There are several different types of annuities, each designed to fill a different investment niche among investors. Variable annuities offer all the benefits of annuities in general, but they also enable you to earn investment income for both stocks and bonds. Much like target date funds, they represent something of a “fund of funds” offered by insurance companies.

Like IRAs and other retirement plans, they also provide tax-deferred investment income, as well as income payouts once you reach retirement age.

Table of Contents

What Are Variable Annuities?

A variable annuity is an annuity contract offering investors an opportunity to earn higher rates of return on their investments than what they can get with fixed annuities. This is because while fixed annuities pay interest similar to certificates of deposit, variable annuities include participation in both the stock and bond markets.

Just as is the case with other types of annuities, the money that you invest in a variable annuity accumulates on a tax-deferred basis. A variable annuity can also be set up to provide an income upon reaching retirement or some other desired date. However, unlike fixed annuities, variable annuities are not generally guaranteed and will be largely dependent upon the performance of the sub-accounts where the money is invested.

Sub-accounts are the insurance industry equivalent of mutual funds. They can invest in various types of stocks and bonds, depending upon the desired purpose of the investment. However, the sub-accounts, unlike mutual funds and exchange-traded funds, are usually not listed on public exchanges. They are investment units offered on a proprietary basis by individual insurance companies.

Within a single variable annuity contract, you can choose to invest in multiple sub-accounts covering various asset classes. Since these sub-accounts are professionally managed, variable annuities represent “hands-off” investments. Exactly which asset classes will be invested in will depend upon the income desired.

Though variable annuities do not come with the guaranteed income offered by fixed annuities, they can actually provide a long-term return that is superior to fixed annuities since it includes participation in the equity markets. This gives the investor in variable annuities an opportunity to both keep up with inflation and even outpace it as a result of higher returns.

On the flip side, however, is the possibility that the investments within the variable annuity will experience a prolonged period of poor performance. If that’s the case, the investor in a variable annuity could actually experience a loss of principal, resulting in a smaller income stream upon retirement.

Variable annuities are long-term investments and have limitations on when you can withdraw money. They generally permit you to make one withdrawal each year. However, if the withdrawals are taken during the “surrender period” – the time during which a surrender charge applies – that charge will have to be paid upon withdrawal. The surrender period can last as long as 10 years. Once it expires, withdrawals can be made without incurring the charge.

The Benefits of Variable Annuities

Guaranteed Death Benefit. This is a benefit that does not come with mutual funds or exchange-traded funds. The death benefit ensures that your heirs will receive an amount equal to no less than your initial investment in the plan – and that’s even if the value of the plan declines due to market factors. The protection is provided through a mortality charge.

Minimum Rate Guarantee. This is a rider that can be added to your variable annuity for an extra fee, which will ensure that you receive a minimum rate of return, even if the sub-accounts within your plan experience a loss. You can also add a similar rider that will provide a guaranteed minimum payout rate when you begin making withdrawals. It similarly guarantees your payments despite a poor performance by the sub-accounts. Both riders are available with some variable annuities, but not all.

Income Tax Deferral. As is the case with all annuities, though your contributions to the plan are not tax-deductible, the investment earnings within the plan are. That means that your variable annuity can grow from inception to retirement without any concern for tax consequences. As is the case with all tax-deferred retirement accounts, any withdrawals made before you turn age 59 1/2 will be subject to ordinary income tax and the IRS early withdrawal penalty of 10%.

Investments Within the Plan Can Be Changed. Unlike a mutual fund, your investments within a variable annuity are not fixed. Since there are multiple sub-accounts to choose from, covering different asset classes, you can shift the investment mix within the plan. This can give you the opportunity to take advantage of different investment environments, as well as changes in your own investment needs, or to make adjustments based on your age.

Lifetime Income. One of the primary reasons people invest in annuities is to provide them with income that will cover the rest of their lives. This is obviously important when it comes to retirement income, as one of the biggest concerns of retirees is the prospect of outliving their money. An annuity can be established that will provide you with a fixed income for your entire life.

Protection From Creditors. In some states, annuities are protected from the claims of creditors. If you are an occupation that is subject to lawsuits – such as the medical profession – annuities, including variable annuities, can protect the assets within them from creditor claims.

Are Variable Annuities FDIC Insured?

One potential disadvantage annuities have is the lack of any sort of insurance coverage provided by the US government, such as FDIC insurance for bank deposits or the Securities Investor Protection Corporation (SIPC) coverage for brokerage accounts. However, that doesn’t mean that you have a significant risk of loss of your account.

Annuities are insured by the insurance company that issues them. And while there is a slight chance of an insurance company failing, it is an event that is very unusual in US history. You can reduce the chance of this happening by determining the financial strength of the insurance company before you invest in an annuity.

You can do this by checking out a rating agency, such as A. M. Best. They are considered to be the industry standard for measuring the financial integrity of insurance companies. They issue ratings on more than 3,500 insurance companies worldwide. They issue ratings on insurance companies that range from a high of A++ to a low of F.

If you invest with insurance companies that are at the higher end of the rating scale, the likelihood of company failure will be even lower.

In addition, most states do have guaranty associations that will provide protection on annuities, typically up to a limit of $100,000 per annuity contract. You can check with your state insurance commissioner to determine if your state has a guaranty association and what the limit of coverage is. If the dollar amount of annuities that you hold exceeds that limit, then you will want to spread your annuity contracts across several different insurance companies.

The Risks of Variable Annuities

While variable annuities offer definite benefits, there are also risks associated with them. Some are general risks that apply to all annuities, but others are specific to variable annuities.

Surrender Charges. In the event that you decide to terminate your annuity early – as in before the surrender period expires – your account will be subject to a surrender charge. This charge will vary from one insurance company to another and even between annuities within the same company. However, the company could set the charge at 4% or 5% of the amount of the withdrawal. This charge may limit your ability to change the annuities or insurance companies after the fact.

Early Withdrawal Penalty. It’s not just the insurance company that will charge you a fee for closing out your annuity early. Since annuities are tax-deferred, your withdrawal will be subject to ordinary income tax plus the 10% early withdrawal penalty imposed by the IRS.

Death and Survivorship. This is another limitation that applies to all annuities, and not just variable annuities. Once the funding phase of an annuity plan ends and you begin taking withdrawals, the remaining balance of the annuity will revert to the insurance company upon your death. That means that it will not be available to be included in your estate and passed on to your heirs.

While this may not be an issue if you live for 30 years after you begin taking withdrawals, it will seriously reduce your estate should you die within a few years of retirement.

High Fees. Variable annuities contain a large number of fees that have the potential to reduce your investment performance substantially. In the next section, we’ll cover the fees associated with variable annuities in some detail. However, this is a disadvantage for variable annuities when compared to other investment types and even other annuities.

Variable Annuities Are Complicated Investments. If you’re looking for a relatively simple investment plan, variable annuities won’t fit the bill. Though they have a number of benefits, you have to be careful when investing in them. For example, a variable annuity may contain between 80 and 300 sub-accounts.

These accounts typically are not listed on any public exchanges, and little information will be available about them, other than that which is provided by the insurance company itself. Coming up with the right mix of sub-accounts can be a challenge all by itself.

No Guarantee of Principal Value. Much like stocks and mutual funds, your principal is at risk when you invest in variable annuities. They could rise substantially in value, but they can also lose money. There is no guarantee that your principle will remain stable or grow in value.

As is the case with any equity-based investment, if the general market performs poorly, your sub-accounts and your variable annuity will do the same.

The Death Benefit and Income Accounts Aren’t Permanent. The insurance company could reduce or remove the death or income riders for new policies. They may also attempt to change existing policies if possible. Under certain circumstances, the company might even offer a lump sum as an incentive to eliminate guarantees made when the annuity was first established.

No Truly Fixed-Rate Investment Option. Some insurance companies may offer a money market fund within an annuity, but not all do. And few offer anything that looks like a real fixed-rate investment. That means that your plan must be 100% invested in the market at all times.

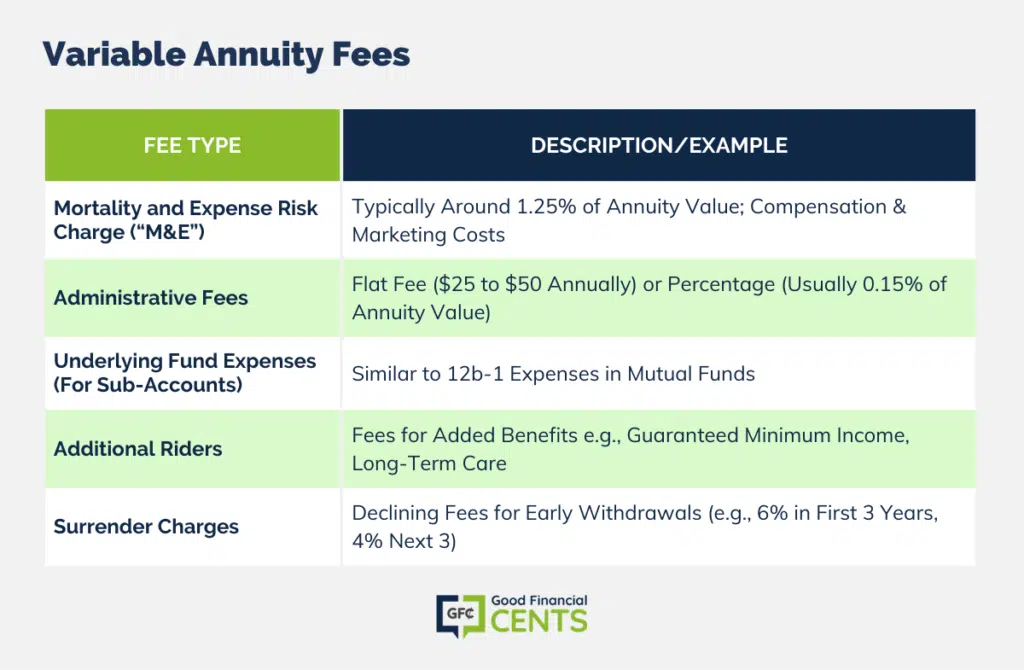

Variable Annuity Fees

The fee structure within variable annuities is higher than it is with most other investment types and even many other types of annuities. The national average for variable annuity fees is 3.61%. However, it can be substantially higher than that on any given variable annuity plan. What makes it even more problematic is that the fees are not always obvious within the plan. They can be pretty well hidden, which means you’ll hardly ever see them listed on your statement.

Here is a list of fees commonly found in variable annuities:

Mortality and Expense Risk Charge (“M&E”). This expense represents compensation for the insurance company for the insurance risks that it takes on under an annuity contract. The fee also helps to pay for the insurance company’s cost of marketing variable annuities, including commissions paid to financial advisors and insurance agents. It is typically in the neighborhood of 1.25% of the value of your annuity plan.

Administrative Fees. The insurance company may charge these for administrative tasks, such as recordkeeping and reporting. It’s a small amount, and usually, a flat fee ($25 to $50) is charged on an annual basis. But with some annuity contracts, it can also be a fee charged on a percentage basis, typically 0.15% of the value of your annuity contract.

Underlying Fund Expenses (For Sub-Accounts). These are similar to the investment expenses (12b-1 expenses) charged within mutual funds, except that they are charges of the sub-accounts.

Additional Riders. These are fees associated with riders that can be attached to a variable annuity. They can be for the cost of adding a guaranteed minimum income benefit, long-term care insurance, or a stepped-up death benefit.

Surrender Charges. We discussed these earlier, and they can be assessed if you decide to withdraw from your annuity or completely close it out within the surrender period. It is typically several percentage points of the value of the annuity contract and is designed to keep you from liquidating your account early while the plan is building up value. In many cases, the surrender charge works on a declining basis. For example, it might be equal to 6% if you withdraw funds within the first three years, then fall 4% for the next three years, and then 2% for the next four years.

Are Variable Annuities Good for You?

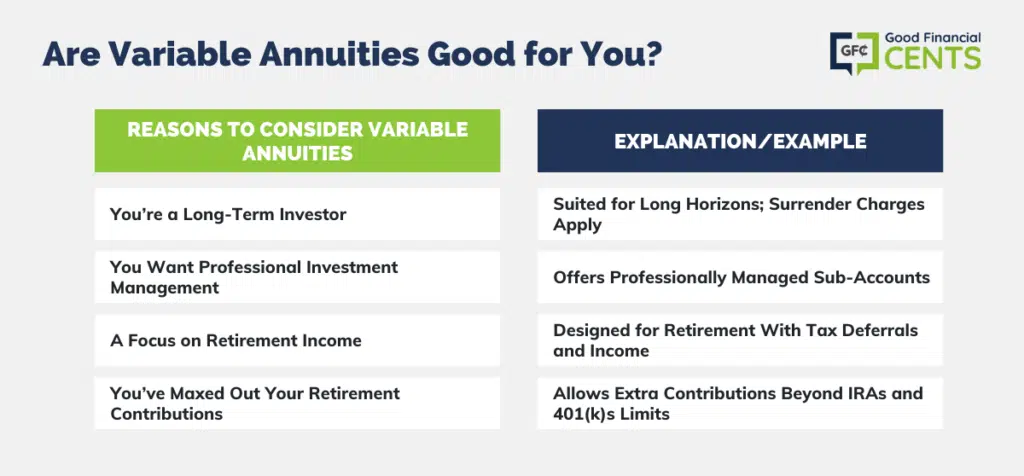

As you can see, variable annuities are complex investment contracts. While they can work well for some people, they’re certainly not an investment for everyone. In order to determine if a variable annuity will work well for you, you have to be certain as to what it is you expect it to do.

You may want to look into a variable annuity if any of the following situations apply to you:

You’re a Long-Term Investor. You have a very long investment horizon stretching between now and out to the very end of your life. Not only are variable annuities long-term investments, but surrender charges make it difficult to withdraw from them within the surrender period, when you will have to pay a surrender charge in order to do so.

You Want Professional Investment Management. A variable annuity is virtually a portfolio unto itself. It includes a mix of stocks and bonds, each of which is in a sub-account that is professionally managed by investment managers.

A Focus on Retirement Income. As is the case with all annuities, they are designed primarily for retirement. The long-term nature of the investment, in combination with tax deferral and a long-term income payout, makes it perfect for this purpose. You can invest your money in an annuity for a time, after which it automatically converts into something like a pension.

You’ve Maxed Out Your Retirement Contributions. If you’ve reached a point where you’ve made the maximum contributions to your IRA and/or 401(k) plans, a variable annuity can enable you to make virtually unlimited additional contributions toward your retirement. Though there is no tax deduction for the contributions themselves, the money will accumulate on a tax-deferred basis. This can be a major advantage if you have begun preparing for retirement late in life and need to contribute more than traditional retirement plans allow

Carefully consider the benefits offered by variable annuities, as well as the risks and fees that are involved with them, to determine if they are the right investment choice for you.

Bottom Line

Variable annuities are investment contracts that offer unique features tailored toward long-term investors, especially those focusing on retirement income. They allow investors to potentially earn higher returns by participating in the stock and bond markets.

While they come with benefits such as tax deferral, guaranteed death benefits, and professional investment management, they also carry certain risks and fees.

Factors like surrender charges, high fees, and market volatility can impact the performance and value of these investments.

Additionally, while they’re not federally insured like some other financial products, they are backed by the issuing insurance company.

Considering their complexities, potential investors should weigh the benefits against the risks and costs and consult with financial professionals to determine if variable annuities align with their investment goals and financial situations.

1 Cited Research Article

- Investopedia.com (n.d.) What Is a 12b-1 Fee on a Mutual Fund and What Is It Used for?

https://www.investopedia.com/terms/1/12b-1fees.asp