In a previous post, I shared some of the basics of 403(b) Tax Sheltered Annuities. As a recap, a 403(b) is a type of retirement account that’s only offered to employees in certain not-for-profit and government jobs.

For these employees, their 403(b) is the equivalent of their 401(k). While employee limits are the same for those offered with an employer-sponsored 401(k), 403(b)s offer another component that helps employees contribute even more if they qualify.

Called the maximum allowable contribution, this perk lets certain qualified employees grow their retirement accounts even faster.

Table of Contents

What Is a Maximum Allowable Contribution?

Generally speaking, 403(b) accounts come with the same contribution limit as you would get in a traditional 401(k) plan. For 2024, contribution limits for employees are limited to $23,000 for both types of accounts, up from $20,500 in 2022.

If you are over the age of 50, however, you can also make an additional “catch-up” contribution of up to $8,000. For workers over 50, that adds up to a total annual contribution limit of $30,000.

Here’s where the maximum allowable contribution comes into play for those who have a 403(b).

Employees with 15 years of service with their current employer and an annual average contribution of less than $5,000 per year are eligible for an additional $3,000 contribution per year up to a lifetime maximum “catch up” of $15,000.

Known as the “15-year rule,” this benefit allows individuals who have been lax about retirement savings to boost their annual contributions once they’re ready. Employees who are eligible for “catch-up” contributions because they are over the age of 50 can also take advantage of the 15-year rule if they qualify.

However, when that’s the case, the IRS will apply any contributions made above the regular limit to the 15-year rule first. To determine whether you are eligible, you must first calculate your income and employee status using certain IRS tables. Doing so allows you to figure out if you have the years of service required and also determine if you had any prior contributions that would affect how much you can put in.

Your accountant or tax preparer should help you fill out the required forms to take advantage of this provision. While some computations are involved, this option still offers a smart way to contribute more money to your retirement account over time.

The 2022 and 2023 update to a maximum of 403(b) contributions is beneficial as it allows you to contribute even more to your retirement.

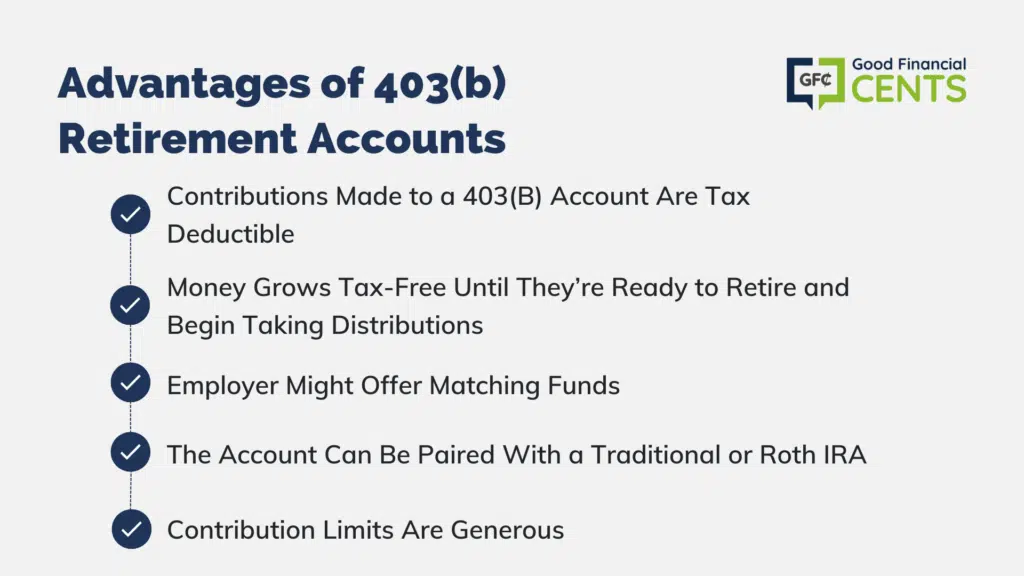

Advantages of 403(b) Retirement Accounts

If you have just been offered a 403(b) retirement plan due to employment at a non-profit or for a government agency, you may be wondering whether you should sign up or wait it out. By and large, 403(b) plans can be used to fund the bulk of your retirement if you take your contributions and the responsibility of saving for your own retirement seriously. If you’re on the fence about contributing, here are some perks to consider:

Contributions Made to a 403(B) Account Are Tax Deductible

When you contribute to a 403(b) plan, the contributions you make are tax-deductible. This can help you lower your taxable income, which will, in turn, help you save money on taxes each year you contribute.

If you pay a lot of taxes now and wish you could lower your tax liability, contributing heavily to a 403(b) account can help you reduce your tax bill while also adding necessary funds to your retirement account.

Your Money Grows Tax-Free Until You’re Ready to Retire and Begin Taking Distributions

Just like contributions made to a 401(k) plan, funds in a 403(b) account grow tax-free. Once you open your account and begin making contributions, you won’t have to worry about paying taxes on gains as you would with a taxable investment account. Simply deposit funds, then sit back and watch them grow tax-free.

Your Employer Might Offer Matching Funds

While 401(k) plans are notorious for the generous matching funds many employers offer, 403(b) plans can come with this perk as well. Depending on your employer and the specifics of their plan, you may receive matching funds or “free money” just for participating in a 403(b).

Before you sign up for your plan, figure out how much you need to contribute each month to get the full employer match.

You Can Pair This Account With a Traditional or Roth IRA

Just like if you had a 401(k) plan, you can pair certain other retirement accounts with your 403(b). For example, many people open and contribute to a 403(b) account but then also stash money away in a traditional or Roth IRA each year. While the best scenario for you will depend on your individual situation and retirement goals, it’s nice to know you can save for retirement in more ways than one.

Related: Best Places to Open a Roth IRA

Contribution Limits Are Generous

In 2024, most employees can contribute up to $23,000 to a 403(b) account. On top of that, some employees who have worked for the same employer for 15 years are eligible for a maximum allowable contribution extension that lets them contribute another $3,000 each year until they reach a maximum of $15,000.

Employees over the age of 50 can also contribute an additional $8,000 to a 403(b) plan each year in what is known as a “catch-up” contribution. If someone is eligible for a catch-up contribution and the “15-year rule,” they can feasibly contribute up to $30,000 to a 403(b) account that year.

Final Thoughts

If you are eligible for a 403(b) plan, it’s usually smart to start contributing right away. If you have waited on the sidelines so far, you can still jump into the game and start building a nest egg for retirement.

While the rules that govern 403(b) plans can seem complicated, they are crucial to understand if you hope to leverage your access to work-sponsored retirement accounts to build wealth over time. And if you are indeed eligible for the 15-year rule or the “catch-up contribution” provision for workers over the age of 50, you can contribute more money than most.

Since your retirement years are coming, whether you like it or not, you’ll be better off if you start saving sooner rather than later.