Helping people prepare for a successful retirement is what I do every day. A bulk of retirees typically will have some sort of pension or retirement account that represents the majority of their investable assets.

Deciding the proper strategy to do with that money is the most common thing we do, and more times than not, it makes sense to roll that retirement account into a traditional IRA. When we’re deciding on an income plan with the IRA, it never fails to answer the question, “How much interest does an IRA make?”. I always crack a smile when I hear this because it’s such a common question that hear that I thought it would be best to explain how you actually make interest in an IRA.

Table of Contents

Why an IRA Is a Good Choice for Retirement Funds

While everyone is different, and you shouldn’t roll your money into an IRA without carefully considering your choices, there are some very valid reasons to do so in retirement.

- Flexibility: The biggest reason to use an IRA for your retirement portfolio is the flexibility that comes with an IRA. With most IRAs, you have the ability to choose your own investments. You can choose funds that work well for you and that might not be available in your current 401(k). It’s easier to make changes to your IRA than it is to make changes to a less flexible retirement plan sponsored by your former employer.

- Access: Because you can choose your own IRA custodian, it can make access a little easier. As a retiree, you need access to your account. Choosing your own custodian might allow you easier account access, plus there is a good chance that your new IRA custodian offers an array of tools that can make your in-retirement income planning a little easier. A 401(k) or 403(b) at your former employer means that you have to stick with the custodian the company chooses.

- Lower Cost: While consumer pressure has resulted in lower fees for many employer-sponsored plans, the reality is that you can often find even lower fees with an IRA. Combine the lower administrative costs of an IRA with the fact that you have the flexibility to choose lower-cost funds and ETFs for your IRA, and your money will be more cost-efficient since your real returns won’t be eaten away by the high fees you were paying previously.

The right IRA is easier to manage, less expensive, and provides you with more choices. Consult with a knowledgeable financial planner to help you find the right place to keep your IRA and to help you figure out how to allocate your assets within an IRA so that you are more likely to accomplish your goals.

The Best Rates on Your IRA

I wrote a post about the best rates on a Roth IRA, which is a great guide for those who are still in the accumulation stage of investing. If you are already retired, though, your needs are different. The best rates on your IRA mean something different if you rely on your nest egg for the income you need to support your retirement lifestyle.

Getting the best rates on your IRA is about understanding what you can keep in your IRA, as well as knowing how to use asset allocation to your advantage during your retirement years. Unfortunately, there isn’t a lot of education out there for retirees on this subject, so there is a measure of confusion about how to use an IRA to your best advantage.

Why Is There So Much Confusion?

Many investors associate IRAs with the IRA CD you see advertised at your local bank. A CD is a product that offers a fixed rate of return. Your CD will pay according to a stated interest rate. Unless the financial institution has a relationship with a brokerage firm, then CDs or savings accounts are the only investment option that the IRA can have. That means that your yield is going to be relatively low.

An IRA CD is often offered with a 10-year term, and the rate is higher than most of the other CD offerings from the bank. However, most of these rates are nothing to write home about. As a result, retirees get the idea that IRAs offer yields that are too low for their needs.

The reality is that an IRA is an extremely flexible tax-advantaged retirement account that allows you to keep a variety of assets. The most common assets are stocks and bonds in the form of funds. However, in some cases, it’s possible to use IRAs to invest in real estate, businesses, and even precious metals. (You will need to find a custodian willing to work with you for more exotic IRA holdings, and your administrative costs will be higher.)

Most retirees, though, are better off sticking to stock and bond funds in their IRAs. These assets usually offer better returns than IRA CDs while still allowing you to maintain an acceptable level of risk.

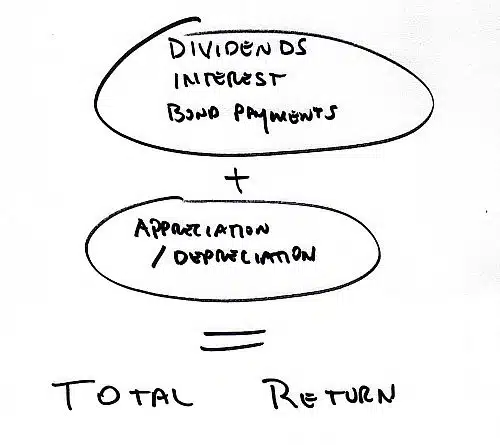

IRA Interest Rate = Total Return

They say a picture is worth a thousand words. Let’s see if this sketch helps paint a clearer picture of how you are able to make money on an IRA:

*Dividends are not guaranteed. Interest and bond payments are subject to the claims-paying ability of the issuer and may be subject to certain terms or restrictions. Investing is subject to risk. Appreciation is not guaranteed.

Let’s keep it simple: Almost every retiree’s portfolio consists of a portion of stocks and bonds. Stocks and bonds are called asset classes because they are two different types of investments. The mix of stocks and bonds, called asset allocation, depends on a number of risk profiles, including your own risk tolerance and when you expect to need the money. When you have a portfolio that consists of these two asset classes, you have two main components that will you give the total return (or interest rate, as most of us think of it):

1. Income (from stock dividends, bond interest payments, and distributions)

2. Appreciation (or depreciation)

You need to understand how these operate inside your IRA in order to get a sense of your true interest rate, as well as if you want to make better decisions about what to do with your money.

Income From a Portfolio

Typically, when you hear “income” regarding an investment portfolio, the most common thing that comes to mind is bonds. Bonds pay what is called a “coupon payment,” which is based on the stated interest rate on the bond. These coupon payments can be paid monthly, quarterly, or semi-annually- all depending on the issuer of the bond. When your bond matures, you receive the principal back, and you can reinvest in another bond if you wish.

The other income component from a portfolio is dividends from stocks or preferred stocks. If you own a percentage of stock in your portfolio, then there’s a good chance that some of the stock you own pays dividends. Here’s a tidbit on stock dividends from Investopedia.com:

Dividends are determined by the company that issued the stock, and they may fluctuate greatly. Dividends are cash payments that the company pays to stockholders based on profits and are paid out on a per-share basis. In other words, a business may determine that the dividend payout to stockholders for the first quarter is $.25 per share. So, a person who owns 1000 shares would receive a dividend payment of $250 for the first quarter.

The income portion of the portfolio is the closest you’ll get to a fixed interest rate on your portfolio. I want to stress that even the income portion of a portfolio can change pretty quickly based on many factors. Increasing or decreasing interest rates will have the largest effect, just as they would on CDs at your bank.

Additionally, it’s possible that a company will cut its dividend, reducing how much you receive. Many retirees choose to invest in stocks known as dividend aristocrats, or invest in funds composed of dividend aristocrats. These are companies that have increased their dividends at least once a year for the last 25 years. While there is always the possibility that these companies will cut their dividends, there is a lower chance of that because of their long history and the fact that many of these companies have to be pretty sound to keep raising dividends.

Appreciation of a Portfolio

The second factor that will contribute to the return on your IRA portfolio is appreciation (or depreciation). Simply put, making money. With stocks, that is pretty simple. You buy stock XYZ and $5.00 and sell it at $10.00, you have appreciation. That is pretty straightforward. What most investors don’t realize is that appreciation potential does not just apply to stocks. You can make it on your bonds, too. Say what?

When people think of investing in bonds, they just think that you buy a bond and collect the interest. Just like a CD. While this is true, most investors don’t realize that you can trade bonds in the secondary market, and the value can go up or down.

Many bonds are issued at par (or face value), which is $1,000. The value of the bond has a “teeter-totter” relationship with the movement of interest rates. After the bond is issued, if interest rates go up, the value of that bond will go down. Reverse the interest rate movement, and the value will go up. Your bank CDs actually do this, too; it’s just not as obvious.

Another factor to consider in the value of the bond is the strength of the issuer. Remember when Lehman Brothers was on the verge of bankruptcy? Their bonds went from $1,000 to less than $100 before they eventually went bankrupt.

The way you can make appreciation on a bond is by buying in the secondary market if it’s now selling below the $1,000 issue value. You can wait until the bond is worth more than the issue value and then sell it for a profit later.

Example:

For Best Results: Avoid Active Trading in Your IRA

As always, you are most likely to achieve your best results when you avoid actively trading in your IRA. While IRAs offer flexibility and a way to buy and sell assets on a tax-advantaged basis, the reality is that frequent buying and selling can result in lower returns.

Not only is there a better chance that you will trade at the wrong time (the worst is panicking and selling low), but you might also choose the wrong individual securities for the long term.

Many retirees have better luck by investing in low-cost funds and ETFs in an asset allocation that helps them meet their needs. These funds can help even out income from the portfolio, and they offer diversity and a certain degree of protection. Plus, it’s a lot less work on your part.

Count Your Interest Blessings

The interest you earn on your IRA has many variables. That’s why it’s important to meet with a CERTIFIED FINANCIAL PLANNER™ to help make sense of your income needs and to help you position your accounts to potentially make the highest rates on your IRA.

More Disclosures:

- Certificates of Deposit at FDIC insured and offer a fixed rate of return. Certificates of Deposit that are sold prior to maturity in the secondary market are subject to market fluctuation so that upon sale, an investor may receive more or less than their original investment.

- Stock investing involves risk, including loss of principal.

- Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and are subject to availability and change in price.

- Price, yields, and availability of securities are subject to change. Certain call or special redemption features may exist, which could impact yield.

- Hypothetical examples are for illustrative purposes only. Results will vary.

Final Thoughts – How to Make Interest in Your IRA

Preparing for a successful retirement involves understanding how to maximize your IRA’s potential. Rolling retirement accounts into a traditional IRA provides flexibility, access, and lower costs compared to employer-sponsored plans. The confusion around IRA yields stems from misconceptions about investment options.

IRAs offer various assets beyond CDs, such as stocks and bonds, contributing to total returns. Income from bonds and dividends, along with appreciation, shape your IRA’s returns. Active trading within an IRA may reduce returns; a prudent approach involves low-cost funds and ETFs aligned with your goals. Consulting a financial planner ensures optimal IRA strategies for a secure retirement.