It’s a sad fact, but we’re all mortal and one day we will all die. This is true whether we have retired or not and there’s a 100% chance of that happening. According to Vanguard, over 25% of all Americans have a 401k plan.

This means 1 out of every 4 Americans will be forced to deal with a 401k plan after someone passes away. That brings us to the all-important question:

What happens to our 401k when we die?

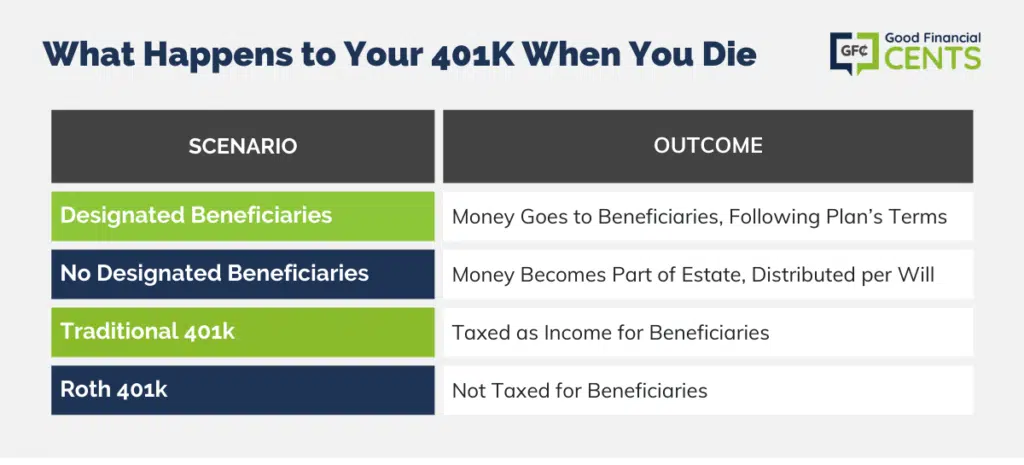

Generally speaking, what happens to your 401k when you die depends on a few things: whether you have any beneficiaries designated, what type of 401k plan you have, and what the rules of that particular plan are.

If you have designated beneficiaries for your 401k, then they will receive the money in the account after you die. The money will be distributed according to the terms of the 401k plan.

If you do not have any designated beneficiaries, then the money in your 401k will become part of your estate and will be distributed according to the terms of your will.

If you have a traditional 401k plan, the money in the account will be taxed as income when it is distributed to your beneficiaries. If you have a Roth 401k plan, the money in the account will not be taxed when it is allocated to your beneficiaries.

Table of Contents

- What Happens to 401k When You Die Before Retirement?

- Understanding 401k Beneficiaries

- How Your 401(k) Is Distributed After Death

- How Long Does It Take to Transfer the 401k Plan?

- 401k Beneficiary Gone Wrong – IRL Example

- How a 401k Distribution to Your Spouse Is Supposed to Work

- What About a Trust?

- Changes Made Under the SECURE Act

- The Bottom Line – 401k After Death

- FAQs 401k After Someone Dies

What Happens to 401k When You Die Before Retirement?

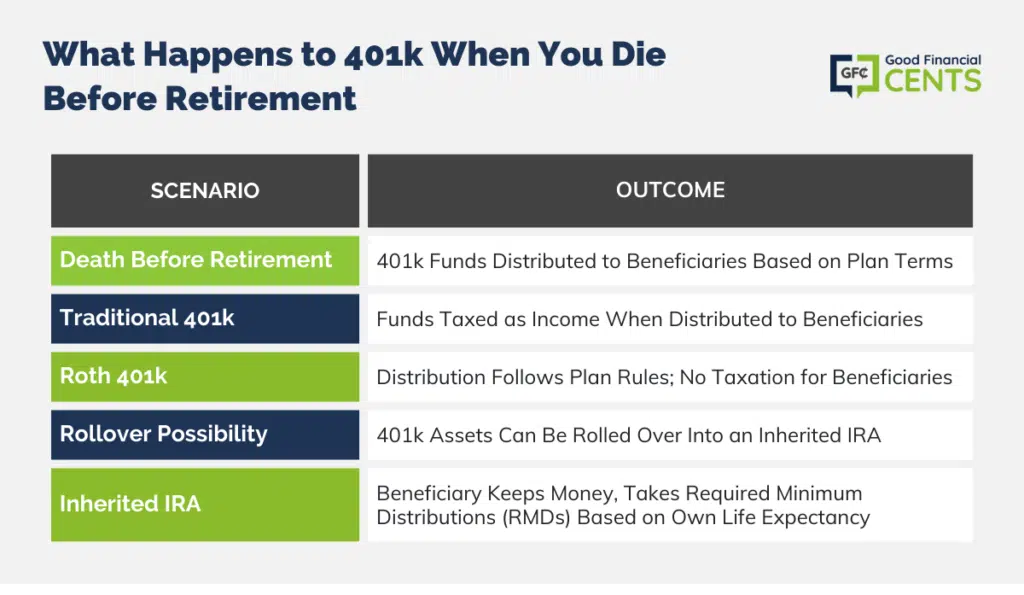

If you die before retirement, the money in your 401k will be distributed to your beneficiaries according to the terms of the plan. If you have a traditional 401k plan, then the money in the account will be taxed as income when it is distributed to your beneficiaries. The same rules apply if you have a Roth 401k.

They also could initiate a rollover of the 401k assets into an Inherited IRA. According to Fidelity,

“An inherited IRA allows the designated beneficiary to keep the money in the account and take required minimum distributions (RMDs) based on his or her own life expectancy.”

It is important to note that if you die before retirement, your beneficiaries will not be able to continue contributing to the account. Nor will they be able to take advantage of any employer matching contributions that may have been available to you.

Understanding 401k Beneficiaries

A beneficiary is someone who you designate to receive the assets in your 401k after you die. You can name more than one beneficiary, and you can change your beneficiaries at any time.

Typically your spouse is the primary beneficiary and your children are the contingent beneficiaries, but this is not always the case. You can name anyone as a beneficiary, including your parents, siblings, friends, or a charitable organization.

The rules for 401k beneficiaries are set by the Internal Revenue Service (IRS). According to the IRS,

“If you die before your entire interest is paid out to you, your named beneficiary or beneficiaries will receive what is left according to the terms of your plan.”

How Your 401(k) Is Distributed After Death

The money in your 401k will be distributed to your beneficiaries according to the terms of the plan. If you have a traditional 401k plan, then the money in the account will be taxed as income when it is distributed to your beneficiaries. If you have a Roth 401k plan, then the money in your account will not be taxed when it is distributed to your beneficiaries.

The beneficiaries will need to provide the financial institution with a death certificate to begin the process of transferring the assets into their names. You’ll need to complete and submit the proper paperwork to the administrator of your 401k plan.

How Long Does It Take to Transfer the 401k Plan?

The timing of the distribution will depend on the rules of the particular 401k plan and also the financial institution you’re dealing with. For example, I’ve had clients whose 401k plans were with Fidelity or Vanguard and the process was seamless.

In contrast, I’ve had other clients whose 401k plan was through their employer and it took much longer to get the money transferred – in one case, it took over 6 months!

So to answer the question: How long does it take to get 401k money?

The answer is: it depends.

I know that’s not the answer you wanted to hear but based on my experience I’ve seen all ends of the spectrum.

What You Need to Do

It’s a good idea to designate a primary and secondary beneficiary for your 401k (and all your other accounts for that matter). You’ll need to name a beneficiary (or beneficiaries) when you open the account and you can change the beneficiaries at any time.

If you don’t name a beneficiary, then the money in your 401k will become part of your estate and will be distributed according to the terms of your will – which may not be what you want.

401k Beneficiary Gone Wrong – IRL Example

I witnessed several examples of something tragic, those horrific life events you’ll never think will happen to you but it does, it’s these types of moments.

The 401k is the last thing on our mind but if not considered could have financial and emotional ramifications. Here is one example that still breaks my heart:

A young couple had been married for only a few years they had yet to start a family but that was on the horizon. The husband had begun working before meeting his wife and had already stashed away a decent nest egg in his 401k, specially for someone as young as he was.

Tragically he was killed in a freak accident while at work, and the family was left reeling. Since he and his wife remarried, you would expect her to be the beneficiary of his entire 401k, correct?

Not quite.

Since this young man started working before he was married, he had named both of his parents as beneficiaries on the 401k. After getting married, there wasn’t much thought to update the beneficiary form from his parents to his new wife.

While I can’t say for certain I suspect the husband would have wanted his wife to get some of his 401k. Perhaps all of it. But the parents based on their own rationale decided they would take all of the money and not give any to their daughter-in-law. That’s one example of the importance of updating your beneficiary forms on your 401k.

How a 401k Distribution to Your Spouse Is Supposed to Work

Another client experienced a similar tragedy but with a completely different outcome. The wife came to me after unexpectedly losing her husband of more than 20 years.

Earlier that morning he was out washing the car which was a normal Saturday activity. A few hours later he was in their bedroom deceased from an unexpected massive heart attack. He was only 55.

Since he was much older and a physician, his 401k was much larger than the young man from the previous story. So, imagine how catastrophic they would have been if his parents or any other person for that matter, was the beneficiary of his 401k plan.

Thankfully, that wasn’t the case. And he had properly named both his wife as the primary beneficiary and his two children as the contingent beneficiaries because he had taken the time to complete all the beneficiary forms correctly. The transfer of his 401k to his wife was a seamless process.

| While it’s not pleasant to think about what happens to our 401k when we die, the fact is that many people do die before they reach retirement age. |

According to the Social Security Administration, about 1 in 4 of today’s 20-year-olds will become disabled before they retire and about 1 in 8 will die before they reach 67.

What About a Trust?

If you have a trust, then the money in your 401k can be distributed to the beneficiaries of the trust. The rules for how the money is distributed will depend on the terms of the trust.

How an A/B Trust works: With an A/B trust, the assets in the trust are divided into two parts: the “A” trust and the “B” trust. The “A” trust is for the benefit of the surviving spouse and is not taxed when the surviving spouse dies.

The “B” trust is for the benefit of the children or other beneficiaries and is taxed when the surviving spouse dies.

Changes Made Under the SECURE Act

The Setting Every Community Up for Retirement Enhancement (SECURE) Act was passed in 2019 and made some changes to how 401ks are distributed after death.

Previously, you could implement what was called a “Stretch IRA”. This meant that your beneficiaries could take distributions from your IRA over their lifetime. This allowed the money to grow tax-deferred for many years.

Under the SECURE Act, this is no longer allowed. Now, most beneficiaries must take distributions from an inherited 401k within 10 years of the account holder’s death.

There are some exceptions to this rule. If the beneficiary is a spouse, then they can still take distributions over their lifetime. And if the beneficiary is a minor child, they can take distributions over their lifetime until they reach the age of majority (18 or 21, depending on the state).

Other exceptions include beneficiaries who are disabled or chronically ill and beneficiaries who are not more than 10 years younger than the account holder.

The Bottom Line – 401k After Death

When someone dies, their 401k plan is typically passed on to their spouse or heirs. If the deceased had a will, the plan will be distributed according to the will’s instructions. If there is no will, the plan will be distributed according to state law.

Typically, the plan will be passed on to the spouse or heirs intact, with no taxes owed. However, if the plan contains any after-death distributions, such as life insurance policies or annuities, those payments will be taxed as ordinary income.

FAQs 401k After Someone Dies

If the account holder dies before retirement, the beneficiaries named in the account will receive the funds in the account. If the account holder dies after retirement, the funds will be paid out in a lump sum to the beneficiary or beneficiaries named in the account.

It’s a good idea for 401(k) account holders to review and update their beneficiary designations regularly, to ensure that the funds will be distributed according to their wishes in the event of their death.

It may take several weeks or even months for a 401(k) to pay out after the account holder’s death.

The beneficiary or beneficiaries should receive a letter from the financial institution or plan administrator outlining the steps they need to take to claim the funds.

It’s a good idea for the beneficiary or beneficiaries to contact the financial institution or plan administrator as soon as possible after the account holder’s death to begin the process of claiming the funds. They should also gather any necessary documentation, such as a copy of the account holder’s death certificate, to help facilitate the process.

If the beneficiary is the surviving spouse of the account holder, they may have additional options for receiving the funds, such as rolling the funds over into their own 401(k) or IRA account. It’s important for the surviving spouse to understand their options and make a decision that is best for their financial situation.

If you are divorced and you die before reaching age 70½, the money in your 401k will be distributed to your beneficiaries according to the terms of the plan. If you have a traditional 401k plan, then the money in the account will be taxed as income when it is distributed to your beneficiaries. The same rules apply if you have a Roth 401k.

If you don’t have any beneficiaries on your 401k, then the money in your 401k will become part of your estate and will be distributed according to the terms of your will.

No, creditors cannot go after the money in your 401k after you die. The money in your 401k is protected from creditors.

You can protect your 401k from creditors by naming a specific beneficiary for the account. By doing this, the money in the account will not become part of your estate and will not be subject to creditors.

If you die without a will, the money in your 401k will be distributed to your heirs according to the laws of intestate succession. Intestate succession is the order in which your assets will be distributed if you die without a will. The order is generally as follows: spouse, children, parents, siblings, and so on.