There are all kinds of annuities available, including one for just about every investment niche there is. If you are interested in generating a guaranteed income with no risk to your principal value, then fixed annuities might be what you are looking for.

They pay higher rates of return than other interest-bearing investments, like CDs and money market funds, and also offer tax-deferred income as well. They aren’t for everyone, but they could be right for you.

Table of Contents

What Are Fixed Annuities?

A fixed annuity is an investment contract between you and an insurance company, which obligates the company to make fixed annuity payments to you under the terms specified in the annuity contract. It is an excellent way to earn a safe, stable return on your investments, which also makes fixed annuities very popular among retirees.

Fixed annuities work very much like certificates of deposit (CDs) that are issued by banks. You invest a certain amount of money in the annuity, and it pays you a fixed rate of interest. If interest accumulates in the plan, the account will grow in value, which will enable still more interest income to the plan in the future.

However, there are certain ways in which a fixed annuity is different from a CD. For example, if you surrender a fixed annuity prematurely, you will generally have to pay a surrender charge. That charge can cut into the principal value of the annuity rather than just reducing your interest income, as is usually the case with early withdrawal penalties on CDs.

In addition, you may be subject to a 10% early withdrawal penalty from the IRS – but we’ll get deeper into that point a little bit later in this article.

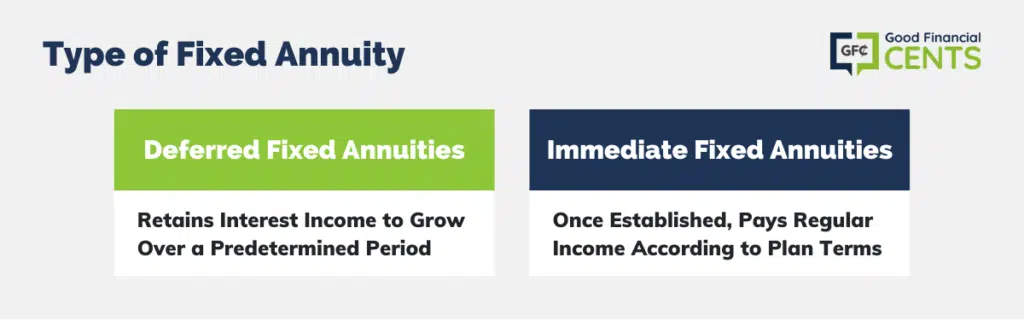

Fixed annuities can take two different forms:

Deferred Fixed Annuities

This type of fixed annuity retains interest income in the plan so that it will grow into a larger amount for a predetermined number of years. After that point, you can begin taking distributions out of the plan to provide you with immediate income.

Immediate Fixed Annuities

This is a fixed annuity that pays you income immediately. You establish the annuity, and it begins paying you a regular income according to the terms of the plan.

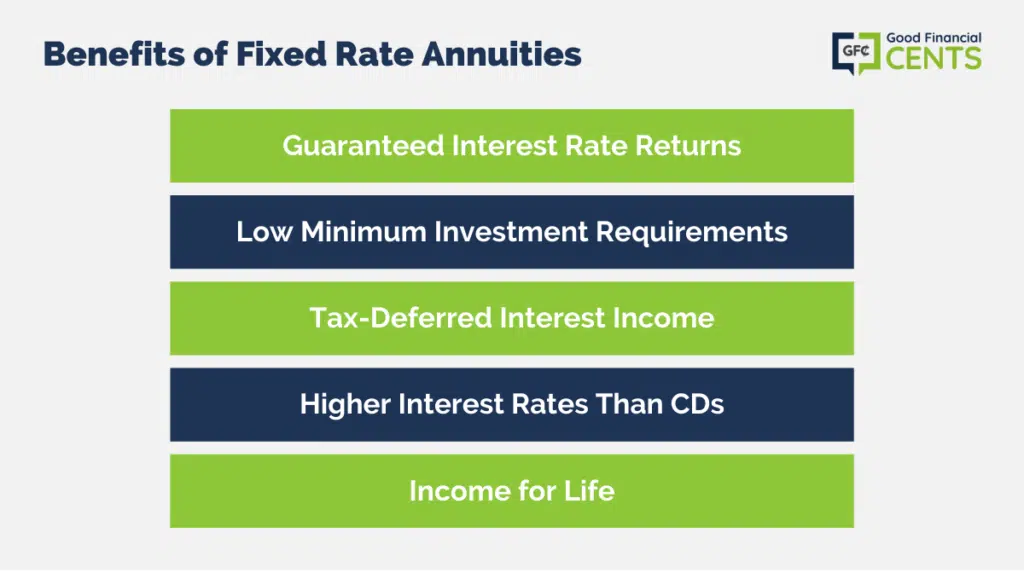

The Benefits of Fixed Rate Annuities

Fixed annuities come with a number of benefits that make them desirable investments, particularly for those who are close to retirement. Some of those benefits include:

Guaranteed Interest Rate Returns

Fixed annuities can provide a guaranteed income for the life of the annuity contract. This is very unlike the performance of stocks, where both principal value and dividend income are subject to change over time.

Low Minimum Investment Requirements

You can generally purchase fixed annuity contracts for as little as $1,000 to $10,000. That puts them within reach of both new and small investors. This is especially true if you are a small investor who is looking to diversify your investments and wants to include a fixed-income component.

Interest Income Is Tax-Deferred

In this way, a fixed annuity works similarly to a Roth IRA. Though the contributions to the plan are not tax-deductible, the interest income earned on the annuity is tax-deferred. That means that you will not have to pay income taxes on your interest income. No tax will be required until you begin taking distributions from the annuity.

Much as is the case with other types of tax-deferred investment plans, you must generally wait to take withdrawals from the plan until you are at least 59 1/2 years old. Should you take them sooner, you will not only have to pay ordinary income tax on the withdrawals but also the IRS 10% penalty on early withdrawals.

(NOTE: Though some insurance agents will encourage you to do so, you probably don’t want to include fixed annuities in your IRA or other retirement plan. That’s because the income on them is already tax-deferred, so including them in a plan that’s also tax-deferred serves no real purpose. It’s similar to why you wouldn’t put municipal bonds into a retirement account – the income on them is already tax-free.)

Interest Rates on Fixed Annuities Are Typically Higher Than They Are on CDs

This is especially true in the first year of the annuity. For example, a five-year fixed annuity may pay you something more than 5% in the first year and then 3% for the remaining four years of the contract. This is considerably better than rates that you can get with a five-year CD. Naturally, interest rates paid on fixed annuities will adjust based on the current interest-rate picture.

Income for Life

A fixed annuity can be set up to provide you with an income for the rest of your life. You establish and fund the annuity, and it then begins to accumulate interest income. Once you reach retirement, the annuity can be set up to provide you with an income for the rest of your life. This is another reason why they are considered solid investments for retirement purposes.

Are Fixed Annuities FDIC Insured?

This is an area in which fixed annuities depart from CDs completely. While CDs come with federal insurance through FDIC for up to $250,000 per depositor, fixed annuities – and all annuities, for that matter – have no similar government insurance.

They are also not covered by the Securities Investor Protection Corporation (SIPC), which protects investor’s accounts from the fraud or failure of the investment brokerage firm.

Fixed annuities, in fact, all annuities, are primarily “insured” by the insurance company that issues them rather than a third-party agency, like FDIC or SIPC. That means that the financial strength of the insurance company issuing the annuity is extremely important.

This isn’t necessarily a panic situation. The incidence of insurance company failures is actually quite rare in US history. Often, when an insurance company does, its assets and obligations are distributed to other insurance companies operating within the state where it is located.

But that doesn’t mean that you should ignore the strengths or weaknesses of the insurance company that you want to hold an annuity with. One of the best ways to gauge the strength and safety of the insurance company issuing an annuity is by checking their rating by A. M. Best.

They are considered to be the industry standard for measuring the financial integrity of insurance companies. They issue ratings on more than 3,500 insurance companies worldwide. They issue ratings on insurance companies that range from a high of A++ to a low of F.

Naturally, if you are investing in an annuity, you will want to stay with the companies that are at the higher end of the rating range. Also, be sure to check the rating on any insurance company you are investing with, at least on an annual basis. Ratings of individual insurance companies can be either upgraded or downgraded, depending upon the performance of the company.

Beyond the financial strength of the issuing insurance company, most states have guaranty associations that provide some level of protection for those who invest in annuities. There is usually a limit of $100,000 on the annuity contracts if your state does have a guaranty association. You can check with your state insurance commissioner to determine both the existence of the guaranty association, as well as the amount of protection that it provides.

If your state does have a dollar limit on how much protection will be provided, you should plan to keep your annuity investments with any single insurance company below that level. If your total annuity investment exceeds the state protection level, you should spread your annuities among several different insurance companies.

In doing so, you should also check with the state insurance commissioner as to whether or not the protection limit applies to your investment with a single insurance company or represents an aggregate of all of your annuity contracts. However, since it is extremely unlikely that any insurance company will fail, it is even less likely that two or more will fail at the same time.

That’s not FDIC insurance, but it comes close enough that you can invest your money in an annuity contract with confidence.

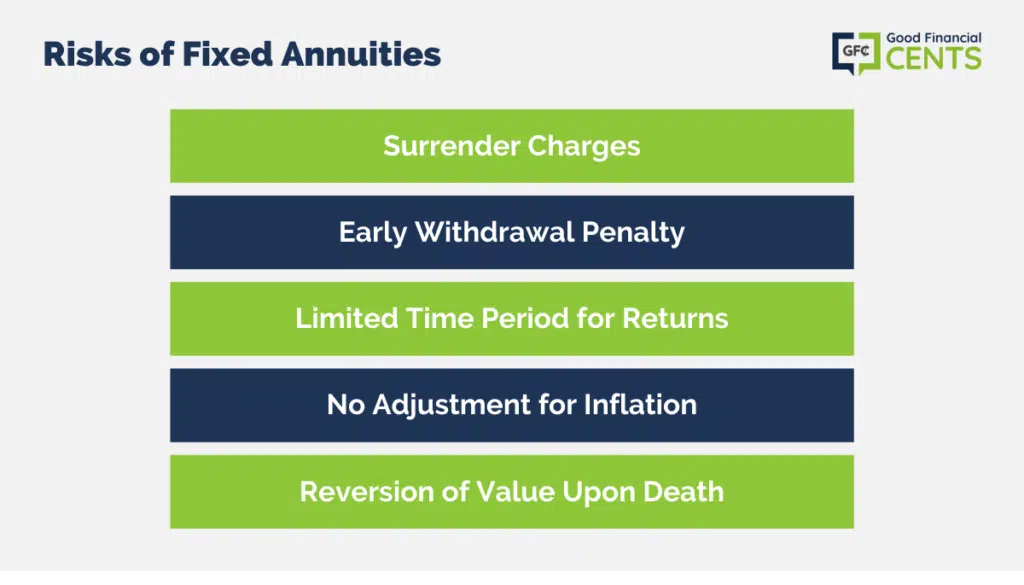

The Risks of Fixed Annuities

Apart from the risk that the insurance company issuing an annuity could fail – which is an admittedly very small risk – there are other risks that are inherent in fixed annuities.

Surrender Charges

As explained earlier, these charges can actually reduce the principal value of your annuity contract. They could represent a percentage of the annuity value, say 5%. They will generally apply for a certain timeframe, which could extend out over many years.

Even if you don’t intend to surrender the annuity within the time in which the surrender charge applies, you can never know that for certain. Life has a way of throwing curveballs, and you could be stuck paying the surrender charge at a very inconvenient time.

Early Withdrawal Penalty

As we discussed earlier, in addition to the surrender charge, if you liquidate your annuity contract before you turn 59 1/2, you’ll be subject to the 10% early withdrawal penalty imposed by the IRS. This is due to the fact that the interest income on your annuity accumulates on a tax-deferred basis.

And since annuities have been established primarily for the purpose of retirement, the IRS imposes the penalty as a way of discouraging investors from withdrawing money from their annuities before reaching retirement age.

Interest Rate Returns Are for a Limited Time Period

Interest on fixed annuities typically lasts no more than a few years. For example, you may get a high initial rate that will be effective for one year, after which the rate will be considerably lower for the balance of the term. It might be, say, 5% in the first year and then drop down to 2% for the next four years.

Of course, CDs are similar. Though it may be possible to get CDs that run for terms of 10 years, most offerings are for five years or less.

Interest Rates Don’t Adjust for Inflation

Whatever the interest rate return on a fixed annuity is, it will remain constant for the full term. But given that inflation decreases purchasing power virtually every year, you may find that the interest income you are receiving on your annuity, once you begin taking withdrawals, will not keep pace with inflation.

Of course, this is true of virtually every fixed-income investment, especially long-term bonds. And that’s where equity investments, like stocks and real estate investment trusts, come into the picture.

Death and Survivorship

One of the major benefits of a fixed annuity is that it can provide you with an income for literally the rest of your life. But the flip side of that benefit is that the remaining value of the annuity contract will revert to the insurance company upon your death.

This can happen once the annuity reaches maturity and begins making distributions. The insurance company will make payments for the rest of your life – whether that’s one year or 30. Whatever is remaining in the annuity at that time will become the property of the insurance company. That means it will not be available to be passed on to your heirs. It is strictly a living benefit investment plan.

Are They Good for You?

In weighing out the benefits and risks of fixed annuities, how can you know if they are a good investment for you? They can work if you want some or all of the following financial arrangements:

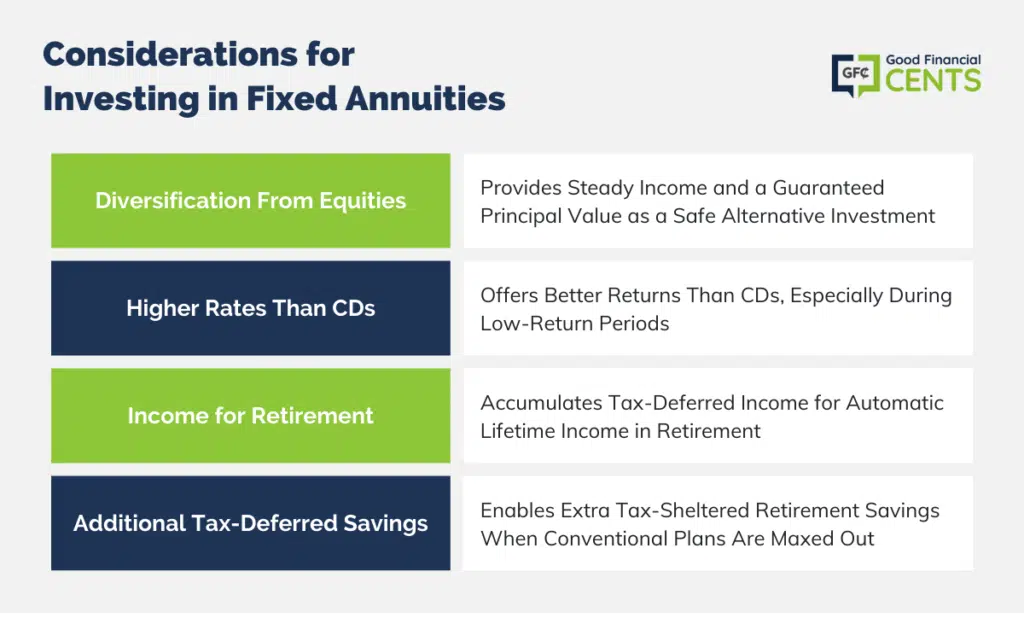

Looking for a Diversification From Equities

If you’re looking for a safe alternative investment for part of your portfolio, fixed annuities can be a solid diversification. They provide a fixed rate of return, steady income, and a guaranteed principal value.

You Want Higher Rates Than You Can Get on CDs

Over the past few years, returns on CDs have hovered just above zero. On longer-term CDs, such as five years, it’s hard to get much more than 2%. You can do better than that with fixed annuities, and that’s one of the major reasons why people invest in them over CDs.

Income for Retirement

Fixed annuities are investment vehicles that have been made specifically for retirement. The income that you earn on them prior to taking distributions accumulates on a tax-deferred basis. After that, you can set up a plan to pay income for the rest of your life. In theory, you can do this with CDs, but with fixed annuities, it all happens automatically.

You’ve Maxed Out Your Retirement Contributions

Let’s say that you have maxed out your contributions to standard retirement plans, like IRAs and 401(k)s, but you still want more tax-deferred savings for retirement. You can use an annuity to provide additional tax-sheltered savings. There are no dollar limits on how much you can contribute to an annuity, which may provide you with an excellent opportunity to fast-forward your retirement savings, especially if you have begun saving for retirement late in the game.

Fixed annuities, or any annuities for that matter, are certainly not for everyone. But if you like the benefits they provide – and you’re comfortable with the risks that come with them – you should take a serious look at investing in one. It could turn out to be the exact investment product for your needs.

Final Thoughts – Fixed (Rate) Annuities

Fixed annuities offer a reliable avenue for generating guaranteed income with principal protection. These investment contracts with insurance companies present numerous advantages: assured interest rate returns, low minimum investment requirements, and tax-deferred interest income.

While similarities to CDs exist, fixed annuities stand out with potentially higher interest rates and income for life, making them an appealing choice for retirement planning. However, potential risks include surrender charges, early withdrawal penalties, limited interest rate duration, and no inflation adjustment.

Assessing your financial goals and risk tolerance is crucial in determining whether fixed annuities align with your investment strategy.