A recent client of mine found herself in a very interesting position.

My client and her husband both had very handsome pensions that paid them more in retirement than they were making while they were working. Each month, they had a surplus and were putting a portion of it into a savings account that they most likely would never spend.

In addition to the pensions, they both had tax-deferred accounts – in this case, they were 403(b)s – that they knew they would never spend. The husband didn’t need the account but liked to have it for extra spending money for the “just in case.”

The wife, however, knew that she would never spend it and, since they had two boys with two grandchildren whom they wanted to help pay for school and other financial needs as they grew up, were interested to see what possibilities she had to pass on more.

She knew that required minimum distributions were just a year away and that she would be forced to take out money that she didn’t need. She wasn’t really sure what her options were, so she made an appointment with my team to see what she could do.

Table of Contents

Below is a sample case study looking at the different options one might have who wants to take retirement dollars, whether that be in a 401(k), 403(b), deferred compensation plan, or a 401(k), to pass on a larger death benefit or inheritance to the beneficiaries.

We’ll be looking at five different options that we shared with her to see which one made the most sense.

Option 1: Do Nothing

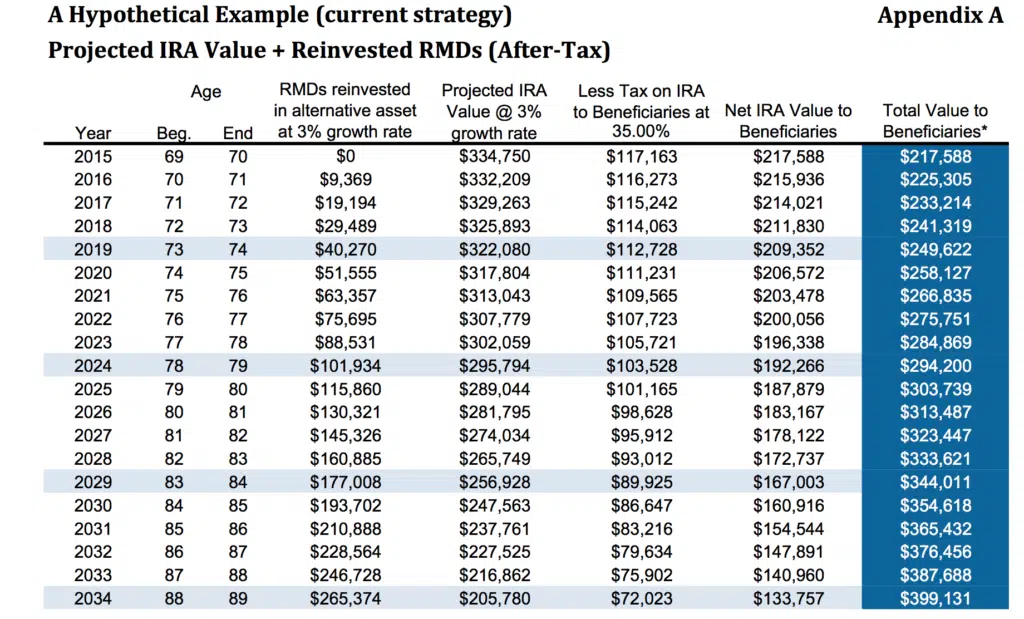

The money was currently in a 403(b) where two-thirds of the account was in a fixed annuity, paying roughly 3%. She, of course, didn’t have to do anything with the money. We wanted to show her what that would be like in case something happened to her.

Assuming a 3% growth rate and a tax of 35%, at age 80, she would pass on approximately $313,487. That’s assuming that she invested the required minimum distributions and earned 3% on those assets in the tax rate, as I mentioned previously, at 35%. This does not assume that the beneficiaries take advantage of the stretch option if she rolled it into a Traditional IRA or a LendingClub IRA.

According to a ramseysolutions.com article, research found, that about one-third of those who received an inheritance saw their wealth remain the same or even decline – within two years of receiving the inheritance (so even though the illustration below is accurate, it’s possible that kids might blow through the money anyway). If they do choose the “stretch” IRA option, here’s how that would be calculated.

Give me a moment to explain the “stretch” IRA option to you. It’s a pretty simple concept.

You see, when a non-spouse inherits an IRA, there are required minimum distributions that must be taken over the course of the person’s remaining life expectancy. An older person will obviously have a shorter remaining number of years until they reach their life expectancy age (really death expectancy age) than a younger person.

That’s where the “stretch” IRA option comes into play. Those with IRAs can choose to name younger beneficiaries instead of older ones so that the funds may be kept in the IRA over a longer period of time.

The “stretch” IRA option allows beneficiaries to take advantage of tax deferral and to also keep the money in the investment account so that it can grow more over time. This gives the younger beneficiaries that are chosen more flexibility in choosing what they’d like to do.

It’s a pretty straightforward idea that works, but there are plenty of other options.

Option 2: Purchase Annuity With Enhanced Death Benefit Rider

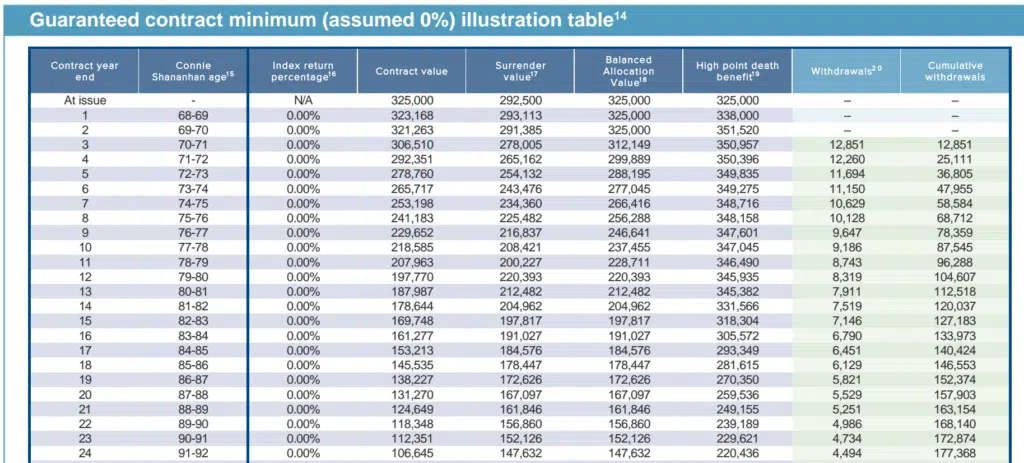

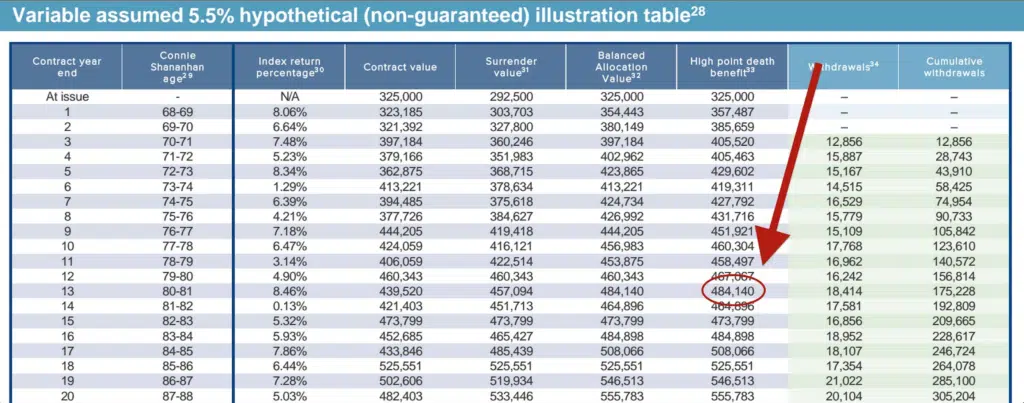

We analyzed what it would look like if she were to do nothing. The next option we’ll look at is if she purchased an annuity with an enhanced death benefit rider.

Please keep in mind that various annuities will have different enhanced death benefit riders. Enhanced death benefits riders will be an additional cost on top of any internal expenses that the annuity has. The example that we’re looking at here is a fixed-indexed annuity so there is no internal cost on the subaccounts and the enhanced death benefit rider is 0.55%.

For simplicity’s sake, we’re going to leave off the name of the insurance provider since these types of riders change constantly.

In the first illustration, we’re looking at a 0% growth rate on the principal but the death benefit rider will compound at 4% based on the initial premium so, at $325,000 initially invested, at age 80, she would have $345,935 of the death benefit on top of $112,518 of withdrawals from her required minimum distributions, not assuming that those have grown at all.

Just in this scenario alone, she’ll have approximately $456,000 to pass onto her heirs compared to the $313,000 above. As you can see, that’s a pretty significant jump.

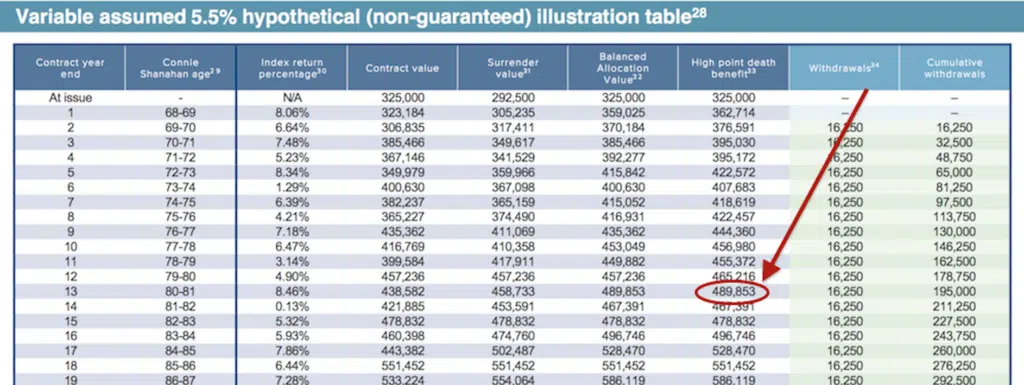

If we looked at a hypothetical growth of 5.5%, we now see that the enhanced death benefit rider at age 80 would be $484,140 plus accumulative withdrawals of $175,000 for a total death benefit of approximately $659,000.

Keep in mind, though, that there would be taxes having to be paid on the death benefit portion so that would reduce the net amount passed onto the heirs.

Option 3: Use IRA RMDs to Purchase Life Insurance

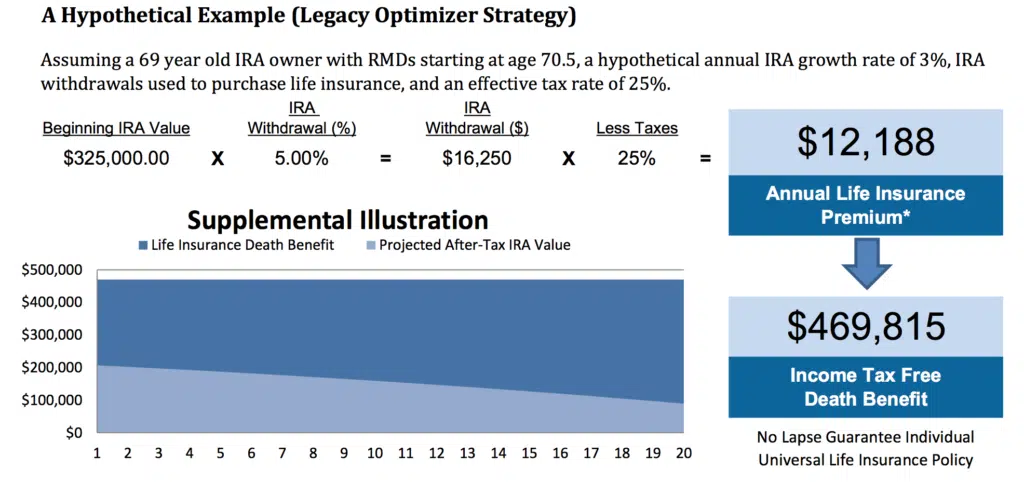

As we discussed, the client was a year and a half out from having to take out her required minimum distributions. She knew she didn’t need the money so she wanted to see where she could move that money to better enhance her children’s and her grandchildren’s finances.

Another possibility is leaving the IRA where it is, and then taking the required minimum distributions to purchase a permanent life insurance policy. In this case, we’re looking at a no-lapse guaranteed individual universal life policy.

As you can see below, we’re assuming a 5% IRA withdrawal rate of $16,250 gross minus 25% taxes equals a net annual withdrawal of $12,188. That amount is then used to purchase one of the types of permanent life insurance, which will give her a guaranteed income tax-free death benefit of $469,815.

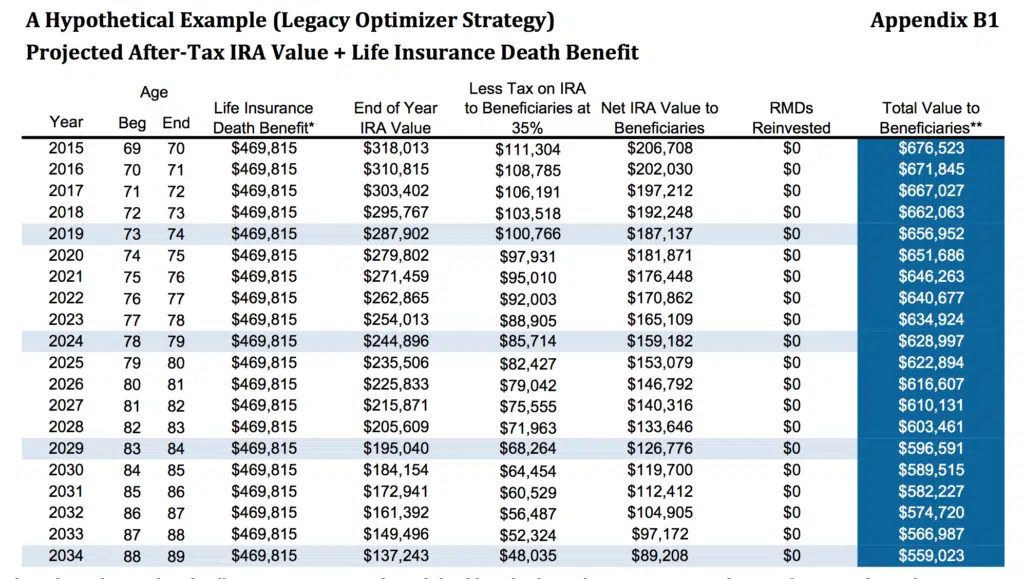

Looking at the graph below, appendix B1, at age 80, between the remaining amount in her IRA plus the tax-free death benefit, the total value to the beneficiaries would be $616,607.

This is, of course, dependent that she could qualify for the permanent policy but, in her current condition, she would have no issues getting approved. While that might seem like the best option, let’s look at another example.

Option 4: Purchase Annuity With EDBR + Life Insurance

Similar to the second option, we’re purchasing the same annuity with the enhanced death benefit rider but then we’re taking the withdrawals and using those to purchase the permanent life insurance policy.

There are a few different ways we could do this but for simplicity purposes, we’ll be purchasing the same life insurance policy above.

With the annuity, assuming a 5.5% growth rate, the enhanced death benefit amount would be $489,000. After we deduct approximately 35% tax that would net $317,000 plus the $469,000 for $786,000 net to her heirs.

$489,000 after 35% tax = $317,000. $317,000 + $469,000 = $786,000.

Option 5: Purchase SPIA + Life Insurance

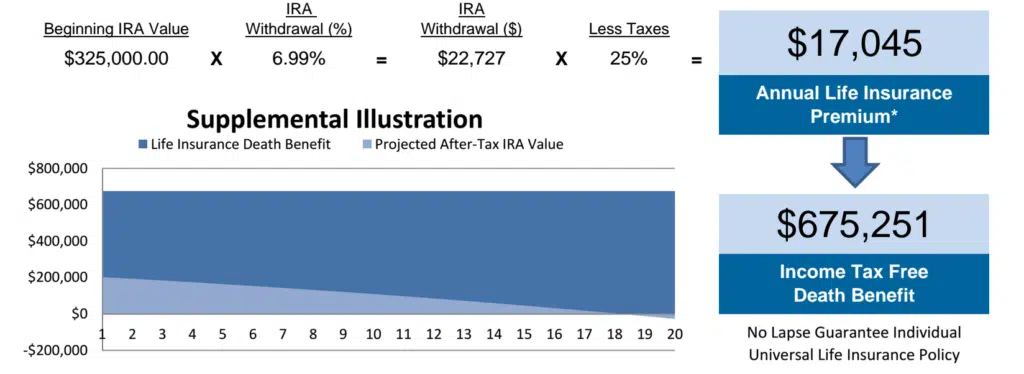

The final option that we showed was using the IRA to purchase an SPIA, otherwise known as a single-premium immediate annuity. We would then use the annuity payout to purchase the life insurance policy. This would give her a guaranteed tax-free death benefit of $675,251.

The one downside to this strategy was once we purchased a SPIA, we lost control of the money. In the examples above using the annuity, even though they had a 10-year contract period, she still had some control and was allowed to pull out around 10% a year penalty-free.

By opting to go with the SPIA, she would get a higher death benefit, although not that much more, and she would be losing control of a big chunk of her retirement.

This is the strategy that we least recommended but we wanted to show her so that she could see if she wanted to pass more tax-free using life insurance.

Closing Thoughts

As you can see, there were quite a few options for her to choose from. We believe in presenting these options to our clients because we want them to know not only what we think they should do, but why we think they should take a particular option.

Additionally, presenting a variety of options gives us an opportunity to discover more about our clients. Many times, when our clients are looking at the options, one of the pros or cons of a particular option might bring up a consideration that changes the equation.

For example, if the client wants full control of their money, they obviously wouldn’t want to choose to purchase the SPIA. They may not realize that – in some scenarios – increasing the benefit for beneficiaries might result in them losing control of their money which helps us narrow the focus.

In the end, we suggested option #4 for our client. Which option do you like? Which would you choose for yourself? Let us know in the comments!

One other option to consider is whether the client is currently donating a significant amount of money to a charity or tax-exempt religious organization. If so, they should consider using the RMDs to cover that amount directly out of the tax-benefitted account. By doing that, the charity gets the money tax free, and the client fulfills the distribution requirements. Now they can take the money they were previously giving to the charitable organization from after-tax funds and apply that in another direction (like those above). Obviously there will likely be some other tax implications, so those should be taken into consideration. But this approach would cut the tax effects off the RMDs and stretch those dollars even further. More info in this article https://personal.vanguard.com/us/insights/article/QDC-RMD-tax-break-122014.

This has “CFP practice question” written all over it! You can see where my mind is right now. 🙂 Definitely a good read for financial planners.