REITs or make direct investments in specific properties. This flexibility ensures that both novice and experienced investors find opportunities that align with their investment goals.

How It Works

Upon joining RealtyMogul, investors can choose between REITs or direct property investments. Their funds are then channeled into these real estate ventures. Returns are generated through rental incomes, property sales, or successful project completions.

Pros

Cons

The Future of Accredited Investing

The world of accredited investing is dynamic and ever-evolving. Emerging trends suggest a shift towards democratizing investment opportunities, with regulatory bodies considering more inclusive criteria for accredited investor status. This shift aims to balance the need for investor protection with the recognition that financial acumen can come from experience and education, not just wealth.

Furthermore, technological advancements are playing a pivotal role. The rise of blockchain and tokenized assets, for instance, is creating new avenues for investment and might reshape the landscape of opportunities available to accredited investors.

As the line between traditional and alternative investments blurs, the future promises a more integrated, inclusive, and innovative environment for accredited investors.

The Bottom Line – Top Investments for Accredited Investors

Understanding the role and opportunities of accredited investors is crucial in the modern financial landscape. While the distinction offers privileged access to unique investment opportunities, it also comes with increased risks and responsibilities.

As the world of investing continues to evolve, potential accredited investors are encouraged to stay informed, conduct thorough research, and seek professional advice. The realm of accredited investing, with its blend of challenges and opportunities, promises exciting prospects for those ready to navigate its complexities.