Whenever tax time rolls around, many people panic.

Those returns should be simple to complete.

All you need to do is to fill in the correct details on the correct form. It sounds easy enough, and it can be if you know exactly what forms to complete.

For most people, however, knowing what form to use and inserting the right information becomes difficult. This is not an area where you want to make a mistake, either.

Leave out a vital piece of info, and it could look like you’re trying to underpay the government.

At the very least, a mistake could cost you that refund you’ve worked so hard to earn. That’s why so many people turn to tax preparation software to help them get it right the first time.

In this Liberty Tax review, we’ll look at what the company offers and whether it lives up to its promises.

Let’s examine things a little more closely before you make your final decision.

Table of Contents

Our Liberty Tax Review: Make Filing Your Returns a Breeze

Liberty Tax has a number of beneficial tools both for its basic users with less complicated returns and those with trickier finances, also providing assistance for users facing audits.

The software is built on the motto, “You do life. We do taxes,” and the services it offers aim to take the tedium of tax filing off your shoulders.

Here are some of the features that we feel make this software an asset.

Key Features

- Ability to Import Forms: It’s not that hard to fill in the details yourself, but it’s a lot easier if the software can do it for you. With this software, you can download the W-2 from your employer. You can also download your prior return from any source.

- Credit Maximizer: The main reason that you want help with your return is so that you get the maximum refund possible. This feature analyzes your figures and ensures that every qualifying deduction or credit is accounted for.

- You Can Amend Your Return for Free: This doesn’t sound like a big deal until you consider that TaxAct software, for example, charges you $44.95 to do the same thing. Hopefully, you’ll get the return right the first time around. It’s nice to know that you have this option, however.

- Free Customer Support and Expert Advice: Maybe there’s something that you just need to check quickly. The company has several channels open to clients. You can email them, call them, use instant chat, or reach out via social media.

- Audit Assistance: This has to be one of the scariest notices that an adult can receive. It’s enough to reduce a lot of people to a nervous wreck. Liberty Tax can provide advice on how to proceed.

- Get Your Return Checked: Liberty stands behind its product. At participating branches, you can take your return to a consultant. They’ll give it the once over to check for correctness so that you have extra peace of mind before submitting it.

- Useful Online Tools: There are several calculators that make your life easier. You can get a rough idea of the refund you can expect, and there are other tools that help you prep for your return. The Tax Organizer, for example, will help you to get all the proper documents together.

How to File Your Return With Liberty Tax

It Has a Very User-Friendly Interface

The interface has been designed to be easy to use. You don’t have to hunt around to find the right buttons – the navigation and layout are simple enough to read.

What’s more, they’ve been as sparing as possible when it comes to excess information.

You don’t have to scroll through pages of needless information to get what you need.

There Is Branch Support as Well

With 4,000 local branches, you are bound to find one nearby to consult if you get stuck.

The system has been designed so that it is easy to transfer the application from an online one to an in-person one so you get the assistance you need when you visit a branch in person.

You Can Flip Through the Application Easily

With some software, you have to work section by section, always completing one section before moving on to the next. When you’re completing a tax return, this isn’t always convenient.

Maybe you’ve forgotten to get a key piece of information, or you want to skip ahead. This software makes it easy to switch back and forth.

Get Your Refund Upfront

In some cases, you might qualify for a refund advance, and Liberty Tax will be sure to get you the money you qualify for.

The company will lend up to $3,250 as an advance on your refund if you qualify.

That’s quite a big chunk of change for an advance, one of Liberty Tax’s most appealing features.

What if Your Situation Is More Complicated?

If you have rental income or need to file in more than one state, for example, you need to choose one of the more advanced packages like the Deluxe or Premium options that Liberty Tax offers.

If you’re still concerned, you can opt to make an in-person application in a branch instead, where you can get more hands-on assistance from Liberty’s team of professionals.

File your taxes with Liberty Tax>>

Key Features of Liberty Tax Filing Services

| Feature | Description |

|---|---|

| User-Friendly Interface | Simple, Clutter-Free Interface for Easy Tax Filing |

| Branch Support | 4,000 Local Branches for In-Person Help, Seamless Online-to-In-Person Transition |

| Flexible Application Process | Easily Switch Between Tax Sections for Convenience |

| Refund Advance | Potential Refund Advance up to $3,250 for Quick Cash |

| Complex Situations Covered | Deluxe and Premium Packages for Rental Income or Multi-State Filings |

How Much Does Liberty Tax Cost?

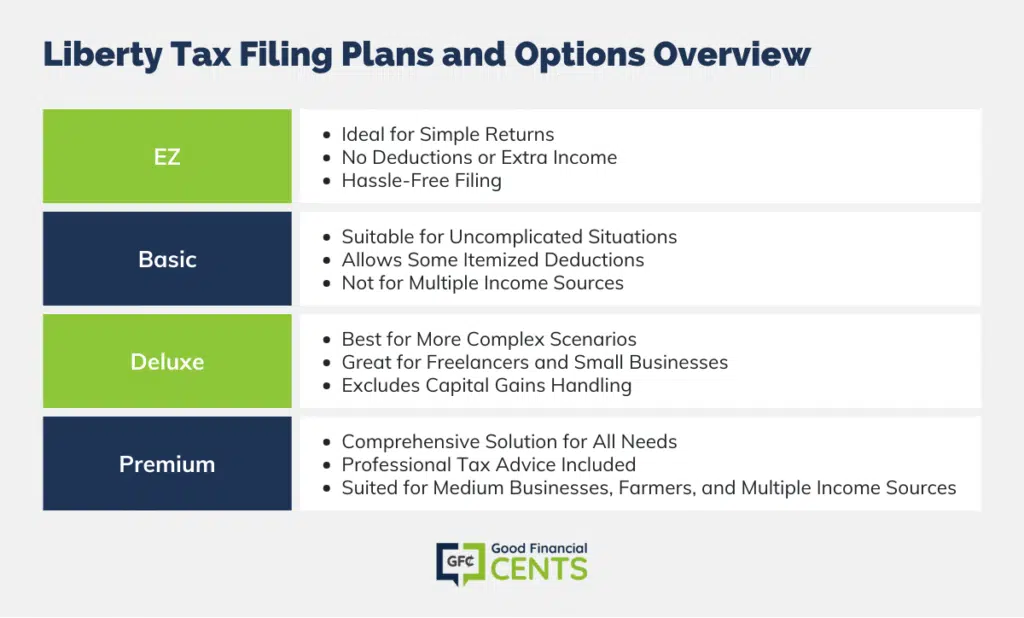

Liberty Tax offers users 4 paid levels of service for filing their federal and state returns, ranging from as low as $14.95 to as high as $69.95 for federal returns.

- EZ Package: Federal return: $14.95; state return: $39.95

- Basic Package: Federal return: $28.95; state return: $39.95

- Deluxe Package: Federal return: $43.95; state return: $39.95

- Premium Package: Federal return: $69.95; state return: $39.95

Let’s take a closer look at all of the features that you can access with each of those levels of service. Which package is the best fit for you boils down to how complex your tax needs are.

Liberty Tax Filing Options & Plans

EZ

This is the software version for you if your return is simple.

You don’t get to list deductions, and there is no room for extra income, but filing with this package means there are no complications at all.

Basic

This plan encompasses a bit more than the EZ package.

The basic package is not going to be much use to you if you have a complicated tax situation, like if you have multiple sources of income.

But it does allow you to itemize your deductions a little more than the EZ package.

Deluxe

If your situation is more complex, this plan is where you should start looking.

The deluxe package is popular with those who freelance or run a small home business. It won’t handle issues related to capital gains, however.

Premium

If you want to be able to do it all, this is the package for you. The Premium plan comes with professional tax advice from Liberty’s experts and audit consultation.

It’s also a good option for those with a medium business, farmers, and those with multiple income sources.

Other Considerations

Now that we’ve gone through the pros let’s have a look at the negatives.

- Liberty only offers paid options. Most companies allow their clients some form of basic free service. Liberty is not like most in this respect.

- The packages border on pricy. You get a lot of features, but the prices are higher as well.

- The site can be annoying because it times out quickly. If you’re inactive on the site for what seems like a few seconds, it will time out. What really annoyed us here is that it timed out even if we were checking out the “Learn More” links.

- The customer service aspect needs to be improved. Don’t get us wrong; they deliver excellent customer service, but only as long as you’re able to contact them during normal business hours. In this day and age, we expect at least a 24-hour chat option for basic queries.

The Verdict

With Liberty Tax, results and accuracy are guaranteed. The company promises to get the best possible results and create completely accurate returns.

Overall, the positives do outweigh the negatives. You’ll battle to find software with quite so many useful features built into it. You do have to pay a bit more, but you are getting a better-quality product overall.

The support hours are an annoyance, but it’s not a deal-breaker. Overall, we’d say that the experience is a positive one.

We’d be confident about submitting our returns through this service.

Get started with Liberty Tax>>

The Bottom Line – Liberty Tax Review

Liberty Tax presents a robust suite of features catering to diverse financial scenarios. While its pricing is on the higher end and there are a few operational drawbacks, the comprehensive tools, guarantees of accuracy, and extensive support make it a worthy consideration for tax filers.

The option to amend returns for free, combined with a user-friendly interface and local branch support, adds to its appeal.

Despite some limitations in customer service availability, the overall offerings ensure that users receive value for their investment.

Liberty Tax stands out as a reliable choice for those prioritizing precision and support during tax season.

How We Review Tax Preparation Software:

Good Financial Cents reviews various tax preparation software options, emphasizing user experience, feature sets, and accuracy in calculations. We aim to provide users with a balanced perspective, assisting them during tax season. Our editorial process is transparent and thorough.

We source data from software providers, testing functionalities and evaluating user interfaces. This hands-on approach, combined with our research, ensures a comprehensive review. Each software option is then rated based on its strengths and weaknesses, resulting in a star rating from one to five.

For a deeper understanding of the criteria we use to rate tax preparation software and our evaluation approach, please refer to our editorial guidelines and full disclaimer.

Liberty Tax Review

Product Name: Liberty Tax

Product Description: Liberty Tax is a comprehensive tax preparation software designed to assist users with their tax filing needs, catering to various financial complexities. By leveraging its intuitive tools and features, the platform aims to simplify the tax-filing process, ensuring maximum refunds and accuracy.

Summary

Liberty Tax stands out in the crowded tax software market by offering tailored solutions for individuals with different financial scenarios, from basic to complex. The software is built around the user’s convenience, allowing for form imports, maximizing deductions, and offering free amendments to returns. With thousands of local branches available for in-person consultations and a plethora of online tools, Liberty Tax positions itself as both a digital and brick-and-mortar solution for those seeking a seamless tax filing experience.

-

Cost and Fees

-

Customer Service

-

User Experience

-

Product Offerings

Overall

Pros

- Versatility: Suits various financial complexities with multiple package options.

- Convenience: Features like form imports, credit maximization, and free amendments enhance user experience.

- Branch Support: With 4,000 branches, users can get in-person assistance if needed.

- Refund Advances: Offers advances up to $3,250 on refunds, providing quick financial relief.

Cons

- No Basic Free Version: Unlike some competitors, Liberty Tax doesn’t offer a free basic service.

- Higher Costs: While offering robust features, the packages are pricier than some alternatives.

- Website Timeouts: Quick session timeouts can lead to minor user inconveniences.

- Limited Support Hours: Lack of 24/7 customer support can be a drawback for those needing assistance outside of business hours.