If the authorities pull you over on the water, they may ask to see your identification or your fishing license. They may want to count your complement of life jackets.

But they probably won’t ask about your boat insurance.

Very few states — only Hawaii, Arkansas, and Utah — require residents to insure boats the way they mandate auto coverage.

Still, you should consider boat coverage because insurance doesn’t exist to satisfy the water patrol. It exists to protect your investment.

Whether your boat’s in the marina, in tow, or beneath the shed behind your cabin, unexpected things can happen. If they do, your boat could lose value, or you could lose the ability to use it, or both.

Table of Contents

- What Boat Insurance Covers

- What Boat Insurance Does Not Cover

- How Much Would Hull Coverage Pay?

- Which Boats Need Insurance

- Are There Other Ways to Insure Your Boat?

- How to Save Money on Boat Coverage

- How to Buy Boat Insurance

- Best Boat Insurance Providers

- Boat Insurance: Protection On and Off the Water

- Bottom Line – Boat Insurance | Protection On (And Off) The Water

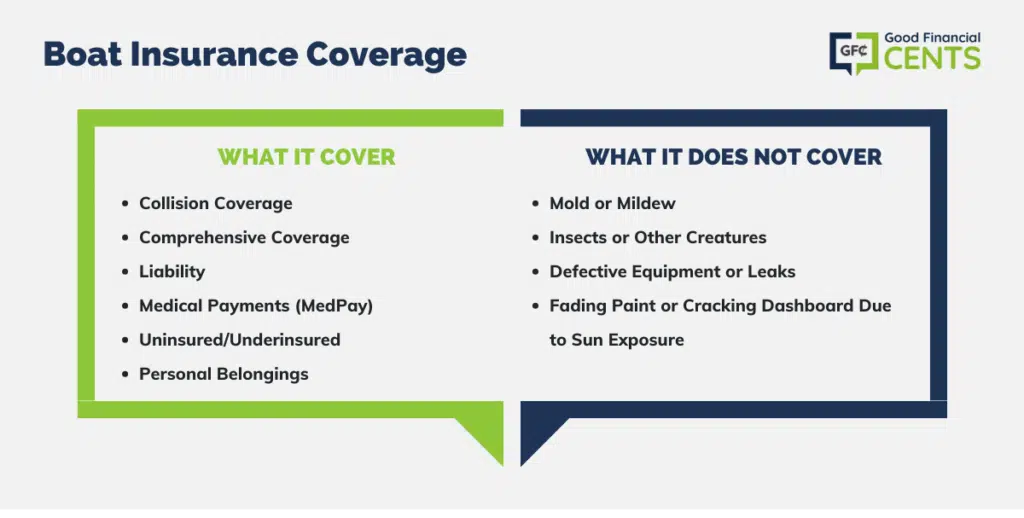

What Boat Insurance Covers

A boat insurance policy, also known as hull insurance, works a lot like auto coverage. It packages several kinds of coverage into one premium.

How much of each coverage you buy will help determine your policy’s cost:

- Collision Coverage: It can pay to replace or repair your boat after a collision on the water. Most policies require you to pay a deductible to access your coverage.

- Comprehensive Coverage: Covers damage to your boat not caused in a collision — damage from theft, vandalism, or hail, for example. A deductible usually applies here, too.

- Liability: Pays a third party on your behalf to compensate for damages you caused while using your boat. This coverage should pay the third party’s medical bills (bodily injury) and any property damage, assuming accident investigators determine the collision was your fault. This coverage should not require a deductible.

- Medical Payments (MedPay): It can pay your medical bills resulting from an accident you caused. If you have good health insurance, you may not need much coverage in this category.

- Uninsured/Underinsured Boater: If someone without boat insurance causes damage to your property, this coverage can compensate you for the damage.

- Personal Belongings: This coverage can help you replace lost or stolen items that are not attached to your boat. Things like fishing equipment, small appliances, or electronics.

As you shop for a policy, decide how much of these primary coverages you need. Collision and comprehensive coverages protect your investment. Liability protects your overall financial picture if you cause damage to someone else. So I wouldn’t skimp there.

However, you may not need personal belongings protection if you don’t keep very many removable valuables on board. Only you can know your exact needs here.

We’ll go into some other optional coverages below.

First, let’s be clear about what a policy will not cover.

What Boat Insurance Does Not Cover

Boat enthusiasts like to keep their watercraft shipshape, and when you’re paying an insurance premium, you may expect your policy to cover any problem that threatens your investment.

Insurance will not cover all problems that arise, though. Insurance protects your boat’s financial value after a wreck, a crime, or a fire — something external that happens to your boat.

But it does not cover damage from normal wear and tear, so boat insurance won’t help when:

- Mold or Mildew: Build up in or beneath your boat.

- Insects or Other Creatures: Harm electronics or upholstery.

- Defective Equipment or Leaks: Damage other systems in your boat.

- The Sun: Fades your paint or cracks the dashboard.

A manufacturer’s warranty could address some of these issues.

Before buying an insurance policy, find out where your insurance company draws the line between external damage and normal wear and tear, especially if you’re getting personal belongings coverage.

Most policies will cover an outboard motor if it gets destroyed by an accidental fire at the marina, but not if it wears out from normal use.

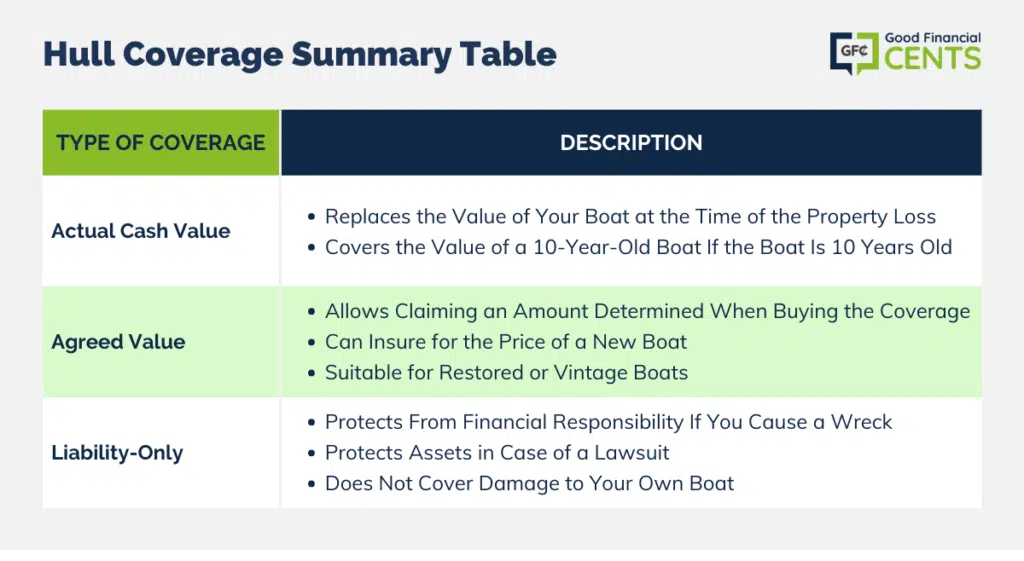

How Much Would Hull Coverage Pay?

Policyholders usually hope they’ll never have to file a claim. In the best-case scenario, you’d pay your premiums and feel safer knowing you have a plan in place if something goes wrong.

Unfortunately, not everyone can stay claims-free. If you knew you’d never file a claim, you wouldn’t buy insurance in the first place.

When you file a claim because of property loss or extensive property damage, your insurance company could reimburse you according to your type of coverage:

- Actual Cash Value: This kind of coverage would replace the value of your boat at the time of the property loss. If you have a 10-year-old boat, your claim will cover the value of a 10-year-old boat and not the amount you paid to purchase the boat when it was new 10 years ago.

- Agreed Value: With this kind of coverage, you can claim an amount you determined when buying the coverage. So, if you wanted to be insured for the price of a new boat, you could buy a policy to cover such an amount.

Unless you specifically seek a policy with an agreed value, your policy will most likely cover actual cash value.

A policy with an agreed value can lead to higher premiums since the amount of coverage you have directly impacts the cost of your coverage.

Agreed value coverage works especially well for someone with a restored or vintage boat whose value includes the amount of time and hard work you invested in the project.

Liability-Only Coverage

Some companies also allow you to buy only liability coverage. This would help protect you from financial responsibility if you caused a wreck on the water, either by colliding with another boat, a swimmer, or property along the shore.

If such a tragedy happened and you were sued for damages, the court could seize your assets to settle the lawsuit. Liability insurance is a must whenever there’s a chance you could cause someone harm.

Liability-only coverage protects you from liability, but it does not protect your own investment. Only comprehensive and collision coverages, along with personal belongings and other add-ons, can protect your boat.

Which Boats Need Insurance

Why do so few states regulate boat insurance? One reason is the wide variety of boats. The word boat can describe a 75-foot yacht you keep at the marina or the kayak you keep in the garage.

When to Boat Without Coverage

Buying a dedicated insurance policy for a boat you could easily replace yourself doesn’t make a lot of sense. If you paddle your boat or haul it in the back of a pickup truck, insurance may not be the best investment.

This distinction may sound like common sense for a lot of people, but it’s still important to point out. You probably don’t need boat insurance for…

- A Canoe or Kayak: Any boat you paddle or carry onto the water probably isn’t big enough to insure.

- A Small Boat With a Motor: If your boat wouldn’t exceed 25 mph, you probably can get by without coverage, though this is more of a judgment call.

When to Protect Yourself and Your Boat

You will need insurance to protect yourself and your investment in your boat if you have…

- A Faster Boat With a Motor: A motor capable of exceeding 25 mph means you’re putting yourself and others at more risk. You’ll need the protection of an insurance policy.

- A Personal Watercraft: WaveRunners and other personal watercraft move quickly, and they’re expensive to replace. You’ll need insurance.

- Any Larger Boat: Naturally, a yacht, a pontoon, a large sailboat, a jet boat — anything you’ve invested significant money in — deserves to be protected by insurance.

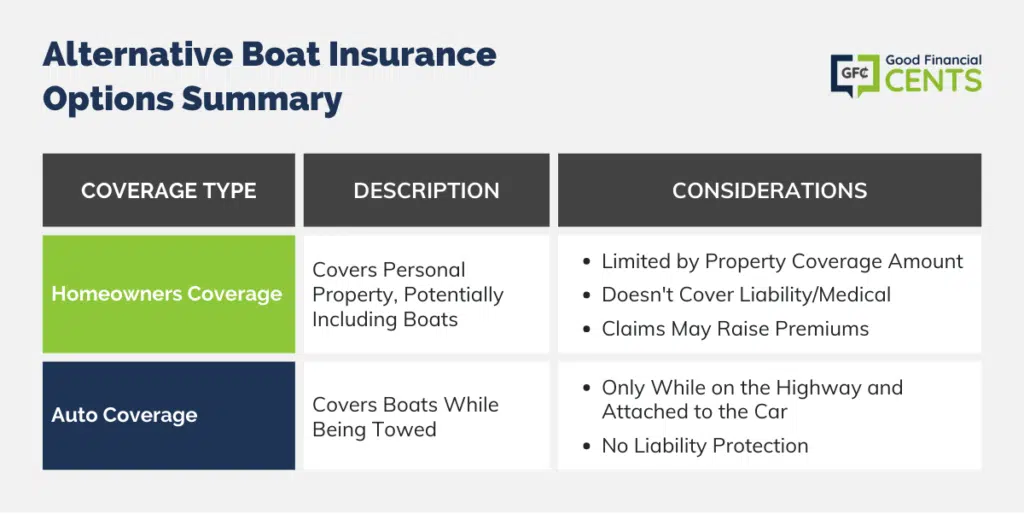

Are There Other Ways to Insure Your Boat?

New boat owners who already have homeowners insurance, auto insurance, health and dental coverage, life insurance, and pet insurance understandably don’t want to add yet another premium to the monthly budget.

I get it. In this case, it’s a natural tendency to look for alternative ways to protect your investment. But these ideas usually don’t pan out.

Homeowners Coverage

I’ve had this discussion with clients about RVs and small vacation cabins, too: “Doesn’t my homeowners policy already cover all my property,” they’ll say, “including my new boat?”

They’re referring, of course, to the personal property coverage within their homeowners’ policy. This coverage can reimburse you for lost, damaged, or stolen belongings even if they’re away from home — out on the lake, for example — when the damage happens.

Technically, this idea could work, but only if you have a boat with a value small enough to fit within your homeowners’ personal belongings coverage.

Homeowner’s policies calculate personal belongings coverage as a percentage of your actual home’s value, and they tend to cap annual payouts at levels beneath the value of a boat.

Even if you could somehow make this work, you wouldn’t be addressing liability or medical issues at all. And, when you file a claim asking your homeowner’s insurance agent for help with your boat, the agent may increase your homeowner’s premiums.

Auto Coverage

Other people sometimes assume their auto policy will cover their boat. They think this because their auto agent does want to know they’re towing a boat.

This is important for your auto policy because it helps insure your car and your boat while they’re on the highway. But this coverage will not protect you from liability, nor will it protect your boat when it’s not attached to your insured automobile.

In most cases, a boat insurance policy offers the best protection for your boat and the best shield against liability on the water.

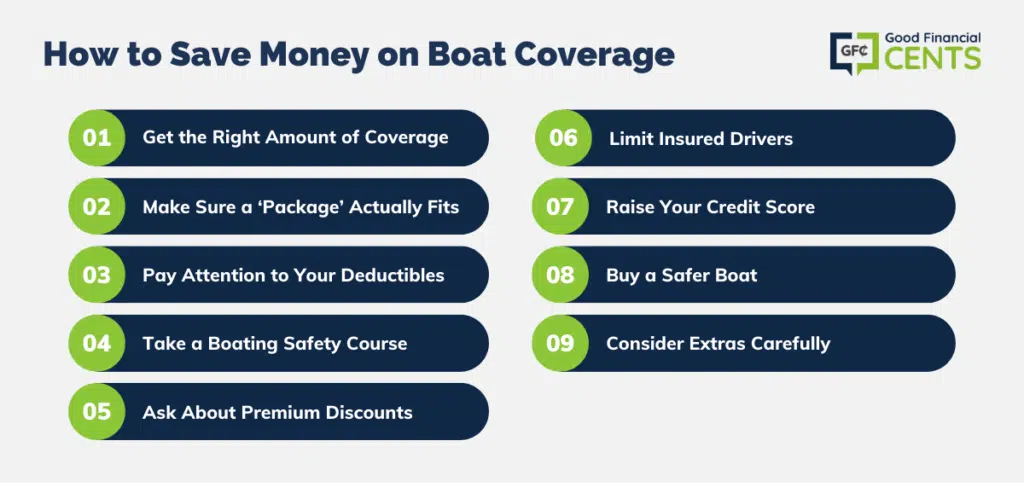

How to Save Money on Boat Coverage

Just because you need boat insurance doesn’t mean you need to pay too much for your coverage. By shopping around and knowing exactly what you need, you can save money on your premiums.

1. Get The Right Amount of Coverage

A lot of new boat owners buy more coverage than they’ll ever use. More coverage means higher premiums. Defining your coverage needs in advance can help you avoid paying too much.

- Comprehensive/Collision:These coverages protect your investment. Actual cash value coverage can save on your premiums.

- Liability: This is an important component. But by getting an umbrella policy, which can offer liability coverage across several different kinds of insurance policies, you may be able to save some on your boat-specific liability insurance.

- MedPay: If you’re confident about your health insurance situation, you can save money by lowering or eliminating this coverage; however, it’s best to keep this coverage if you have a high medical insurance deductible or a catastrophic medical plan.

- Uninsured/Underinsured: This coverage protects you when someone without insurance (or with very little insurance) causes you property damage. It’s nice to have this coverage when you need it, and it’s relatively affordable.

- Personal Property: This one’s a judgment call, depending on your boat and its valuables. You can spend thousands of dollars on navigation guides, fish-finding gear, and other electronics. Protecting these investments makes sense. If you keep things simple on your boat, though, you may be able to save by lowering this coverage amount.

2. Make Sure a ‘Package’ Actually Fits

Many companies offer boat insurance coverage packages. These packages adjust the components of your policy in ways to serve the specific needs of fishing boats, houseboats, personal watercraft, and so on.

While these packages may mesh nicely with your coverage needs, your situation may not always fit a package precisely.

For example, if you use your boat for fishing but don’t use a lot of expensive gear, the fishing package may have more personal belongings coverage than you need.

These packages do make shopping easier, but take a close look at how they’re built to make sure you can’t save more by custom-building your own package.

3. Pay Attention to Your Deductibles

Deductibles directly impact premiums in most cases. Your deductible will determine the amount you’ll need to pay out of pocket before your insurance company starts paying.

With a low-deductible policy, you’ll pay less out of pocket but more in premiums. A higher-deductible policy saves on your monthly premiums but requires more out of your pocket before you can file a claim.

I’m all for saving on premiums, but avoid deductibles so high you’d never be able to afford them. If you can’t pay the deductible, your insurance won’t be very helpful after an accident or theft.

4. Take a Boating Safety Course

Like just about any kind of insurance, boat insurance underwriters consider risk as a component of your premiums. Lowering the risk you present as a policyholder can lower your premiums.

Completing a boating safety course can help prove you’re a lower-risk applicant.

To be sure your course will help you lower premiums, check with your agent or your insurance company’s customer service reps.

5. Ask About Premium Discounts

Many insurance companies give policyholders discounts, which helps keep you an active customer. Not all companies offer the same discounts, but here are some common discounts to ask about:

- Bundled Policies: Your auto or home insurance company may offer boat insurance. If so, there’s a good chance you can save all three policies through a bundled policies discount. Make sure all three policies meet your needs, though. If not, you’re better off breaking up the bundle and getting better coverage elsewhere.

- Diminishing Deductibles: When you go years without filing a claim, you’re obviously saving your insurance company money. Many companies will lower your premiums in response. In some cases, your premium may be lower each year you go without a claim.

- Layup Periods: Just like with a motorcycle or an RV, you may not use your boat year-round. If not, ask about layup insurance. With these plans, you can pay a lower premium to reflect the months in which you’re never on the water. Make sure you abide by the schedule, though. You’d be unprotected out there during a layup period.

6. Limit Insured Drivers

Just like with a car, the number of people who will drive your boat impacts premiums. If you have a teenage son, for example, you’ll save on premiums by keeping him off your policy.

Your driving record on the highway can also impact your insurance rates. Insurers assume your behavior on the road will mirror your tendencies on the water.

Generally speaking, someone with a good driving record who is older than 25 will get better boat insurance rates. You may not fit this description, and you’ll just have to live with that. But you can save money by keeping other drivers who present a higher risk from getting behind the wheel.

7. Raise Your Credit Score

People with lower credit scores also tend to pay higher insurance premiums because researchers have noticed a correlation: people with higher credit scores are less likely to file a claim.

Fair or not, this is a reality of 21st-century underwriting, and it offers a way to help yourself by keeping a higher credit score.

8. Buy a Safer Boat

If you already have a boat, this may not help, but if you’re currently shopping for a boat, keep in mind that boats with lower horsepower motors can usually qualify for lower premiums.

If you can do without that extra burst of power, you may save month to month on insurance.

The same goes for on-board safety equipment like fire extinguishers and Coast Guard-approved radio equipment to help you call for help. You can buy this aftermarket if you’ve already invested in a boat. Better equipment can lower your premiums.

When you upgrade equipment, tell your insurance agent or customer service reps.

9. Consider Extras Carefully

Along with the primary coverages we’ve been discussing, you can add all sorts of extra features to your boat insurance policy.

You can sign up for on-the-water assistance when you have a mechanical breakdown. You can also get towing packages if your craft is beyond repair.

Several boat insurers offer AAA-like memberships with discounts on equipment and extra layers of customer service.

These are great ideas and potentially very helpful, but they’ll also add to your premiums. Before buying memberships or adding special features, consider how often you’ll use them and how much they’ll add to your premiums.

How to Buy Boat Insurance

Most major national insurers offer boat coverage. The easiest approach may be to start with your auto or homeowners insurance company.

Ask an Independent Agent

If you really want to control the process, though, look for an independent agent in your area or online. Independent insurance agents have all sorts of knowledge about insurance products.

Independent agents can help you compare policies from dozens of carriers rather than just one or two carriers. This makes it easier to save money by finding just the right policy.

Check Ratings and Reviews

Whether you’re considering a regional or a national carrier, be sure to check the company’s rating with A.M. Best or Standard & Poor’s. These rating agencies can tell you a lot about an insurance company’s overall financial health.

You can also read reviews on TrustPilot, Facebook, and the Better Business Bureau. Keep in mind customers tend to share their thoughts most often if they’re unhappy. A satisfied customer isn’t as likely to post a review.

Still, if you see the same issues popping up over and over, chances are you should pay attention.

Best Boat Insurance Providers

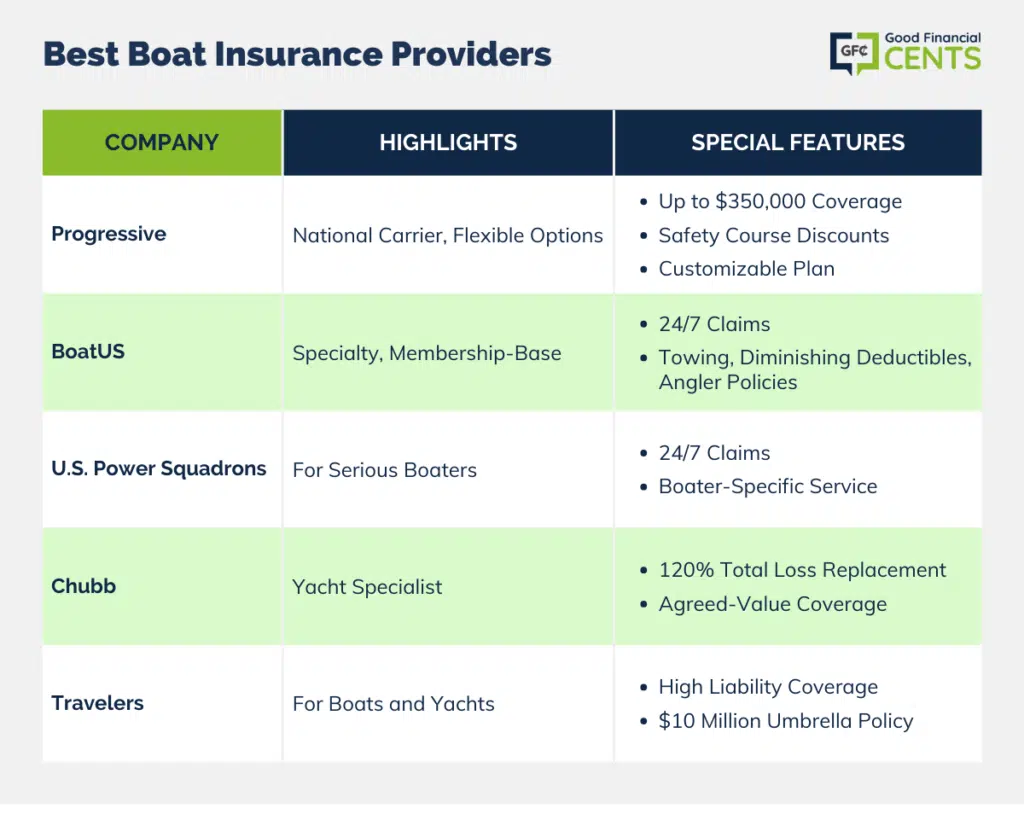

I won’t go into a full analysis of the strengths and weaknesses of boat insurance companies here, but I will share the five companies I’d be in touch with first about boat insurance:

- Progressive: This national carrier with name recognition offers some flexible options for personal watercraft and huge houseboats with values up to $350,000. They also give discounts for boating safety courses and the ability to customize your own coverage, as we discussed above.

- BoatUS: This specialty, membership-based carrier processes claims around the clock and offers some helpful add-ons like towing (with membership), diminishing deductibles, and angler-only policies for serious fishers. You can also get liability-only coverage.

- U.S. Power Squadrons: Another membership-based insurance program for serious boaters, U.S. Power Squadrons also processes claims 24/7 and offers a customer service experience designed specifically for boaters.

- Chubb: Yacht owners can find specialty policies with Chubb, which offers up to 120 percent replacement coverage in the case of a total loss. Chubb specializes in agreed-value coverage for boaters with specific coverage needs.

- Travelers: While not boat-specific, Travelers has a solid program for boats and yachts. The company’s liability coverage appeals to boaters who are on the water as a lifestyle. Travelers offer up to $10 million in liability with its umbrella policy, which can spread across several kinds of insurance.

Boat Insurance: Protection On and Off the Water

No, your state probably won’t require you to buy it, but boat insurance can save you a lot of trouble and a lot of money when something unexpected happens.

Vandalism, fires, theft, collisions — these things happen, sometimes when you least expect it and sometimes when you’re miles away and busy doing something unrelated.

That’s why many marinas require boats to be insured before they enter a storage agreement.

So shop around, get quotes, and customize your coverage to protect your boat while you’re in it and while it’s sitting empty, waiting for your next outing.

Bottom Line – Boat Insurance | Protection On (And Off) The Water

Boat insurance is vital to protect marine investments and ensure peace of mind on the water.

While it mirrors auto insurance in many aspects, specific needs depend on the boat type and usage. While canoes might not require comprehensive coverage, motorboats do.

Standard homeowners or auto insurance might not offer adequate boat protection, emphasizing the need for a dedicated boat policy.

To maximize value, owners should assess their precise coverage requirements, opt for tailored over bundled packages, and wisely select deductibles.

Enhancing safety skills, maintaining good credit, and exploring discounts can lower premiums.

Prioritize established insurers and seek customer feedback to ensure a blend of affordability and thorough coverage.