If you have bad credit and need a car loan, there are some challenges when compared to obtaining a standard car loan. However, pick your head up because there are a handful of great lenders that specifically tailor their programs to people with bad credit. We researched the landscape of lenders that can help you get a car loan even if you have a below-average credit score.

Based on our study, OneMain Financial and LightStream are two of the top lenders offering bad credit card loans. This is due to factors including loan options, requirements to qualify, and interest rates offered. Of course, we offer in-depth reviews of all the top lenders who offer bad credit car loans further down in this piece.

Apply Now With Our Top Pick: OneMain Financial

In this guide, we also help you understand the factors that go into selecting the right auto lender and how to get the best rate you can.

Table of Contents

- Most Important Factors for Bad Credit Car Loans

- The Best Bad Credit Car Loans of 2024

- Why Some Lenders Didn’t Make the Cut

- Bad Credit Auto Loan Reviews

- What You Need to Know When Applying for a Car Loan With Bad Credit

- How to Get the Best Rate

- How We Chose the Best Auto Loans

- Summary: Best Bad Credit Card Loans of 2024

- Final Thoughts – Best Car Loans When You Have Bad Credit

Most Important Factors for Bad Credit Car Loans

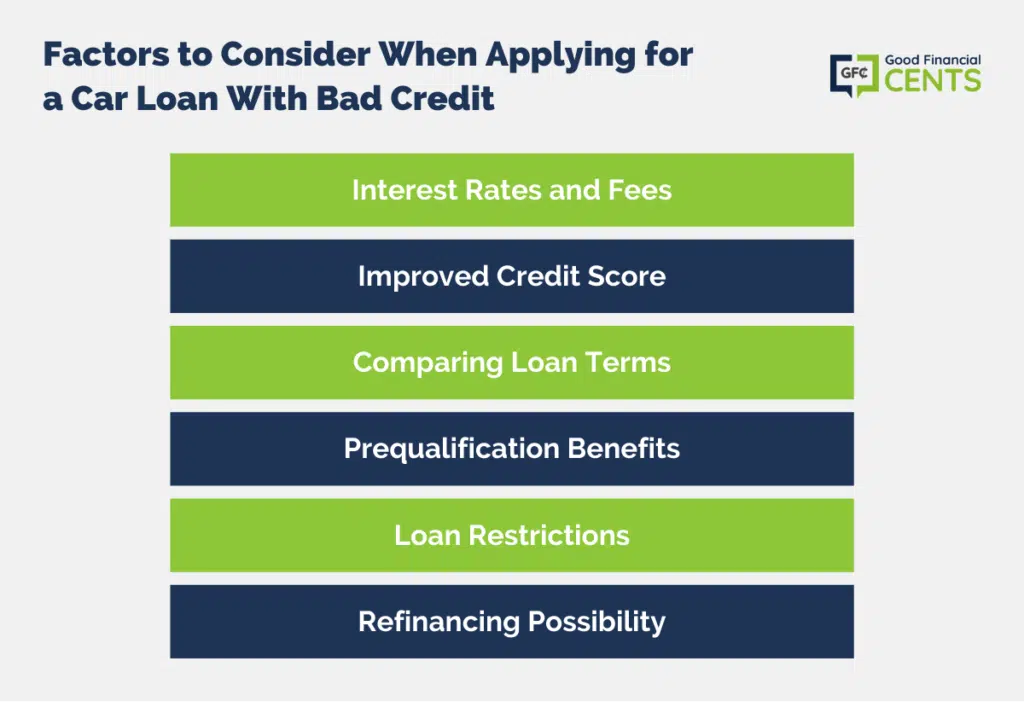

If you’re in the market for a bad credit car loan, there are a plethora of factors to consider and compare. Here are the main loan details we looked at in our study and the ones you should prioritize as you select the best car loan for your needs.

- Check your credit score and understand what is in your credit report.

- FICO scores under 579 are considered ‘poor.’ But you may need a bad credit loan with a score as high as 669.

- Interest rates and fees matter. These can make a huge difference in how much you pay for an auto loan each month.

- Compare loan terms. Consider your repayment timeline and compare lenders with this in mind.

- Getting prequalified online can help. Some lenders, including ones that made our ranking, let you get prequalified for a loan online without a hard inquiry on your credit report.

- Watch out for loan restrictions. Some lenders impose restrictions on what car you can purchase. Keep this in mind to avoid unpleasant surprises later.

The Best Bad Credit Car Loans of 2024

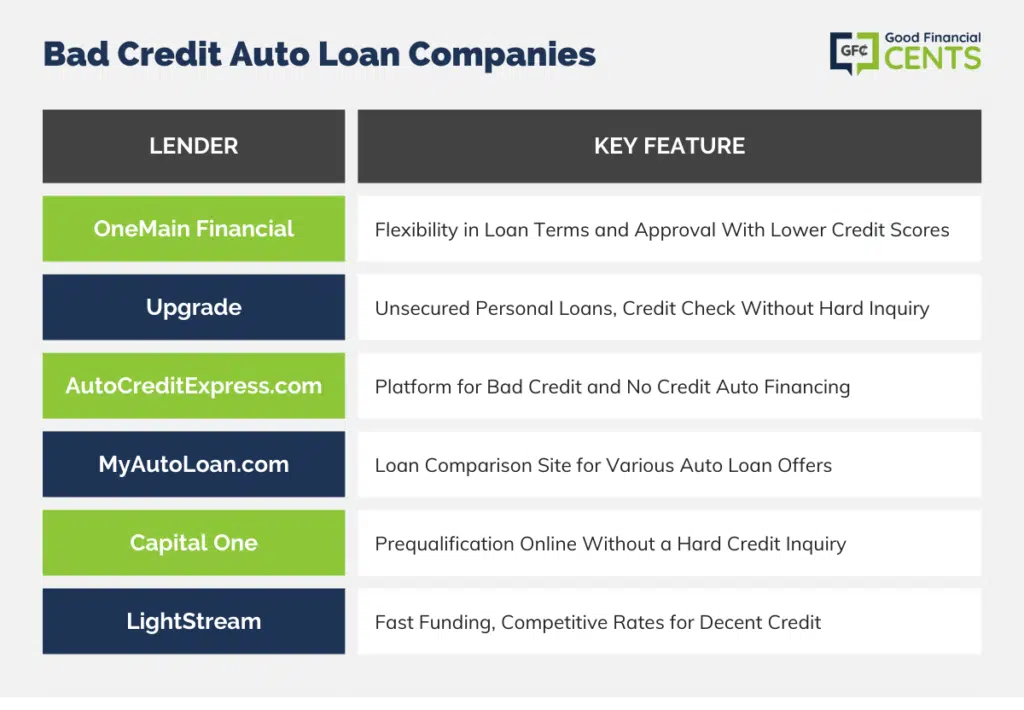

The best bad credit car loans make it easy for consumers to qualify for the financing they need. The following lenders made our list due to their superior loan offerings, excellent customer service, and reputation in this industry.

| Car Loan Company | Best For… | Get Started |

| Best for Flexibility | Apply Now | |

| Best Personal Loan Option | Apply Now |

| Best Loan for Bad Credit and No Credit | Apply Now |

| Best Loan Comparison Site | Apply Now | |

| Best Big Bank Loan for Bad Credit | Apply Now |

| Best for Fast Funding | Apply Now |

Why Some Lenders Didn’t Make the Cut

While the lenders we are profiling are the best of the best, there are plenty of bad credit car loans that didn’t quite make the cut. We didn’t include any lenders that only offer auto loan refinancing, for example, since we know many people need a car loan in order to purchase a new or used car or truck. We also stayed away from bad credit car loans that charge outrageous fees for consumers with the lowest credit scores.

Bad Credit Auto Loan Reviews

We listed the top companies we selected in our study above, but we also aim to provide readers with more insights and details on each. The reviews below highlight the highlights of each lender that made our list, plus our take on who they might be best for.

OneMain Financial: Best for Flexibility

OneMain Financial offers personal loans and auto loans with interest rates that range from 18.00% to 35.99%. You can repay your auto loan in 24, 36, 48, or 60 months, and you can use this lender to borrow up to $20,000 for a new or used car. You can apply for your auto loan online and from the comfort of your own home, and it’s possible to get approved within a matter of minutes.

While OneMain Financial doesn’t list a minimum credit score requirement, it’s believed they will approve consumers with scores as low as 600. You should also note that auto loans from OneMain Financial come with an origination fee of up to 5% of your loan amount.

Sign Up With OneMain Financial Today

Why This Lender Made Our List: OneMain Financial offers a lot of flexibility in terms of your loan terms, including the option to repay your auto loan over five years. OneMain Financial also has pretty decent reviews from users for a bad credit lender, and they have an A+ rating with the Better Business Bureau.

Potential Downsides to Be Aware Of: OneMain Financial charges some pretty high rates for its bad credit loans, and don’t forget that you may need to pay an origination fee that is up to 5% of your loan amount. Their loans are also capped at $20,000, which means this lender won’t work for everyone.

Who It’s Best For: This lender is best for consumers with really poor credit who need auto financing but can’t get approved for a better loan.

Upgrade: Best Personal Loan Option

Upgrade is an online lender that offers personal loans with fixed interest rates, fixed monthly payments, and a fixed repayment timeline. You can borrow up to $50,000 in an unsecured loan, which means you won’t actually use the car you purchase as collateral for the loan.

You can repay the money you borrow over 36 to 60 months, which makes it possible for you to tweak your loan offer to secure a monthly payment you can afford. Upgrade has a minimum credit score requirement of 620 to qualify, although they’ll consider additional factors such as your income and employment history.

Why This Lender Made Our List: Upgrade lets you “check your rate” online without a hard inquiry on your credit report. This makes it easy to shop around and compare this loan offer to others without having to fill out a full loan application. Also note that Upgrade has an A+ rating with the BBB.

Potential Downsides to Be Aware Of: Upgrade charges APRs as high as 35.89% for consumers with the worst credit, and an origination fee of up to 6% of your loan amount might also apply.

Who It’s Best For: Upgrade is best for consumers with decent credit who need to borrow a larger loan amount. This loan is also best for anyone who wants an auto loan that isn’t secured by their vehicle.

AutoCreditExpress.com: Best Loan for Bad Credit and No Credit

AutoCreditExpress.com is an online platform that lets consumers with bad credit and even no credit get the financing they need. Once you fill out some basic loan information, you’ll be connected with a lender who can offer you financing as well as a dealership in your area. From there, you’ll head to the local dealership and pull the pieces of your auto loan together, including the purchase price of the car you want.

Sign Up With Autocreditexpress.com Today

Why This Lender Made Our List: AutoCreditExpress.com has an A+ rating with the Better Business Bureau. This platform also makes it possible for consumers with no credit at all to finance a car, which is a welcome relief for people who are building credit for the first time.

Potential Downsides to Be Aware Of: This website is a loan platform, but they don’t offer loans directly to consumers. This means you won’t have any idea about rates and terms until you fill out an application and get connected with a lender.

Who It’s Best For: This loan is best for consumers with no credit or minimal credit history who cannot get approved for a loan elsewhere.

MyAutoLoan.com: Best Loan Comparison Site

MyAutoLoan.com is a loan comparison site that makes it easy to compare up to four auto loan offers in a matter of minutes. You can use this website to apply for a new auto loan, but you can also utilize it to consider refinancing offers for an auto loan you already have. You can also use funds from this platform to purchase a car from a dealer or from a private seller.

Sign Up With MyAutoLoan.com Today

Why This Lender Made Our List: Comparing auto loans in terms of their terms, rates, and fees is the best way to save money and wind up with the best deal. Since MyAutoLoan.com is a loan comparison site, they make it easy to shop around and compare competing offers.

Potential Downsides to Be Aware Of: Loan comparison sites connect you with other lenders who have their own loan terms and minimum requirements for approval. Make sure you know and understand all the details of the loans you’re considering before you sign on the dotted line.

Who It’s Best For: MyAutoLoan.com is best for consumers who want to do all their auto loan shopping on a single website.

Capital One: Best Big Bank Loan for Bad Credit

Capital One offers online auto loan financing in conjunction with a program called Auto Navigator®. This program lets you get prequalified for an auto loan online, then work with a participating dealer to coordinate a loan for the car you want. Capital One also lets you search available vehicles at participating dealerships before you apply for financing, making it easy to figure out how much you might need to borrow ahead of time.

Sign Up With Capital One Today

Why This Lender Made Our List: Capital One offers the huge benefit of letting you get prequalified online without a hard inquiry to your credit report. Capital One is also a reputable bank with a long history, which should give borrowers some comfort. They have anA+ rating with the BBB and plenty of decent reviews from consumers.

Potential Downsides to Be Aware Of: You should be aware that Capital One auto loans only work at participating dealers, so you may be limited in terms of available cars to choose from.

Who It’s Best For: Capital One auto loans are best for consumers who find a car they want to buy at one of the participating lenders that work with this program.

LightStream: Best for Fast Funding

LightStream offers online loans for a variety of purposes, including auto financing. Their auto loans for consumers with excellent credit start at just 3.99% with autopay, and even their loans for consumers with lower credit scores only run as high as 16.79% with autopay.

You can apply for your LightStream loan online and get approved in a matter of minutes. This lender can also send your funds as soon as the same business day you apply.

A minimum credit score of 660 is required for loan approval, although other factors like your work history and income are considered.

Sign Up With LightStream Today

Why This Lender Made Our List: LightStream offers auto loans with exceptional terms, and that’s even true for consumers with less-than-perfect credit. You can also get your loan funded as soon as the same business day you apply, which is crucial if you need auto financing so you can get back on the road.

Potential Downsides to Be Aware Of: With a minimum credit score requirement of 660, these loans won’t work for consumers with the lowest credit scores.

Who It’s Best For: LightStream is best for people with decent credit who need to get auto loan financing as quickly as possible.

What You Need to Know When Applying for a Car Loan With Bad Credit

Interest Rates and Fees Matter

If you think your interest rate and loan fees won’t make a big difference in your monthly payment, think again. The reality is that rates and fees can make a huge difference in how much you pay for an auto loan each month.

Consider this: A $10,000 loan with an APR of 35.89% will require you to pay $361 per month for five years. The same loan amount at 21.99% APR will only set you back $276 per month. At 9.99%, you would pay only $212 per month for five years.

The bottom line: Make sure to compare auto loans for bad credit so you wind up with the lowest possible APR you can qualify for.

Take Steps to Improve Your Credit Score Before You Apply

It’s not always possible to wait to apply for a car loan, but you may be able to secure a lower interest rate and better loan terms if you can improve your credit score before you borrow money. The most important steps you can take to improve your score include paying all your bills early or on time, as well as paying down debt in order to decrease your credit utilization. You should also refrain from opening or closing too many credit card accounts in order to avoid new inquiries on your credit report and maintain the longest average length of your credit history possible.

Compare Loan Terms

Some lenders let you borrow money for up to 84 months, while others let you repay your loan over 36 or 60 months at most. If you need to repay your loan over a longer timeline in order to secure an affordable monthly payment, make sure to compare lenders based on this factor. If you’re having trouble figuring out how much you can afford, gauging affordability based on the monthly payments you can handle can also help in that effort.

Getting Prequalified Online Can Help

Some lenders, including those that made our ranking, let you get prequalified for a loan online without a hard inquiry on your credit report. This makes it considerably easier to compare rates and shop around without formally applying for an auto loan. Getting prequalified with more than one lender can also help you determine which one might offer the lowest rate without having to fill out a full loan application.

Watch Out for Loan Restrictions

As you compare the lenders on this list, keep in mind that not all lenders extend loans for any car you want. Some only let you finance cars with participating lenders in their network, which can drastically limit your options and make it impossible to purchase a car from a private seller. If you hope to purchase a car from someone you know or a website like craigslist.org, you may want to consider reaching out to your personal bank or a credit union you have a relationship with.

Bad Credit Car Loans Don’t Have to Last Forever

Finally, you should know that a car loan for bad credit doesn’t have to last forever. You may need to borrow money for a car right now, regardless of the interest rate and terms you can qualify for, but it may be possible to refinance your loan into a better loan product later on. This is especially true if you focus on improving your credit score right away, and use your auto loan as an opportunity to prove your creditworthiness.

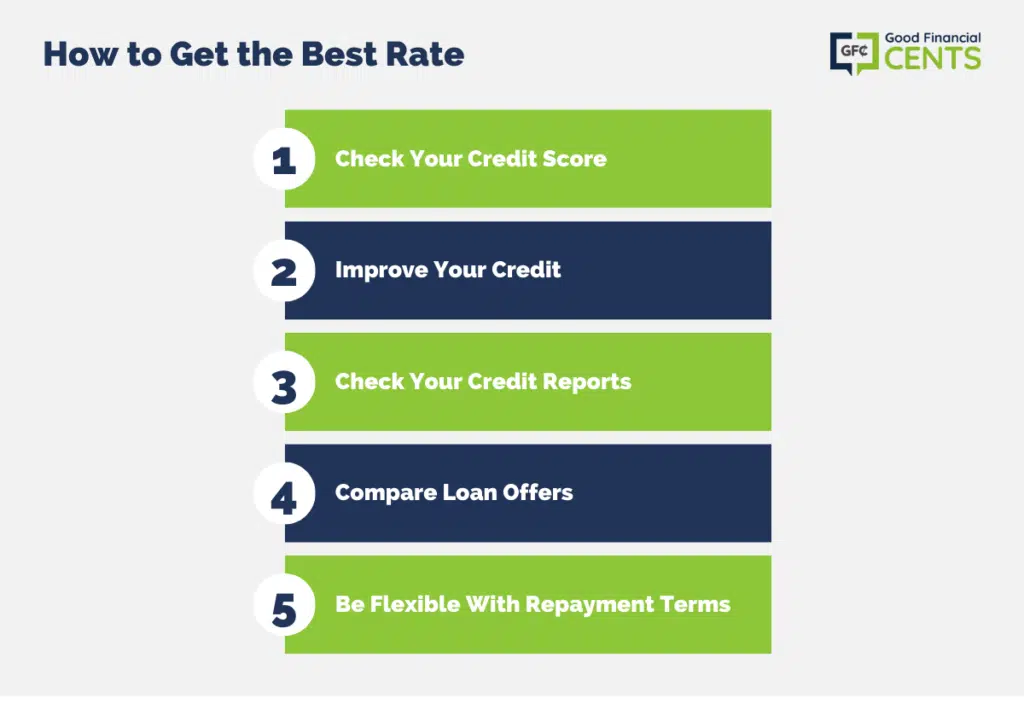

How to Get the Best Rate

1. Check Your Credit Score

Your credit score is one of the most important defining factors that dictate loan costs. Before you apply for an auto loan, it can be helpful to check your credit score to see where you stand. Your score may not be as bad as you realize, but it could also be worse than you ever imagined. Either way, it helps to know this important information before you start shopping for an auto loan.

2. Improve Your Credit Over Time

If your credit score needs work, you’ll want to take steps to start improving it right away. The most important steps you can take to boost your credit score include paying all your bills early or on time and paying down debt to decrease your credit utilization. Also, make sure you’re not opening or closing too many credit accounts within a short amount of time.

3. Check Your Credit Reports

Use the website AnnualCreditReport.com to get a free copy of your credit reports from all three credit bureaus. Once you have this information, check your credit reports for errors. If you find false information that might be hurting your score, take the steps to have the incorrect information removed.

4. Compare Loan Offers From at Least Three Lenders

A crucial step to get the best rate involves shopping around and comparing loan offers from at least three different lenders. This is important since lenders with different criteria might offer a lower APR or better terms than others.

5. Be Flexible With Repayment Terms

Also, consider a few different loan terms, provided you can afford the monthly payment on each. Some auto lenders offer better rates for shorter terms, which can help you save money if you can afford to repay your loan over 24 or 36 months instead of 60+.

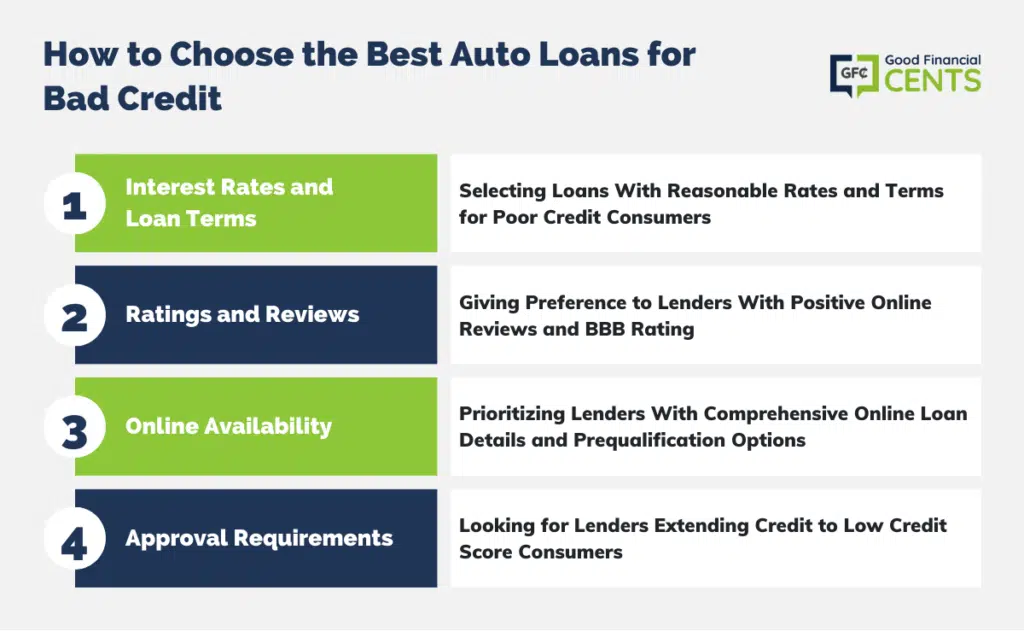

How We Chose the Best Auto Loans

The lenders on our list weren’t plucked out of thin air. In fact, the team behind this guide spent hours comparing auto lenders based on a wide range of criteria. Here’s everything we considered when comparing the best bad credit car loans of 2025:

- Interest Rates and Loan Terms: Our team looked for loans that offer reasonable rates and terms for consumers with poor credit. While higher APRs are typically charged to consumers with a low credit score, we only considered lenders that offer sensible rates that don’t seem out of line for the auto loan market.

- Ratings and Reviews: We gave preference to lenders who have decent reviews online, either through Consumer Affairs, Trustpilot, or another third-party website. We also gave higher marks to lenders who have a positive rating with the Better Business Bureau (BBB).

- Online Availability: Lenders who offer full loan details online were definitely given top priority in our ranking, and lenders who let you get prequalified online without a hard inquiry on your credit report were given the most points in this category. But since not everyone wants to apply for a loan online, we also included some lenders that let you apply over the phone.

- Approval Requirements: Finally, we looked for lenders that extend credit to consumers with low credit scores in the first place. Not all lenders offer specific information on approval requirements, but we did our best to sort out lenders that only accept borrowers with good or excellent credit.

Summary: Best Bad Credit Card Loans of 2024

- Best for Flexibility: OneMain Financial

- Best Personal Loan Option: Upgrade

- Best Loan for Bad Credit and No Credit: AutoCreditExpress.com

- Best Loan Comparison Site: MyAutoLoan.com

- Best Big Bank Loan for Bad Credit: CapitalOne

- Best for Fast Funding: LightStream

Final Thoughts – Best Car Loans When You Have Bad Credit

Getting a car loan with bad credit can be challenging, but lenders like OneMain Financial and LightStream specialize in helping. They offer flexibility, reasonable rates, and easy online applications.

When applying, consider factors like credit score, interest rates, fees, and loan terms. Prequalification lets you compare offers without impacting your credit. While some lenders have restrictions, keep in mind the option to refinance later. By understanding these aspects, you can secure the best rate and work toward credit improvement.

Other notable lenders include Upgrade, AutoCreditExpress.com, MyAutoLoan.com, Capital One, and LightStream, each with their unique benefits.