Finding the best renters insurance policy is what most renters want but aren’t interested in spending a lot of time weighing all the different options.

Worse, a lot of renters don’t know much about it, or think it’s important.

But if you rent the home you live in, whether it’s a house, a condo, or an apartment, renters insurance is no less important than homeowner’s insurance is to a homeowner.

Renters often assume that if they experience any losses due to disasters, such as fire and theft, they’ll be covered under the landlord’s insurance. That’s almost never true!

The landlord’s property insurance will cover the destruction of the building, but not the contents that are within it. And since virtually all of the contents in a rental property belong to you, the renter, you will be completely out of luck if disaster strikes.

Table of Contents

- Best Renters Insurance Companies for 2024

- What Is Renters Insurance?

- What Renters Insurance Covers

- Non-standard Renters Insurance Provisions

- What Renters Insurance Doesn’t Cover

- When Is Renters Insurance Needed?

- How Much Renters Insurance Do You Need?

- How Much Does Renters Insurance Cost?

- How to Lower the Cost of Renter’s Insurance

- What to Watch Out for With Renters Insurance

- Bottom Line – Should You Get Renters Insurance?

Best Renters Insurance Companies for 2024

It would be impossible to say which company offers the lowest premiums on renters insurance. That’s because the quotes you’ll get will be different based on your personal needs and profile, other insurance policies you might bundle with the renter’s policy, your geographic location, and the type of property you live in.

And while some companies seem to provide additional coverage, it’s hard to know if what they were giving were actual extras, or if they were simply giving more detailed quotes. It’s possible that similar types of coverage are available with all five companies.

What Is Renters Insurance?

Renters insurance is a specific type of coverage that insures the possessions that are stored in your rental property. Exactly which possessions are covered depends upon the type of renters insurance you have.

Whether you want to protect your prized jewels, new laptop, big screen TV, or a number of other items that are near and dear to your heart, a good renters insurance policy is probably well within your reach.

Renters insurance helps you not only with replacing stolen or damaged property, but also with protecting yourself from liability on your property and providing you with a backup plan in the event that your home itself is damaged. Let’s take a closer look at those below.

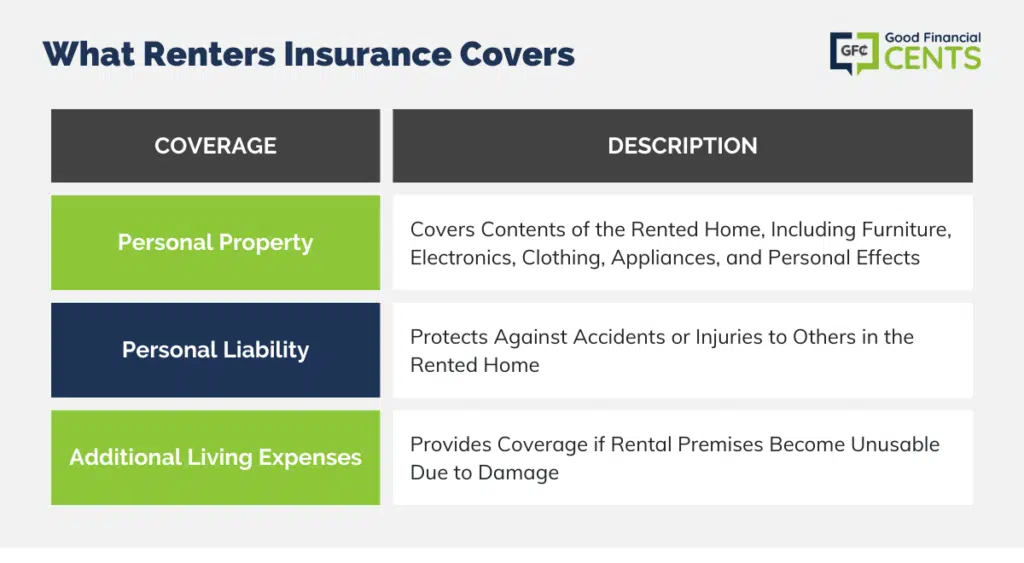

What Renters Insurance Covers

There are three standard provisions that will be found in nearly all renter’s insurance policies:

Personal Property

Similar to a homeowners policy, renters insurance covers the contents of the home you are renting. That includes furniture, electronic equipment, clothing, appliances, and personal effects. You will typically take a policy that will cover anywhere from $10,000 to $100,000 in personal property, though it can be higher.

To determine how much personal property coverage you need, you should take an inventory of everything you have. List the inventory, and then get retail prices on the cost to replace each. It’s tedious, but that’s the only way to really know how much coverage you’ll need.

Personal Liability

Personal liability coverage will protect you if an accident or injury happens to someone else who’s in your home. This can be someone slipping and falling in the home, being bitten by a family pet, or other types of injuries.

It could include visitors, repair people, or even the landlord if the cause of the injuries is determined to be your fault.

Personal liability coverage will protect you and your assets from lawsuits brought against you by injured parties who are holding you responsible.

Additional Living Expenses

This is coverage that pays in the event you lose the use of the rental premises.

For example, if the property is destroyed or damaged by a fire, the insurance policy will pay for reasonable relocation expenses, such as reimbursement for a hotel stay, meals, and other expenses related to the temporary lodging situation.

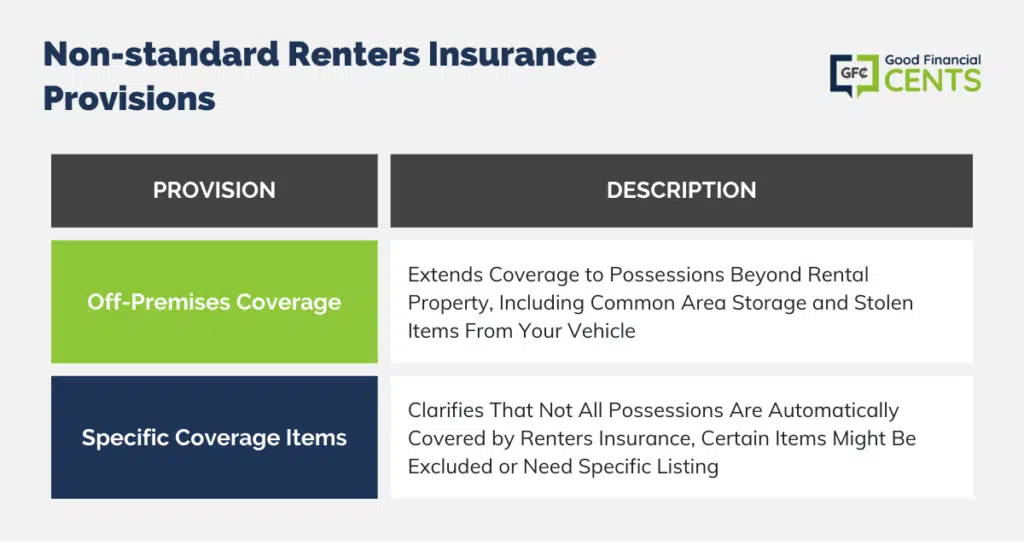

Non-standard Renters Insurance Provisions

The following may be offered as part of a standard package with some insurance companies, but are additional provisions with others:

Off-Premises Coverage

This is coverage for possessions beyond the rental property itself. For example, it could include possessions stored in the common area of the basement of your apartment that are subject to either damage, destruction, or theft.

It can also extend to personal items stolen from your vehicle if those items would normally be covered under your rental policy. This might be a laptop computer, as long as it’s specifically covered under your renter’s policy.

Some renter’s insurance may also include a provision to cover lost luggage, which might be lost by an airline.

Specific Coverage Items

You should never assume a renters insurance policy covers every possession you own. Some have specific exclusions, and others will exclude an item if it is not specifically listed.

Common specific coverages include home computers, jewelry and furs, business personal property, and firearms. If you have these items, be sure to check to make sure they’re included in your coverage. If not, you may have to get special coverage for each category individually.

Some policies specifically include all four of these categories. State Farm is an example (see policy quote below). But never assume they’re automatically covered in your policy.

What Renters Insurance Doesn’t Cover

In the broadest sense, renters insurance doesn’t cover any hazards that are not specifically listed in the policy.

Got that? That’s the general rule, but there are certain specifics you should be aware of.

For example, just as is the case with homeowners insurance policies, renters insurance doesn’t usually cover losses due to floods and earthquakes. Those are considered a special category of hazard, specifically requiring either flood insurance or earthquake insurance.

While a renters policy may cover damages sustained as a result of a burst water pipe, you won’t be covered if your home is destroyed as a result of a river that floods your neighborhood.

If you live in an area that’s subject to natural disasters, you should look into getting a policy specifically for that hazard.

When Is Renters Insurance Needed?

When Required by a Landlord

Large apartment complexes typically require you to have renters insurance, but so do a lot of individual landlords. It’s likely they have this requirement to protect themselves from tenants filing suits to get compensation for possessions lost due to fire or some other hazard. The requirement is written into the lease.

When You Want Your Possessions Protected

Even if your landlord doesn’t require you to have renters insurance, you should have at least a small policy to protect your possessions. Though your stuff may not seem to be worth much, it could easily cost several thousand dollars to replace it, should most or all of it be destroyed or stolen.

College Students

Whether you live in a dorm or off-campus, renters insurance is worth having. You probably have at least a laptop, clothing, and some entertainment equipment that would need to be replaced upon loss. You can usually get an inexpensive rider added to your parent’s policy to cover your dorm room.

Retirees Who Rent

Like college students, retirees may assume that what they have isn’t of much value, particularly if much of it is more than a few years old. But once again, the cost to replace your possessions could be many thousands of dollars. Renters insurance would provide you with the cash for the replacements.

Anyone Who Rents Their Home

You might assume if your rental is short-term you don’t need renters insurance. Or, if you’re renting a house, you may assume you’re covered under your landlord’s homeowner’s policy. Both assumptions are wrong.

Renters insurance is necessary anytime you’re in a rental situation.

How Much Renters Insurance Do You Need?

As I wrote earlier, you need to do an inventory of your possessions to determine how much coverage you’ll need to replace everything you have that could be lost. You might also have to get additional coverage for gray-area possessions like business property, computer equipment, jewelry, and furs.

Liability coverage requirements are harder to estimate. $100,000 should probably be the minimum. But you should also adjust for factors such as how frequently you have visitors or people coming and going to and from your home, as well as any maintenance considerations.

For example, if you live in an area where snow and ice are common and you’re responsible for keeping walkways and stairways clear, you may need more coverage.

As to the additional living expense portion, try to come up with a reasonable estimate of how much it will cost to live in a hotel for maybe 30 days while repairs are being done to your rental property. If it’s a severe situation, you might need several months. But the cost of that coverage could be high.

Replacement Cost Versus Actual Cash Value

This might be the most important single factor in choosing a renters insurance policy. It will determine how much you’ll receive on a claim, so you need to know which provision your insurance company is using.

Under a replacement cost provision, the insurance company will pay a sufficient amount to replace the lost items based on retail cost.

Under actual cash value, the insurance company will reimburse you for the depreciated value of the item. Let’s say you paid $1,000 for a flatscreen TV five years ago, and it was destroyed in a fire. The insurance company may decide the value of the TV is just $200 based on its age. That’s the amount you will be reimbursed for.

Now, actual cash value policies are less expensive than replacement cost policies. But, as you can imagine, they’ll also pay you a lot less if you file a claim.

Unless you’re in the habit of buying your possessions at flea markets and garage sales at deep discounts, you’ll be much better off with a replacement cost policy. It may cost more for the premium, but it will do its job better when disaster hits.

How Much Does Renters Insurance Cost?

According to the Minnesota Department of Commerce, renters insurance averages between $15 and $30 per month.

How much renters insurance costs depends on the usual factors that affect all insurance policies. These can include the amount of coverage you want, the deductible you’re willing to accept, your history of claims, and even how you plan to use the property.

But where renters insurance is concerned, there are more specific considerations. For example, the number and type of pets you have can be a factor. Certain breeds known to be more aggressive will result in a higher premium. So will a wood-burning fireplace. The number of occupants might also factor in. Presumably, the higher the number, the more likely a claim will be paid out.

A higher premium might also be charged if you’re running a business out of the residence. In fact, certain types of businesses might require you to get a commercial policy rather than a standard rental policy.

One of the Biggest Single Factors Is Property Location

Urban locations typically cost more than rural ones due to the closer proximity of buildings and the likelihood of fire. If the property is located in a high-crime area, it can also increase the premium.

So can a location in an area that’s more prone to natural disasters, such as tornadoes and hurricanes.

The type of construction of the building is also important. For example, a building made of brick rather than wood would have a lower premium.

The age of the building might also be a factor since newer buildings generally have better fire protection features like smoke alarms and sprinkler systems.

Here’s a table put out by the Insurance Information Institute that shows the average cost of both homeowners and renters insurance from 2006 to 2021.

Notice how inexpensive renters insurance is compared with homeowners? It is a common misconception that insurance is too expensive for renters.

In fact, it is affordable and well worth the cost for the peace of mind and protection you receive. In 2024 and beyond, you can expect the same kind of minimal changes and affordability to remain intact, as the table below suggests.

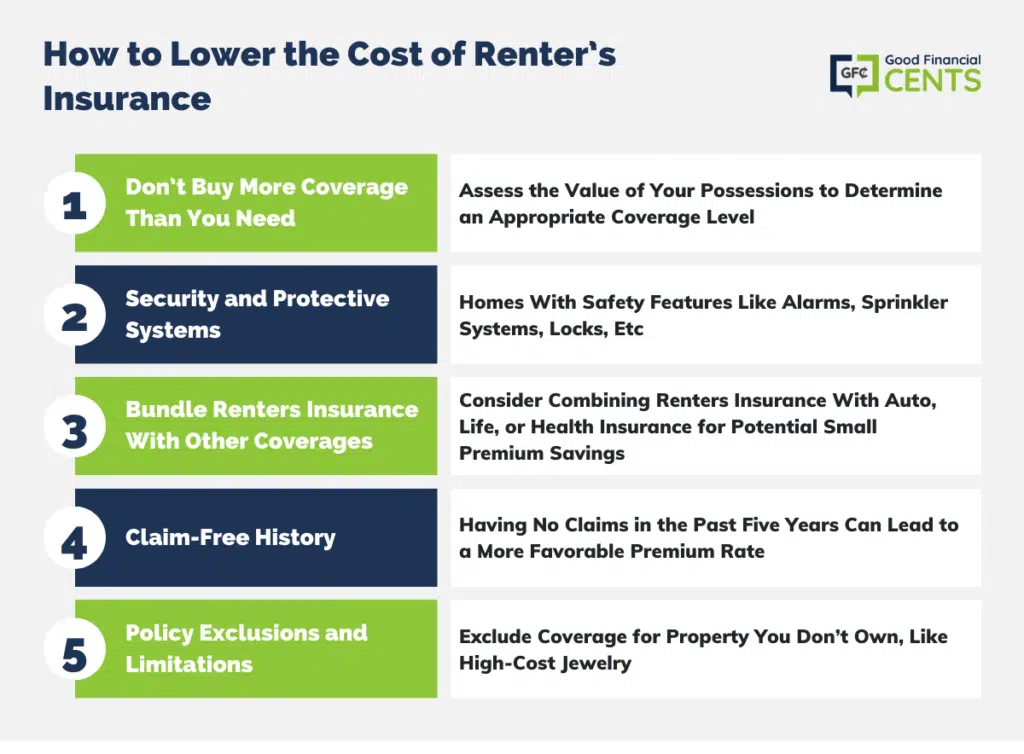

How to Lower the Cost of Renter’s Insurance

Whatever the situation with your renter’s insurance premium, there are ways that you can keep the cost down.

- Don’t Buy More Coverage Than You Need: Take an inventory of the contents of your home and make a reasonable estimate of the replacement value of what you have. If it’s only realistically worth $25,000, then you don’t need a $50,000 policy.

- Security and Protective Systems: Residences that have smoke alarms, fire extinguishers, indoor sprinkler systems, deadbolt locks, and security systems will usually have lower premiums.

- Bundle Renters Insurance With Other Coverages: If you have auto, life, or health insurance, consider bundling your renter’s insurance with one of these policies. It can result in small savings on the premium.

- Claim-Free History: Like all other types of insurance, your claim history will be a major factor in determining the premium. When it comes to renters insurance, companies normally look back at least five years. If you had no claims filed during that time, you’d get the best premium rate.

- Policy Exclusions and Limitations: You can specifically exclude any types of property that you don’t actually own. For example, if you don’t have much in the way of high-cost jewelry, you won’t need coverage for jewelry and furs. Also, you can save a good bit of money by increasing your deductible from $500 to $1,000, or even higher if you have the liquid savings to cover the difference.

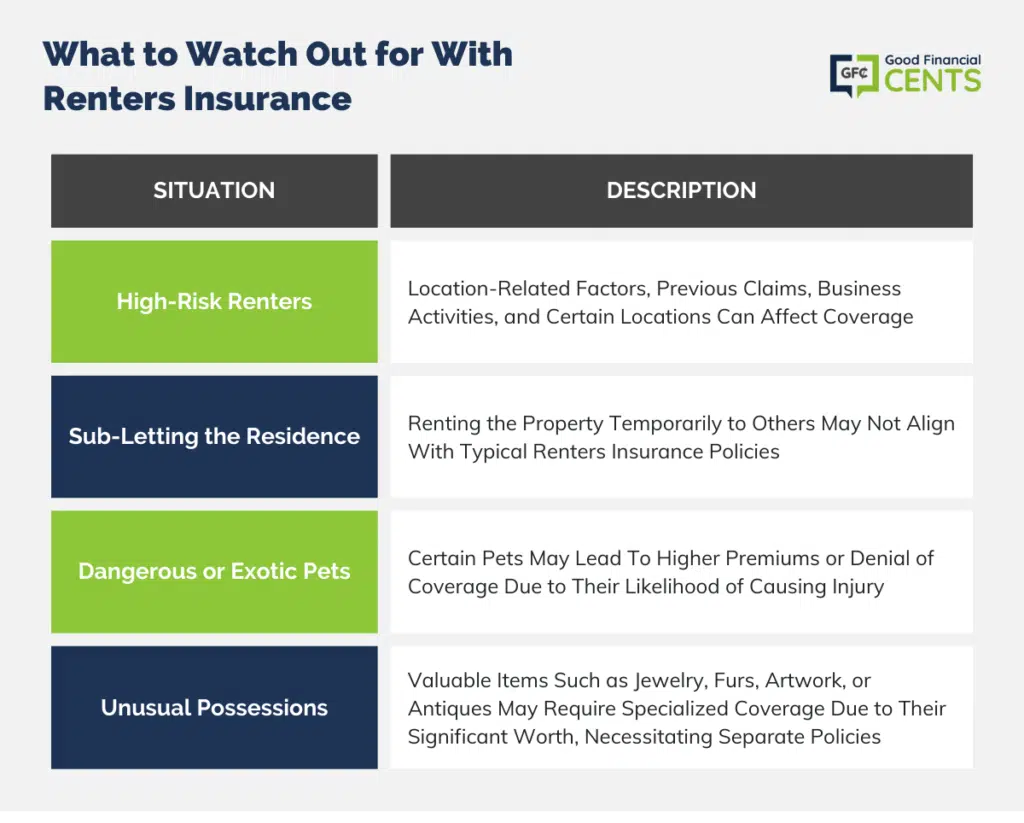

What to Watch Out for With Renters Insurance

There are a few situations that might cause your premium to be higher or even cause the insurance company to deny your application.

High-Risk Renters

This could be the result of the location of the rental property or even certain risks associated with you as a tenant.

Location can be a factor if you’re living in a high-crime area or in an area that has seen an above-average number of fires and other hazards. A location may be considered high-risk if it’s located too far away from fire hydrants or fire stations.

Your premiums will be higher if you’re located in such a neighborhood, or you may find that an insurance company is unwilling to extend coverage at all.

You could be considered a high-risk renter if you made one or more claims against your policy within the past five years (this is a standard question on renters insurance applications, so be ready). Some insurance companies may not offer a policy at all if you have one.

Still, another possibility that would make you a high-risk renter is if you run a business out of your home. While a work-from-home situation won’t usually be a problem, having the type of business where you have people coming and going from the residence could be an obstacle.

One prominent example is if you’re running a childcare business out of your home. A situation like that would probably require a business insurance policy in addition to renters insurance.

Sub-Letting the Residence

This is where you are the primary tenant in the property, but you might then rent the property out to another party on a temporary basis.

While renters policies do provide for roommates and other regular occupants, they generally frown on transient arrangements. This will pretty much preclude using a rental premise for AirBnB customers!

Dangerous or Exotic Pets

Since certain types of pets are statistically more likely to cause injury to people, the insurance company may either charge you a higher premium for these pets or even refuse to issue the policy entirely.

This is a common occurrence with certain dog breeds. For example, most insurance companies will have a problem if you have a pitbull, a German Shepherd, or other dogs deemed to be aggressive.

You might also run into a problem with certain exotic pets. A good example might be an iguana or a 10-foot python.

Both are considered to be potentially dangerous and don’t fall within the definition of ordinary pets. You probably won’t be able to get a renters insurance policy at all if you have this type of pet.

Unusual Possessions

The same can be true of jewelry, furs, artwork, or antiques. If you have items that have significant value, either individually or collectively, you may need a separate policy that specializes in that particular type of possession.

Bottom Line – Should You Get Renters Insurance?

Unless you’re the kind of person who travels light in life – like really light – you absolutely need renters insurance. That means anything other than the clothes on your back and an overnight bag with toiletries.

It can be furniture, computer equipment, photography equipment, family heirlooms, appliances – you name it. If it’s worth anything at all to you, to the point that you would need to replace it if it were lost, then you need renters insurance.

Never assume your personal possessions will be covered under your landlord’s homeowners insurance or under any other policies you may have. Renters insurance is a very specific type of coverage, and there’s no substitute for having your own policy.

great job