Like it or not, emergency accounts are kind of boring.

And they need to be.

The main purpose of an emergency account is to sit around and wait for an emergency.

That certainly limits your options as to where to hold the money.

Because you may need the money on very short notice, the safety of the principal needs to be the primary concern.

But that doesn’t mean you can’t try to earn some income on your emergency account in the meantime.

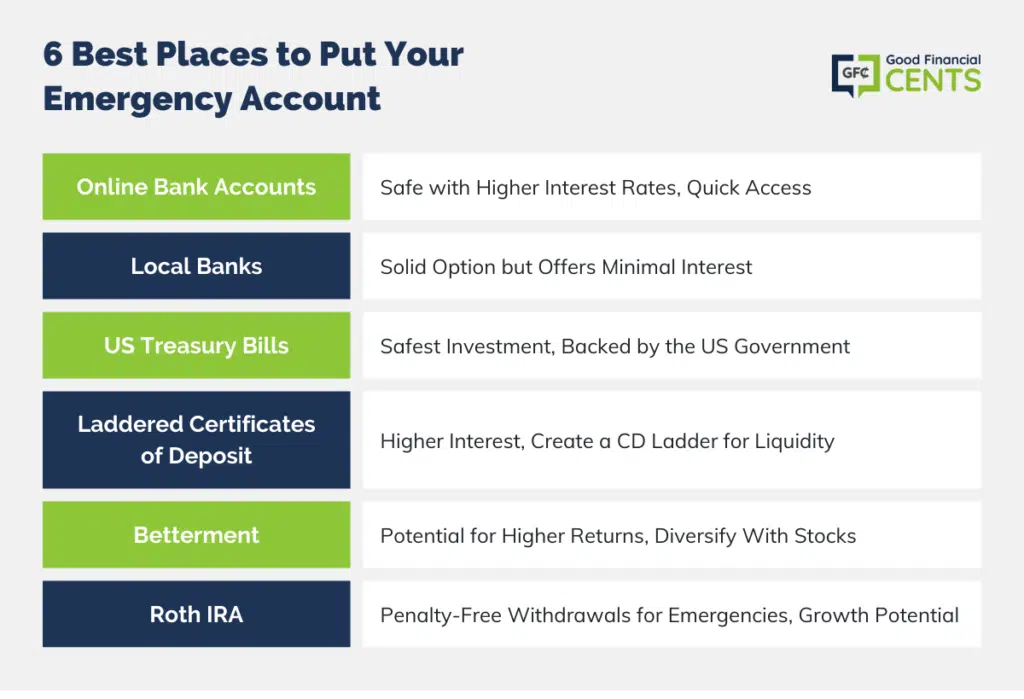

6 Best Places to Put Your Emergency Account:

2. Local Banks

4. Laddered CDs

5. Betterment

6. Roth IRA

Table of Contents

1. Online Bank Accounts

If you want to keep your money absolutely safe but earn higher interest than you can at a local bank, seriously consider online bank accounts.

In today’s world of electronic money, you can often get access to your funds from an online account just as quickly as you can from a local bank branch.

In fact, most provide various options for you to get your money, including transferring it into a checking account at a local bank.

The interest online banks pay on your savings are a welcome relief from the fractional rates being paid at local banks.

For example:

- CIT Bank currently pays up to 0.65% APY on its Savings Builder account.

- Ally Bank currently pays 2.20% APY on all balance tiers on its Online Savings account.

- BBVA (formerly BBVA Compass) is currently offering 2.40% APY on it’s Money Market Account.

- HSBC currently offers 1.30% APY on its Direct Savings account.

Online banks may not have local branches, but they’re the next closest thing in terms of liquidity. And when you consider that the interest rates they pay on savings instruments run between 10 and 20 times higher than what local banks are paying, it’s well worth keeping most of your emergency account with at least one of them.

2. Your Local Bank

Your local bank is always a solid option.

Unfortunately, most don’t pay much in the way of interest. And it usually doesn’t matter whether that’s interest-bearing checking, savings, money markets, or certificates of deposit (CDs).

Because they have a network of local branches, they don’t need to pay high interest rates to attract customers.

For example, according to the Federal Deposit Insurance Corporation’s Weekly National Rates and Rate Caps, average rates on bank savings vehicles look something like this:

- Savings, 0.10%

- Interest Checking, 0.06%

- Money Markets, 0.19%

- 3-month CDs, 0.22%

- 6-month CDs, 0.41%

Those interest rates are downright microscopic. But the one advantage to local banks is that they can provide immediate physical access to your money in the event of an emergency.

And even though the interest they pay amounts to little more than dust, it’s better than nothing.

3. US Treasury Bills

US Treasury Bills are short-term debts issued by the US government. And because they are issued by the US government, they are considered the safest of all investments, backed by the full faith, credit, and taxing power of the US government.

They can be purchased in denominations of as little as $100 through the US Treasury’s portal,

Treasury Direct, and with terms of 4 weeks, 8 weeks, 13 weeks, 26 weeks, and 52 weeks. You can both purchase and redeem them through Treasury Direct.

Current yields on these securities are all in excess of 3.32% APY, with the specific rates as of October 20, 2023, here.

4. Laddered Certificates of Deposit

CDs generally pay higher rates of interest than what you will get on savings accounts or money markets.

But the best rates go to the CDs that have longer terms. Typically, the better paying rates start with 12-month CDs.

That creates a bit of a problem if you’re looking to build an emergency fund. After all, emergencies don’t wait 12 months for your CD to mature. You’ll need an ability to access funds before a CD matures.

Now you can usually liquidate a CD early.

But if you do, you’ll be subject to an early withdrawal penalty. That can cost you several month’s worth of interest.

Exception: CIT Bank 11-month No-Penalty CD (1.25%)

An alternative might be to have some money in a savings account or money market account, with most of your money in 12 months CDs earning higher interest.

But an even better strategy will be to create a “CD ladder”. The laddering part has to do with staggering the maturities.

For example, you can divide up your emergency account into 12 equal parts and invest the funds in 12 different 12-month CDs.

If you have $12,000 in your emergency account, instead of investing it all in a single CD, you can instead invest $1,000 in one CD each month.

You’ll get the benefit of the 2.55% APY, but each month you’ll have one CD maturing, while investing in a new one.

Because one CD is maturing each month, you would have at least $1,000 available for that month, and for every month.

That’s how you can use a CD ladder to earn higher interest on your money, but also add a measure of liquidity for emergency purposes.

5. Betterment

If you want to add even higher returns to your emergency account, and you’re willing to take on some risk to do it, you can consider putting at least some of your money into a robo-advisor.

The most popular, and perhaps the best robo-adviser overall, is Betterment.

For a low annual fee of just 0.25%, Betterment will provide you with a fully managed investment portfolio that will be diversified across stocks and bonds.

Stocks are the riskiest asset allocation, so if you plan to use a Betterment account as an emergency account, you should favor a higher bond position.

That will make it easier for you to liquidate funds at more predictable valuations than you can with stocks.

But maybe the best use of a Betterment account is to put the bulk of your emergency account into it, to earn higher returns on your money. But you should also hold a portion in more liquid assets, such as those listed above.

You would then be able to tap your liquid savings for immediate emergencies, and access funds from Betterment only when either a larger amount of money is needed, or the emergency lasts longer than expected, such as in the case of a job loss.

Either way, you probably won’t want to put all of your emergency account into Betterment. There is the risk of loss in the event of a general stock market decline.

The best way to protect against that risk is to make sure you always have at least some funds sitting in a completely liquid account, using the Betterment account as a secondary emergency account.

Start earning with Betterment today >>

6. Roth IRA

This one’s a bit controversial as an emergency account, but it can actually make perfect sense.

If you put money into a traditional IRA – or virtually any other retirement account – and you need to withdraw funds before you turn 59 ½, you’ll have to pay ordinary income tax on the amount withdrawn, plus a 10% early withdrawal penalty.

But the Roth IRA is the exception to that rule.

Under what is known as IRS Roth IRA Ordering Rules, you can withdraw your contributions to a Roth IRA at anytime, free of both ordinary income tax and the 10% early withdrawal penalty.

That’s because under the ordering rules, the first funds withdrawn from a Roth IRA are considered to be your contributions. And since contributions to a Roth IRA are not tax deductible, they are not taxable on withdrawal.

Apart from the fact that you can take tax-free early withdrawals from a Roth IRA, using one as an emergency account has several advantages:

- They Can Be Used to Earn Higher Rates of Return, Such as by Holding the Roth IRA With Betterment

- Investment Earnings on a Roth IRA Are Tax-Deferred, so They’ll Build Up More Quickly Than in a Taxable Account

- Since a Roth IRA Is First and Foremost a Retirement Account, Any Funds Not Withdrawn for an Emergency Will Continue to Help You Save for Retirement

Once your Roth IRA account gets big enough, you may be able to keep a small portion in liquid assets, like bonds, to use as an emergency account.

But the rest of the account, the majority, can be invested for growth as part of your retirement strategy.

Where You Should Put YOUR Emergency Fund?

As you can see, there are more options as to where to put an emergency account than just the local bank. Best of all, you don’t have to pick just one type of account.

You can use several, effectively turning your emergency savings into something of a diversified portfolio.

For example, you can hold a small amount, say enough to cover 30 days of living expenses, in a high-yield savings account or money market.

You can put a larger amount into higher-yielding (but safe) investments, like CDs and Treasury Bills.

Then you can put the largest amount into a growth account, like Betterment and/or a Roth IRA, to earn even higher returns for the long term.

That will enable you to have the liquid funds you need for an emergency account while earning a lot better than 0.09% in a local bank savings account.

The Bottom Line – Where Should You Keep An Emergency Account

When it comes to emergency funds, it’s essential to balance safety and potential returns. This article explores various options for parking your emergency cash, emphasizing the need for liquidity in case of unexpected expenses. Online bank accounts offer safety and competitive interest rates, bridging the gap between traditional banks and higher yields.

Local banks provide easy access to funds but often offer minimal interest. US Treasury Bills are a secure option, backed by the US government. Laddering certificates of deposit (CDs) can boost returns while maintaining liquidity. Betterment and Roth IRAs, though unconventional, offer growth potential while allowing penalty-free withdrawals of contributions. Diversification among these choices can create a robust emergency fund tailored to your needs.

I like diversifying so that my money can earn some good interest and at the same time, I can access some of it immediately in case of an emergency.