If you’ve been declined coverage from an insurance company, don’t assume that you can’t get the protection that your family needs. There are plenty of affordable insurance options.

For those who cannot get approved for a basic term life policy, guaranteed acceptance life insurance is the solution to their problem. Being exactly what it sounds like, there is not a single person turned away or left uninsured if you want a guaranteed acceptance life policy. On paper, this sounds like an excellent option for insurance coverage.

Even if you’ve been declined in the past for life insurance, this may not be your only option, but it’s important that you understand all of your options and that you realize even if you have terrible health, you can still get life insurance coverage.

Smokers, those with medical conditions, and seniors over 50 seeking life insurance with health conditions are the majority who look to these types of life insurance policies, hoping to be able to leave something behind for their families.

Anyone who has a health problem or has any risky behavior is going to be classified as a “high-risk applicant,” which means higher premiums or possibly being rejected.

Many companies have a guaranteed acceptance life insurance policy available and a little searching will do you worlds of good in getting the best rates. A policy is only as good as the company that offers it, and knowing whether the company you choose is right will take a little time and some research, but can wind up saving you quite a bit.

Note:

What You Need to Know About Guaranteed Issue Life Insurance

Table of Contents

- What You Need to Know About Guaranteed Issue Life Insurance

- Benefits of Guaranteed Acceptance Life Insurance

- What Questions Do They Ask?

- Does Guarantee Issue Insurance Offer Same Death Benefit?

- Pros and Cons of Guaranteed Issued Life Insurance

- How Much Life Insurance Do You Need To Buy?

- Is a Guaranteed Acceptance Life Insurance Policy Right for Me?

- Final Thoughts on Guaranteed Acceptance Life Insurance – How Does it Work

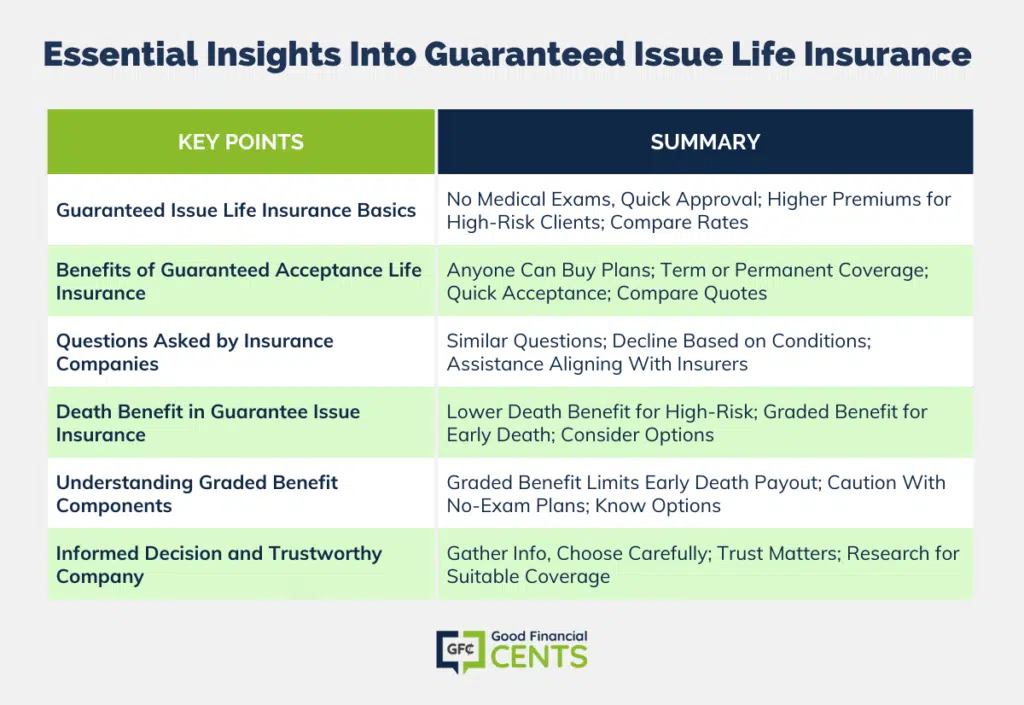

The first thing to know about a guaranteed issue life policy is that no medical examination, medical history, or tests are performed; simply apply and you’re approved. The lack of underwriting means you can be approved within minutes. Many clients considered ‘high risk’ will find this type of policy to be the only one available to them, and it comes with a price.

See here for more information regarding term life insurance that does not require a medical exam.

With the majority of clients being ‘high risk,’ the premiums you’ll pay on the policy are more expensive. Rates will vary from company to company, but you’ll always wind up paying more than you would for a simple term life policy. If you want cheap life insurance protection, then you’ll need to find a company that will accept you with one of their traditional plans.

Benefits of Guaranteed Acceptance Life Insurance

There are some obvious advantages to these guaranteed acceptance life insurance plans, the biggest one is that anyone can buy one of these plans. Anyone can purchase one of these plans and get the coverage that they want. Nobody should have to go without the insurance protection that their family needs.

Perhaps one of the most beneficial features of a guaranteed acceptance life insurance policy is that it can be whatever you need it to be, term life or permanent. With a term life policy, your rates are set and won’t increase with your age while a permanent policy will be there for the rest of your life. The freedom to choose what policy you want makes a guaranteed acceptance life plan unique.

Another benefit to these plans that you won’t find with other types of insurance coverage is how quickly you can be accepted for the insurance policy. With a traditional life insurance policy, you’ll wait weeks to get life insurance, or even months. Guaranteed acceptance gives you coverage in hours.

Taking the time to search and compare premiums will help you find the best-guaranteed acceptance life insurance policy available. Companies will be quick to offer free quotes and estimates, features that can help you find the right company faster. If you can’t find the information you need from their site then contact their customer service, someone in the company is sure to be able to help you.

What Questions Do They Ask?

For the most part, insurance companies will ask the same or similar questions for a guaranteed life policy. The trick is that some companies will decline you on specific conditions while others will not.

How do you know who to go through? That’s the good news. You don’t!

That’s what we’re here to do. 🙂

We just need to ask some basic questions about your previous conditions and we’ll help align you with the right guaranteed issue insurance company.

Does Guarantee Issue Insurance Offer Same Death Benefit?

In most cases, the answer is no. Since the insurance company is taking on more risk by insuring higher risk individuals, the maximum amount of death benefit you can get is substantially lower. Face amounts will range between $5k-$50,000.

There are some carriers that will issue higher amounts, just be prepared to pay exorbitant prices. For most applicants that are looking for life insurance protection, this isn’t nearly enough life insurance. The smaller plans would leave their loved ones with debt leftover. Which means that if you’re looking for an insurance policy that is going to give you more coverage than that, you’ll have to go with a normal life insurance plan. The other option is that you can buy two smaller plans to get the coverage that you need.

Sometimes, too, you won’t have the same death benefit payout getting what’s called a “graded benefit”. A graded benefit means that if you die within 2 years of taking out the policy, you’ll only get the premiums you paid plus a certain amount of interest. These graded benefit clauses are the way that the insurance company offset the additional risk.

The majority of no-exam plans are going to come with the graded benefit components. This shouldn’t keep you from purchasing one of these plans, but it’s something to be aware of. The only way that you would receive the full benefit is if you were to die because of an accident.

Getting you the information you need to make an informed decision will show you how dependable a company can be, and with something as important as life insurance you need a company you know you can trust.

Pros and Cons of Guaranteed Issued Life Insurance

Guaranteed Acceptance Life Insurance policies have both advantages and disadvantages. On the one hand, they do not require a medical exam or health questions, guarantee acceptance regardless of health status, and may be a suitable option for individuals with pre-existing medical conditions or those seeking only a small amount of coverage. The death benefit is typically paid out tax-free.

On the other hand, these policies are often more expensive than traditional life insurance policies, have lower coverage limits, and have a graded death benefit that limits the benefit payout if the insured dies within the first two years of the policy.

As a result, these policies may not be suitable for those who require a large amount of coverage for income replacement or other financial needs.

Pros and Cons of Guaranteed Issued Life Insurance

| PROS | CONS |

|---|---|

| – No Medical Exam or Health Questions Required | – Typically More Expensive Than Traditional Life Insurance Policies |

| – Guaranteed Acceptance, Regardless of Health Status | – Lower Coverage Limits Than Traditional Policies |

| – Can Be a Good Option for People With Pre-existing Medical Conditions or Older Individuals Who May Have Difficulty Getting Traditional Life Insurance | – Graded Death Benefit Means That if the Insured Dies Within the First Two Years of the Policy, the Death Benefit May Be Limited |

| – Can Be a Good Option for Those Who Only Need a Small Amount of Coverage for Final Expenses or to Leave a Small Legacy | – May Not Be a Good Option for Those Who Need a Large Amount of Coverage for Income Replacement or Other Financial Needs |

| – Death Benefit Is Typically Paid Out Tax-Free | – Before Purchasing, It’s Important to Compare Rates From Different Insurers and Consider Other Types of Life Insurance That May Be a Better Fit for the Individual’s Needs and Budget |

How Much Life Insurance Do You Need To Buy?

It’s vital that you get the right amount of life insurance protection that you and your loved ones need to how the money that they need. Getting the perfect size life insurance policy is a delicate balance between not paying for more insurance than you need and buying enough coverage.

If you’ve already paid off your mortgage, and you don’t hold a lot of debt, you can consider getting a smaller insurance plan, like one of the guaranteed acceptance life insurance policies. They are built to give coverage for people who don’t have any major debts.

The next factor to consider is your salary. As long as you don’t have anyone who needs your paycheck, then you can buy one of these guaranteed issue plans and they will provide enough protection.

There are more factors that you’ll need to look at based on your situation to determine how much life insurance you and your family need. Our independent insurance agents can help you decide how much insurance you need, and they can also help you find the perfect plan to fit your needs. These guaranteed-issued plans are a great way to get the coverage that you need, but they aren’t for everyone.

Is a Guaranteed Acceptance Life Insurance Policy Right for Me?

Because there are so many different types of insurance policies, it can be difficult to decide which type of plan fits your needs. While these guaranteed accepted plans are an excellent option for anyone that’s been declined for a life insurance policy, don’t automatically assume that they are your only option. If you have severe preexisting conditions, like heart problems or diabetes, guaranteed acceptance is one option, but not necessarily your only option.

Every insurance company is different, which means all of them are going to view your applicant through different medical underwriting. There are dozens of insurance companies that specialize in insuring high-risk applicants with various conditions and health problems. These companies have experience working with applicants that are in less than perfect health and they will give you a much greater chance of being accepted for life insurance and will deliver much lower rates.

Additionally, our agents have years of experiencing working in the insurance market, which means they know the companies that specialize in high-risk applicants and can get you the best chances of getting insurance coverage at an affordable rate.

Going with a life insurance plan that requires medical underwriting is going to be much cheaper than a plan that has no exam. These guaranteed issue policies should always be used as a last resort for life insurance unless you have a specific reason for choosing one of these plans.

Final Thoughts on Guaranteed Acceptance Life Insurance – How Does it Work

For individuals denied traditional coverage, guaranteed acceptance life insurance offers an option for obtaining necessary protection. It doesn’t require medical exams or history, making approval quick. Premiums, however, tend to be higher due to the higher risk. While offering coverage to high-risk individuals, the maximum death benefit is usually lower.

Guaranteed acceptance plans can be term or permanent, providing flexibility. Pros include no health questions and guaranteed acceptance, while cons involve higher costs and graded death benefits. Consideration of individual needs and exploring alternatives is crucial for making an informed choice.

My husband has been turned down on Ethos for term life insurance because he has a heart stent and high blood pressure. What companies can you offer that could insure him?

Thanks.

I just move in with a good friend, who is a little older than me. I found out she does not have a life insurance. I urge her to get one and also offered to help find an affordable Term life insurance. She is 74 years old and only have few health issues, no heart problems. Can you send me a quote please? Thanks.

Great post! I am in the process of going Indy and I have alot of decline cases I am working on. This cleared up alot!

Diabetic and heart stent…who will insure me life insurance?

@ Kevin There are companies that specialize in guaranteed issue life insurance that will insure you. Be sure to contact our office to explore your options.