According to a survey released by the Federal Reserve, up to 46 percent of American adults don’t have an extra $400 to cover an emergency.

While this worrisome statistic is partly due to poverty and low wages, poor spending and saving habits are also to blame.

When we don’t save enough money in the short-term or the long-term, we are bound to struggle when it comes to covering an emergency home or auto repair, unexpected medical bills, or any other financial “surprises” that arise.

That’s why everyone – and I mean everyone – needs to make saving money a priority. You might think you can’t afford to, but I can assure you that you can’t really afford not to, either.

While workers from previous generations were able to rely on pensions to cover their retirement, today’s employees are largely on their own. And although social security is still solvent, I wouldn’t count on receiving full benefits by the time you reach retirement age.

Plus, we all need a certain amount of cash on hand – cash to cover a car repair so you can make it to and from work next week, cash to pay that medical bill so your daughter can have surgery, and cash to pay for college, help pay for a wedding, or cover myriad other financial responsibilities we all face.

Table of Contents

How Much Money Should You Save to Fund Your Long-Term Goals?

But how much should you save? Years ago, it was commonplace to assume we should all save at least ten percent of our incomes for retirement and the future. But nowadays, it’s pretty standard to work towards saving at least 15 percent and hopefully more.

As a financial advisor, I always tell my clients to save at least 20 – 25 percent of their incomes across their retirement accounts and cash savings.

Saving that much might seem crazy to some people, but in my eyes, this is what you need to do to prepare yourself for the harsh realities of today’s world. If you’re not saving for yourself and your own future, who is?

Hands-down, the best way to formulate – and stick with – long-term financial plans is to set goals and review them frequently. I’m a big believer in having lifetime, three-year, one-year, and 90-day financial goals.

I tend to review my 90-day goals every quarter in order to make sure I am on track with my longer-view goals.

If you’re trying to boost your savings rate, creating goals you can “check in with” is a smart move. If you’re saving 10 percent of your income across retirement accounts and cash and want to boost that over time, you can start by shooting for a 15 percent savings rate within 90 days. Within one year, try to shoot for 20 percent or 25 percent.

An easy way to do this is to boost your work-sponsored retirement account contributions incrementally over time – say, every 60 or 90 days. You may not even notice the extra percentage taken from your paycheck, but those extra funds will add up and grow your wealth in a big way.

When it comes to cash savings, you’ll need to take a slightly different approach. Since it’s easy to squander extra money you have in your checking account, I always suggest having automatic monthly withdrawals moved over to a long-term savings account on a regular basis.

Long-Term Savings Plans That Make Good Financial Cents

If you’re a long-term reader of this website, you already know how important your retirement savings are to your financial future. Without a properly funded retirement account, you are destined to work longer than you want and struggle financially in old age.With plenty of money invested, on the other hand, you can potentially retire early, reach your lifetime “bucket list” goals, and retire with less stress and more peace of mind.

With plenty of money invested, on the other hand, you can potentially retire early, reach your lifetime “bucket list” goals, and retire with less stress and more peace of mind.

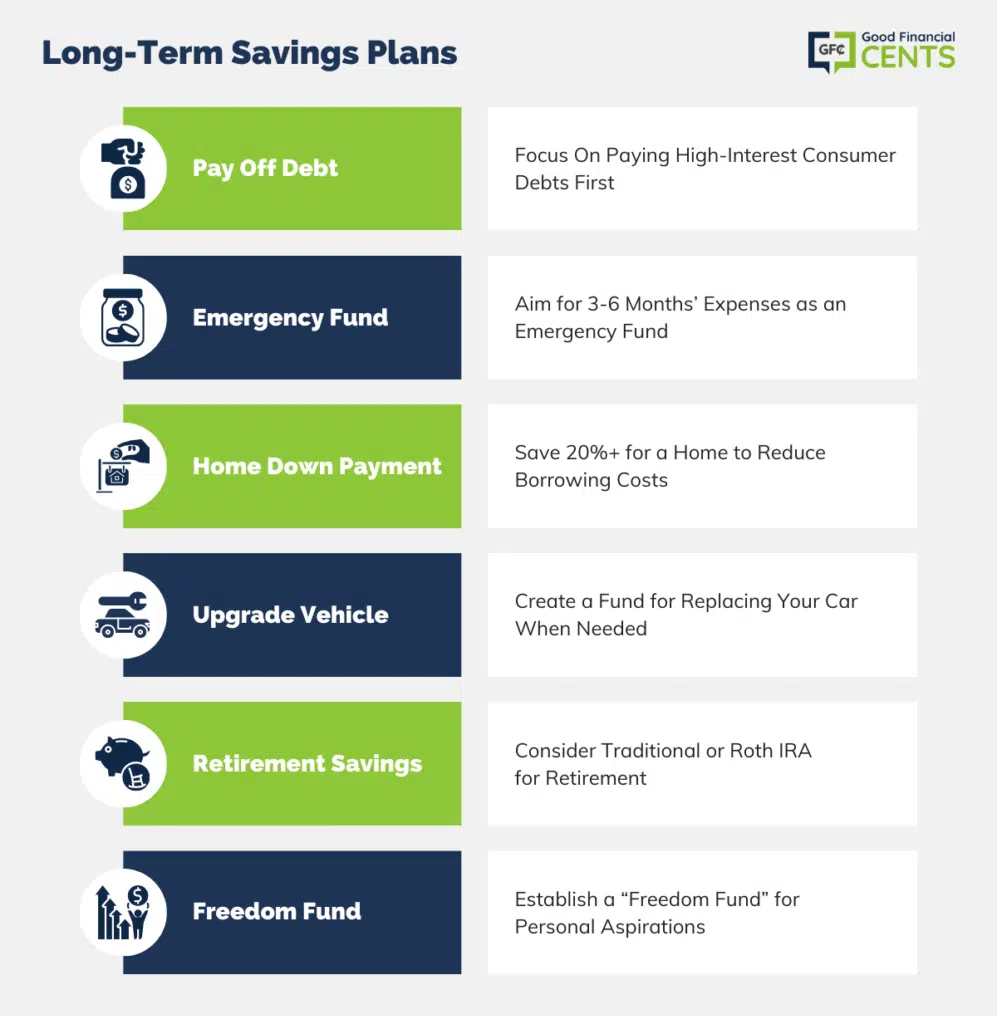

Beyond retirement, though, you’ll need cash savings for all of life’s challenges – and life’s expenses. Here are some awesome long-term savings plans anyone could benefit from:

Long-Term Savings Plan #1: Pay Off Consumer Debt

While paying down debt isn’t necessarily “saving,” there are huge benefits that come from dumping your high-interest consumer debts for good.

While nearly any debt you have should be on the chopping block, you should start by focusing on high-interest credit card debt and personal loans first, then other debts like car payments and student loans.

Bonus Tip:

Regardless of which debts you need to tackle, paying them off for good will help your finances tremendously. Without those monthly debt payments, you’ll have more money to save and invest each month.

And with more capital available to save and invest, you’ll be able to grow wealth at a much faster rate. Plus, you’ll avoid the real wealth-killer on the table – credit card and debt interest payments you’re making.

Related: Online Tools that Help You Get Out of Debt

Long-Term Savings Plan #2: Build Your Emergency Fund

Remember how almost half of Americans can’t afford a $400 emergency? Trust me, you don’t want to find yourself in that camp.

When an emergency hits, and you don’t have the money to cover it, it’s easy to wind up falling behind on your other bills or, worse, taking on new debt. The best way to avoid these problems altogether is to have an emergency fund to fall back on.

Most financial advisors suggest keeping 3-6 months of expenses on hand for emergencies, and I tend to agree. As you launch your long-term savings plans, make sure to add an emergency fund to the list. To get started, figure out how much you need to save.

Then, come up with a dollar figure you need to set aside every month. Lastly, make it automatic and keep saving until you reach your goal.

Let’s say your monthly expenses sit at around $3,000 per month. If you want to save up to three months of expenses ($9,000) within the next 24 months, you would need to save $375 per month.

Long-Term Savings Plan #3: Save Up the Down Payment for a Home

Another long-term savings plan that can help you get ahead is saving up the down payment for your own home. Doing so can help your finances in more than one way.

First, saving up a large down payment for a home can help you reduce the amount of money you need to borrow. And when you borrow less for your home, you’ll enjoy a lower monthly payment and pay less interest each month.

Secondly, saving up at least 20 percent as a down payment for your home can help you avoid costly private mortgage insurance or PMI. This “insurance coverage” can cost up to 1 percent of your home’s value each year, but without any real benefit to you.

As an example, PMI on a $200,000 home can cost up to $2,000 per year or $166 per month. By putting down at least 20 percent, you can avoid PMI altogether and save that money instead.

Long-Term Savings Plan #4: Save to Upgrade Your Vehicle

While you may already have a car you love, we all know it won’t last forever. If you’re looking for another long-term savings plan to get excited about, having a “new car fund” is an additional option to consider.

By establishing this fund, you can save up for the inevitable – the day your car dies or the cost of repairs becomes unsustainable. With a car fund growing in the bank, you won’t have to stress when it comes to replacing your ride with a new or used vehicle.

In addition to your new car fund, you can also consider signing up for a rewards credit card that makes it even easier to save. The GM BuyPower card is an obvious example of a card that could really help in this respect. With this credit card in your wallet, you’ll earn 5 percent earnings on your first $5,000 spent every year.

Beyond that, you’ll earn 2 percent back on every purchase you make. Your earnings will never expire, and your points are redeemable toward an eligible new Chevrolet, Buick, GMC, or Cadillac vehicle. Read here to learn more about the GM BuyPower credit card.

Long-Term Savings Plan #5: Save Even MORE Money for Retirement

If you’re funding your work-sponsored or personal retirement accounts religiously and have even more cash to stash away, you might consider opening a traditional or Roth IRA.

With a traditional IRA, your contributions are likely deductible on your taxes. However, you’ll need to pay income taxes on your withdrawals once you reach retirement age and start using your account.

With a Roth IRA, on the other hand, the contributions you make today are made with after-tax dollars. On the flip side, your money will grow tax-free until retirement, and you won’t have to pay income taxes on your withdrawals after age 59 ½, either.

As an added bonus, you can withdraw your Roth IRA contributions at any time before retirement age without paying a penalty. You’ll notice I said contributions and not earnings.

If you want to withdraw your earnings before retirement age, you’ll have to pay a penalty and taxes to boot.

By and large, I think the Roth IRA is a smart idea for anyone whose income allows them to contribute. After all, having some tax-free income in retirement will probably make you feel like a genius down the line!

Related:

Long-Term Savings Plan #6: Get Your “Freedom Fund” in Order

If you have the rest of your long-term savings plans in order, a “freedom fund” should be the next goal on your list. While this fund will look different for everyone, it should be filled with enough cash to give you the freedom to do what you want in life.

Remember how I suggested you list your lifetime goals? Whatever they are, your freedom fund is what will allow you to achieve them.

Once your finances and savings goals are in order and being fully funded each month, you can use your freedom fund to start saving for whatever you want in life – whether that’s the freedom to take a chance, the financial freedom to quit your job, or the freedom to take an amazing trip of a lifetime.

When it comes to your freedom fund, you are only limited by your dreams and the amount of money you can save up!

Final Thoughts

While figuring out where to invest your long-term savings can be a challenge, there are plenty of different goals to save for if you really think about it.

With money in the bank to fund those goals, you’ll be in the best position to cover an emergency expense, retire earlier, and live the life of your dreams!

If you’re struggling to figure out how to allocate your long-term savings, don’t forget to sit down and create a list of short-term and long-term goals. Once you do, the right plan for your money will likely come together on its own.

Don’t forget – this is your life and your money we’re talking about. When it comes to how you should spend and save, there is nothing more important than your own goals and dreams!

This was a great article to read! Having an emergency fund is extremely important because you never know when a crisis might occur out of the blue! I also believe having a freedom fund is a good thing to have because it allows you to have a little fun and use your saved money for something that is on your bucket list!

I feel that personal money management tips should be taught in high school. There are only four states now that require high school students to take a personal finance course in order to graduate – Missouri, Virginia, Utah and Tennessee. As a nation we are in the financial mess we are today partically because of the financial iliteracy of kids coming out of high school. Thank you Jeff for the work you do in helping people.

Agreed 100%! I think it’s part of the problem with why so many young people get too deep into student loan debt. If they had a basic financial education in high school, a few of them might think better of it.

I typically recommend building a liquid emergency fund of at least 6 months first, then once that’s done investing in retirement. The more you can put toward retirement when you’re younger, the better! The time value of money is too great when you’re young to pass up.

Great start. I would add to this, simply as a tip, automate everything! This applies from step 1 to 6, try to pay your debts off with automatic payments, invest automatically each pay, and take off the behavioral risk out of the equation.