Due to the financial consequences and broader impact of our current economy, now is an excellent time to consider refinancing most loans you have. This can include mortgage debt you have that may be converted to a new loan with a lower interest rate, as well as auto loans, personal loans, and more.

Refinancing student loans can also make sense if you’re willing to transition the student loans you currently have into a new loan with a private lender. Make sure to take time to compare rates to see how you could save money on interest, potentially pay down student loans faster, or even both if you took the steps to refinance.

Get Started and Compare Rates Now

Still, it’s important to keep a close eye on policies and changes from the federal government that have already taken place, as well as changes that might come to fruition in the next weeks or months.

Interest on federal student loans, which had been effectively set to 0% since March 2020, started accruing again on September 1. This means that the interest rates, which vary by loan and were frozen during the pandemic, will return to their pre-freeze levels.

It’s hard to say what will happen after that, but it’s smart to start figuring out your next steps and determining if student loan refinancing makes sense for your situation.

Note that, in addition to lower interest rates than you can get with federal student loans, many private student lenders offer signup bonuses as well. With the help of a lower rate and an initial bonus, you could end up far “ahead” by refinancing in a financial sense.

Table of Contents

Still, there are definitely some negatives to consider when it comes to refinancing your student loans, and we’ll go over those disadvantages below.

Should You Refinance Now?

Do you have student loan debt at a higher APR than you want to pay?

- If no: You shouldn’t refinance.

- If yes: Go to next question.

Do you have good credit or a cosigner?

- If no: You shouldn’t refinance.

- If yes: Go to next question.

Do you have federal student loans?

- If no: You can consider refinancing

- If yes: Go to next question

Are you willing to give up federal protections like deferment, forbearance, and income-driven repayment plans?

- If no: You shouldn’t refinance

- If yes: Consider refinancing your loans.

Reasons to Refinance

There are many reasons student borrowers ultimately refinance their student loans, although they can vary from person to person. Here are the main situations where it can make sense to refinance along with the benefits you can expect to receive:

- Secure a Lower Monthly Payment on Your Student Loans

You may want to consider refinancing your student loans if your ultimate goal is reducing your monthly payment so it fits in better with your budget and your goals. A lower interest rate could help you lower your payment each month, but so could extending your repayment timeline.

- Save Money on Interest Over the Long Haul

If you plan to refinance your loans into a similar repayment timeline with a lower APR, you will definitely save money on interest over the life of your loan.

- Change Up Your Repayment Timeline

Most private lenders let you refinance your student loans into a new loan product that lasts 5 to 20 years. If you want to expedite your loan repayment or extend your repayment timeline, private lenders offer that option.

- Pay Down Debt Faster

Also, keep in mind that reducing your interest rate or repayment timeline can help you get out of student loan debt considerably faster. If you’re someone who wants to get out of debt as soon as you can, this is one of the best reasons to refinance with a private lender.

Why You Might Not Want to Refinance Right Now

While the reasons to refinance above are good ones, there are plenty of reasons you may want to pause on your refinancing plans. Here are the most common:

- There Is Still Economic Uncertainty Caused by the COVID-19 Pandemic

Given the economic uncertainties caused by events like the COVID-19 pandemic, you may be hesitant to refinance your student loans. The pandemic has highlighted the importance of federal student loan protections, such as income-driven repayment plans and loan forbearance during times of financial hardship. You may feel more secure keeping your federal loans, which come with built-in safety nets, as you navigate an unpredictable job market and economic conditions. Refinancing may entail giving up these safeguards, which could be particularly concerning during uncertain times.

- You May Want to Take Advantage of Income-Driven Repayment Plans

Income-driven repayment plans like Pay As You Earn (PAYE) and Income-Based Repayment let you pay a percentage of your discretionary income each month and then have your loans forgiven after 20 to 25 years. These plans only apply to federal student loans, so you shouldn’t refinance with a private lender if you are hoping to sign up.

- You’re Worried You Won’t Be Able to Keep Up With Your Student Loan Payments Due to Your Job or Economic Conditions

Federal student loans come with deferment and forbearance that can buy you time if you’re struggling to make the payments on your student loans. With that in mind, you may not want to give up these protections if you’re unsure about your future and your finances.

- Your Credit Score Is Low and You Don’t Have a Cosigner

Finally, you should probably stick with federal student loans if your credit score is poor and you don’t have a cosigner. Federal student loans come with fairly low rates and most don’t require a credit check, so they’re a great deal if your credit is imperfect.

Important Things to Note

Before you move forward with student loan refinancing, there are some details you should know and understand. Here are our top tips and some important factors to keep in mind.

Compare Rates and Loan Terms

Because student loan refinancing is such a competitive industry, shopping around for loans based on their rates and terms can help you find out which lenders are offering the most lucrative refinancing options for someone with your credit profile and income.

We suggest using Credible to shop for student loan refinancing since this loan platform lets you compare offers from multiple lenders in one place. You can even get prequalified for student loan refinancing and “check your rate” without a hard inquiry on your credit score.

Check for Signup Bonuses

Some student loan refinancing companies let you score a bonus of $100 to $750 just for clicking through a specific link to start the process. This money is free money if you’re able to take advantage, and you can still qualify for low rates and fair loan terms that can help you get ahead.

We definitely suggest checking with lenders that offer bonuses, provided you can also score the most competitive rates and terms.

Consider Your Personal Eligibility

Also, keep your personal eligibility in mind, including factors beyond your credit score. Most applicants who are turned down for student loan refinancing are turned away based on their debt-to-income ratio and not their credit score. Generally speaking, this means they owe too much money on all their debts when you compare their liabilities to their income.

Credible also notes that adding a creditworthy cosigner can improve your chances of prequalifying for a loan. They also state that “many lenders offer cosigner release once borrowers have made a minimum number of on-time payments and can demonstrate they are ready to assume full responsibility for the repayment of the loan on their own.”

It’s Not “All or Nothing”

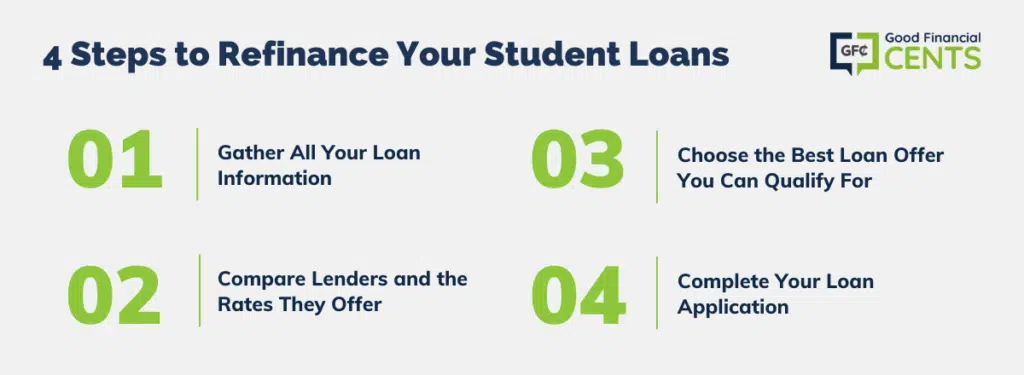

4 Steps to Refinance Your Student Loans

Once you’re ready to pull the trigger, there are four simple steps involved in refinancing your student loans.

Step 1: Gather All Your Loan Information

Before you start the refinancing process, it helps to have all your loan information, including your student loan pay stubs, in one place. This can help you determine the total amount you want to refinance as well as the interest rates and payments you currently have on your loans.

Step 2: Compare Lenders and the Rates They Offer

From there, take the time to compare lenders in terms of the rates they can offer. You can use this tool to get the process started.

Step 3: Choose the Best Loan Offer You Can Qualify For

Once you’ve filled out basic information, you can choose among multiple loan offers. Make sure to check for signup bonus offers as well as interest rates, loan repayment terms, and interest rates you can qualify for.

Step 4: Complete Your Loan Application

Once you decide on a lender that offers the best rates and terms, you can move forward with your full student loan refinancing application. Your student loan company will ask for more personal information and details on your existing student loans, which they will combine into your new loan with a new repayment term and monthly payment.

The Bottom Line

Whether it makes sense to refinance your student loans is a huge question that only you can answer after careful thought and consideration. Make sure you weigh all the pros and cons, including what you may be giving up if you’re refinancing federal loans with a private lender.

Refinancing your student loans can make sense if you have a plan to pay them off, but this strategy works best if you create a debt repayment plan you can stick with for the long term.

Where do I find companies that transfer a parent loan into the child’s name and does it change it from being the worst loan possible??

Probably not Wendy. Some will allow you to be removed if you’re a cosigner, but if it’s in your name only the only way is for the child to refinance the loan into his or her own name.

hey jeff, thanks for sharing the best information about the loans because a very student doesn’t know the student loan process and they are in problems.

I think the “paying your debt down as soon as possible” makes sense for most. Only because I think there’s a tremendous amount of freedom and mental and emotional relief with paying off one’s debts. And in today’s society where a lot of millennial college grads have six figure debts accrued as they start their careers; I’d say taking off that ball and chain is pretty high up on the priorities list!!

I wish more students knew about this. Not enough people know about their options, and with tuition rising, students are spending more and more money that they’ll be paying back for decades.

Thanks Jeff for sharing the useful information. There is a great deal of confusion regarding the student loans. With all the inputs you have offered, it becomes somewhat easy to understand the intricacies involving the loans.

Thanks Katherine, that’s exactly what I’m trying to do here!

I think the best way to get rid of debt is to understand its cons. First of all, one should take all course of action to avoid debt and if nothing works out take loan but plan it. I mean how would you repay the debt.